1/ #GM

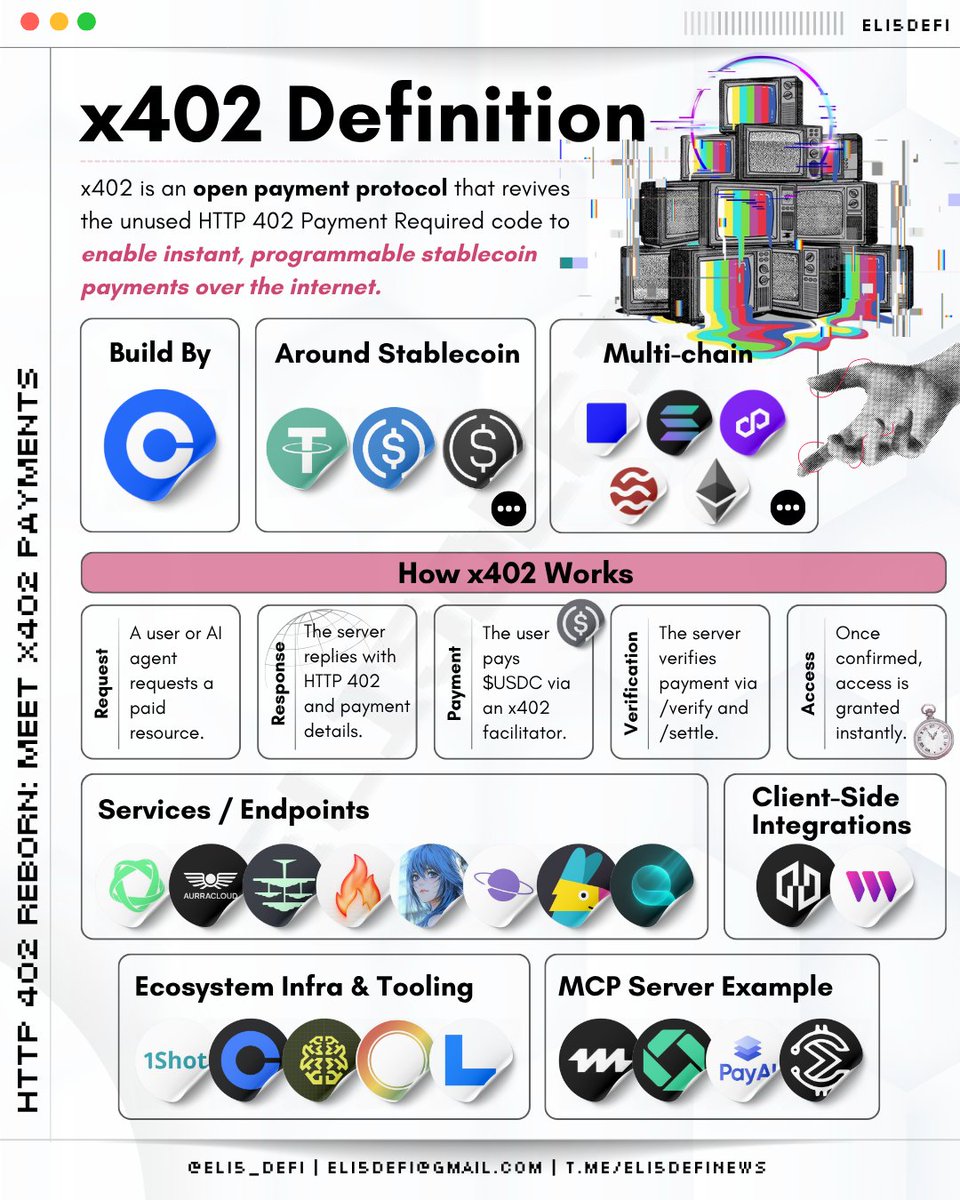

How does @FactorDAO build #DeFi products for mass adoption? What is #Hyperstructures? how does @FactorDAO weaves the #RealYield narrative and create the liquidity layer of asset management? Tune in to our visual thread.

How does @FactorDAO build #DeFi products for mass adoption? What is #Hyperstructures? how does @FactorDAO weaves the #RealYield narrative and create the liquidity layer of asset management? Tune in to our visual thread.

2/ Disclaimers

Before we move forward, please note that this thread merely aims to share our understanding of the topic, and should not be taken as financial advice. We are also part of @FactorDAO and as objectively as this thread was created there might be some bias involved.

Before we move forward, please note that this thread merely aims to share our understanding of the topic, and should not be taken as financial advice. We are also part of @FactorDAO and as objectively as this thread was created there might be some bias involved.

3/ #DeFi brings innovations in finance but with a non-inclusivity aspect due to the protocol's complexity and dedicated resources to conduct due diligence. DAM delegates the investment decision while retaining transparency, self-custody of assets, and composability.

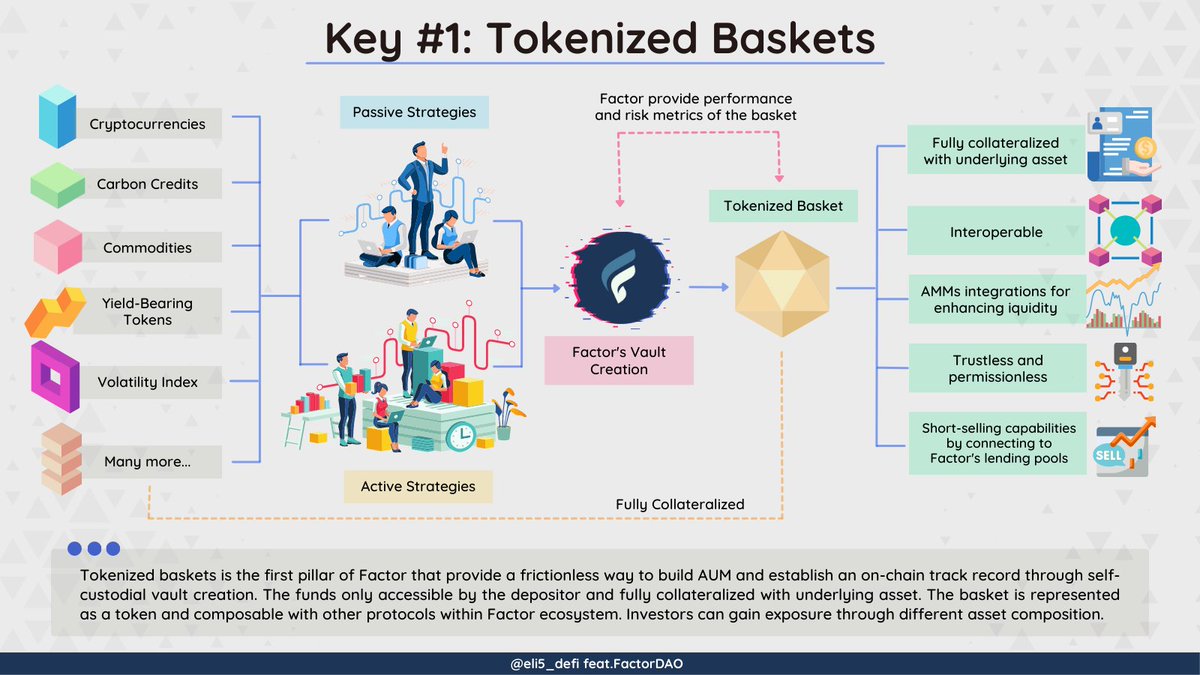

4/ @FactorDAO is the DeFi project that aims beyond regular DAM by providing the infrastructures for tokenized baskets, yield pools, and derivatives assets.

5/ @FactorDAO 's infrastructure for the tokenized vault is based on the ERC-4626 token standard that makes development, integration, and seamless interoperability possible. Factor expand and leverage ERC-4626 functionalities to support multiple underlying assets.

6/ Tokenized baskets provide a frictionless way to build AUM and establish an on-chain track record through self-custodial vault creation. The basket is represented as a token and composable with other protocols within the @FactorDAO ecosystem.

7/ Yield Pools enable permissionless non-custodial pools for borrowing and lending. Investors can supply and borrow assets in various yield pools that are adjusted based on the collateralization factor and asset liquidity.

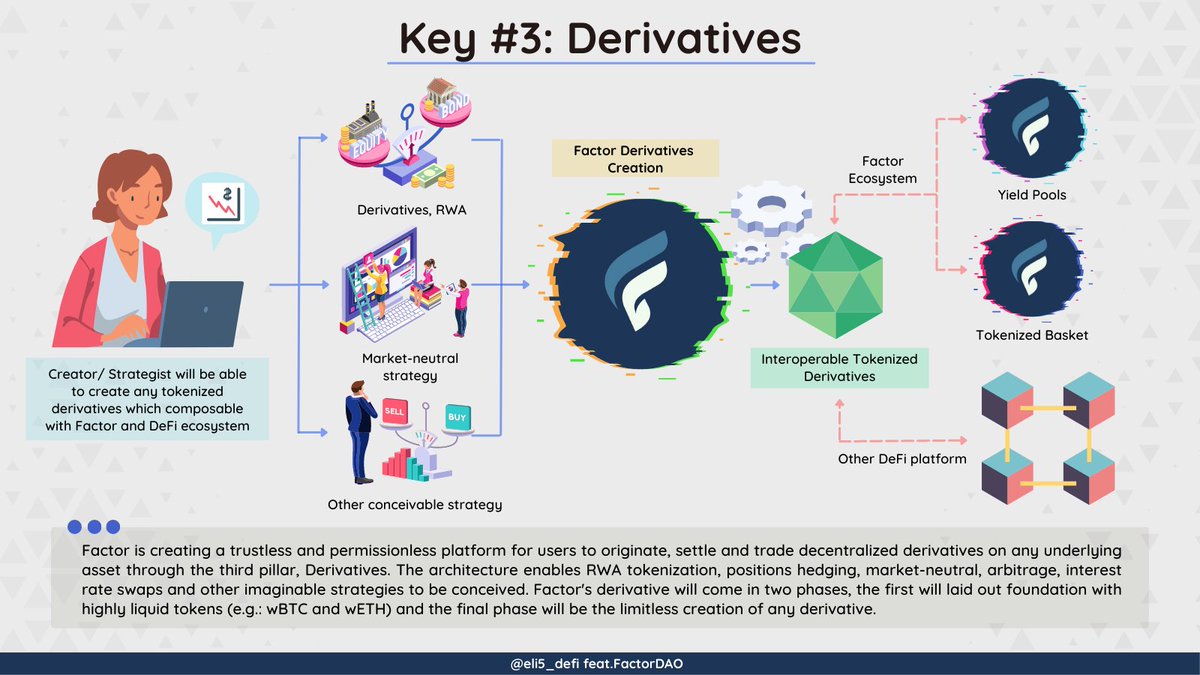

8/ @FactorDAO is creating a trustless and permissionless platform for users to originate, settle, and trade derivatives. The architecture enables RWA tokenization, positions hedging, market-neutral, arbitrage, interest rate swaps, and limitless strategies to be conceived.

9/ #Hyperstructures in blockchain refer to the unstoppable protocol that runs without any maintenance, interruption, or intermediaries, whilst maintaining neutrality. @FactorDAO's ultimate iteration aims to become the positive-sum ecosystem for any #DeFi participants

10/ With all the pillars being architected as the foundation for modular decentralized asset management, @FactorDAO becomes the #hyperstructures of digital assets by empowering participants to access, create, customize and synergize building blocks of #DeFi across the chain.

12/ In the next publication, we will discuss more on how @FactorDAO provide #RealYield, not as a narrative but deeply integrated into all of the aspects of their product and how it benefits the partner protocol, treasury managers, and retail investors.

13/ #Omake! we also prepared the audio visual format for @FactorDAO please put your 🔊on to tune in!

cc: @CrossChainAlex, @Kurapika_DAO

🎵 - Dylan Sitts - Closure

epidemicsound.com/track/Mxvq315H…

cc: @CrossChainAlex, @Kurapika_DAO

🎵 - Dylan Sitts - Closure

epidemicsound.com/track/Mxvq315H…

13/ To learn more about @FactorDAO and $FCTR:

🌐 Website: factor.fi

📑 Whitepaper; notion.so/Whitepaper-d25…

📺 YouTube:

🐦 Twitter: @FactorDAO

👾 Discord: discord.gg/UKUGJHXZbP

🌐 Website: factor.fi

📑 Whitepaper; notion.so/Whitepaper-d25…

📺 YouTube:

🐦 Twitter: @FactorDAO

👾 Discord: discord.gg/UKUGJHXZbP

14/ @FactorDAO native tokens $FCTR will launch on 20th February '23 on @CamelotDEX in @arbitrum with price discovery mechanism, no whitelist or presale. See this video to get more details on how the mechanism works and post-launch information.

15/ @FactorDAO will host #TheKeyFactor Spaces - 1st February 2023 - with @BufferFinance as a guest to discuss options trading, derivatives, and risk hedging. Join and set your reminder in link below:

twitter.com/i/spaces/1dRKZ…

twitter.com/i/spaces/1dRKZ…

16/ Tagged #RealYield seekers:

@TheCryptoDog

@milesdeutscher

@OnChainWizard

@SamuelXeus

@Route2FI

@thedefiedge

@blocmatesdotcom

@CryptoHayes

@takegreenpill

@0xthade

@CryptoKaduna

@MoonKing___

@crypto_condom

@ThorHartvigsen

@AstrologyCrypto

@CroissantEth

@andrewsaunders

@TheCryptoDog

@milesdeutscher

@OnChainWizard

@SamuelXeus

@Route2FI

@thedefiedge

@blocmatesdotcom

@CryptoHayes

@takegreenpill

@0xthade

@CryptoKaduna

@MoonKing___

@crypto_condom

@ThorHartvigsen

@AstrologyCrypto

@CroissantEth

@andrewsaunders

17/ Tagged amazing #DeFi educator (1):

@byChadManDan

@jediblocmates

@rektdiomedes

@alpha_pls

@JiraiyaReal

@NickDrakon

@ReveloIntel

@RiddlerDeFi

@crypthoem

@TheDeFinvestor

@crypto_linn

@mimiLFG

@launchy_

@Dynamo_Patrick

@jake_pahor

@CryptoDragonite

@VirtualKenji

@defi_mochi

@byChadManDan

@jediblocmates

@rektdiomedes

@alpha_pls

@JiraiyaReal

@NickDrakon

@ReveloIntel

@RiddlerDeFi

@crypthoem

@TheDeFinvestor

@crypto_linn

@mimiLFG

@launchy_

@Dynamo_Patrick

@jake_pahor

@CryptoDragonite

@VirtualKenji

@defi_mochi

18/ Amazing #DeFi educators (2):

@phtevenstrong

@DeFi_Made_Here

@Prof_Crypto_B

@thewolfofdefi

@0xUnihax0r

@defiprincess_

@cyrilXBT

@patrickrooney

@DefiIgnas

@DegenSensei

@DeFi_Cheetah

@TheDeFISaint

@TheCoffeeBlock

@ViktorDefi

@safetyth1rd

@SmallCapScience

@ChadCaff

@phtevenstrong

@DeFi_Made_Here

@Prof_Crypto_B

@thewolfofdefi

@0xUnihax0r

@defiprincess_

@cyrilXBT

@patrickrooney

@DefiIgnas

@DegenSensei

@DeFi_Cheetah

@TheDeFISaint

@TheCoffeeBlock

@ViktorDefi

@safetyth1rd

@SmallCapScience

@ChadCaff

19/ Amazing #DeFi educators (3):

@DeFiMinty

@Slappjakke

@DAdvisoor

@burstingbagel

@royalty_crypto

@shitc0in

@EricCryptoman

@LouisCooper_

@WinterSoldierxz

@FishMarketAcad

@Chinchillah_

@0xTindorr

@ArbiAlpha

@0xCrypto_doctor

@Only1temmy

@CoinSurveyor

@RealCryptotem

@DeFiMinty

@Slappjakke

@DAdvisoor

@burstingbagel

@royalty_crypto

@shitc0in

@EricCryptoman

@LouisCooper_

@WinterSoldierxz

@FishMarketAcad

@Chinchillah_

@0xTindorr

@ArbiAlpha

@0xCrypto_doctor

@Only1temmy

@CoinSurveyor

@RealCryptotem

@DeFiMinty @Slappjakke @DAdvisoor @burstingbagel @royalty_crypto @shitc0in @EricCryptoman @LouisCooper_ @WinterSoldierxz @FishMarketAcad @Chinchillah_ @0xTindorr @ArbiAlpha @0xCrypto_doctor @Only1temmy @CoinSurveyor @RealCryptotem 20/ If you love our thread, please like, retweet, follow @FactorDAO, and share our #visualguide.

Many thanks!

Many thanks!

https://twitter.com/eli5_defi/status/1620389794068180993?s=20&t=3nRPLd00ymargP1KfxgULw

• • •

Missing some Tweet in this thread? You can try to

force a refresh