It is necessary to clarify @CrescentHub stance on proposal #103 relating to @EvmosOrg

Let me show you why you are wrong when you think $EVMOS won't benefit from this

As a brief overview :

• 𝑹𝒂𝒏𝒈𝒆𝒅 𝒑𝒐𝒐𝒍

• 𝑫𝒐𝒖𝒃𝒍𝒆 𝒊𝒏𝒄𝒆𝒏𝒕𝒊𝒗𝒆

• 𝑳𝒊𝒒𝒖𝒊𝒅 𝑭𝒂𝒓𝒎𝒊𝒏𝒈

Let me show you why you are wrong when you think $EVMOS won't benefit from this

As a brief overview :

• 𝑹𝒂𝒏𝒈𝒆𝒅 𝒑𝒐𝒐𝒍

• 𝑫𝒐𝒖𝒃𝒍𝒆 𝒊𝒏𝒄𝒆𝒏𝒕𝒊𝒗𝒆

• 𝑳𝒊𝒒𝒖𝒊𝒅 𝑭𝒂𝒓𝒎𝒊𝒏𝒈

1. Whether you've already voted or not, I encourage all validators / Delegators to read this thread for a more thorough comprehension & engage with us on this common goal.

@notionaldao

@OrbitalApes

@StakeEco

@swiss_staking

@CitadelDAO

@imperator_co

@frensvalidator

$EVMOS #IBCgang

@notionaldao

@OrbitalApes

@StakeEco

@swiss_staking

@CitadelDAO

@imperator_co

@frensvalidator

$EVMOS #IBCgang

2. It seems evident, upon first reading, that an incentive for a project outside the @EvmosOrg ecosystem could harm $EVMOS

It is entirely understandable, even logical, that all actors within the ecosystem may perceive it as such.

It is entirely understandable, even logical, that all actors within the ecosystem may perceive it as such.

3. This highlights two issues:

• Firstly, the lack of knowledge about the @CrescentHub project by actors within the Cosmos ecosystem in general.

• Our desire to effect changes and demonstrate the importance of what we are building and our goal to become a public good.

• Firstly, the lack of knowledge about the @CrescentHub project by actors within the Cosmos ecosystem in general.

• Our desire to effect changes and demonstrate the importance of what we are building and our goal to become a public good.

4. If you want to understand what @CrescentHub is, and especially the philosophy of the team, I strongly recommend watching the @Cointelegraph interview from yesterday here :

5. First, an assessment :

$EVMOS community is very iffy on external incentives, as you're focused on building native defi.

But with no live incentives program at the moment, Crescent can be a great short or even long term incentive program to reduce sell pressure on $EVMOS .

$EVMOS community is very iffy on external incentives, as you're focused on building native defi.

But with no live incentives program at the moment, Crescent can be a great short or even long term incentive program to reduce sell pressure on $EVMOS .

6. Also, $EVMOS is THE MOST requested asset @CrescentHub so we know there is demand from your community.

We're not asking for free money from your community pool, we also match the incentives with our own public farming to the max at 6%, on the level of other large cap tokens.

We're not asking for free money from your community pool, we also match the incentives with our own public farming to the max at 6%, on the level of other large cap tokens.

7. Also, I know that people want #DeFi utility for $EVMOS , and we can provide that through liquid staking #LSD , in which we will make a LF token from an $stEVMOS / $EVMOS or any other $EVMOS pool.

8. In the future, your LF tokens can be IBC transferred to be used on lending platforms as collateral.

This will also create more demand for $EVMOS , as users can benefit from staking rewards, our farming rewards, AND deposit APR from @Umee_CrossChain for example !

This will also create more demand for $EVMOS , as users can benefit from staking rewards, our farming rewards, AND deposit APR from @Umee_CrossChain for example !

9. This adds an utility to the $EVMOS token, and that is the whole point after all.

We believe it is a win-win for @EvmosOrg and @CrescentHub , the amount is very minimal, and it also shows commitment to the partnership that we can share in building composable DeFi.

We believe it is a win-win for @EvmosOrg and @CrescentHub , the amount is very minimal, and it also shows commitment to the partnership that we can share in building composable DeFi.

10. By using our Ranged pool you will be able to maximize your rewards using $stEVMOS / $EVMOS.

while also creating a larger monetary flow and having lower trading fees than anywhere else.

while also creating a larger monetary flow and having lower trading fees than anywhere else.

11. Our community is already prepared to incentivize stEvmos/Evmos for public farming see the Proposal bellow :

mintscan.io/crescent/propo…

mintscan.io/crescent/propo…

12. Ranged pools are customized pools which provide liquidity only within a predefined price range of a given token pair. It gives multiple use cases such as:

• Pools with similar token pairs with maximized capital efficiency

• Leveraged pools within specific price range

• Pools with similar token pairs with maximized capital efficiency

• Leveraged pools within specific price range

13.

We choose to incentivized :

$EVMOS / $BCRE pools to create liquidity and monetary flow in @CrescentHub

$EVMOS / $StEVMOS to maximized capital efficiency as we do with $stATOM and $stkATOM

All this to make @CrescentHub a grat place to Trade / Farm with your $EVMOS

We choose to incentivized :

$EVMOS / $BCRE pools to create liquidity and monetary flow in @CrescentHub

$EVMOS / $StEVMOS to maximized capital efficiency as we do with $stATOM and $stkATOM

All this to make @CrescentHub a grat place to Trade / Farm with your $EVMOS

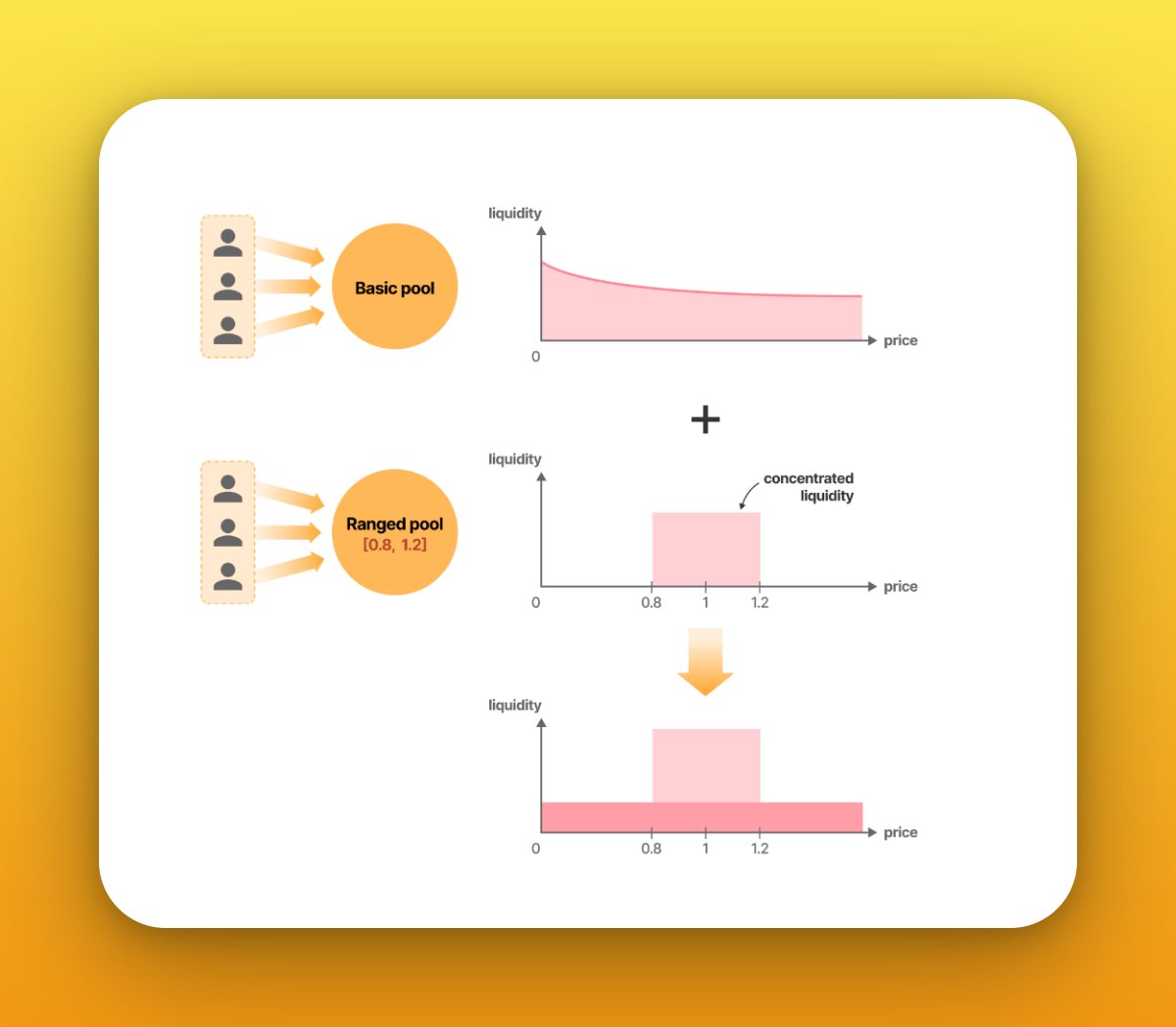

14. More than that, a pair of coins can have multiple liquidity pools such as one basic pool and multiple ranged pool with different ranges. The following example illustrates one basic pool and one ranged pool together providing the liquidity to the market.

15. Thanks to the higher capital efficiency of the ranged pool, the traders benefit very low slippage in the price range of the pool.

In the out-of-range of the ranged pool, the liquidity can still be provided by the basic pool, which enables trading in the region.

In the out-of-range of the ranged pool, the liquidity can still be provided by the basic pool, which enables trading in the region.

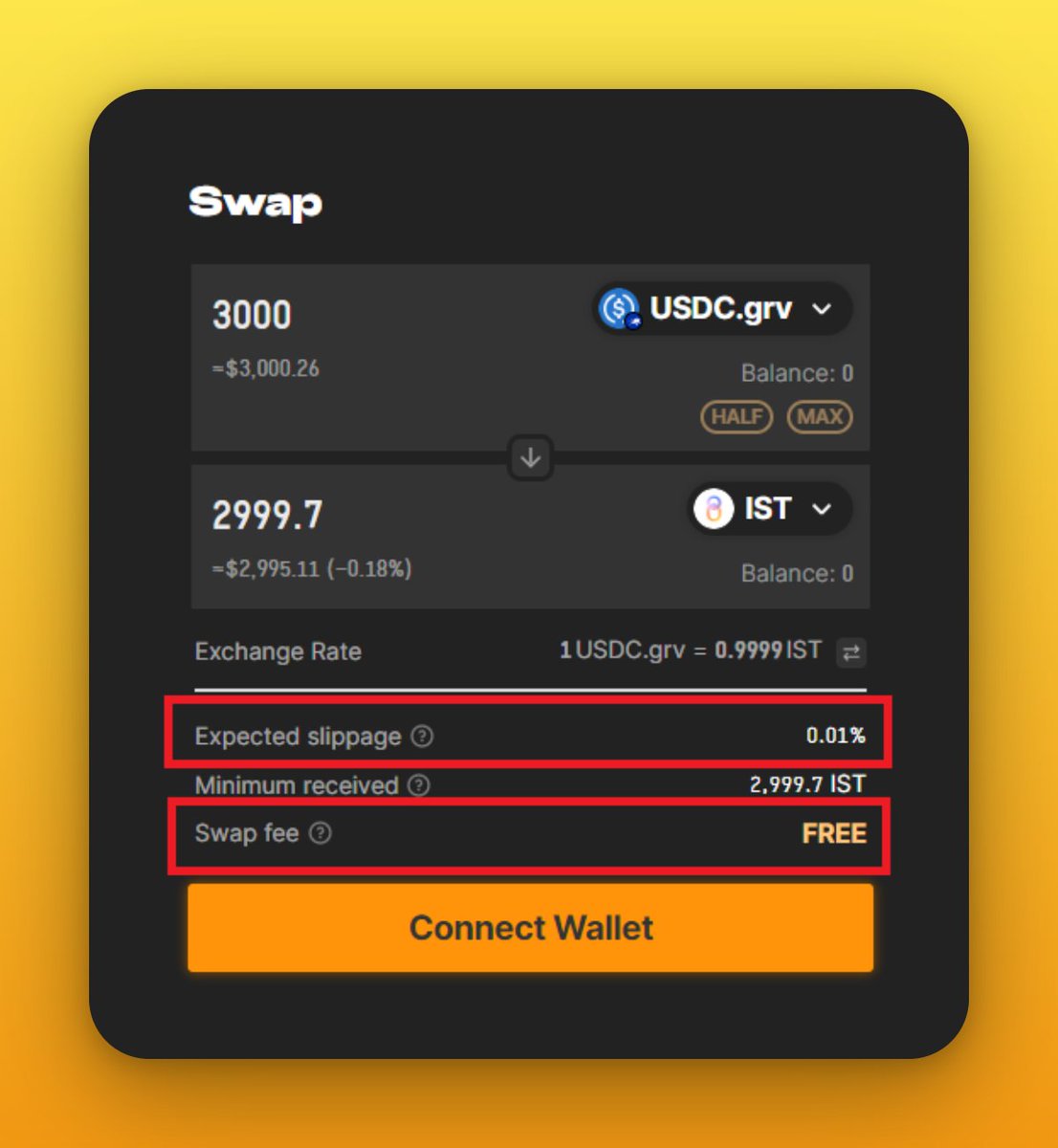

16. To sum up, Crescent creates several important things for Evmos:

• A place to exchange $EVMOS with 0% trading fees

• A place to farm and earn $EVMOS and $bCRE

• A place to use #LSD representation of $EVMOS

• A place to use liquid farming in the near future.

• A place to exchange $EVMOS with 0% trading fees

• A place to farm and earn $EVMOS and $bCRE

• A place to use #LSD representation of $EVMOS

• A place to use liquid farming in the near future.

17. Since December 2022 @CrescentHub has launched a community-focused initiative to help users to understand and improve DeFi, The Crescent Academy.

Evmosian friends, you are welcome to participate!

medium.com/crescentacademy

Evmosian friends, you are welcome to participate!

medium.com/crescentacademy

18. In addition, if you want to read some documents :

- Ranged-pools : docs.crescent.network/introduction/c…

- Liquid-farming : docs.crescent.network/introduction/l…

Crescent Proposal :

mintscan.io/crescent/propo…

Crescent Dex website :

app.crescent.network/farm

- Ranged-pools : docs.crescent.network/introduction/c…

- Liquid-farming : docs.crescent.network/introduction/l…

Crescent Proposal :

mintscan.io/crescent/propo…

Crescent Dex website :

app.crescent.network/farm

• • •

Missing some Tweet in this thread? You can try to

force a refresh