Credit Suisse - a bank too big to fail - crashes to all-time low after raising deposit rates to reverse bank run📉

Read the thread!

1/4

$CS #banknifty $SPY $QQQ #recession #stockmarketcrash

Read the thread!

1/4

$CS #banknifty $SPY $QQQ #recession #stockmarketcrash

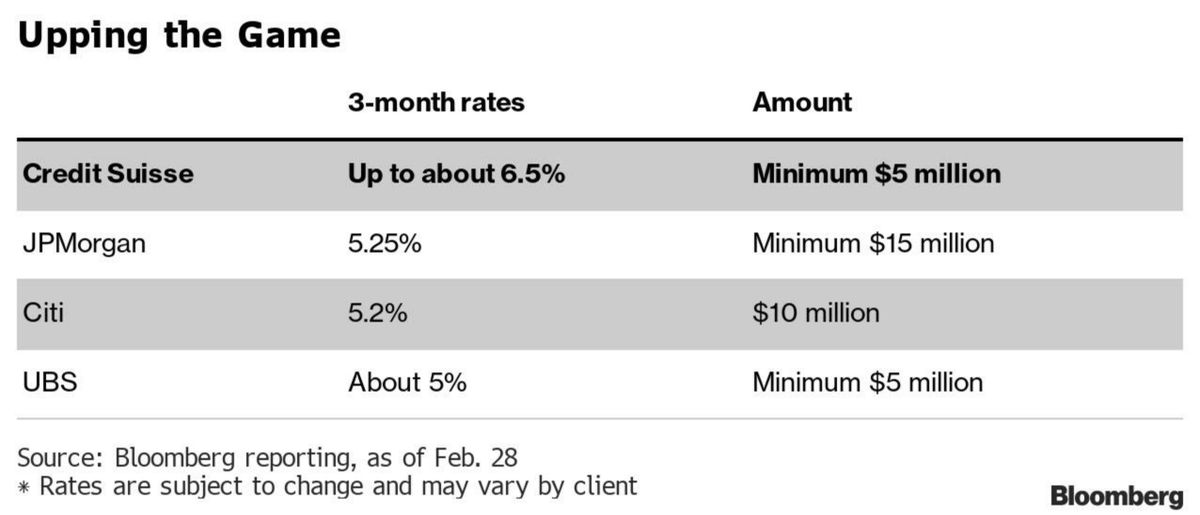

Credit Suisse offering a 6.5% annual rate on new three-month deposits of $5 million or above - and a rate as high as 7% for one-year deposits — far above matched maturity Bills, and suggesting that to attract a client, the bank is forced to eat a GIANT loss.

2/4

2/4

Beyond liquidity woes, Credit Suisse faces significant talent bleed as dozens of private bankers at managing director-level & above have left, taking client assets with them. Senior bankers handling at least $1 bn. may take up to 60% of funds managed to their new employers.

3/4

3/4

The market was quick to read through the bank's superficial ruse to "boost" liquidity and sent $CS to a new ATL while blowing out its CDS although with dumb Asian "deposit" money now used as funding, the default risk has been mitigated somewhat for the time being.

4/4

4/4

• • •

Missing some Tweet in this thread? You can try to

force a refresh