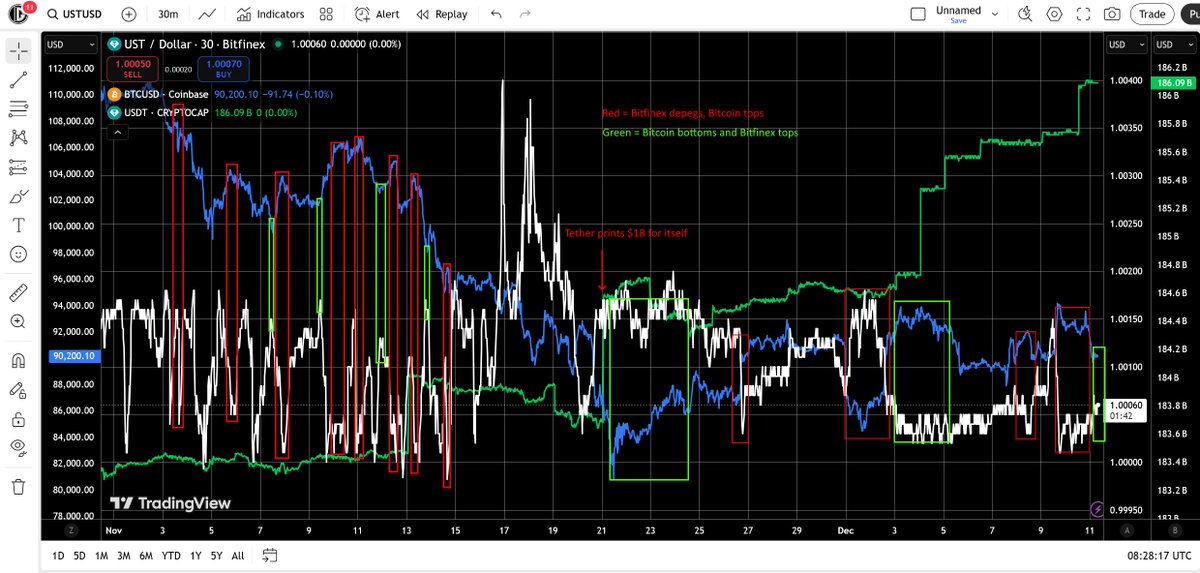

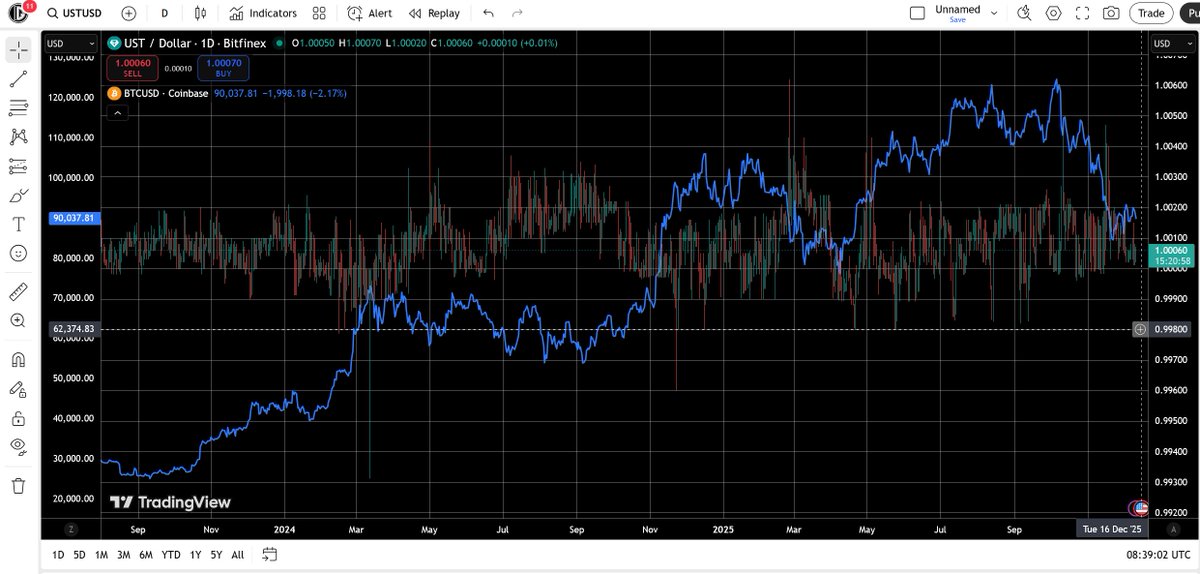

#Tether watch!

More BRRR. But that's not the question of today, which remains these darn chainswaps Bitfinex keeps doing.

This isn't small potatoes yknow. $388 million in 5 days!

More BRRR. But that's not the question of today, which remains these darn chainswaps Bitfinex keeps doing.

This isn't small potatoes yknow. $388 million in 5 days!

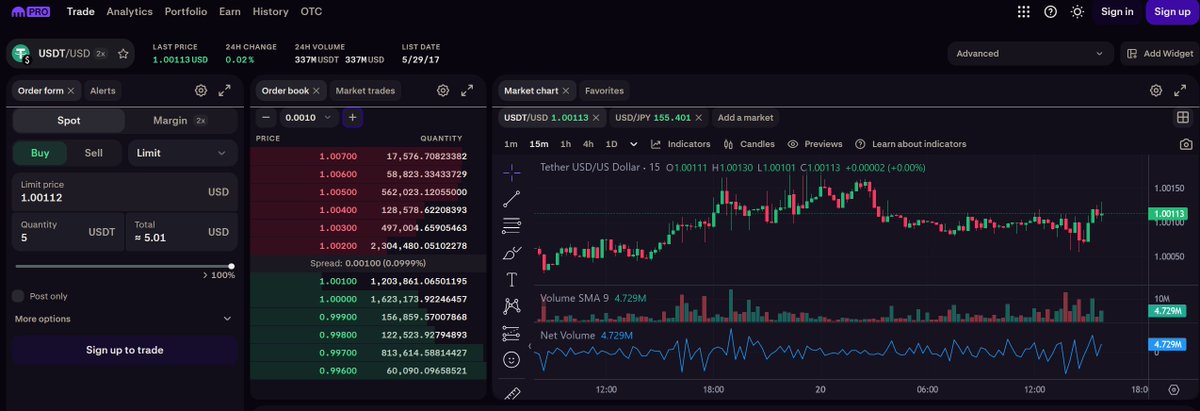

I really wonder what the function of Bitfinex 2 on Ethereum is as well. Since these chainswaps keep originating from there, and the INs before the chainswap are a total mystery to me.

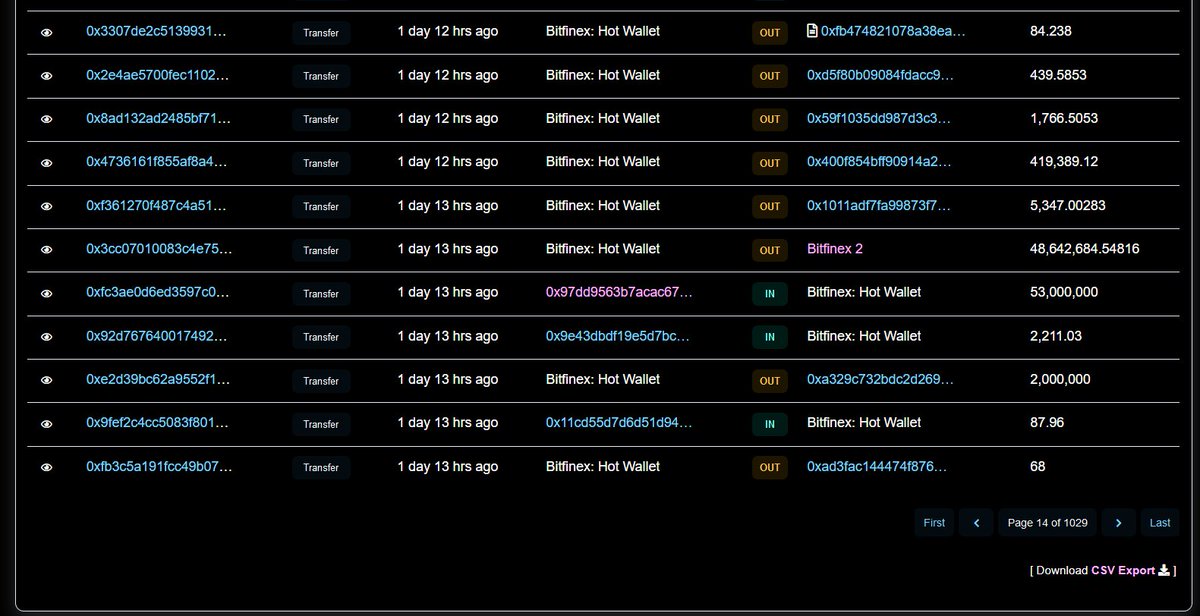

Looking up these transactions in the Bitfinex hotwallet, we can see the money flows in from other wallets *right before* it flows into Bitfinex 2 - but not always the exact amount that came into the hot wallet.

Honestly this looks like a bot network (cut and pasted together):

Honestly this looks like a bot network (cut and pasted together):

It's also interesting to note that 53 million came into Bitfinex Hot from the chainswap wallet on ETH, 53 million went out to Kraken on TRON - but *not all 53 million* coming in from Kraken to Bitfinex Hot on ETH went into Bitfinex 2.

Indicating either commingling or ownership.

Indicating either commingling or ownership.

I.E. Bitfinex is commingling user funds as it's not being sent over from one chain/wallet to another 1 to 1. They'd have to "top it off" with their own money.

Or they aren't because they themselves own this wallet - but that'd indicate they own *all* these Bitfinex 2 wallets.

Or they aren't because they themselves own this wallet - but that'd indicate they own *all* these Bitfinex 2 wallets.

I also checked, on the 53M txn there's a $4,357,316 difference i can't square away afterwards, so it's not a case of delay. Only 2 other txn exceeded that amount; a $48M of the same account and a $7.5M one that itself was $2.5M less than the IN in Bitfinex Hot.

Again either they're commingling funds in Bitfinex Hot or they own all of these accounts and they've been operating an elaborate network of trading bots (or both which is also fine with me).

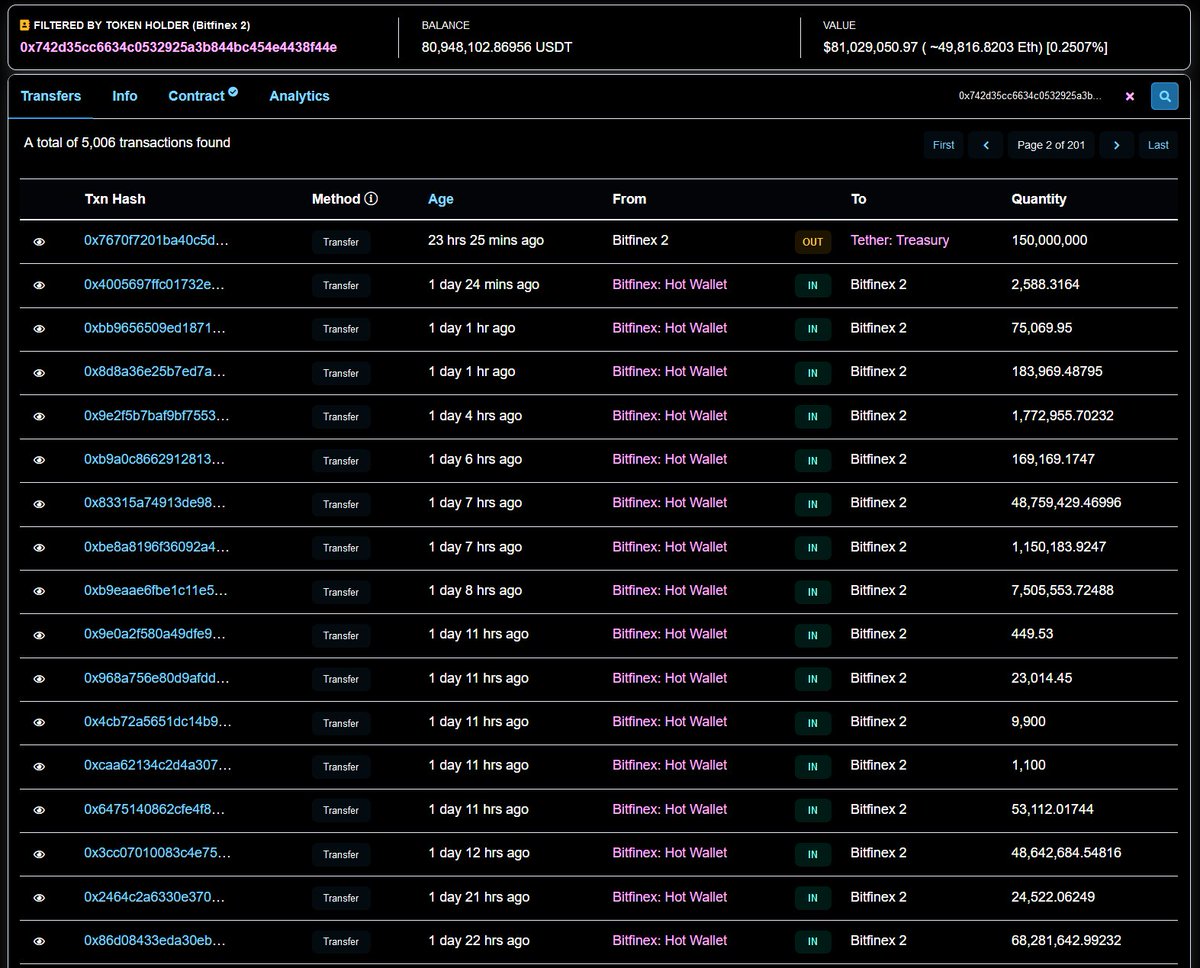

So the majority of this chainswap came from 1 account. Infact $165M out of $150M did:

So the majority of this chainswap came from 1 account. Infact $165M out of $150M did:

So. $150M was chainswapped from Bitfinex ETH to Bitfinex TRON.

$165M of that $150M came into Bitfinex 2 from 1 wallet.

$171M of that $165M was swapped into Bitfinex Hot from the ETH Kraken swap wallet.

$171M was swapped from Bitfinex Hot to Kraken Hot on TRON.

$165M of that $150M came into Bitfinex 2 from 1 wallet.

$171M of that $165M was swapped into Bitfinex Hot from the ETH Kraken swap wallet.

$171M was swapped from Bitfinex Hot to Kraken Hot on TRON.

In short: I favor Bitfinex owning all of these wallets and this being some money laundering scheme. I don't know why they'd chainswap or what the behind the scenes effect of all this is - but that it's happening is indisputable.

It's always something when numbers don't line up.

It's always something when numbers don't line up.

It gets even more weird looking at Bitfinex Hot on TRON (sorry can't help myself, with their hot wallet being fairly inactive it becomes possible to track these things).

The money went from Bitfinex 2 to the treasury on ETH, on ETH it went to Bitfinex Hot, but then it split:

The money went from Bitfinex 2 to the treasury on ETH, on ETH it went to Bitfinex Hot, but then it split:

This actually matters because that means Bitfinex 2 cannot be a "staking" or otherwise locking up wallet, including an official chainswap wallet (I.E. put your ETH tether here and we'll get you TRON tether).

Because that money would be distributed from its TRON counterpart.

Because that money would be distributed from its TRON counterpart.

If the -BeL wallet can move the money out of Bitfinex Hot before it's touched Bitfinex 2 on TRON, that means either Bitfinex is touching customer funds, or they own that wallet to begin with so it makes no difference to their control what route they send the money through.

Looking at the activity in Bitfinex 2 on ETH pre-chainswap and TRON Bitfinex 2 post-chainswap further indicates Bitfinex controls ALL these wallets, as now lots of small transactions have changed into a lump sump transaction in and out (or again, massive commingling happening):

The Bitfinex 2 wallet on TRON itself showing some very sketch behavior, transferring money out in bulk to Bitfinex Hot only to *right after* transfer alot or even most of the money right back.

And the latest chainswap happening *right in the middle of this* to boot.

And the latest chainswap happening *right in the middle of this* to boot.

If this isn't enough to prove shenanigans with ownership on-chain i dunno why we have blockchain. What's the point of verification if it's ignored?

@DoombergT @Bitfinexed @MikeBurgersburg @Cryptadamist @ParrotCapital @CasPiancey @DataFinnovation @intel_jakal @concodanomics

@DoombergT @Bitfinexed @MikeBurgersburg @Cryptadamist @ParrotCapital @CasPiancey @DataFinnovation @intel_jakal @concodanomics

Oh, and as a bonus?

That one blue link coming out of the ETH #Tether treasury way at the beginning?

That's Bitfinex printing themselves unbacked #USDT. Because that USDT went straight into Bitfinex 2. Which after this thread only a fool would bet is backed by "investments".

That one blue link coming out of the ETH #Tether treasury way at the beginning?

That's Bitfinex printing themselves unbacked #USDT. Because that USDT went straight into Bitfinex 2. Which after this thread only a fool would bet is backed by "investments".

• • •

Missing some Tweet in this thread? You can try to

force a refresh