How to read and analyze Order Book ? A quick thread 🧵

Dont get fared away by fancy statement Current Order book is X times of TTM revenue

#investing #curatedread #StockMarket

Dont get fared away by fancy statement Current Order book is X times of TTM revenue

#investing #curatedread #StockMarket

Most of stakeholders get flown away with big order intake or order book size which is XX times of TTM revenue. This is ❌️ approach

Always see the timelines of revenue realization of order book which will give you clear picture of potential future annual revenue from order book

Always see the timelines of revenue realization of order book which will give you clear picture of potential future annual revenue from order book

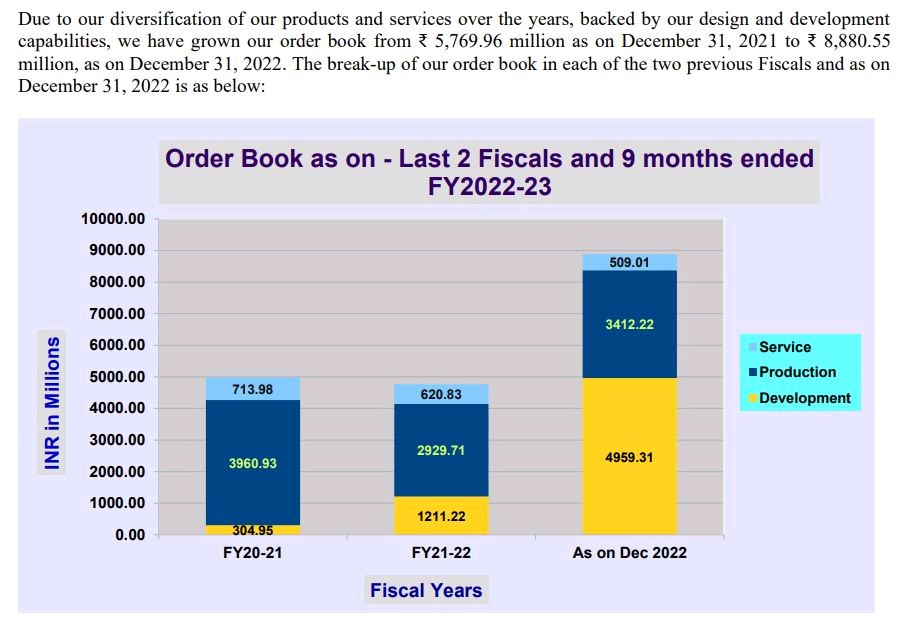

Here is one example

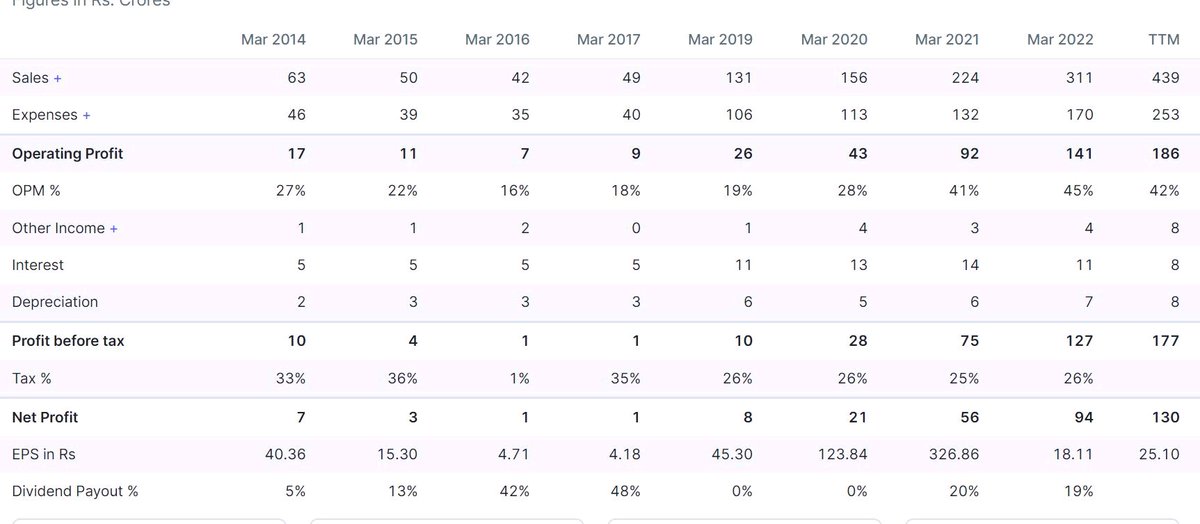

Data Patterns which is having order book of INR 880 crores will be realized & executed in next two years thereby generating revenue of INR 440 crores which is in-line with current TTM revenue of INR 449 crores.

Data Patterns which is having order book of INR 880 crores will be realized & executed in next two years thereby generating revenue of INR 440 crores which is in-line with current TTM revenue of INR 449 crores.

If you have looked otherwise without considering timelines of execution you would have concluded that current order book size is 2X of TTM revenue.

Other factors to consider in analyzing order book are margin guidance from said order book, capex and debt to be undertaken to execute the said order book, type of orders - non-binding or binding, order book diversification (product and clientele)

• • •

Missing some Tweet in this thread? You can try to

force a refresh