We need to stop the 'RBA Governor is out of touch' rubbish

Sustained high inflation is much worse than temporarily high(er) interest rates

You want his head on a pike for looking after the country?

Yet you're not taking the pollies to task for fiscal policy?

#ausbiz #auspol

Sustained high inflation is much worse than temporarily high(er) interest rates

You want his head on a pike for looking after the country?

Yet you're not taking the pollies to task for fiscal policy?

#ausbiz #auspol

What would you have Lowe do?

Let inflation run rampant?

It's not like there is a good choice and a bad choice.

There are two bad choices. One is slightly less bad.

That's where we are.

Let inflation run rampant?

It's not like there is a good choice and a bad choice.

There are two bad choices. One is slightly less bad.

That's where we are.

*Any* RBA Governor would (and, by the way, *every* central bank head, globally is) putting up rates to curb inflation.

It's the only option, unless you want to make the country even poorer.

Now, let's turn to the pollies.

It's the only option, unless you want to make the country even poorer.

Now, let's turn to the pollies.

Under the last few governments, structural budget balance (that probably would have run surpluses in the last year or so) has been jettisoned.

If there'd been structural balance, the economy would have been cooled. Instead, it's running a *deficit*, adding to demand!

If there'd been structural balance, the economy would have been cooled. Instead, it's running a *deficit*, adding to demand!

The last government?

They reportedly told APRA to cut the loan buffer, meaning people borrowed more at record low rates. That's just dumb.

They responsibly supported the economy during COVID, but put *no* plans in place to recover the debt accrued as a result.

They reportedly told APRA to cut the loan buffer, meaning people borrowed more at record low rates. That's just dumb.

They responsibly supported the economy during COVID, but put *no* plans in place to recover the debt accrued as a result.

They had no plans for deficit reduction, instead aiming to pass yet more tax cuts - Stage 3 (on top of Stage 1 and 2) - that would further juice an overheated economy.

And the current mob doesn't get a free pass. They might have inherited a poisoned chalice, but that's just governing.

As the incumbent government they have a responsiblity to govern appropriately. They get a tick for not opening the floodgates, but did almost nothing to fix it

As the incumbent government they have a responsiblity to govern appropriately. They get a tick for not opening the floodgates, but did almost nothing to fix it

Of course, it's not only domestic. There are huge global issues.

But the idea of policy is to do what you can to minimise the bad stuff.

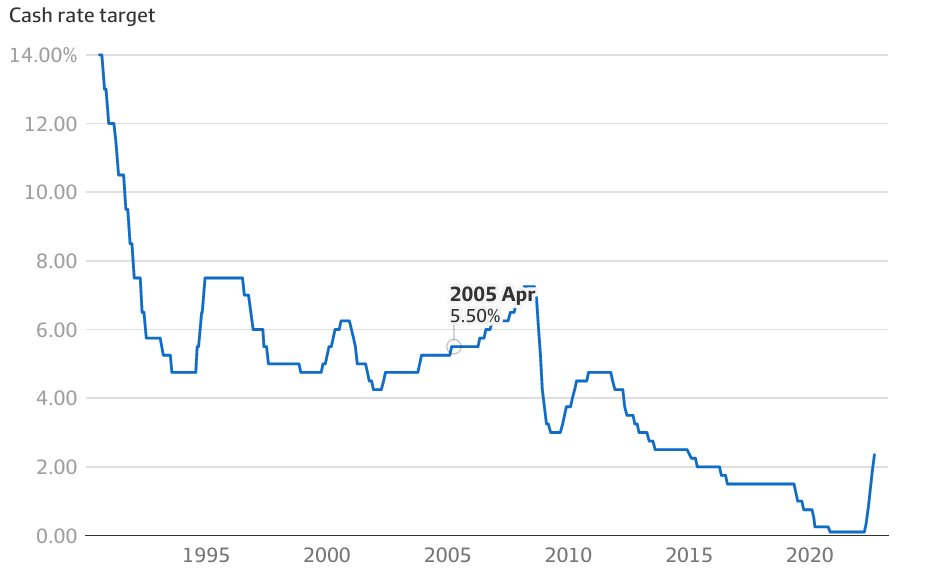

Lowe made mistakes on the way in - rates should have been higher, and then raised more quickly.

But...

But the idea of policy is to do what you can to minimise the bad stuff.

Lowe made mistakes on the way in - rates should have been higher, and then raised more quickly.

But...

... but the amount of attention he's getting, compared to the lack of interest/effort/focus on current and past fiscal policies is pretty irresponsible from those who should know better and have the megaphones.

Yes, people are hurting.

It sucks.

No-one wants this to be the case, but here we are.

The RBA is doing the least-worst thing it can.

The pollies are doing all-but nothing.

And the macro environment is unkind.

So here we are.

It sucks.

No-one wants this to be the case, but here we are.

The RBA is doing the least-worst thing it can.

The pollies are doing all-but nothing.

And the macro environment is unkind.

So here we are.

And remember, most 'cost of living relief' would be 'more money to spend in the economy', working directly against the RBA, and making the deficit worse.

We *absolutely* need to look after people in dire straits.

But we should also be using other tools to slow the economy

Fin.

We *absolutely* need to look after people in dire straits.

But we should also be using other tools to slow the economy

Fin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh