TokenUnlocks 2022 annual report is out !! 🔥🔥

Learn about token unlocks, tokenomics, and the price impact of unlocks in the crypto space. 📊

Discover our insights, analysis, and thoughts on what to expect in 2023✨

Learn about token unlocks, tokenomics, and the price impact of unlocks in the crypto space. 📊

Discover our insights, analysis, and thoughts on what to expect in 2023✨

In this report, we will cover 📌;

- Understand token unlocks 🔎

- Learn how projects vest tokens & distribution 🔏

- Study tokenomics changes in major projects 📊

- Understand the price impact of token unlocks 📉

- Analyze major unlocks in 2022 ⭐️

- See what's next in 2023. ⏭️

- Understand token unlocks 🔎

- Learn how projects vest tokens & distribution 🔏

- Study tokenomics changes in major projects 📊

- Understand the price impact of token unlocks 📉

- Analyze major unlocks in 2022 ⭐️

- See what's next in 2023. ⏭️

1/x What is TokenUnlocks 🔎 ?

TokenUnlocks are fundamental aspects of tokenomics. 📊

Token unlocks are like releasing locked shares in the crypto market over a set period of time to align incentives for all stakeholders 🤝

The key elements related to token unlocks include ⬇️

TokenUnlocks are fundamental aspects of tokenomics. 📊

Token unlocks are like releasing locked shares in the crypto market over a set period of time to align incentives for all stakeholders 🤝

The key elements related to token unlocks include ⬇️

2/x 2022 Lookback 🌄

The year 2022 was marked by a decline in the overall crypto market capitalization, major events such as the collapse of the Terra, and a fraud case at a major crypto exchange. Token unlocks also played a role in introducing newly liquid tokens to the market.

The year 2022 was marked by a decline in the overall crypto market capitalization, major events such as the collapse of the Terra, and a fraud case at a major crypto exchange. Token unlocks also played a role in introducing newly liquid tokens to the market.

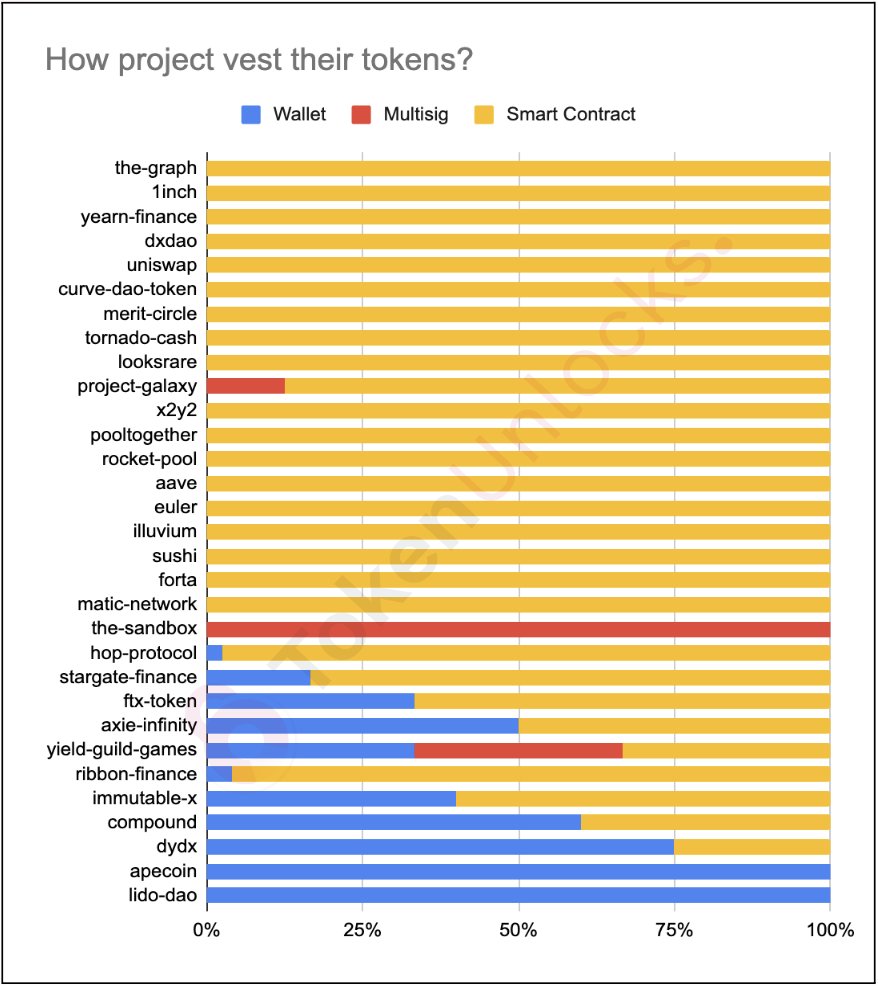

3/x How do projects vest their tokens? 🔐

There are various ways to implement token vesting methods. We analyzed 31 protocols and found that 2 projects use only EOA or wallets, 20 use only smart contracts, and 9 use both wallets and smart contracts.

There are various ways to implement token vesting methods. We analyzed 31 protocols and found that 2 projects use only EOA or wallets, 20 use only smart contracts, and 9 use both wallets and smart contracts.

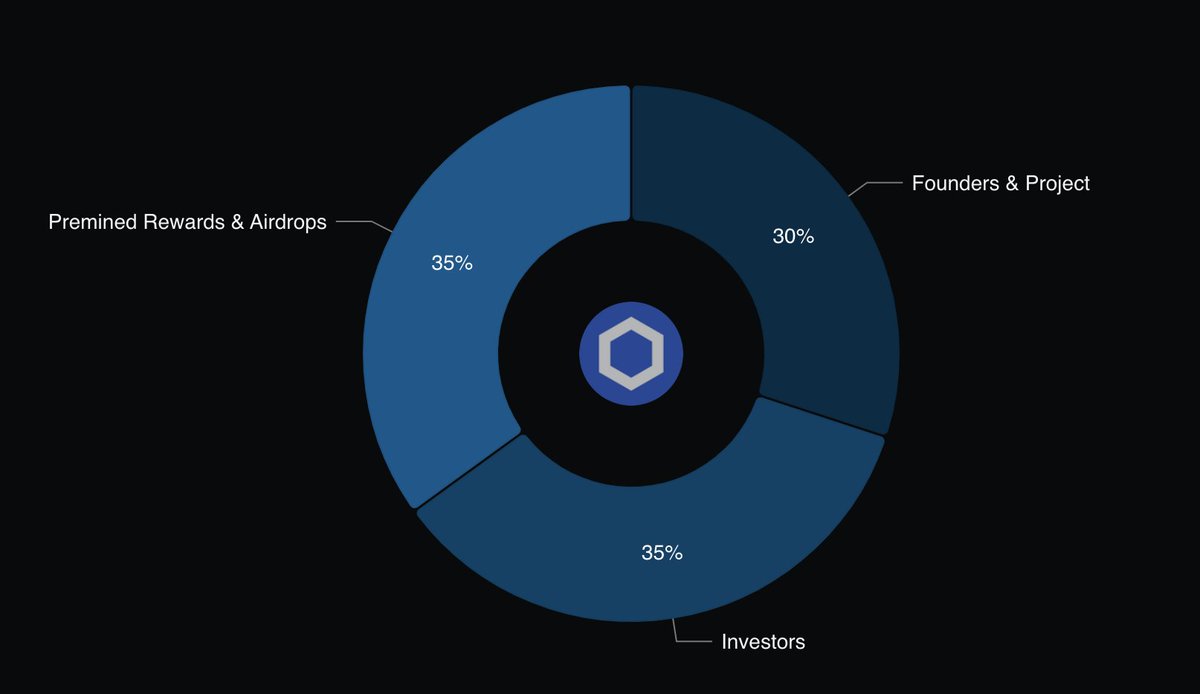

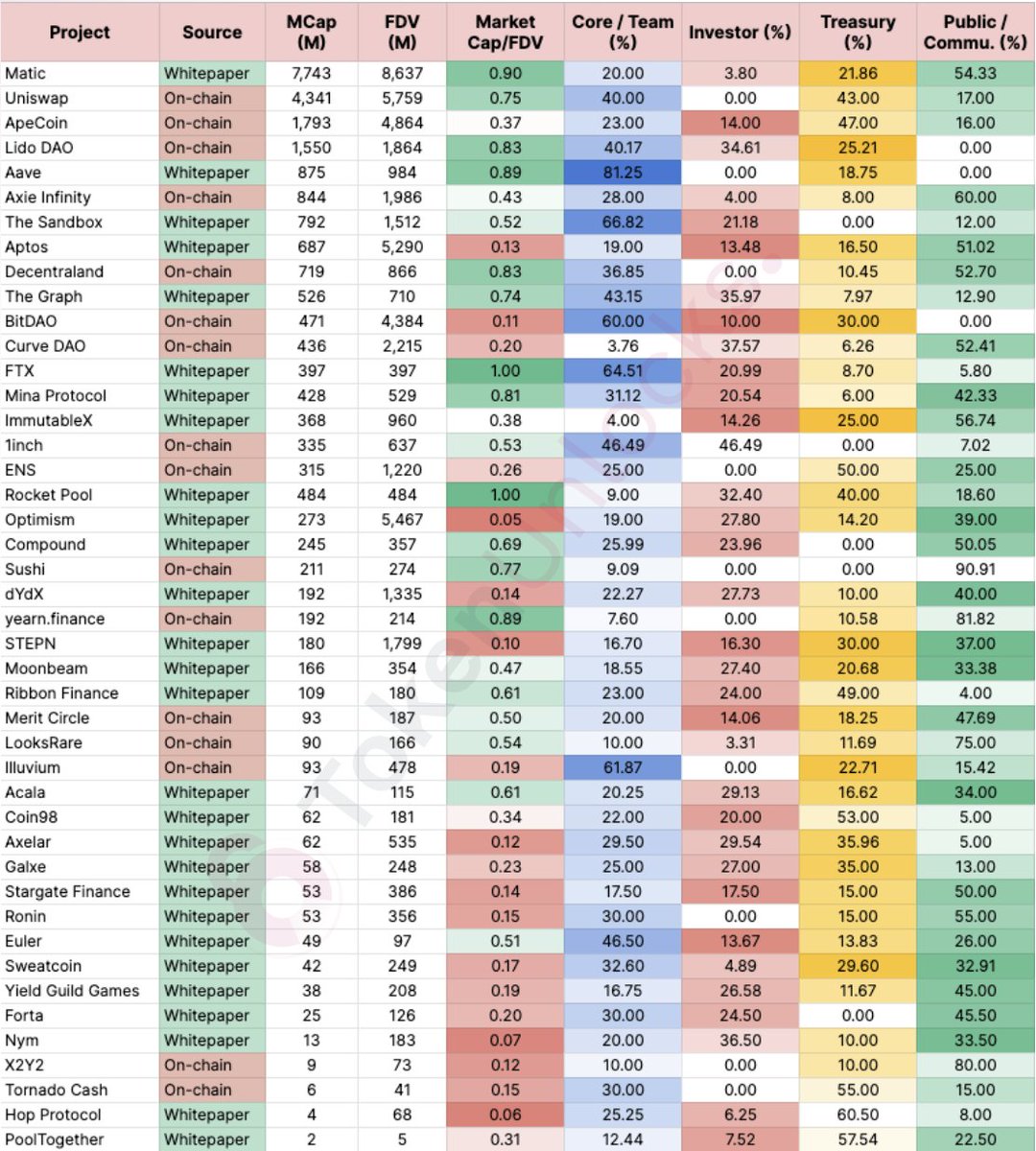

4/x The Distribution 🔀

- Token distributions can be classified into 4 types:

- The Core/Team distribution rewards the developers.

- Treasury is for project expenses.

- Investor for funding, Public/Community for support. Ensure a fair token allocation for a sustainable project

- Token distributions can be classified into 4 types:

- The Core/Team distribution rewards the developers.

- Treasury is for project expenses.

- Investor for funding, Public/Community for support. Ensure a fair token allocation for a sustainable project

5/x Token Allocation Analysis 📜

Results show that projects with more tokens allocated to Core/Team and Investors tend to have higher market capitalization. Increases liquidity & attracts more investors

Results show that projects with more tokens allocated to Core/Team and Investors tend to have higher market capitalization. Increases liquidity & attracts more investors

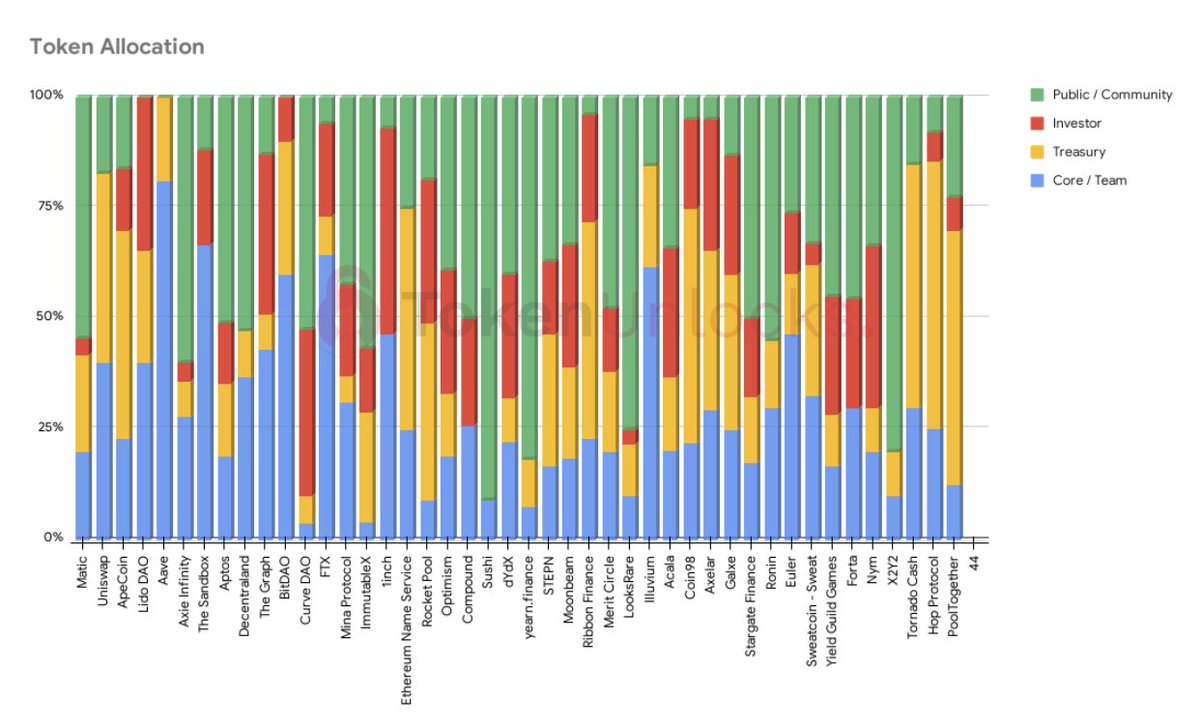

6/x Token Allocation Analysis 📜 ( cont. )

Token allocations vary greatly among projects. Some have no investor or treasury allocation, and others allocate the majority to the core team

The chart below demonstrates the token allocation of each project.⬇️

Token allocations vary greatly among projects. Some have no investor or treasury allocation, and others allocate the majority to the core team

The chart below demonstrates the token allocation of each project.⬇️

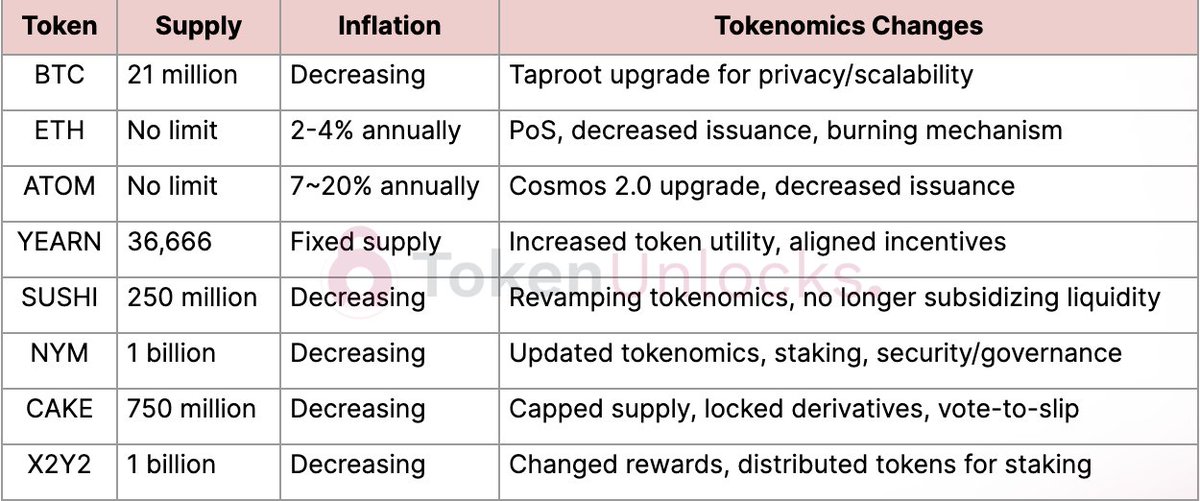

7/x Major changes in tokenomics 📊

#Bitcoin activated Taproot, improving privacy and scalability.

@ethereum switched to PoS and decreased issuance.

@cosmos proposed an upgrade to increase scalability and predictability.

@iearnfinance revamped tokenomics.

#Bitcoin activated Taproot, improving privacy and scalability.

@ethereum switched to PoS and decreased issuance.

@cosmos proposed an upgrade to increase scalability and predictability.

@iearnfinance revamped tokenomics.

8/x Major changes in tokenomics 📊 ( cont. )

@SushiSwap plans to revamp tokenomics.

@nymproject capped supply and incentivized staking.

@PancakeSwap capped supply and implemented "vote-to-slip."

@the_x2y2 switched the reward system and incentivized staking.

@SushiSwap plans to revamp tokenomics.

@nymproject capped supply and incentivized staking.

@PancakeSwap capped supply and implemented "vote-to-slip."

@the_x2y2 switched the reward system and incentivized staking.

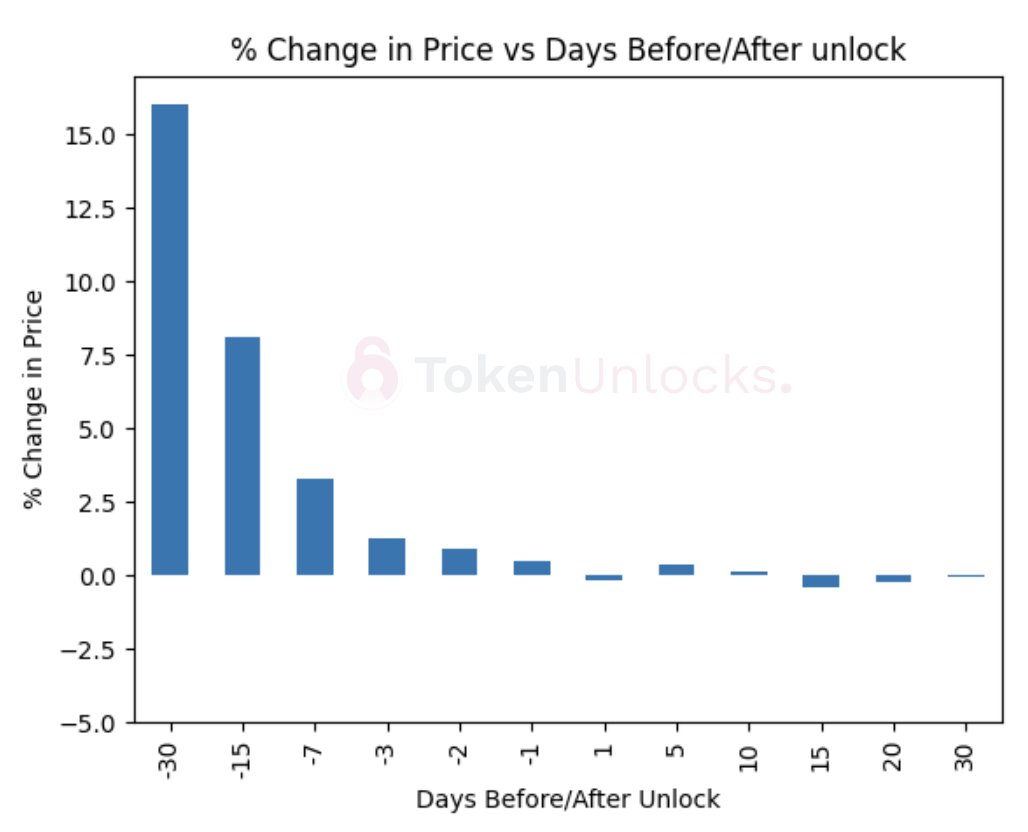

9/x Price Impact 📉

The price of tokens tends to decrease by up to 15% before an unlock event, but stays relatively flat after. This trend is shown through data analysis using Bitcoin's price denominator as a reference point.

The price of tokens tends to decrease by up to 15% before an unlock event, but stays relatively flat after. This trend is shown through data analysis using Bitcoin's price denominator as a reference point.

10/x Major 2022 Token Unlocks ⚠️

We selected four specific tokens ( $SAND, $LOOKS, $AXS, and $IMX ) and their major unlocks, including price fluctuations and vesting schedules.

These tokens were selected due to high user interest during major unlocks.

We selected four specific tokens ( $SAND, $LOOKS, $AXS, and $IMX ) and their major unlocks, including price fluctuations and vesting schedules.

These tokens were selected due to high user interest during major unlocks.

11/x Outlook 2023 🌅

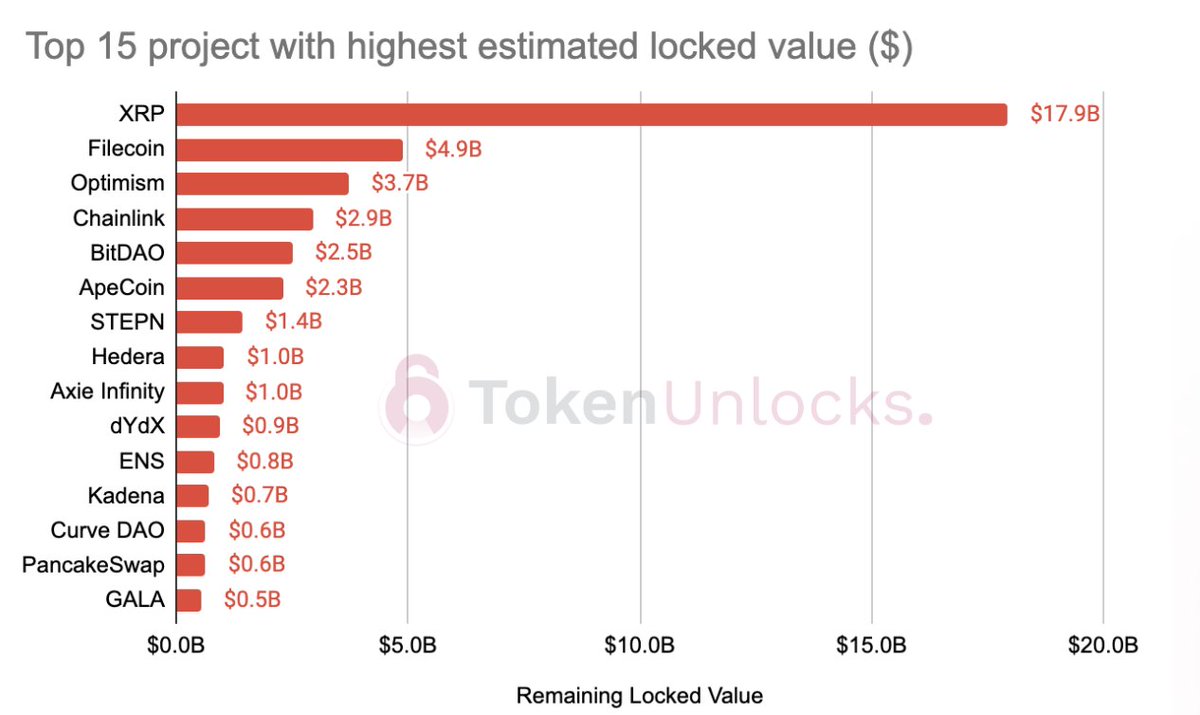

In this report we've looked at token unlocks & how they impact crypto projects & markets. We've also looked at 4 specific projects & predictions for 2023. We analyzed the top 300 projects to estimate future unlock values for the upcoming year.

In this report we've looked at token unlocks & how they impact crypto projects & markets. We've also looked at 4 specific projects & predictions for 2023. We analyzed the top 300 projects to estimate future unlock values for the upcoming year.

12/x Overall 🌟

An exciting year ahead as many projects cash out vested tokens for operations. 💼

Our TokenUnlocks team will continue to promote transparency in this industry. 🔎💖

Sign-up as a beta reader now, limited spots are available. 📑

token.unlocks.app/reports/tokenu…

An exciting year ahead as many projects cash out vested tokens for operations. 💼

Our TokenUnlocks team will continue to promote transparency in this industry. 🔎💖

Sign-up as a beta reader now, limited spots are available. 📑

token.unlocks.app/reports/tokenu…

In addition, you can read the 43-page TokenUnlocks 2022 Annual Report in its entirety by clicking here.

👇👇👇

token.unlocks.app/reports/tokenu…

👇👇👇

token.unlocks.app/reports/tokenu…

• • •

Missing some Tweet in this thread? You can try to

force a refresh