Composability💠is a core feature of DeFi, enabling developers to integrate existing protocols to create new services. @GMX_IO is one of them.

This is a comprehensive guide to all 28 projects on GMX.

🧵👇 covers a few, find the full guide link in the last tweet

#CryptoResearch

This is a comprehensive guide to all 28 projects on GMX.

🧵👇 covers a few, find the full guide link in the last tweet

#CryptoResearch

In this thread, we'll cover 5 project categories👇

1/ Vaults, the biggest category with most projects.

2/ Lending, enabling degens to borrow against their GLP holdings and add leverage to their yield farming.

3/ Options

4/ Social Trading

5/ Others

1/ Vaults, the biggest category with most projects.

2/ Lending, enabling degens to borrow against their GLP holdings and add leverage to their yield farming.

3/ Options

4/ Social Trading

5/ Others

1.1/ @MIM_Spell

Abracadabra is the largest auto-compounding GLP farm with a TVL of $15.47 million. With magicGLP, the ETH yield generated is automatically reinvested into magicGLP, which maximizes returns. The value of magicGLP will increase over time due to the auto-compound.

Abracadabra is the largest auto-compounding GLP farm with a TVL of $15.47 million. With magicGLP, the ETH yield generated is automatically reinvested into magicGLP, which maximizes returns. The value of magicGLP will increase over time due to the auto-compound.

1.2/ @PlutusDAO_io

The 2nd largest with a TVL of $7.86 million, where users deposit GLP for plvGLP.

plvGLP holders receive 15% of PLS liquidity mining emissions. The emissions are weighted towards the early months, meaning the first few months will have the highest emissions.

The 2nd largest with a TVL of $7.86 million, where users deposit GLP for plvGLP.

plvGLP holders receive 15% of PLS liquidity mining emissions. The emissions are weighted towards the early months, meaning the first few months will have the highest emissions.

1.4/ @rage_trade

Its popular Risk-On Vault invests $USDC deposited by users into GLP while building short positions in $ETH and $BTC via flash loans. So it hedges your long exposure when you hold GLP.

The combined TVL of Rage is $11.13m.

Its popular Risk-On Vault invests $USDC deposited by users into GLP while building short positions in $ETH and $BTC via flash loans. So it hedges your long exposure when you hold GLP.

The combined TVL of Rage is $11.13m.

1.5/ @Neutrafinance

It tackles the delta-neutral problem via a different route. By hedging the long exposure by GLP via opening leveraged short positions on GMX itself. It maintains delta neutrality through a unique rebalancing mechanism with a TVL of $1.16m.

It tackles the delta-neutral problem via a different route. By hedging the long exposure by GLP via opening leveraged short positions on GMX itself. It maintains delta neutrality through a unique rebalancing mechanism with a TVL of $1.16m.

1.6/ @UmamiFinance

Similar to Neutra, Umami's delta-neutral strategy also involves hedging on GMX. It also implements an internal netting strategy, which reallocates Delta among vaults to minimize hedging costs. Hedges are algorithmically rebalanced at regular intervals.

Similar to Neutra, Umami's delta-neutral strategy also involves hedging on GMX. It also implements an internal netting strategy, which reallocates Delta among vaults to minimize hedging costs. Hedges are algorithmically rebalanced at regular intervals.

1.7/

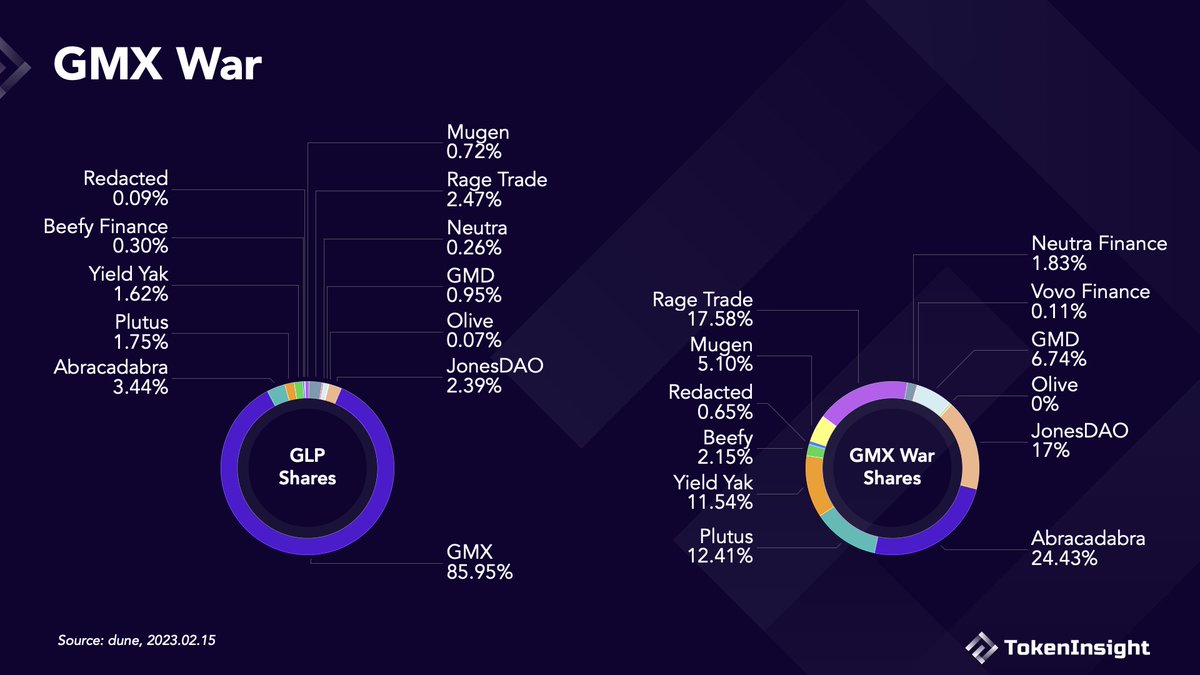

The GMX War has already begun as players fight each other for GLP shares. While the basic auto-compounding function is already attractive, further innovations could boost GLP yields even more.

The GMX War has already begun as players fight each other for GLP shares. While the basic auto-compounding function is already attractive, further innovations could boost GLP yields even more.

2.1/

Behind vaults, lending is the second biggest category building on @GMX. @JonesDAO_io Vault is also a leverage yield farming product with built-in lending.

The main players are @vestafinance, @sentimentxyz , @RodeoCoin, and @tender_fi on @arbitrum.

Behind vaults, lending is the second biggest category building on @GMX. @JonesDAO_io Vault is also a leverage yield farming product with built-in lending.

The main players are @vestafinance, @sentimentxyz , @RodeoCoin, and @tender_fi on @arbitrum.

2.2/

As well as @DeltaPrimeDefi, @YetiFinance, and @Moremoneyfi on @avalancheavax. All of them allow users to borrow against their GLP. Sentiment also enables using GMX as collateral, while Rodeo has its own auto-compounding GLP vault.

As well as @DeltaPrimeDefi, @YetiFinance, and @Moremoneyfi on @avalancheavax. All of them allow users to borrow against their GLP. Sentiment also enables using GMX as collateral, while Rodeo has its own auto-compounding GLP vault.

3.1/ @lyrafinance

A DEX for options. It aims to keep the exposure of liquidity providers close to delta-neutral, which is achieved via either opening a long or short perpetual futures position through GMX or spot synth position through Synthetix.

A DEX for options. It aims to keep the exposure of liquidity providers close to delta-neutral, which is achieved via either opening a long or short perpetual futures position through GMX or spot synth position through Synthetix.

3.2/ @dopex_io

Dopex integrates GMX in 2 ways.

The Atlantic Perp Protection allows perp traders to shield themselves against liquidation risks.

Dopex also helps with GLP farming, where their Atlantic Put acts as a hedge against GLP price action.

Dopex integrates GMX in 2 ways.

The Atlantic Perp Protection allows perp traders to shield themselves against liquidation risks.

Dopex also helps with GLP farming, where their Atlantic Put acts as a hedge against GLP price action.

4.1/ @STFX_IO

STFX stands for Single Trade Finance Exchange. It offers short-duration, non-custodial, active asset management vaults that are dedicated to one trade. STFX traders use GMX to route their trades. The platform charges a fixed performance fee of 20%.

STFX stands for Single Trade Finance Exchange. It offers short-duration, non-custodial, active asset management vaults that are dedicated to one trade. STFX traders use GMX to route their trades. The platform charges a fixed performance fee of 20%.

4.2/ @PerpyFinance

It's similar to STFX in concept but differs in set up. According to Perpy, the main difference is that Perpy Vaults are continuous, charge variable fees, have no fundraising period, and protect privacy.

It's similar to STFX in concept but differs in set up. According to Perpy, the main difference is that Perpy Vaults are continuous, charge variable fees, have no fundraising period, and protect privacy.

5/ @dappOS_com

An operating protocol designed to lower the barrier of interacting with crypto infrastructures. In particular, DappsOS allows users to access GMX via BSC wallets directly.

An operating protocol designed to lower the barrier of interacting with crypto infrastructures. In particular, DappsOS allows users to access GMX via BSC wallets directly.

6/ @demexchange

Demex bridges GLP to Cosmos via smart contract vaults and offers an auto-compounding service, allowing Cosmos users to access GMX and earn yield from GLP.

Demex bridges GLP to Cosmos via smart contract vaults and offers an auto-compounding service, allowing Cosmos users to access GMX and earn yield from GLP.

7/ If you find this guide insightful, give us a ❤️

RT for us!

Read the full guide with 28 projects here:

tokeninsight.com/en/research/ma…

Follow us to stay sharp in crypto 🌊.

The author: @quantumzebra123

RT for us!

Read the full guide with 28 projects here:

tokeninsight.com/en/research/ma…

Follow us to stay sharp in crypto 🌊.

The author: @quantumzebra123

• • •

Missing some Tweet in this thread? You can try to

force a refresh