#GLP strategy

As many know, I've been a big fan of @GMX_IO $GLP strategy due to unique qualities protecting downside & maintaining upside...

real APU ~20%-30% + juiced #AVAX Rush rewards compounding on @yieldyak_ $YAK

it just got a lot better...

1/14

As many know, I've been a big fan of @GMX_IO $GLP strategy due to unique qualities protecting downside & maintaining upside...

real APU ~20%-30% + juiced #AVAX Rush rewards compounding on @yieldyak_ $YAK

it just got a lot better...

https://twitter.com/rogeravax/status/1603081770538254336

1/14

1st off, @GMX_IO is experiencing a record in trading & other fees, resulting in real yields of +90% APY

Just compounding that on @yieldyak_ YAK would result in +130% APYs

2/14

Just compounding that on @yieldyak_ YAK would result in +130% APYs

2/14

w/ the advent of @DeltaPrimeDefi allowing you to undercollateralise your @GMX_IO $GLP & lever your exposure, you can multiple your APY!

3/14

https://twitter.com/harry_avax/status/1625756968165023745

3/14

Here's my step-by-step guide (based initially on this great article by @harry_avax)

Many of my friends struggled to deploy this - forgivable since we all need to stretch our defi sea legs after a long bear mkt - so hopefully this helps!

medium.com/@harry.avax/re…

4/14

Many of my friends struggled to deploy this - forgivable since we all need to stretch our defi sea legs after a long bear mkt - so hopefully this helps!

medium.com/@harry.avax/re…

4/14

Step-by-Step Guide

1) Buy @GMX_IO $GLP via @yieldyak_ $YAK swap

2) Deposit GLP on @DeltaPrimeDefi

3) Stake GLP on farms page

4) Borrow $USDC (or #AVAX)

5) Use USDC to mint/redeem add'l GLP

6) Deposit newly minted GLP

5/14

1) Buy @GMX_IO $GLP via @yieldyak_ $YAK swap

2) Deposit GLP on @DeltaPrimeDefi

3) Stake GLP on farms page

4) Borrow $USDC (or #AVAX)

5) Use USDC to mint/redeem add'l GLP

6) Deposit newly minted GLP

5/14

1) Buy @GMX_IO $GLP via @yieldyak_ swap

yieldyak.com/swap

which gives you optimal pricing on GLP

6/14

yieldyak.com/swap

which gives you optimal pricing on GLP

https://twitter.com/yieldyak_/status/1625146032320393222

6/14

2) Deposit GLP on @DeltaPrimeDefi

Go to:

app.deltaprime.io/#/prime-accoun…

+ symbol -> deposit collateral

add funds (in this case 7.7k GLP)

(also deposit a small amt 0.1 #AVAX to open up your DeltaPrime account)

7/14

Go to:

app.deltaprime.io/#/prime-accoun…

+ symbol -> deposit collateral

add funds (in this case 7.7k GLP)

(also deposit a small amt 0.1 #AVAX to open up your DeltaPrime account)

7/14

3) Stake GLP on farms page

Go to "Farms" tab

+ symbol -> Stake

DeltaPrime is staking your GLP in the @yieldyak_ $GLP strategy, enabling autocompounding & #AVAX Rush Rewards 🔺💕

8/14

Go to "Farms" tab

+ symbol -> Stake

DeltaPrime is staking your GLP in the @yieldyak_ $GLP strategy, enabling autocompounding & #AVAX Rush Rewards 🔺💕

8/14

4) Borrow $USDC (or #AVAX)

Go back to "Assets" tab

I'm choosing to borrow USDC at 35% at ~3.5x my GLP collateral

+ symbol -> Borrow

Note: since I'm borrowing USDC to then buy GLP, as long as GLP APY is >35%, this strategy is profitable

9/14

Go back to "Assets" tab

I'm choosing to borrow USDC at 35% at ~3.5x my GLP collateral

+ symbol -> Borrow

Note: since I'm borrowing USDC to then buy GLP, as long as GLP APY is >35%, this strategy is profitable

9/14

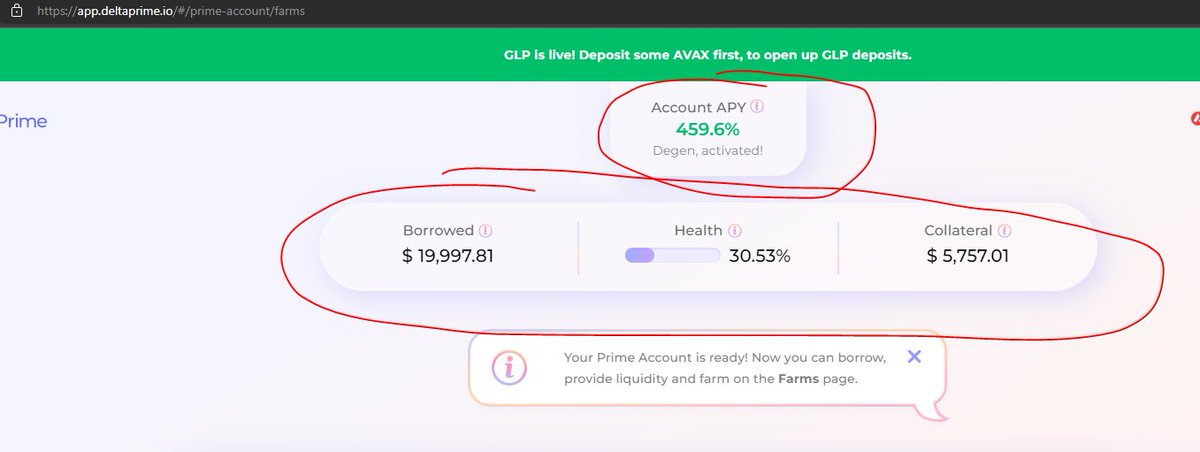

BE CAREFUL w/ leverage. My borrowing USDC at 3.5x GLP collateral ($20k/$5.7l) is still risky

Note: if you borrow AVAX you're essentially short AVAX vs GLP (50% stables, 24% BTC, 21% ETH, 5% AVAX)

Note: you start getting partially liquidated when your health % goes to 0%

10/14

Note: if you borrow AVAX you're essentially short AVAX vs GLP (50% stables, 24% BTC, 21% ETH, 5% AVAX)

Note: you start getting partially liquidated when your health % goes to 0%

10/14

5) Use USDC to mint/redeem add'l GLP

In same "Assets" tab, click arrows action on GLP to mint/redeem GLP

In this case I'm using $20k USDC to mint a further /$0.75/GLP = 26.6k GLP

11/14

In same "Assets" tab, click arrows action on GLP to mint/redeem GLP

In this case I'm using $20k USDC to mint a further /$0.75/GLP = 26.6k GLP

11/14

That's it!

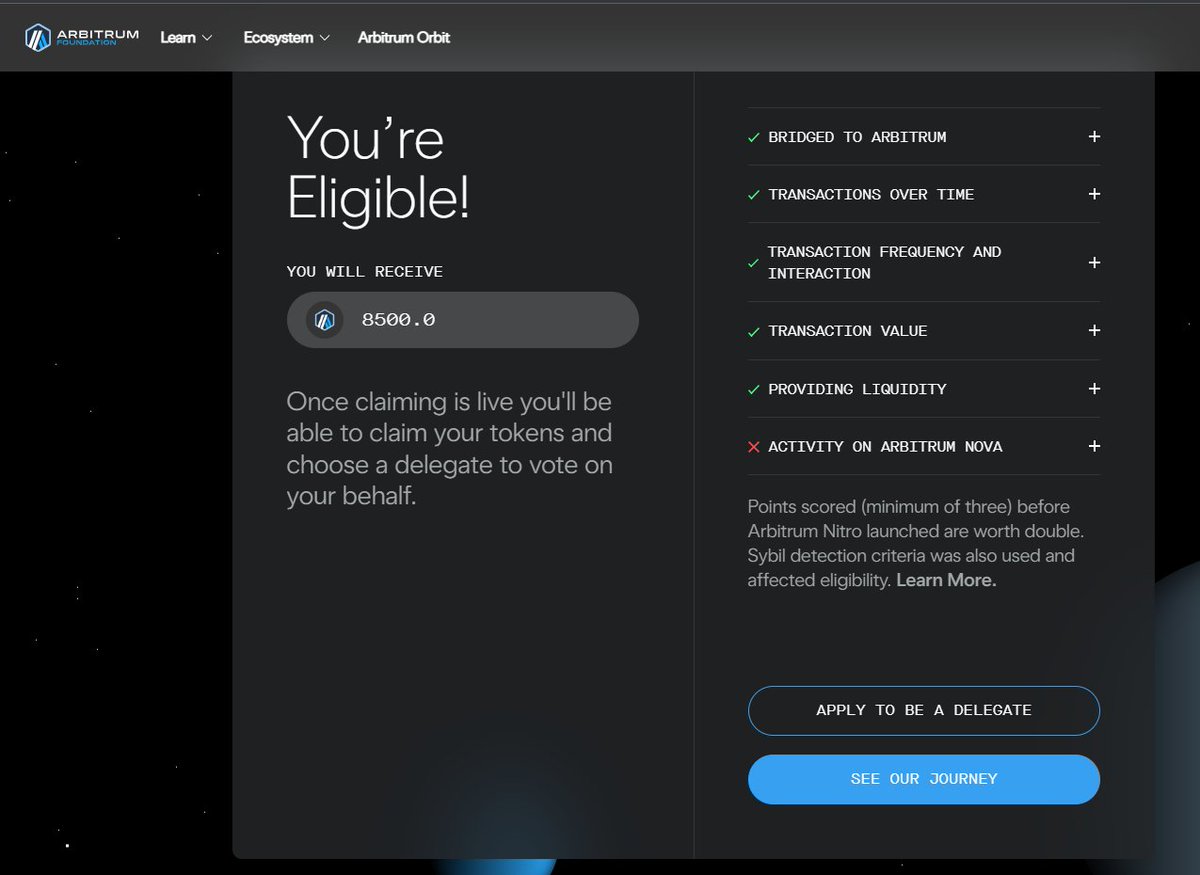

The final outcome is taking my $5.7k $GLP, depositing as collateral to borrow $USDC to buy ~3.5x more GLP

APY ~460%!!!

We'll have to watch this closely & evaluate as variables (esp APY borrow & earn rates)

13/14

The final outcome is taking my $5.7k $GLP, depositing as collateral to borrow $USDC to buy ~3.5x more GLP

APY ~460%!!!

We'll have to watch this closely & evaluate as variables (esp APY borrow & earn rates)

13/14

1 final note: there's no add'l "looping"

the borrow and the deposit of the @GMX_IO $GLP minted on @DeltaPrimeDefi are NOT on your personal account but on DeltaPrime's account so they are not part of your collateral

Be careful & NFA! Have a nice day!!!

14/14

the borrow and the deposit of the @GMX_IO $GLP minted on @DeltaPrimeDefi are NOT on your personal account but on DeltaPrime's account so they are not part of your collateral

Be careful & NFA! Have a nice day!!!

14/14

Update on my @GMX_IO $GLP leveraged position on @DeltaPrimeDefi

-been steadily adding to my GLP collateral, selling altcoins from last day's pump

-also adding leverage (now 20% health vs. previous 25% health)

feels good to be degen defi-ing again

-been steadily adding to my GLP collateral, selling altcoins from last day's pump

-also adding leverage (now 20% health vs. previous 25% health)

feels good to be degen defi-ing again

• • •

Missing some Tweet in this thread? You can try to

force a refresh