The Biden administration keeps proving that personnel are policy. Biden himself is a kind of empty vessel into which different wings of the Democratic party pour their will, yielding a strange brew of appointments both great and terrible. 1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/03/06/per… 2/

pluralistic.net/2023/03/06/per… 2/

On the one hand, you have progressive appointments like #JonathanKanter at @JusticeATR and @linakhanFTC at the @FTC, leaders who are determined to challenge and curb corporate power:

pluralistic.net/2022/01/10/see… 3/

pluralistic.net/2022/01/10/see… 3/

On the other hand, you have appointees like @secretarypete, who fill their own staff with status quo counsel, and then let those timid corporate apologists run the show, leaving the substantial enforcement powers of a powerful agency to gather dust:

pluralistic.net/2023/01/10/the… 4/

pluralistic.net/2023/01/10/the… 4/

While anti-corporate Dems drive the administration's competition agenda, the corporate wing has near-total dominance over finance (with notable exceptions, e.g. @chopracfpb). 5/

I'm thinking here of Trump's #JeromePowell, a bloodletting monster happy to shovel workers into their bosses' crushers all day long:

pluralistic.net/2023/01/19/cre… 6/

pluralistic.net/2023/01/19/cre… 6/

Corporate Dems continue to flex their muscle. A seat has just opened up on the @federalreserve Board. The @WSJ is pretty sure the seat is going to #JaniceEberly.

wsj.com/articles/white… 7/

wsj.com/articles/white… 7/

She's corporate ghoul who helped #Obama Treasury Secretary #TimothyGeithner steal Americans' houses on behalf of the bankers who destroyed the world economy in 2008: 8/

A quick refresher: Obama inherited the #GreatFinancialCrisis, a massive global asset crash that followed from a decade of real-estate and derivatives deregulation. 9/

The world's largest banks issued mortgages they knew would fail, and then placing massive bets on "#CollateralizedDebtObligations" that were supposed to offset the risk. 10/

The banks gambled trillions, nearly destroyed the world's economy, and then blamed it all on reckless borrowers - mortgage holders who had been mis-sold predatory mortgages. 11/

These were designed to trigger defaults thanks to low "teaser rates" that later "ballooned" into monthly payments the banks knew the borrowers couldn't afford.

Geithner was Obama's go-to guy for the #GFC. 12/

Geithner was Obama's go-to guy for the #GFC. 12/

It was under his leadership that billions were handed out to the banks to bail them out and keep them solvent during the crisis - and it was also under his leadership that bank execs were able to pay themselves millions in bonuses using that public money. 13/

When the banks were in trouble, Geithner leapt into action. When the banks' *customers* faced crises, he was MIA - especially during the #foreclosure epidemic that followed, as the banks stole our homes out from under us, often forging the paperwork. 14/

No bank was seriously punished for this policy.

Back to Janice Eberly, who served as Geithner's assistant secretary of the Treasury for economic policy - his hatchet-woman, in other words. 15/

Back to Janice Eberly, who served as Geithner's assistant secretary of the Treasury for economic policy - his hatchet-woman, in other words. 15/

Now, sometimes people in senior government roles stick around because they disagree with their bosses and want to mitigate the harm of their bosses' policies.

That's not why Eberly took the job. 16/

That's not why Eberly took the job. 16/

In 2014, she and Arvind Krishnamurthy wrote "Efficient Credit Policies in a Housing Debt Crisis" for @BrookingsInst, explaining why Geithner had it right all along - bailing out the banks and leaving homeowners in foreclosure is "efficient":

brookings.edu/wp-content/upl… 17/

brookings.edu/wp-content/upl… 17/

Writing in @TheProspect, @MaxMoranHi from the @revolvingdoorDC breaks down "Efficient Credit," explaining how Eberly's stated views should disqualify her from sitting on the Fed board, especially as we teeter on the brink of a deep financial crisis:

prospect.org/economy/2023-0… 18/

prospect.org/economy/2023-0… 18/

The first thing you need to understand here is #HAMP, the #HomeAffordableModificationProgram, which received the $100b Congress allocated to help homeowners whose mortgages were "underwater" - that is, whose houses were worth less than they owed for them. 19/

That money could have gone to "principal reduction" - that is, to paying off part of your loan. If you owned $350,000 on a house that was now worth $300,000, the Feds could give the bank $50k and you wouldn't be underwater anymore. 20/

The FDIC proposed just this, in a plan that would have required homeowners to pay back the US government if the price of their homes rebounded. 21/

If you want to keep Americans in their homes, principal reduction is a straightforward and reliable approach. But banks hated this - so Geithner wouldn't do it. 22/

Banks don't like principal reduction because it means that they'll lose out on future payments: reducing your principal by $50k now means that the banks won't get hundreds of thousands of dollars over the 30 years of your mortgage. 23/

Using the money for principal reduction would have meant the banks' balance sheets would have looked a little worse - which, as Moran points out, is a perfectly fair outcome for banks that had just come close to destroying the world economy. 24/

Of course, many of these underwater borrowers were destined to lose their houses and would never make those payments. 25/

But Geithner didn't do principal reduction. Instead, he did HAMP, which was just a way to temporarily lower borrowers' monthly payments so they could stay in their homes. 26/

Geithner sold Obama on this plan, convincing him to renege on his election promise to support a "cramdown" on the banks, which would have saved homeowners:

propublica.org/article/dems-o… 27/

propublica.org/article/dems-o… 27/

HAMP was full of the kinds of complex requirements and paperwork that the professional managerial class love, rules that made it almost impossible for homeowners to invoke HAMP and improve their payments. 28/

Meanwhile, the banks got "investor incentive payments" that let them take in public money even as they foreclosed on the public:

irs.gov/newsroom/princ…

HAMP was a disaster. 29/

irs.gov/newsroom/princ…

HAMP was a disaster. 29/

Almost no one managed to use it, and even among the lucky few who did manage to do so, many were tricked into foreclosure.

theguardian.com/money/2014/mar… 30/

theguardian.com/money/2014/mar… 30/

This is the policy that Eberly and Krishnamurthy defend in their paper: rather than reducing debt, just temporarily restructure mortgage payments. 31/

One reason they defend this: it's cheaper, and Congress didn't allocate enough money to help everyone who needed principal reduction. 32/

But, as Moran points out, Geithner's anemic response to the crisis caused Congress to claw back $225b of the money allocated to deal with it - enough to do $50k principal reductions for 4.5m households. Under Geithner, HAMP only spent $10b. 33/

But of course, the US government didn't *need* to pay the banks off to do principal reduction. They could simply order the banks to take a loss. That's how lending usually works: lenders who originate bad loans have to eat them - they don't get made whole by Uncle Sucker. 34/

But when Eberly was working for Geithner, "federal officials convinced themselves this was impossible." 35/

Rather than hold banks to account for their reckless speculation, Geithner announced that he was going to "foam the runway" for the banks, pureeing Americans' homes to make the foam. 36/

But Eberly's tenure coincided with the banks' rebound - by the time she went to work for Geithner, they were rolling in dough, posting massive profits. 37/

As @ryanlcooper put it, "If you force them to eat a bunch of foreclosure losses, maybe a few hundred billion over several years, it probably wouldn’t have been that bad."

38/

38/

Moran nails it here:

> When a bad loan is made, it is both prudent and fair for the lender to bear the most responsibility. They are supposed to be wise stewards of their own capital. 39/

> When a bad loan is made, it is both prudent and fair for the lender to bear the most responsibility. They are supposed to be wise stewards of their own capital. 39/

> Instead, ordinary homeowners who did the least of any actor to cause the financial crisis ended up eating the losses.

Eberly and Krishnamurthy claimed that Geithner's policy would be efficient, and that it wouldn't lead to mass foreclosures. 40/

Eberly and Krishnamurthy claimed that Geithner's policy would be efficient, and that it wouldn't lead to mass foreclosures. 40/

As neoclassical economists love to do, they "proved" this using elaborate mathematical models. And, also in the grand neoclassical tradition, they didn't bother to check whether their model was correct. 41/

To quote Ely Devons: "If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’"

pluralistic.net/2022/10/27/eco… 42/

pluralistic.net/2022/10/27/eco… 42/

Here's what Eberly and Krishnamurthy missed: the choice to foreclose wasn't being made by the lenders, they were being made by the #MortgageServicer. 43/

These are a kind of consequence-free middleman who made more money by foreclosing on homeowners, even if the lenders lost more money over the long term:

researchgate.net/publication/22… 44/

researchgate.net/publication/22… 44/

Eberly and Krishnamurthy barely mention the existence of servicers, but another researcher was keenly aware of them: a law prof named @repkatiePorter, who delved into the servicers' role in foreclosure in a report for the California AG:

oag.ca.gov/sites/all/file… 45/

oag.ca.gov/sites/all/file… 45/

Porter identified the servicers' "dual track" approach to distressed mortgage borrowers: on the one hand, they slow-walked HARP-based changes to payments, and on the other hand, they raced to foreclose on those borrowers who were waiting for their payments to reset. 46/

The servicers' hunger to throw people out of their homes knew no bounds: they set up massive #RoboSigning boiler-rooms. 47/

They paid low-waged employees to forge deed to plug the paperwork holes created by the high-speed, unregulated speculation on mortgages that precipitated the Great Financial Crisis:

reuters.com/article/robosi… 48/

reuters.com/article/robosi… 48/

Eberly knew about robo-signing, she knew about servicers, she knew about foreclosures. It was her job to know. But she still wrote her paper defending Geithner's runway-foaming and all those ruined lives: 49/

> Principal reduction can be helpful, but it is a less efficient use of government resources, since it back-loads payments to households that cannot borrow against these future resources to support consumption today... 50/

> and also because it is most helpful in reducing strategic default, rather than payment-distress-induced default,

This is just #MeansTesting by another name, a fetish for separating the "deserving poor" from "moochers" (AKA "strategic defaulters"). 51/

This is just #MeansTesting by another name, a fetish for separating the "deserving poor" from "moochers" (AKA "strategic defaulters"). 51/

The PMC *loves* means-testing, but only for poor people. As Moran points out, rich people like Trump use strategic defaults all the time:

nytimes.com/2016/06/12/nyr… 52/

nytimes.com/2016/06/12/nyr… 52/

Elite economists and finance ghouls convinced themselves that helping people stay in their homes would enable crooked "strategic defaulting" but there's no evidence for this - rather, it was a fairy tale that justified mass foreclosure:

nber.org/system/files/w… 53/

nber.org/system/files/w… 53/

Eberly helped throw millions of Americans into the street in order to reward reckless banks, already wildly profitable banks, with even more profit. And far from regretting this, she went on to write elaborate justifications for the cruel policies she helped administer. 54/

The historian #MichaelHudson describes #debt and #DebtCancellation as a key determinant of whether a given civilization survives. In every venture, producers have to borrow capital from lenders - farmers, for example, must borrow to pay for seed and fertilizer and labor. 55/

When the ventures are successful, the borrowers pay back the lenders.

But not every venture can succeed. There will always be blights, droughts, fires and other risks that can't be fully mitigated. When failure occurs, borrowers can't pay back creditors. 56/

But not every venture can succeed. There will always be blights, droughts, fires and other risks that can't be fully mitigated. When failure occurs, borrowers can't pay back creditors. 56/

If you farm long enough, you'll eventually lose a crop, and have to roll over your debts next year. Eventually, you'll owe so much that you can't even make the interest payments. 57/

In the absence of some structured, periodic debt cancellation - such as the Bronze Age tradition of #jubilee - creditors eventually end up controlling the work of the entire productive sector. 58/

When that happens, your society stops producing what everyone needs, and instead just makes the things that rich people want:

pluralistic.net/2022/07/08/jub… 59/

pluralistic.net/2022/07/08/jub… 59/

A civilization can't survive if all of its farmers are growing ornamental flowers for rich creditors' villas instead of stable crops. It can't survive if every productive worker is stuck in a dead-end job or a dead-end place because of medical or student debt. 60/

Personnel are policy. Eberly has explained, in excruciating detail, exactly what policy she favors - policy that rewards reckless speculation by incinerating the life chances of everyday Americans. 61/

Appointing her to the Federal Reserve board would be a giant Fuck You from the Biden admin to every person who got their home stolen by a bank. 62/

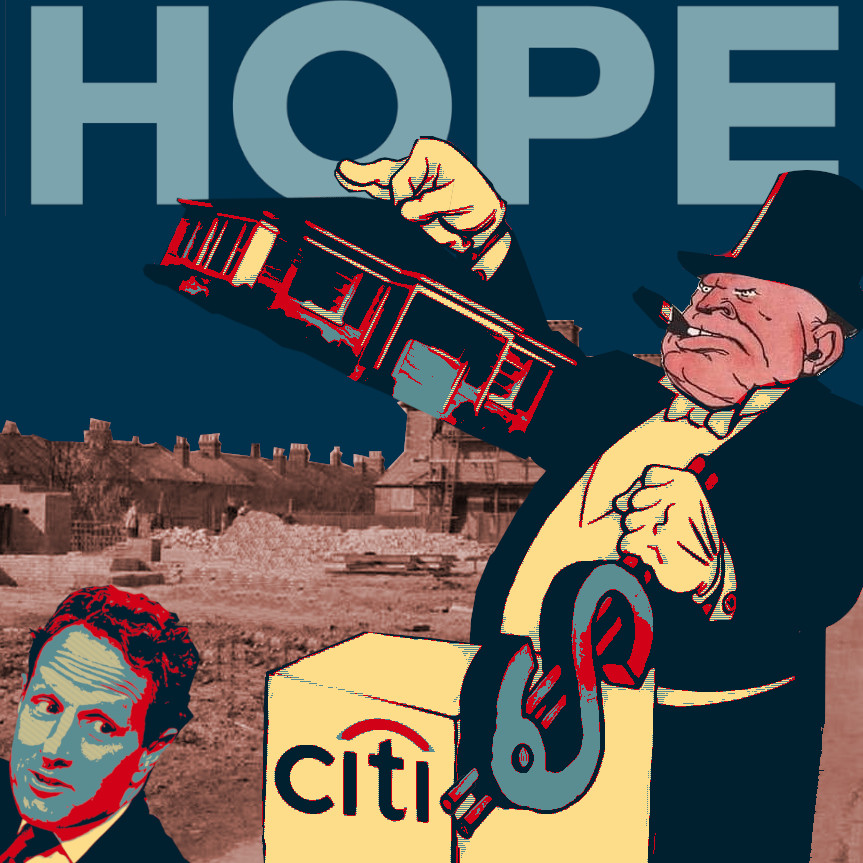

Image:

Medill DC (modified)

commons.wikimedia.org/wiki/File:Timo…

CC BY 2.0

creativecommons.org/licenses/by/2.… 63/

Medill DC (modified)

commons.wikimedia.org/wiki/File:Timo…

CC BY 2.0

creativecommons.org/licenses/by/2.… 63/

• • •

Missing some Tweet in this thread? You can try to

force a refresh