🚀This week European Carbon price approached €100

Main drivers:

Short-term: short-covering, options, catch-up hedging, colder weather

Underlying: Compliance demand, improving economic outlook and optimism following #EUETS reform deal

🧵A thread

Main drivers:

Short-term: short-covering, options, catch-up hedging, colder weather

Underlying: Compliance demand, improving economic outlook and optimism following #EUETS reform deal

🧵A thread

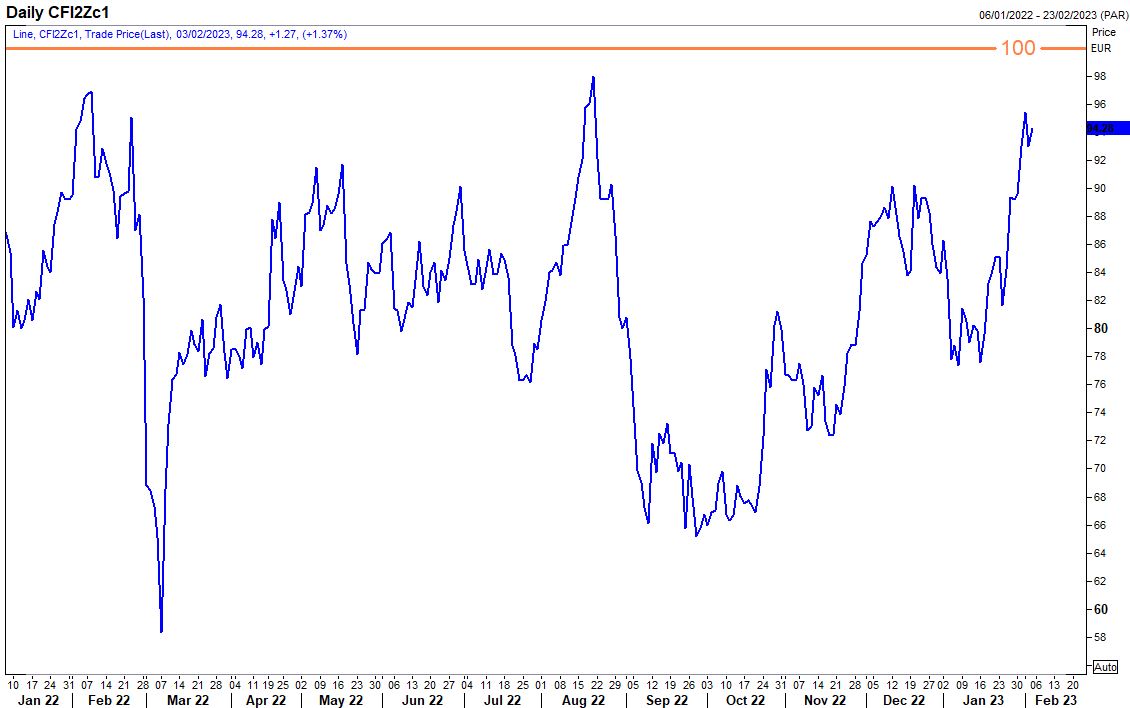

The Dec23 EUA contract broke above several resistance levels in recent sessions, hitting €97.55/t on 1 February, the highest since August 2022.

The rally since mid-January has definitely caught some participants unprepared, triggering short-covering

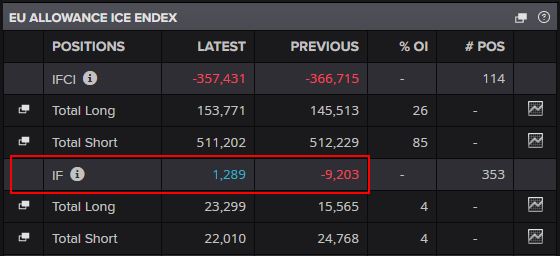

This can be partly observed in the week-on-week changes in Commitments of Traders data.

Investments Funds’ positions flipped from net short 9.2 Mt to net long 1.3 Mt in the week ending 27 January.

Investments Funds’ positions flipped from net short 9.2 Mt to net long 1.3 Mt in the week ending 27 January.

Repositioning of option traders could have accelerated the rally. There have been some movements in March EUA options’ open interests. EUA price rally will change the implied volatility of options, forcing them to hedge EUA futures.

Catch-up hedging by utilities or other participants is another supportive factor.

Volatile energy markets in 2022 made participants postponing their forward hedging.

Open Interests for Dec23 EUA is very low compared to previous years for front Dec contract

Volatile energy markets in 2022 made participants postponing their forward hedging.

Open Interests for Dec23 EUA is very low compared to previous years for front Dec contract

In comparison, Open Interests for March 2023 futures are quite high.

This could implies that some participants have rolled over their Dec22 positions to March23, instead of Dec23, partly due to the prospect of REPowerEU sales hitting the market later on.

This could implies that some participants have rolled over their Dec22 positions to March23, instead of Dec23, partly due to the prospect of REPowerEU sales hitting the market later on.

The rise in Dec23 open interests confirms the view that some participants have built up new positions lately.

And this great explanation of the postponed hedging by Jan @Jan_CO2

And this great explanation of the postponed hedging by Jan @Jan_CO2

https://twitter.com/Jan_CO2/status/1613213636733829120

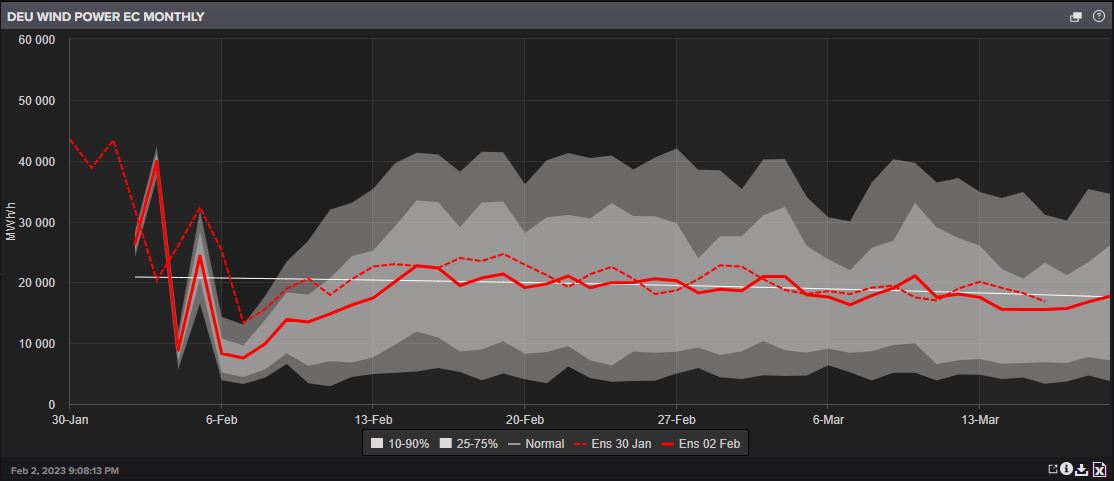

🌡️Weather remains an important driver in the winter months.

The latest forecasts point towards colder temperatures and lower wind output, which might support energy complex and carbon too, triggering the upward move.

The latest forecasts point towards colder temperatures and lower wind output, which might support energy complex and carbon too, triggering the upward move.

BUT in addition to the short-term factors above, I would think the strong rally is fundamentally supported by Compliance demand, improving economic outlook and optimism following the landmark EU ETS deal last December #Fitfor55

consilium.europa.eu/en/press/press…

consilium.europa.eu/en/press/press…

Compliance demand is typically strong in the first quarter and we can always observe strong dip-buying interests for allowances when price fell.

Major forecasters have all revised up their EU GDP outlook for 2023

reuters.com/markets/imf-li…

Major forecasters have all revised up their EU GDP outlook for 2023

reuters.com/markets/imf-li…

The expected recovery in industry output could have reduced the willingness to offload surplus allowances by industrials -> less sellers

There is also a question mark on whether the annual free allocation will be handed out in time by 28 February.

There is also a question mark on whether the annual free allocation will be handed out in time by 28 February.

EU ETS reform deal / CBAM etc. are expected to be finalized into legislation this spring. There might already be proxy EUA hedging by maritime operators ⛴️or international enterprises exposed to CBAM

Although, I think this is a very vague supporting factor

Although, I think this is a very vague supporting factor

Going forward, the looming REPowerEU sales of EUAs will still pose downside risks. The timing and pace of these additional EUA supply are very important...

reuters.com/business/energ…

reuters.com/business/energ…

• • •

Missing some Tweet in this thread? You can try to

force a refresh