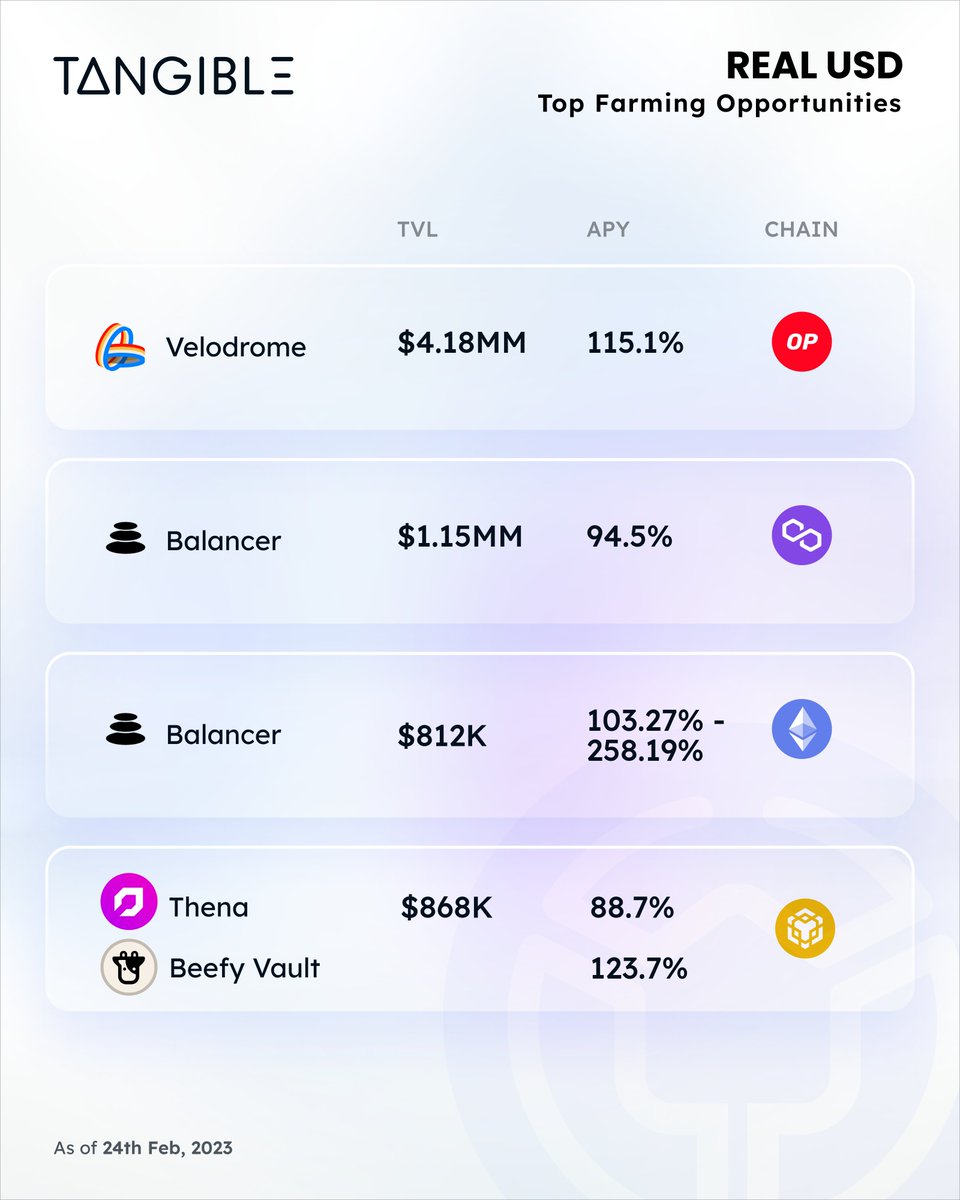

1/21 We spent much of last week highlighting yield.

In this thread we’re back to fundamentals with a deep dive into one of the key features of #RealUSD: Minting on gains

Here we’ll take a detailed look into how $USDR optimizes collateralization by minting against system gains.

In this thread we’re back to fundamentals with a deep dive into one of the key features of #RealUSD: Minting on gains

Here we’ll take a detailed look into how $USDR optimizes collateralization by minting against system gains.

2/ This approach responsibly maximizes yield for $USDR holders while hardening the system from volatility of the underlying assets.

Before we jump in, if you haven’t already, check out our thread on the benefits to backing a stablecoin with real estate:

Before we jump in, if you haven’t already, check out our thread on the benefits to backing a stablecoin with real estate:

https://twitter.com/tangibleDAO/status/1628434857545330689?s=20

3/ There are three benefits to minting on gains:

1️⃣ $USDR’s advantage is its real estate backing, which should be optimally leveraged

2️⃣ $TNGBL gains are returned to users via yield

3️⃣ Higher yields drive customer acquisition

1️⃣ $USDR’s advantage is its real estate backing, which should be optimally leveraged

2️⃣ $TNGBL gains are returned to users via yield

3️⃣ Higher yields drive customer acquisition

4/ Refresher on the $USDR treasury assets/allocations:

‣ 50 - 80% Tangible Real Estate #NFTs

‣ 10 - 50% $DAI (% decreasing as mcap grows)

‣ 10% $TNGBL

‣ 10 - 20% protocol-owned liquidity (USDR - 3pool on @CurveFinance)

‣ 5 - 10% insurance fund

‣ 50 - 80% Tangible Real Estate #NFTs

‣ 10 - 50% $DAI (% decreasing as mcap grows)

‣ 10% $TNGBL

‣ 10 - 20% protocol-owned liquidity (USDR - 3pool on @CurveFinance)

‣ 5 - 10% insurance fund

5/ #RealUSD minting against system gains explained in 280 characters:

6/ As treasury assets increase in value above 100% collateralization, instead of holding that incremental value in the appreciated assets, we immediately realize it by minting new $USDR 1:1 against those gains, spending that money on new property in the Tangible marketplace 🔥

7/ Having passed 100% collateralization, these gains can be minted into new $USDR without risking the peg or 100% backing. In fact, minting against these gains stabilizes the system while also boosting yield.

8/ The two treasury assets that have the potential to appreciate in value are $TNGBL and the tokenized #realestate.

Let’s look at a few examples of the impact of minting against the gains of these assets.

Let’s look at a few examples of the impact of minting against the gains of these assets.

9/ Example 1: Rise and fall in the price of $TNGBL.

We start with the price of TNGBL doubling over a period of time, expanding from 10% to 20% of the backing. This pushes the collateralization rate for $USDR to 110%.

We start with the price of TNGBL doubling over a period of time, expanding from 10% to 20% of the backing. This pushes the collateralization rate for $USDR to 110%.

10/ This is a good outcome, but can be made better:

✅ The additional collateralization makes $USDR stronger

❌ Holding gains in TNGBL adds no benefit to USDR holders

❌ Unlike real estate, $TNGBL is volatile digital asset and can easily lose whatever price gains it has made

✅ The additional collateralization makes $USDR stronger

❌ Holding gains in TNGBL adds no benefit to USDR holders

❌ Unlike real estate, $TNGBL is volatile digital asset and can easily lose whatever price gains it has made

11/ Instead of holding that appreciated value in $TNGBL, #RealUSD will immediately convert it into real estate.

New USDR is minted against the gains, growing the market cap 1:1 against this value. The $USDR is then used to purchase new real estate in the Tangible marketplace.

New USDR is minted against the gains, growing the market cap 1:1 against this value. The $USDR is then used to purchase new real estate in the Tangible marketplace.

12/ Key benefits to shifting value accrual from $TNGBL to #realestate:

🚀 Real estate produces yield, shifting the 10% gain from TNGBL to real estate increases yield by 10% (~80 bps)

🏠 Moving gains out of TNGBL locks the value into the stability of a real world asset

🚀 Real estate produces yield, shifting the 10% gain from TNGBL to real estate increases yield by 10% (~80 bps)

🏠 Moving gains out of TNGBL locks the value into the stability of a real world asset

13/ Continuing in the example, let’s explore the impact of a subsequent 50% drop to the price of $TNGBL.

14/ $TNGBL now constitutes only 5% of $USDR’s backing and the collateralization rate falls to 105%, however:

🔥 Real estate portion is still 10% larger than it was prior to TNGBL’s initial move

💰 Yield is locked into the system

🔥 Real estate portion is still 10% larger than it was prior to TNGBL’s initial move

💰 Yield is locked into the system

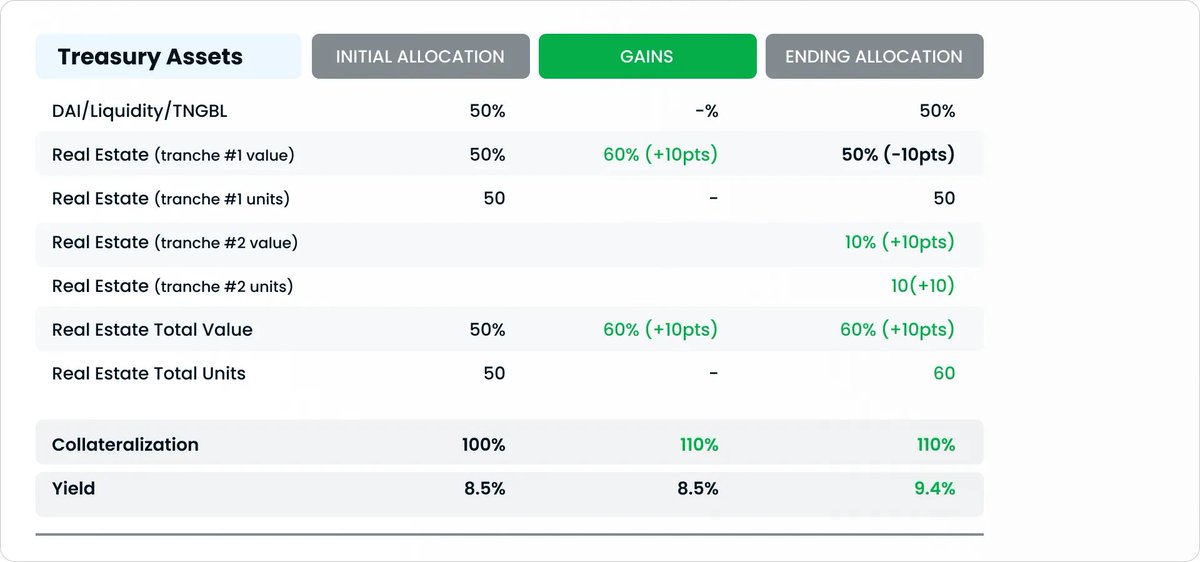

15/ Example 2: Rise and fall in the price of #realestate.

We’ll now look at how the system responds when the price of property fluctuates. We start with 100% collateralization, 50% in real estate spread across 50 units (tranche 1.)

We’ll now look at how the system responds when the price of property fluctuates. We start with 100% collateralization, 50% in real estate spread across 50 units (tranche 1.)

16/ We see the property in the treasury appreciate by 20%, a net 10% gain on the full backing.

The 50 units in tranche 1 are now 60% of the total backing of $USDR, pushing the collateralization rate to 110%. As the total units remain the same, the yield remains the same.

The 50 units in tranche 1 are now 60% of the total backing of $USDR, pushing the collateralization rate to 110%. As the total units remain the same, the yield remains the same.

17/ By minting against these gains, #RealUSD can realize that 10% in new value and reallocate it to new units, increasing the yield.

The 10 points of net value gained in tranche 1 is used to purchase 10 new units, moving the value to tranche 2.

The 10 points of net value gained in tranche 1 is used to purchase 10 new units, moving the value to tranche 2.

18/

✅ Real estate still comprises 60% of the backing

✅ The collateralization rate remains 110%

🏠 But 10 new units have been added to the treasury

💰 Increasing the yield by ~80 bps.

More units = more yield 🔥

✅ Real estate still comprises 60% of the backing

✅ The collateralization rate remains 110%

🏠 But 10 new units have been added to the treasury

💰 Increasing the yield by ~80 bps.

More units = more yield 🔥

20/ We see the value of real estate fall by 10%, reducing the value of the treasury and lowering collateralization to 104%.

🏠 But the gains had already been realized and used to purchase new property

📈 So the decline in value does not impact the recently improved yield

🏠 But the gains had already been realized and used to purchase new property

📈 So the decline in value does not impact the recently improved yield

21/ Minting on system gains is an innovative feature of #RealUSD, positioning the token for long term success. We’ve now sped up the timeline to boost yield above our target rate.

In a space where yield drives adoption, we must responsibly maximize returns to drive growth.

In a space where yield drives adoption, we must responsibly maximize returns to drive growth.

end/ If you've got any questions on the above, please free to hop into discord and we'll do our best to help answer them 🤝

• • •

Missing some Tweet in this thread? You can try to

force a refresh