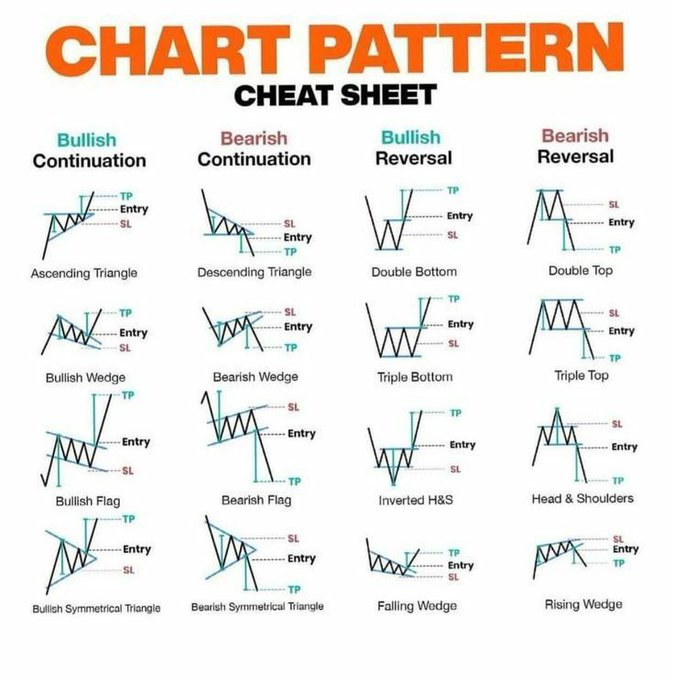

Stock Chart Patterns ↗️↔️↘️

If you #LIKE then also #Retweet please

Stock chart patterns often signal transitions between rising and falling trends.

These patterns can be as simple as trendlines and as complex as double head-and-shoulders formations.

If you #LIKE then also #Retweet please

Stock chart patterns often signal transitions between rising and falling trends.

These patterns can be as simple as trendlines and as complex as double head-and-shoulders formations.

Since price patterns are identified using a series of lines or curves, it is helpful to understand trendlines and know how to draw them. Trendlines help technical analysts spot support and resistance areas on a price chart.

A chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past.

Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking for. 📊 👀

A continuation pattern can be considered a pause during a prevailing trend. This is when the bulls catch their breath during an uptrend or when the bears relax for a moment during a downtrend.

Reversal patterns are those chart formations that signal that the ongoing trend is about to change course. If a reversal chart pattern forms during an uptrend, it hints that the trend will reverse and that the price will head down soon.

Learn more about Best chart patterns 👇

by @valuelevels

Head and shoulders

Double top

Double bottom

Rounding bottom

Cup and handle

Wedges

Pennant or flags

Ascending triangle

Descending triangle

Symmetrical triangle

by @valuelevels

https://twitter.com/valuelevels/status/1477171154670403585

Head and shoulders

Double top

Double bottom

Rounding bottom

Cup and handle

Wedges

Pennant or flags

Ascending triangle

Descending triangle

Symmetrical triangle

• • •

Missing some Tweet in this thread? You can try to

force a refresh