M&A is capital allocation tool to help reimagine the strategic priorities in a company's portfolio

But what happens when the pieces of the portfolio "no longer fit"?

"Separation" transactions are complicated & often misunderstood by investors

Here's some good stuff to know🧵

But what happens when the pieces of the portfolio "no longer fit"?

"Separation" transactions are complicated & often misunderstood by investors

Here's some good stuff to know🧵

WHY do companies "break-up"?

Some reasons:

☑️Enhance operational focus

☑️Accommodate differing capital needs

☑️Create distinct "identities" for investors

☑️"Align" equity comp & currency for M&A

☑️Mitigate anti-trust concerns

☑️Quell activist pressure to "unlock value"

Some reasons:

☑️Enhance operational focus

☑️Accommodate differing capital needs

☑️Create distinct "identities" for investors

☑️"Align" equity comp & currency for M&A

☑️Mitigate anti-trust concerns

☑️Quell activist pressure to "unlock value"

HOW do companies "break-up"?

Some pervasive mechanisms that companies have used to "unbundle the conglomerate discount" include the following:

1⃣ Divestitures

2⃣ Spin-Offs

3⃣ Split-Offs

4⃣ Carve-Out IPO

5⃣ Spin-Mergers

(NOTE: this isn't exhaustive; see WLRK for reference)

Some pervasive mechanisms that companies have used to "unbundle the conglomerate discount" include the following:

1⃣ Divestitures

2⃣ Spin-Offs

3⃣ Split-Offs

4⃣ Carve-Out IPO

5⃣ Spin-Mergers

(NOTE: this isn't exhaustive; see WLRK for reference)

WHICH "separation" tactic depends on objectives:

- Generate cash proceeds ("A")

- Facilitate equity participation ("B")

- Limit deal complexity ("C")

- Mitigate market risk ("D")

- Mitigate investor churn ("E")

- Achieve tax efficiency ("F")

- Speed to disposition ("G")

- Generate cash proceeds ("A")

- Facilitate equity participation ("B")

- Limit deal complexity ("C")

- Mitigate market risk ("D")

- Mitigate investor churn ("E")

- Achieve tax efficiency ("F")

- Speed to disposition ("G")

1⃣ Divestitures

ELI5: ParentCo sells a business for cash in a "taxable" transaction

A=🌕| B=🌑| C=🌖| D=🌗| E=🌖| F=🌑| G=🌖

Works best with: ParentCo valuing speed & certainty & a biz without a viable public market path

Example: $IBM's (HC Data & Analytics Biz) / FP

ELI5: ParentCo sells a business for cash in a "taxable" transaction

A=🌕| B=🌑| C=🌖| D=🌗| E=🌖| F=🌑| G=🌖

Works best with: ParentCo valuing speed & certainty & a biz without a viable public market path

Example: $IBM's (HC Data & Analytics Biz) / FP

2⃣ Spin-Offs

ELI5: ParentCo s/h get shares in the new biz, pro-rata, tax free distribution (100%)

A=🌘| B=🌑| C=🌖| D=🌘| E=🌘| F=🌕| G=🌖

Works best with: a parent that has (in all respects) a "known" biz that can be a public company "right now"

Example: $PYPL (from $EBAY)

ELI5: ParentCo s/h get shares in the new biz, pro-rata, tax free distribution (100%)

A=🌘| B=🌑| C=🌖| D=🌘| E=🌘| F=🌕| G=🌖

Works best with: a parent that has (in all respects) a "known" biz that can be a public company "right now"

Example: $PYPL (from $EBAY)

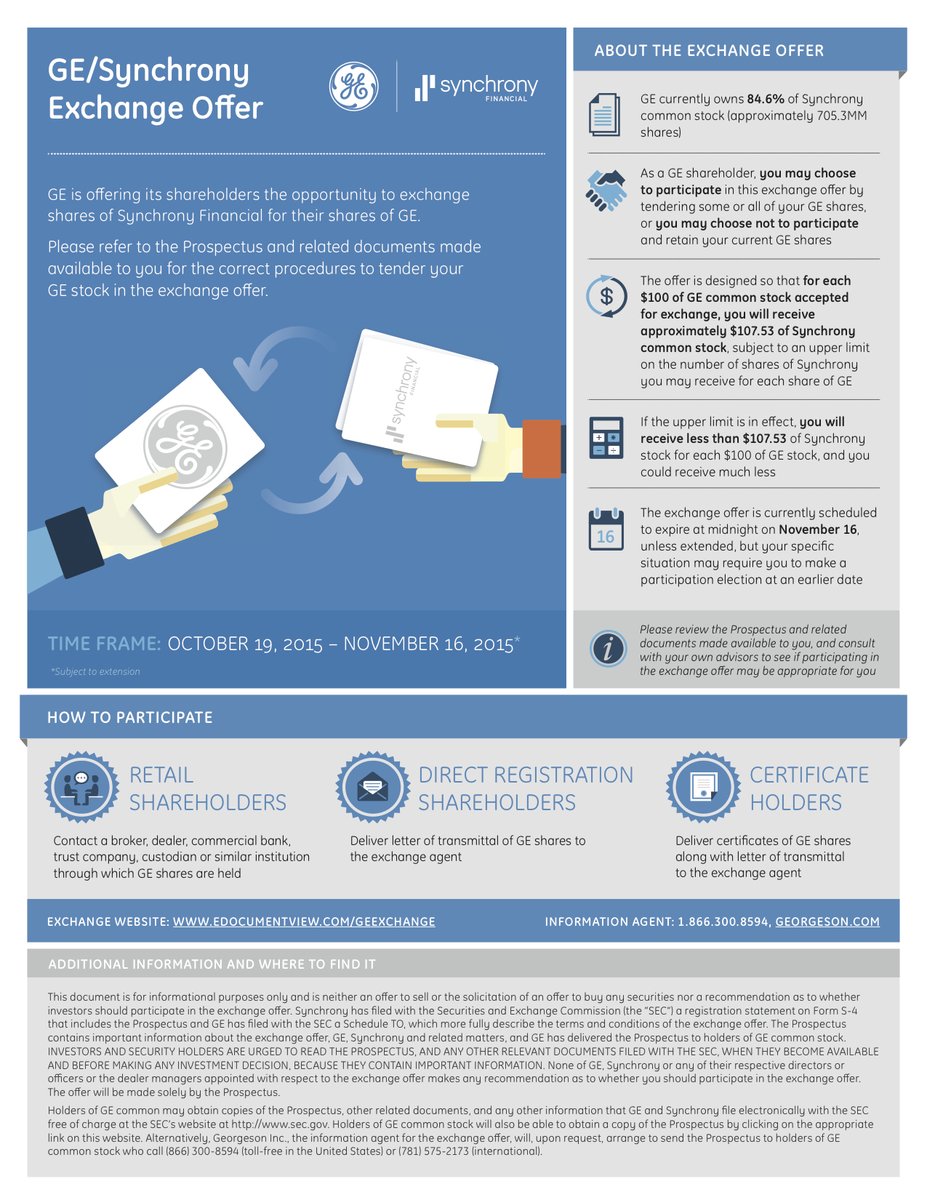

3⃣ Split-Offs

ELI5: ParentCo s/h get shares in new biz but elect to swap their ParentCo stock for new biz stock

(i.e. Spin-Off : Dividend as Split-Off : Stock Buyback)

A=🌘| B=🌑| C=🌗| D=🌘| E=🌗| F=🌕| G=🌗

Works best with: see "Spin-Off" reasons

Example: $SVF (from $GE)

ELI5: ParentCo s/h get shares in new biz but elect to swap their ParentCo stock for new biz stock

(i.e. Spin-Off : Dividend as Split-Off : Stock Buyback)

A=🌘| B=🌑| C=🌗| D=🌘| E=🌗| F=🌕| G=🌗

Works best with: see "Spin-Off" reasons

Example: $SVF (from $GE)

4⃣ Subsidiary-IPOs

ELI5: ParentCo floats biz stock to NEW investors in IPO (primary up to 19%)

A=🌗| B=🌘| C=🌗| D=🌗| E=🌖| F=🌕| G=🌘

Works best with: a biz needing "IPO-style" education, a cash UOP & parent harvesting basis prior to a full spin

Example: $MBLY (from $INTC)

ELI5: ParentCo floats biz stock to NEW investors in IPO (primary up to 19%)

A=🌗| B=🌘| C=🌗| D=🌗| E=🌖| F=🌕| G=🌘

Works best with: a biz needing "IPO-style" education, a cash UOP & parent harvesting basis prior to a full spin

Example: $MBLY (from $INTC)

5⃣ Spin-Mergers

ELI5: ParentCo spins & mergers biz with 3rd party to create a NewCo

A=🌗| B=🌗| C=🌘| D=🌗| E=🌗| F=🌕| G=🌘

Works best with: a 3rd party similar in size to biz as ParentCo s/h must own >50.1% of NewCo to be tax free

Example: $WBD (Warner Media) (from $T)

ELI5: ParentCo spins & mergers biz with 3rd party to create a NewCo

A=🌗| B=🌗| C=🌘| D=🌗| E=🌗| F=🌕| G=🌘

Works best with: a 3rd party similar in size to biz as ParentCo s/h must own >50.1% of NewCo to be tax free

Example: $WBD (Warner Media) (from $T)

Key "break-up" SEC filings to👀:

1⃣ Form 10 & exhibits* (key for Spin-Off & Split-Off)

2⃣ S-3 (key if accessing financing markets)

3⃣ S-1 (key for Carve-Out IPO)

4⃣ Section 16 (i.e. Forms 3 & 4 for "insiders")

5⃣ 8-K (for declarations, completions etc)

*More below...👇

1⃣ Form 10 & exhibits* (key for Spin-Off & Split-Off)

2⃣ S-3 (key if accessing financing markets)

3⃣ S-1 (key for Carve-Out IPO)

4⃣ Section 16 (i.e. Forms 3 & 4 for "insiders")

5⃣ 8-K (for declarations, completions etc)

*More below...👇

Key "break-up" documents (if so inspired to moonlight as a WLRK lawyer):

1⃣ Separation & Distribution - covers the "rules of the road" & "what's in & what's out"

2⃣ Transition Services - covers any services "shared" between businesses

3⃣ Other Key Matters - Tax, Employment, IP

1⃣ Separation & Distribution - covers the "rules of the road" & "what's in & what's out"

2⃣ Transition Services - covers any services "shared" between businesses

3⃣ Other Key Matters - Tax, Employment, IP

Before you start your #fintwit special sits journey, remember to:

🤑Focus on validating if the "value unlocked" is real

🛫Simplify complexity by zeroing on "who gets what"

🤔Always think about deal incentives, merits & risks

🕵️Pay attention to details as media often is wrong

🤑Focus on validating if the "value unlocked" is real

🛫Simplify complexity by zeroing on "who gets what"

🤔Always think about deal incentives, merits & risks

🕵️Pay attention to details as media often is wrong

Thanks to @ValidGuru, @SpecialSitsNews, @JulianKlymochko, @compound248, @akramsrazor, @internetbluprnt, @matt_levine for the suggestions

Follow me @GlogauGordon & enjoy some stream of consciousness on #mergersandacquisitions, #SaaS and other topics

Follow, RT, spread the word!

Follow me @GlogauGordon & enjoy some stream of consciousness on #mergersandacquisitions, #SaaS and other topics

Follow, RT, spread the word!

• • •

Missing some Tweet in this thread? You can try to

force a refresh