There is one asset category in Web3 which I believe could be fundamentally undervalued.

It has recently taken a dip and been on a long term down trend, is this dead in the water or could this be a golden opportunity?

🧵👇

0/42

It has recently taken a dip and been on a long term down trend, is this dead in the water or could this be a golden opportunity?

🧵👇

0/42

1/

Although not as hot some of narratives being shared on alpha-Twitter at the moment, #Web3 name domains were at one point the obvious 20-100x play.

Although not as hot some of narratives being shared on alpha-Twitter at the moment, #Web3 name domains were at one point the obvious 20-100x play.

2/

There was a huge boom of interest in rare domains between the end of 2021 and middle of 2022, yet #ENS had previously existed since 2017.

What the hell took so long for people to clock on?

There was a huge boom of interest in rare domains between the end of 2021 and middle of 2022, yet #ENS had previously existed since 2017.

What the hell took so long for people to clock on?

3/

Domains have since fell out of the limelight, which makes sense with the relentless cycles of narrative hype.

Domains have since fell out of the limelight, which makes sense with the relentless cycles of narrative hype.

4/

In this thread I aim to draw some attention back to name services, explain why they may be a solid play in 2023, offer some guidance on how to register your own domains... and potentially share a little bit of alpha 👀

In this thread I aim to draw some attention back to name services, explain why they may be a solid play in 2023, offer some guidance on how to register your own domains... and potentially share a little bit of alpha 👀

5/

What we'll cover:

1. What are name service domains?

2. ENS

3. Prices

4. How time might be key

5. .Arb domains, obvious play or stay away?

I'm also using this post as an excuse to experiment with video medium. Open to feedback if useful/if not 🙂

What we'll cover:

1. What are name service domains?

2. ENS

3. Prices

4. How time might be key

5. .Arb domains, obvious play or stay away?

I'm also using this post as an excuse to experiment with video medium. Open to feedback if useful/if not 🙂

6/ What are name service domains? 🤔

Web 3 domains are similar to traditional web domains like .com or .io, but built on top of blockchain technology.

Web 3 domains are similar to traditional web domains like .com or .io, but built on top of blockchain technology.

7/

The idea behind web3 name domains is to create a human-readable name for a particular blockchain address - removing the need to remember the long, complex string of numbers and letters in a default blockchain address.

The idea behind web3 name domains is to create a human-readable name for a particular blockchain address - removing the need to remember the long, complex string of numbers and letters in a default blockchain address.

8/

This has made it easier for people to transact with each other in the world of crypto.

As someone who joined the space in 2021, I am so grateful for these UX improvements and developments which lower the barrier to entry.

This has made it easier for people to transact with each other in the world of crypto.

As someone who joined the space in 2021, I am so grateful for these UX improvements and developments which lower the barrier to entry.

9/

If you’ve been in the space for any time at all, you will likely have seen different domains used here on Twitter as user profile names.

You can recognize these as extensions like .eth, .lens, .swoosh etc.

If you’ve been in the space for any time at all, you will likely have seen different domains used here on Twitter as user profile names.

You can recognize these as extensions like .eth, .lens, .swoosh etc.

10/ ENS (Ethereum Name Service) 🖊️

The largest and most recognizable is ENS, a decentralized domain name system that is built on top of the Ethereum blockchain

The largest and most recognizable is ENS, a decentralized domain name system that is built on top of the Ethereum blockchain

11/

The likelihood is you will already own or have at least attempted to create your own ENS domain at some point.

The service is closing in on 3mil names registered and counting.

The likelihood is you will already own or have at least attempted to create your own ENS domain at some point.

The service is closing in on 3mil names registered and counting.

https://twitter.com/ensdomains/status/1630974589097619456

12/

For those who haven’t yet got themselves a unique ENS, here’s a speed-run walkthrough for you… (anyone else skip to tweet 19)

First go to the ENS App, found in the link on their Twitter page:

twitter.com/ensdomains?s=20

For those who haven’t yet got themselves a unique ENS, here’s a speed-run walkthrough for you… (anyone else skip to tweet 19)

First go to the ENS App, found in the link on their Twitter page:

twitter.com/ensdomains?s=20

13/

1. Users can choose a name that they want to register on ENS (comparable to registering a website domain)

2. This name can be any combination of letters, numbers, and special characters, as long as it is not already taken

1. Users can choose a name that they want to register on ENS (comparable to registering a website domain)

2. This name can be any combination of letters, numbers, and special characters, as long as it is not already taken

14/

3. The user is required to pay an initial registration fee - this varies depending on the length of the name

4. On top of the registration fee there are ongoing annual fees which the owner required to pay if they want to retain the name domain

3. The user is required to pay an initial registration fee - this varies depending on the length of the name

4. On top of the registration fee there are ongoing annual fees which the owner required to pay if they want to retain the name domain

15/

5. Once the name is registered, it can be used to resolve addresses for various services on the Ethereum network i.e. anyone can now send you cryptocurrency to your address just by knowing your registered web3 domain name

5. Once the name is registered, it can be used to resolve addresses for various services on the Ethereum network i.e. anyone can now send you cryptocurrency to your address just by knowing your registered web3 domain name

16/

6. If the name you wanted to register isn’t available or already owned by someone, you can attempt to purchase the name through some supported NFT marketplaces like Opensea, Blur or X2Y2.

6. If the name you wanted to register isn’t available or already owned by someone, you can attempt to purchase the name through some supported NFT marketplaces like Opensea, Blur or X2Y2.

17/

Important to remember! ⛔

Be aware of the expiration date if you do decide to purchase a domain, this is so you understand when you will be due to extend the registration and don't get any unwanted surprises if the domain expires.

Important to remember! ⛔

Be aware of the expiration date if you do decide to purchase a domain, this is so you understand when you will be due to extend the registration and don't get any unwanted surprises if the domain expires.

18/

For those who prefer a visual tutorial, I've created a quick vid demoing the new ENS App here:

For those who prefer a visual tutorial, I've created a quick vid demoing the new ENS App here:

19/ What's happening with prices? 📉

As expected in such a speculative driven market, and especially with NFTs, the majority of the value of domains is currently determined by scarcity and rarity.

As expected in such a speculative driven market, and especially with NFTs, the majority of the value of domains is currently determined by scarcity and rarity.

20/

Along with everything else, however, they have essentially flatlined in the slump of the bear market.

Volume is relatively low and floor prices of the most popular categories are way down from ATHs.

Along with everything else, however, they have essentially flatlined in the slump of the bear market.

Volume is relatively low and floor prices of the most popular categories are way down from ATHs.

21/

999 club - digits ranging from 000-999 - the blue-chip of all ENS domains, and similar to Cryptopunks, rarely any get sold

999 club - digits ranging from 000-999 - the blue-chip of all ENS domains, and similar to Cryptopunks, rarely any get sold

22/

10k club - digits ranging from 0000-9999 (or 10,000 depending on who you ask)

@10kClubOfficial < the official Twitter profile if want to check out the community.

10k club - digits ranging from 0000-9999 (or 10,000 depending on who you ask)

@10kClubOfficial < the official Twitter profile if want to check out the community.

23/

Interestingly, in the past few weeks there has been a wave of capitulation with floor prices nearing the 10eth threshold for 999 and the 10k club has actually broken down through 1eth for the first time in months.

Interestingly, in the past few weeks there has been a wave of capitulation with floor prices nearing the 10eth threshold for 999 and the 10k club has actually broken down through 1eth for the first time in months.

24/ Time could be key ⌛

I got a bit curious about this.

Fundamentally, nothing has changed with ENS and these domains are still incredibly rare.

I got a bit curious about this.

Fundamentally, nothing has changed with ENS and these domains are still incredibly rare.

https://twitter.com/dr3a_eth/status/1628017736420065281

25/

There had been other downturns in the market due to macro factors and fed increasing their hawkish rhetoric, but why should these suddenly be considered such a risk to hold?

There had been other downturns in the market due to macro factors and fed increasing their hawkish rhetoric, but why should these suddenly be considered such a risk to hold?

26/

This is a personal theory but I believe this is because of the cyclical trends of the #crypto and NFT markets - of which, ENS was at one of the peaks of its hype in around May 2022.

This is a personal theory but I believe this is because of the cyclical trends of the #crypto and NFT markets - of which, ENS was at one of the peaks of its hype in around May 2022.

27/

One thing you may already be aware of with ENS is that when a domain is registered it comes with an annual fee and you choose how many years you want to extend your ownership of the name.

One thing you may already be aware of with ENS is that when a domain is registered it comes with an annual fee and you choose how many years you want to extend your ownership of the name.

28/

When reviewing the historical trend of ENS, notice the first volume spike around that time 10 months ago…

When reviewing the historical trend of ENS, notice the first volume spike around that time 10 months ago…

29/

Now also see that a lot of 4 digit ENS domains on sale are expiring in a couple of months… which was exactly when that spike of interest hit in 2022 - one year on.

Now also see that a lot of 4 digit ENS domains on sale are expiring in a couple of months… which was exactly when that spike of interest hit in 2022 - one year on.

30/

This indicates that those who aped in are choosing to sell their bags before their registration expires and they are required to pay the fees to retain the name.

This anomaly would naturally pull the price down due to significantly more people selling than buying.

This indicates that those who aped in are choosing to sell their bags before their registration expires and they are required to pay the fees to retain the name.

This anomaly would naturally pull the price down due to significantly more people selling than buying.

31/

Looking into the future and to prove this theory has some legs, I’ll be monitoring to see if we see the same anomaly in September/October time and another dip in prices.

Looking into the future and to prove this theory has some legs, I’ll be monitoring to see if we see the same anomaly in September/October time and another dip in prices.

32/

Of all NFT collections, I believe the scarce domains of ENS will become some of the most desired to hold or be associated with, and ergo, will become some of the most expensive.

Of all NFT collections, I believe the scarce domains of ENS will become some of the most desired to hold or be associated with, and ergo, will become some of the most expensive.

https://twitter.com/sully_finance/status/1617356533976670211

33/

I don’t like to share speculations and it should go without saying ‘NFA’ and all that, but I assume there is now a very short window for people (including me) to buy in before they are priced out.

Please don't be daft and DYOR before getting neck deep in names.

I don’t like to share speculations and it should go without saying ‘NFA’ and all that, but I assume there is now a very short window for people (including me) to buy in before they are priced out.

Please don't be daft and DYOR before getting neck deep in names.

34/

My assumption is that this could happen if other bluechip collections (BAYC Cryptopunks, etc) realize that their jpeg can be uniquely married up with their 1:1 collection identifier number.

My assumption is that this could happen if other bluechip collections (BAYC Cryptopunks, etc) realize that their jpeg can be uniquely married up with their 1:1 collection identifier number.

35/ Bonus: .Arb (Alpha?) The new kid on the blockchain...? 👀

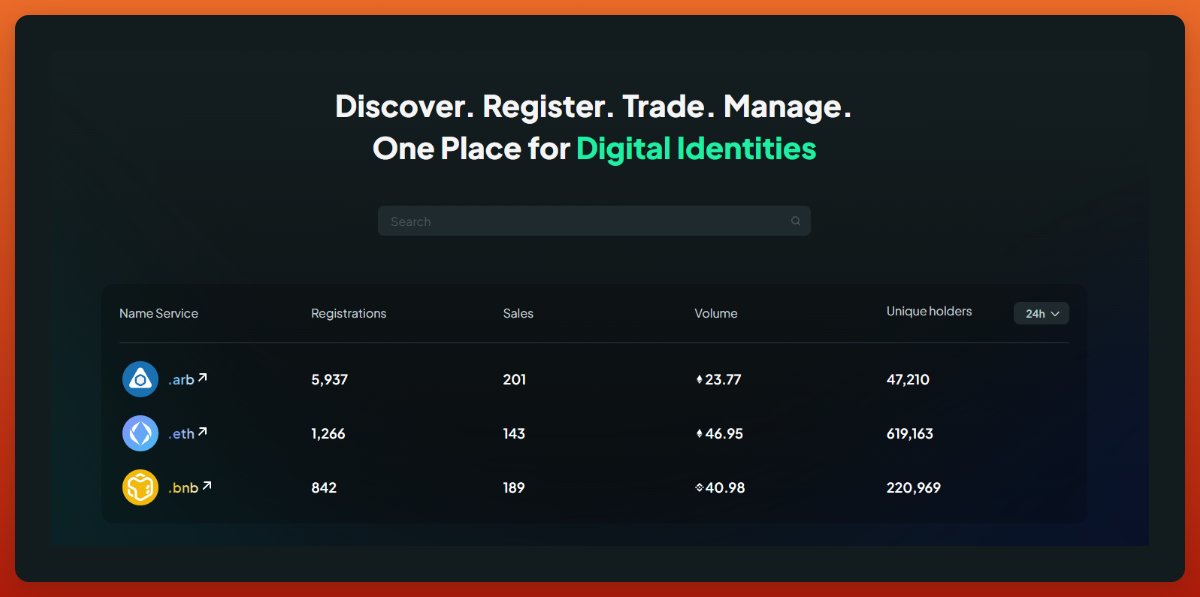

So everyone knows the big daddy ENS… but what fewer might be aware of is a potential up and comer with @SID_arb opening up to public registrations just last week.

So everyone knows the big daddy ENS… but what fewer might be aware of is a potential up and comer with @SID_arb opening up to public registrations just last week.

36/

First thing to mention here... although .Arb domains seem legit, I couldn't find anything which officially stated that it was an @arbitrum domain.

On their Twitter it presents itself as a @SpaceIDProtocol domain name. Just something to keep in mind.

First thing to mention here... although .Arb domains seem legit, I couldn't find anything which officially stated that it was an @arbitrum domain.

On their Twitter it presents itself as a @SpaceIDProtocol domain name. Just something to keep in mind.

37/

I have registered some #Arb names already which is a very similar process to ENS.

Similarly to above, I've created a video tutorial which I'll link to at the end of the thread later today.

I have registered some #Arb names already which is a very similar process to ENS.

Similarly to above, I've created a video tutorial which I'll link to at the end of the thread later today.

38/

The 'alpha' here is that Arbitrum is taking the world by storm and everyone wants to use it, the amount of #DeFi applications which are popping up on CT every day is mind-blowing.

The 'alpha' here is that Arbitrum is taking the world by storm and everyone wants to use it, the amount of #DeFi applications which are popping up on CT every day is mind-blowing.

39/

It's entirely likely that niche's such as Web3 gaming, social based or just retail friendly applications are either created on, or migrate to a layer-2 like Arbitrum.

We've already seen this happening with some protocols and applications.

It's entirely likely that niche's such as Web3 gaming, social based or just retail friendly applications are either created on, or migrate to a layer-2 like Arbitrum.

We've already seen this happening with some protocols and applications.

40/

If .arb domains are going to become the official name domain of a network which is destined to become one of the entry points to Web3, then it could be a good opportunity to register some names which you wouldn't have the chance to on Ethereum

If .arb domains are going to become the official name domain of a network which is destined to become one of the entry points to Web3, then it could be a good opportunity to register some names which you wouldn't have the chance to on Ethereum

https://twitter.com/SID_arb/status/1633359962532347905

41/

Here's one comparison:

🔘 The floor of ENS 999 club is currently 18.5eth

🔘 The floor price of .Arb 999 club is currently less than 0.5eth

Here's one comparison:

🔘 The floor of ENS 999 club is currently 18.5eth

🔘 The floor price of .Arb 999 club is currently less than 0.5eth

42/

Again, I can't stress enough ...NFA and if you register some names, use a burner wallet.

Personally I still think the lack of volume and also lack of hype of this is still potentially a 🚩but can see huge potential if this becomes official

Keeping an eye on it.

Again, I can't stress enough ...NFA and if you register some names, use a burner wallet.

Personally I still think the lack of volume and also lack of hype of this is still potentially a 🚩but can see huge potential if this becomes official

Keeping an eye on it.

And that's it for this weeks thread. I hope you enjoyed!

I'm not usually about posting what I consider to be opportunity and it won't be a focus for me too regularly going forward because I'm happy leaving that to the kings and queens of alpha threadoors.

I'm not usually about posting what I consider to be opportunity and it won't be a focus for me too regularly going forward because I'm happy leaving that to the kings and queens of alpha threadoors.

Tagging the best threadors below 👇

@rektdiomedes

@rektfencer

@ViktorDefi

@diana_web3

@IamZeroIka

@Chinchillah_

@Slappjakke

@DefiIgnas

@cyrilXBT

@arndxt_xo

@CryptoKoryo

@Only1temmy

@N3tyan_

@DeFiMinty

@CryptoShiro_

@DamiDefi

@rektdiomedes

@rektfencer

@ViktorDefi

@diana_web3

@IamZeroIka

@Chinchillah_

@Slappjakke

@DefiIgnas

@cyrilXBT

@arndxt_xo

@CryptoKoryo

@Only1temmy

@N3tyan_

@DeFiMinty

@CryptoShiro_

@DamiDefi

@0xDinoEggs

@pedroo_nv

@bubits_

@ArbiAlpha

@jpegrascal

@nftshark_

@ballanutsa

@cj_zZZz

@0xMughal

@jake_pahor

@eli5_defi

@Mizz0x_

@_Vinsmoked

@GrowCrypto__

@2lambro

@BucharaYT

@pedroo_nv

@bubits_

@ArbiAlpha

@jpegrascal

@nftshark_

@ballanutsa

@cj_zZZz

@0xMughal

@jake_pahor

@eli5_defi

@Mizz0x_

@_Vinsmoked

@GrowCrypto__

@2lambro

@BucharaYT

As promised a brief tutorial on @SID_arb in video format:

Follow me on Substack for newsletters and updates every 1-2 weeks

🌱

cryptocontemplation.substack.com

🌱

cryptocontemplation.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh