I regularly work with large public transactions and as a die-hard United fan, I of course follow the Glazers’ sale process. A very long open-ended 🧵 on some thoughts that I have. More to come in following days.#ManUtd #GlazersOut

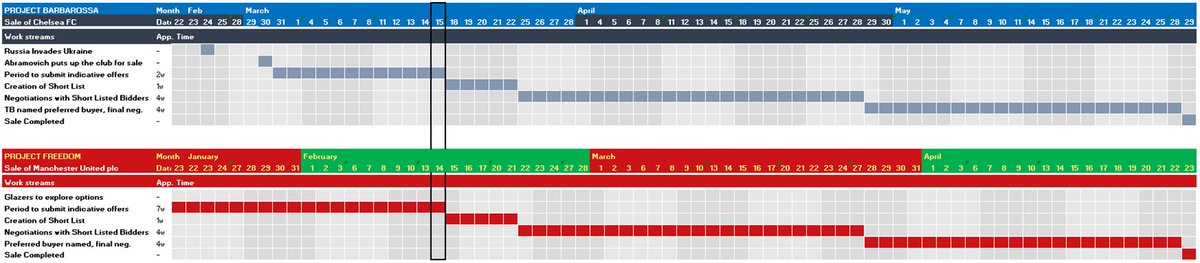

(1/n) (a/x) Since #theRaineGroup managed both the sale of Chelsea FC and ManUtd, it is interesting to compare the deadlines set in that transaction with where we are in this process, starting as of the deadline for the indicative bids set in mid-February:

(b/x) This would give us a transaction date of 23 April 2023. The Chelsea transaction was conducted at neck-breaking speed – but what stands out to me is the first deadline set at mid-March. The following steps are not as rushed.

(c/x) How long does it take to make a 6-7bn transaction? From one perspective, it is important to note that both bigger and more complex transactions than the sale of ManU have been done during an afternoon before…

(d/x) A buyer can gain full control of ManU by buying the Glazers’ 67% stake through a simple transaction note. The plc is a listed company (NYSE), reports using the IFRS. A Due Diligence? Of course, it is preferable, but takeovers are at times conducted without one.

(e/x) From another perspective, CFC had one owner, the plc has 1,000s. To acquire all shares of the plc, either a public merger or a takeover followed by a compulsory redemption of the minority is required. This will take at least 6-12 weeks to finalize.

(f/x) So which one is it? Depends on a buyer. More on this under (2).

(2/n) (a/x) So what will be sold? The entire plc? Just Glazers’ shares? And why it matters.

(b/x) @SeekingAlpha reported on 21 December 2022, having discussed the topic with @UnitedFirstPartners, on how there are no guarantees as to how a buyer will treat the shares listed at NYSE.

(c/x) This is correct. There is no guarantee a “buyer” will buy the shares listed at the NYSE. In the UK, the concept of Mandatory Bids exists. Anyone buying a share in a company without a controlling owner, must be given an option to exist if someone takes control.

(d/x) The concept of mandatory bids does not exist on the Cayman Islands, which is a very majority owner friendly environment. Hence, it is possible to buy 67% of the shares in the plc from the Glazers, and not offer to acquire the minority owners shares.

(e/x) This differs from what took place the last time around, see for example theguardian.com/football/2004/…

(f/x) Why would anyone -- just -- buy a controlling stake of the plc and not the entire club? It is a matter of money. If the club is valued at 6bn, which is rumored, the price of buying 2/3 is “just” 4bn. The relevant question is instead:

(g/x) Why would anyone buy all shares of the club? It is a question of freedom when operating a club. If you own 67%, and you “gift” 2bn to it, you effectively give away 1/3 of 2bn to the others, value transfers from the club to the owner or related parties are banned etc.

(h/x) Normally, a buyer wants full control. But, if the additional price is 2bn £, you could of course think twice about it. If bought by a US consortium, were players like 6th street and others are to be given specific privileges takes part, it must be a complete takeover.

(i/x) Why does it matter? Buying just the Glazers shares will be a lot faster than executing a full merger, which could easily drag into the summer. It is cheaper.

(3/n) (a/x) What will the Club cost? Why we won’t get Glazers 2.0. How will the debt be handled? Some thoughts on the share price on NYSE, that significantly lags the discussed price for the entire club.

(b/x) There have been a lot of debate of how much #ManUtd is worth. This is a topic that is of interest in many ways, and that it is important to dive deep into. Since it will describe who will be interested to buy the club and eventually winning the auction.

(c/x) In auctions like this, the price will be what the bidder willing to pay the most for the club will have to offer to beat the competition. And what a bidder is willing to pay for the club is established by what the bidder can get from the club.

(d/x) Given our price tag, any buyer looking for a passive investment which is to pay regular dividend, is done before the auction starts. The ManU share simply cannot compete with other available investment alternatives.

(e/x) Instead, shorter term investors can only make a profit by increasing the value of the club before selling it in say 10-15 years. Any PE investor buying ManU, will not accomplish that if they in 10-15 years are selling (a club at the same level as) West Ham United.

(f/x) Buying the club, not investing in it, and taking out dividend is 100% an awful proposal. Hence why the Glazers are selling.

(g/x) So what will happen to the debt when we are sold? Normally, this happens to debt after a transaction like the one we might see regarding Manchester United plc. The seller and the buyer agrees on an Enterprise Value (EV) regarding the target.

(h/x) The EV is the club without debt and cash. The Purchase Price is the EV minus the debt and plus any cash. If the EV is 6bn, the price is basically 5.1bn.

(i/x) So you are telling me that the Glazer will make 5.1bn? Disgusting! It is, but of 5.1bn, remember that the Glazers “only” will get 3.37bn, since they only own 67%. If ManU is worth 6bn, you can gain full control of the club for 3.37bn.

(j/x) So instead of paying off the debt, the debt will be deducted from the purchase price. The plc’s Senior secured notes (425 MUSD), Loan Facility (225 MUSD) and Revolving Facility (100 MGBP) will include CoCs.

(k/x) A Change of Control clause (CoC) results in the debt falling due when there is a new owner of the plc. Consequently, an entity is always refinanced in connection with a takeover. This could result in the buyer taking over the plc’s debt, or the debt staying in the plc.

(l/x) Lastly under this sub-topic, let’s look at how the Market Cap of the ManU share traded on the NYSE and what we can read out from it. There is no better tell sign to look at regarding if a takeover will take place, then the share price of the target.

(m/x) What does the market value ManU to? The club has 54,537,360 Class A shares (1 votes/share), and 110,207,613 Class B shares (10 vote/share, owned by the Glazers). Of the Class A shares, 1,682,896 are held in treasury (owned by the club itself).

(n/x) Hence the market value of today is 3.8bn USD based on the share price of 23.35$. If the Club is sold for 5.1bn sterling, that is 37.5$ per share. 60% more than today. Does this mean that the market don’t think the club will be sold for 5.1bn?

(o/x) No, the share price is up 100% since the summer. The market believes the Glazers will sell. But – there is uncertainty whether (a) a buyer just will take the Glazers 67% stake or all shares, and (b) whether the A shares will cost as much as the B shares.

(p/x) Under the UK Companies Act this would be a given, under the Cayman Islands Companies Act it is not. It is why you list there. @SeekingAlpha @ufp:seekingalpha.com/news/3919550-m…

(r/x) So how likely does the market think that a sale is? There are specialist funds calculating on this using complex formulas. Very very roughly, I would like to guess that these funds think a sale of the club for an EV of around 6-7bn is very likely.

(4/n) (a/x) My thoughts on who the prospective buyer will be. Can a buyer own two clubs competing in the CL? Thoughts.

(b/x) It is as simple as this; we will get bought by whomever it makes the most sense for to buy us. The Glazers are looking for a classic “exit”. The exit venue is highly predictable normally.

(c/x) Exit alternatives are: (1) You can float the shares of holding, (2) you can sell the shares to Private Equity or (3) you can sell the shares to a horizontal or vertical industrial buyer.

(d/x) The closest thing to industrial buyer we have is like Amazon or Apple, sorting into the horizontal category. ManU would deliver content to them which they could put on their streaming services. Broadly. I would not rule them out, but they are unlikely alternatives.

(e/x) Why not sell the remaining shares over the stock market? Go back 2 years, I wouldn’t rule out a Spac at least being in the bidding. But the market conditions for IPOs are very limited right now.

(f/x) A PE buyer is of course the most likely alternative. I.e. a state connected investment fund, private US funds or rich individuals.

(g/x) For which PE buyer does it make the most sense to buy Manchester United? I think it is hard to come to any other conclusion that it makes the most sense for ME state fund. Why?

(h/x) They have a longer investment horizon (others look at 5 years, max 10). The ‘sports washing’ factor is positive for them as opposed to an anonymous fund. Could get synergies from existing sports ventures. Rich due to the energy prices, while everyone else are pressed.

(i/x) I do not think any other buyer is likely in terms of %s, but I would put the ME funds as the least unlikely buyers… Qataris first and foremost, albeit they could choose to go with LFC. Then the Saudis. If Dubai wanted a football team, why didn’t they bid for Chelsea?

(j/x) Sir Jim Ratcliffe would be my favorite to bet on today, since he so far publicly is alone in the running. Alone. I think he would be a good buyer. Ineos would get a lot of good press. They are launching the 4x4 Grenadier right now.

https://twitter.com/INEOSGrenadier/status/1615657168761503747?s=20&t=o1ht6Nl1J70TXaRgPhD8uQ

(k/x) But I think Jimmy could be outbid, if there is a hot bidding war.

(l/x) But both SJR and the ME state funds brings us to the topic if one owner can control multiple UEFA clubs?

(m/x) The first key ruling came in CAS 98/200 AEK Athens and SK Slavia Prague v UEFA (the “ENIC Case”). The deliberations in this case lead to the current rules. The CAS considered various ways in which the integrity of a competition may be threatened.

(n/x) For example, the CAS considered the fan interest of clubs which find themselves sharing a qualification group with two co-owned clubs and observed how co-owned clubs could conspire to obtain results that were mutually beneficial to them, at the expense of other teams.

(o/x) Overall, the CAS stressed the need for transparency in UEFA comp., noting that supporters perception of a particular game could be damaged by co-owned clubs.

(p/x) The second key ruling came in 2017 in AC-01/2017 (the "Red Bull Case") in which it was considered if Red Bull held controlling influence over both FC Red Bull Salzburg ("Salzburg") and RasenBallsport Leipzig GmbH ("Leipzig") (the "Clubs)". The UEFA investigation found:

(q/x) (a) that Red Bull had control of the ordinary membership of the General Assembly of Salzburg, that Salzburg garners an unusually high level of income from Red Bull via sponsorship agreements and that Salzburg rents its stadium (and offices) from a subsidiary of Red Bull,

(r/x) (b) that Red Bull has the ability to exercise decisive influence over Leipzig, that Leipzig garners an unusually high level of income from Red Bull via sponsorship agreements and that considerable loan financing is given to Leipzig by Red Bull on favourable terms; and

(s/x) (c) a formal cooperation agreement entered into by the Clubs, the unusually high level of player loans/transfers which have taken place between the Clubs in past seasons, the past involvement of certain individuals who are …

(t/x) …allegedly connected to Red Bull in the operation of both Clubs and the common visual identity/similar branding of the Clubs, as well as noting certain public statements regarding the Clubs made by the CEO of Red Bull.

(u/x) As a first step -- the UEFA "court" ("CFCB") -- looked at the meaning of “decisive influence”, which has no definition in the rules. The CFCB found that in light of the purpose of the rule, it is necessary to limit the nature of the decision making …

(v/x) …under scrutiny to decisions that impact on the integrity of a competition. It is implicit therefore that such decisions must necessarily relate to matters that affect the performance of a club in a competition and not other areas.

(x/x) In addition, the CFCB found that the rule was a "strict test", resulting in that nothing short of a legal power to control decision making -- which might impact the performance of the club in competitions -- is required under these provisions.

(y/x) As a second step, the CFCB noted that the clubs had made several changes, including removing persons performing duties for both clubs, terminating some loans, terminating the cooperation agreement and Red Bull's …

(z/y) membership in the general assembly of Salzburg as well as Salzburg undertaking "to address the situation" regarding the stadium. Hence the CFCB found that Red Bull could not be found to have a controlling influence over Salzburg.

(aa/x) The conclusion that can be drawn from these cases are that UEFA will not interpret the rules broadly and that there must be a danger for the integrity of a club in relation to its participation in competitions. In addition, Red Bull largely severed ties with Salzburg.

(ab/x) Again, I am fairly certain that you quite easily can work around this problem by creating a fictional "50+1" environment. It simply is not in place to interpret the rules broadly and there is no real risk for the integrity of the games in UEFA tournaments.

(ac/x) But, it could definitely end up being looked at by UEFA and it could take some time before you know the exact parameters. It is a bit of a nuisance for a buyer already owning a UEFA club. But ultimately, no serious owner will want to have the ability …

(ad/x) to impact a managers' selection of his team or in game coaching anyway. In a normal cooperate structure, you can however assume that a CEO or at least the board has the formal power to do so. Create a separate entity in control of the managerial aspects –it should be OK.

I was asked about this, the debt is 681m plus app. 300m in owed transfer fees, with some cash and receivables the purchase price should be around 6bn - 0.9bn = 5.1bn

• • •

Missing some Tweet in this thread? You can try to

force a refresh