exploring the next big thing, gamblefi

@MonkeyTiltPlay @LEVR_bet @LiveDuel @goatedcom @shufflecom

How to get URL link on X (Twitter) App

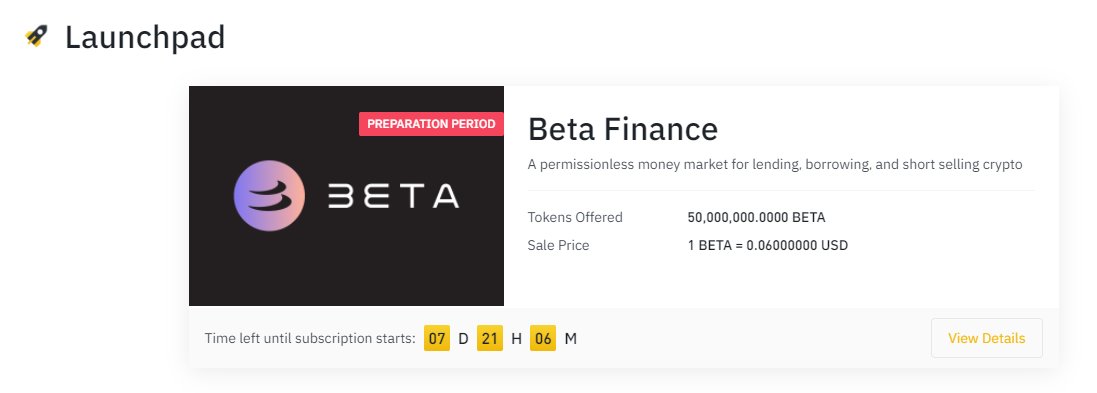

my analysis of the past 6 @binance launchpad IDOs indicate that an IDO allocation is basically free monies, with the median performance at launch of >15x (@opencampus_xyz $ID currently >25x)

my analysis of the past 6 @binance launchpad IDOs indicate that an IDO allocation is basically free monies, with the median performance at launch of >15x (@opencampus_xyz $ID currently >25x)

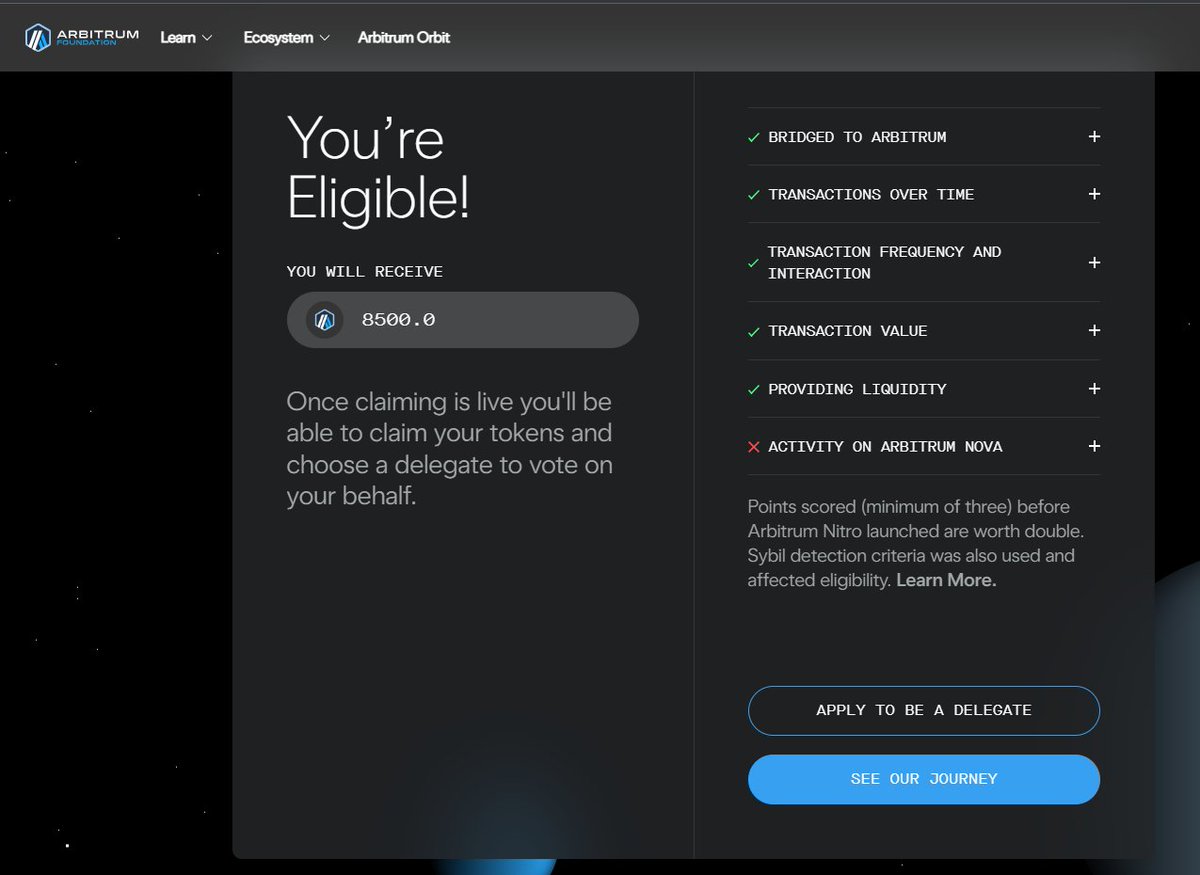

https://twitter.com/arbitrum/status/1636352104913666050Tokens were based on 1) bridging, 2) txs over time, 3) tx freq & interaction, 4) TVL, 5) liquidity & 6) activity on Nova w/ tiers

https://twitter.com/rogeravax/status/1603081770538254336

https://twitter.com/axelarcore/status/1556989244559835137

https://twitter.com/echidna_finance/status/1497994685801205761

https://twitter.com/vector_fi/status/1497993820197294082

What does #PTParty mean?

What does #PTParty mean?https://twitter.com/rogeravax/status/1497722457754681344

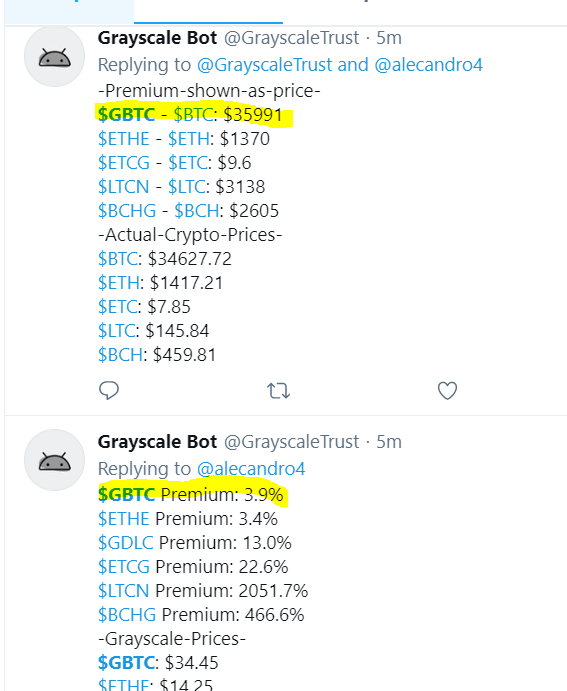

https://twitter.com/rogerclu/status/1389183382370852867

It could've meant a variety of things, perhaps regulatory clearance in a key market (@binance has been getting shut down), but I was hopeful that it could possibly mean... #BNB #launchpad season. And yes my prayers were answered!

It could've meant a variety of things, perhaps regulatory clearance in a key market (@binance has been getting shut down), but I was hopeful that it could possibly mean... #BNB #launchpad season. And yes my prayers were answered!

https://twitter.com/rogerclu/status/1427565319040782339

https://twitter.com/rogerclu/status/1390352456987598853

a) General macro renewed interest in L1s

a) General macro renewed interest in L1s

With this thread I'll do a run-down of my overall portfolio (not just the AVAX portion which is obv. a major piece) & my macro investment decisions, esp. important to do during such volatile times (yesterday – ouch). I hope its helpful, but this is *not* investment advice

With this thread I'll do a run-down of my overall portfolio (not just the AVAX portion which is obv. a major piece) & my macro investment decisions, esp. important to do during such volatile times (yesterday – ouch). I hope its helpful, but this is *not* investment advice

$GDL $25m TVL is all the more impressive given some early hiccups at launch. The team is delivering an airdrop to compensate those users negatively impacted by the staking bug (in conjunction with swapping incentives & early staker airdrops)

$GDL $25m TVL is all the more impressive given some early hiccups at launch. The team is delivering an airdrop to compensate those users negatively impacted by the staking bug (in conjunction with swapping incentives & early staker airdrops)https://twitter.com/gondola_finance/status/1391754656817106949

1) Macro Commentary

1) Macro Commentaryhttps://twitter.com/rogerclu/status/1386041239628288006

https://twitter.com/avalancheavax/status/1388176504631214080

https://twitter.com/Pandaswapex/status/1375834160951140363@Pandaswapex yield farming is LIVE (as of ~9:45 UTC)!!!

1) Price Action: yesterday, we had some uplift with @Tesla's news that they would accept #bitcoin, but that was short-lived with crypto taking a dive & BTC struggling to stay above $50k & #Ethereum hovering ~$1.6k. $AVAX is -17% to $25.50. UGH!!!

1) Price Action: yesterday, we had some uplift with @Tesla's news that they would accept #bitcoin, but that was short-lived with crypto taking a dive & BTC struggling to stay above $50k & #Ethereum hovering ~$1.6k. $AVAX is -17% to $25.50. UGH!!!