"The biggest bull trap I have ever seen"

The current price increase of over 55% in #Bitcoin has caused a lot of euphoria😍although there were also critical voices👺

Let's take a closer look and analyze the price increase🧵

The current price increase of over 55% in #Bitcoin has caused a lot of euphoria😍although there were also critical voices👺

Let's take a closer look and analyze the price increase🧵

The question that comes up is, has the 5th bull market of #Bitcoin started?

The typical sequence of the investment cycle in #Bitcoin is:

1. halving

2. bull run

3. bear market

4. accumulation

The typical sequence of the investment cycle in #Bitcoin is:

1. halving

2. bull run

3. bear market

4. accumulation

Here is an example of the 3rd to 5th cycle. Even if the importance of halving is questioned again and again,halving remains until now biggest driver of a possible bull run. Halving leads to scarcity, leads to price increases. Ergo, price 🔼 So we have to wait for the halving🤓

What we can definitely state, we have seen a double bottom. And this was also the case in the #Bitcoin history of previous bottoms.

In fact, we are going through a textbook Wykoff accumulation. And we are in phase D.

Proclaiming a bull run is certainly too premature as we still have time until the next bisection in March 2024!

#Bitcoin

Proclaiming a bull run is certainly too premature as we still have time until the next bisection in March 2024!

#Bitcoin

Who is buying at moment? There are clear anomalies here🤫

Basically, #Bitcoin and other coins are bought with stablecoins.

Here you can see the flow of money in crypto. Stablecoins are the anchor point in the cycle and you need them to buy crypto.

Basically, #Bitcoin and other coins are bought with stablecoins.

Here you can see the flow of money in crypto. Stablecoins are the anchor point in the cycle and you need them to buy crypto.

While we saw a clear rise in stablecoins in the bull market 2021, we saw decreae in the recent bear market.

Strikingly, despite the sharp rise in #Bitcoin price by over 55%, there is still no trend reversal in stablecoin supply.

So who is buying the Bitcoins in the market now?

Strikingly, despite the sharp rise in #Bitcoin price by over 55%, there is still no trend reversal in stablecoin supply.

So who is buying the Bitcoins in the market now?

So lets have a closer look on CVD spot market.

Interestingly, the recent #Bitcoin price increase was mainly driven by BUSD (stable coin from PAXUS; US) used to buy Bitcoin, while CVD was negative for ALL other stable coins.

[click on ALT to get to know CVD]

Interestingly, the recent #Bitcoin price increase was mainly driven by BUSD (stable coin from PAXUS; US) used to buy Bitcoin, while CVD was negative for ALL other stable coins.

[click on ALT to get to know CVD]

At the same time, #BUSD (stablecoin issued by PAXOS) is far from being the coin with the largest market capitalization, but the one that caused the recent Bitcoin pump.

Thus, one can speak of an over-proportional purchasing power of BUSD in recent weeks.

Thus, one can speak of an over-proportional purchasing power of BUSD in recent weeks.

From this we can conclude the following:

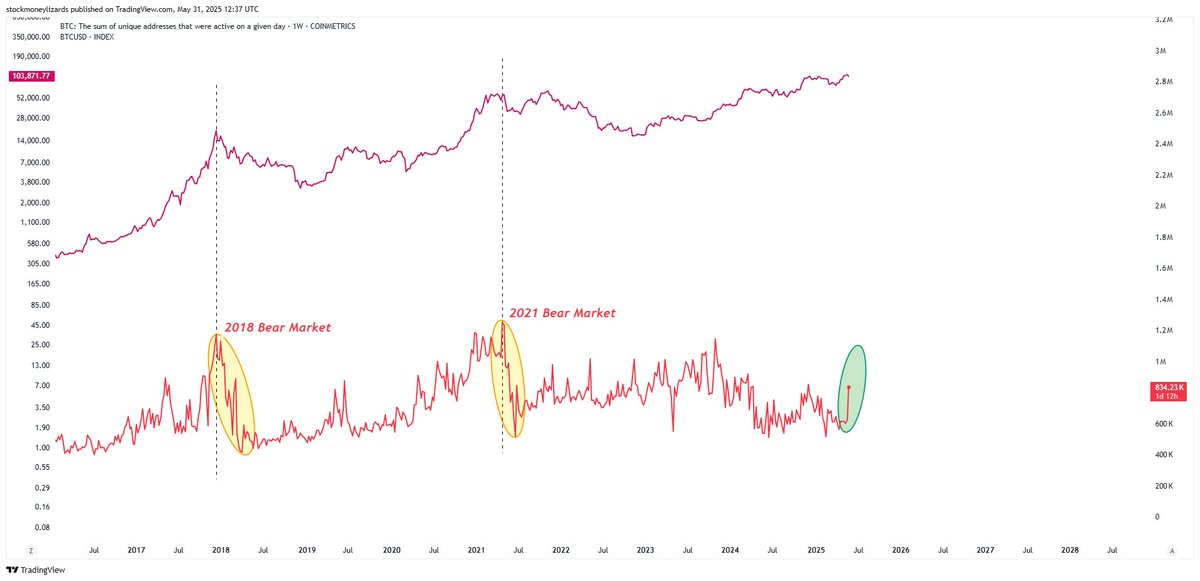

The current #Bitcoin pump is not based on a broad mass of investors, but rather on a small group of BUSD holders. There are currently no signs of new market participants, as was always the case in the last bull run.

The current #Bitcoin pump is not based on a broad mass of investors, but rather on a small group of BUSD holders. There are currently no signs of new market participants, as was always the case in the last bull run.

Therefore, it is not unlikely that there will be another pullback in the near future.

The market is being flooded with trillions of fresh fiat money, especially from China.

Just as we saw in 2021, central bank liquidity is driving up the price of assets like #BTC

The market is being flooded with trillions of fresh fiat money, especially from China.

Just as we saw in 2021, central bank liquidity is driving up the price of assets like #BTC

• • •

Missing some Tweet in this thread? You can try to

force a refresh