1/ A Match Made in Crypto Heaven: Bitcoin Security meets Appchain Sovereignty.

Leveraging IBC and #Bitcoin Security to solve the blockchain trilemma through @babylon_chain

🧵👇

Leveraging IBC and #Bitcoin Security to solve the blockchain trilemma through @babylon_chain

🧵👇

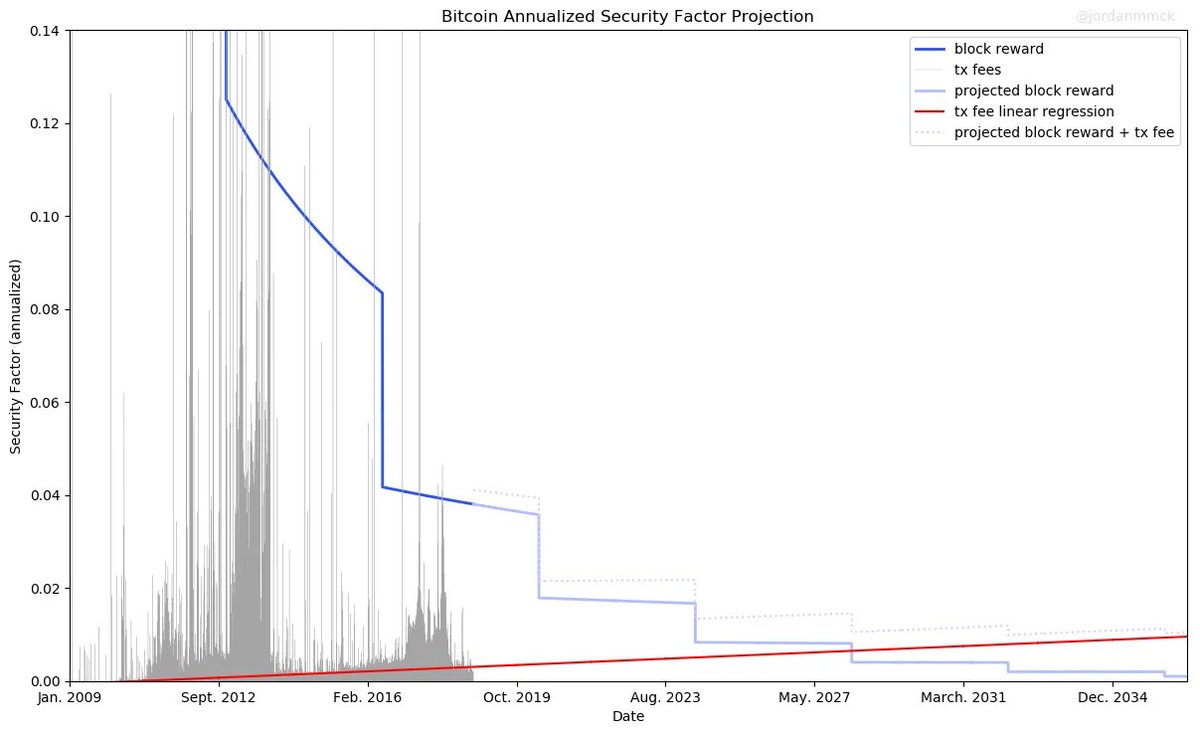

2/ The current security landscape has placed Bitcoin and Ethereum as the largest sources of security.

#BTC 14+ year track record and a $400M Marketcap and $ETH with their POS network.

#BTC 14+ year track record and a $400M Marketcap and $ETH with their POS network.

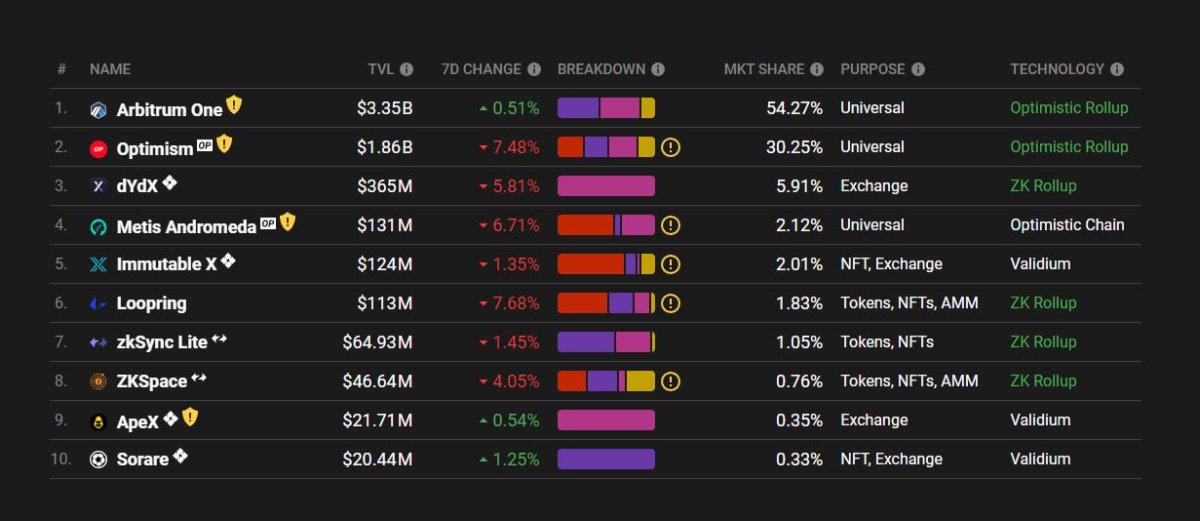

3/ This has created additional challenges for $ETH and its ability to scale while remaining interoperable.

Giving birth to the growth we've seen with rollups such as @arbitrum & @optimismFND

Ethereum is exploding with new ideas, however the issue lies with interoperability.

Giving birth to the growth we've seen with rollups such as @arbitrum & @optimismFND

Ethereum is exploding with new ideas, however the issue lies with interoperability.

4/ Are there other ecosystems that satisfy scalability and interoperability?

Yes. Cosmos!

Yes. Cosmos!

5/ Cosmos Appchains automatically scale through the ecosystem architecture and are:

- Interoperable via IBC

- Sovereign

So what is #Cosmos missing? Security!

- Interoperable via IBC

- Sovereign

So what is #Cosmos missing? Security!

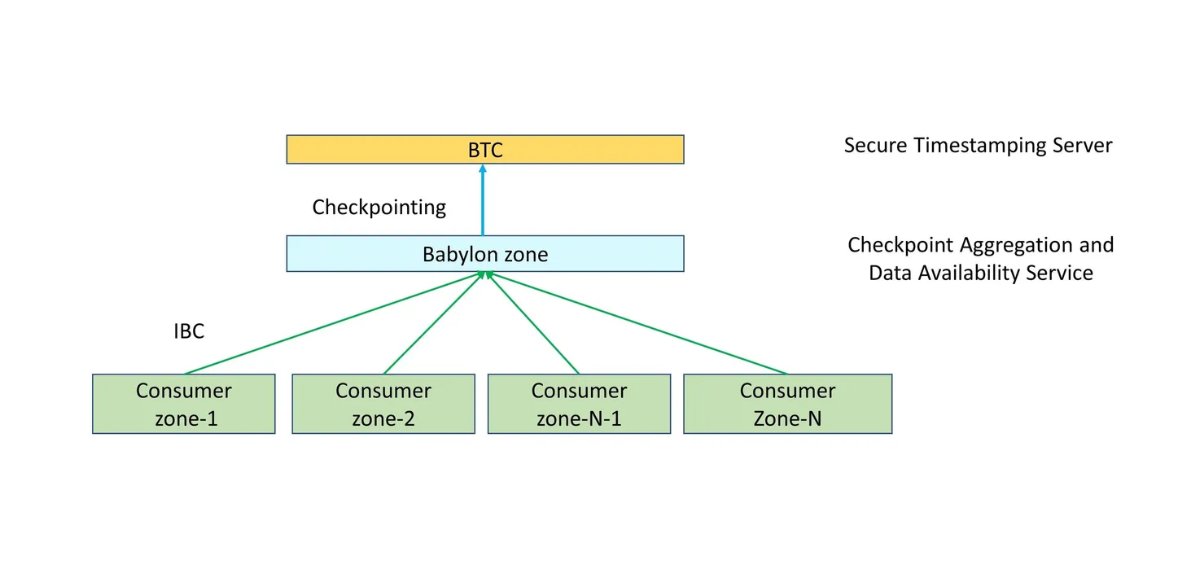

6/ Along comes @babylon_chain attempting to solve the blockchain trilemma of security, scalability, and decentralization.

- Babylon is essentially "marrying" Cosmos and Bitcoin using a technology called timestamping

But what’s so special about #Bitcoin?

- Babylon is essentially "marrying" Cosmos and Bitcoin using a technology called timestamping

But what’s so special about #Bitcoin?

7/ #Bitcoin is Proof of Work, in an ecosystem full of PoS chains offering diversity.

- This means it can protect Proof-of-stake chains like Osmosis from long range attacks.

Additionally, it is the Largest asset in crypto (+400b) with the longest track record of security.

- This means it can protect Proof-of-stake chains like Osmosis from long range attacks.

Additionally, it is the Largest asset in crypto (+400b) with the longest track record of security.

8/ @babylon_chain offers the ability to checkpoint multiple chains at once and submit them as one, creating a small footprint on Bitcoin.

- This alleviates concerns around inefficient clogging down of the network.

Think of this as a "time-stamp as a service" for POS chains.

- This alleviates concerns around inefficient clogging down of the network.

Think of this as a "time-stamp as a service" for POS chains.

9/ Currently the @babylon_chain Testnetis live with 8 different chains in the Cosmos and more to come.

- With @osmosiszone as first time-stamped to Babylon, and through Babylon to #Bitcoin

So what are some benefits users can expect from this union of technologies?

- With @osmosiszone as first time-stamped to Babylon, and through Babylon to #Bitcoin

So what are some benefits users can expect from this union of technologies?

10/ Benefits 🔥

- Faster Unbonding times (21 days ➡ 15 hours)⤵

- Increased liquidity

- Lower Native Cost of security ( more on this)

- Faster Unbonding times (21 days ➡ 15 hours)⤵

- Increased liquidity

- Lower Native Cost of security ( more on this)

11/ The @osmosiszone spent $50M to secure the chain for which 2.5M went to validators.

@babylon_chain integration introduces Bitcoin security which solves:

-Long-Range attacks

-Double-spending

Invalid Execution attacks can be solved via ZK or Fraud proofs.

@babylon_chain integration introduces Bitcoin security which solves:

-Long-Range attacks

-Double-spending

Invalid Execution attacks can be solved via ZK or Fraud proofs.

12/ This leaves Liveness Attack which #Bitcoin cannot solve, however the vectors of attacks are significantly reduced.

Hence the cost to maintain chain security are significantly lowered.

Hence the cost to maintain chain security are significantly lowered.

13/ The road ahead for @babylon_chain

- Aligning economic incentives of $BTC miners with the chain they provide security for example, staking on @osmosiszone

-Adoption of other appchain-type ecosystems beyond Cosmos.

- Aligning economic incentives of $BTC miners with the chain they provide security for example, staking on @osmosiszone

-Adoption of other appchain-type ecosystems beyond Cosmos.

14/ Babylon is leveraging #BTC economic security and the interoperability and scalability IBC bring.

The Cosmos can expect more efficient, secure and censorship resistant chains in the future.

The Cosmos can expect more efficient, secure and censorship resistant chains in the future.

• • •

Missing some Tweet in this thread? You can try to

force a refresh