Your cash balance is the result of the decisions you make every day in your business.

If you're in a cash-burn mode, you must have a path to profitability. Understand the levers to pull with my 5 Pillar SaaS Metrics Framework.

Quick summary. #saas

If you're in a cash-burn mode, you must have a path to profitability. Understand the levers to pull with my 5 Pillar SaaS Metrics Framework.

Quick summary. #saas

I use my framework as a roadmap to financial transparency and better decision-making in SaaS.

Move from left to right. Right metrics for the right stage of your business. #metrics

Move from left to right. Right metrics for the right stage of your business. #metrics

Pillar 1️⃣ - Growth📈

Understanding the “layers” of recurring revenue is key to understanding growth.

➡️ New

➡️ Expansion

➡️ Contraction

➡️ Churn

Understanding the “layers” of recurring revenue is key to understanding growth.

➡️ New

➡️ Expansion

➡️ Contraction

➡️ Churn

Pillar 2️⃣ - Retention↩️

You must understand the health of your recurring revenue in SaaS.

Great #retention provides cash flow stability and drives efficient revenue growth.

GDR and NDR focus on your existing customers. NPS is a nice supplement.

You must understand the health of your recurring revenue in SaaS.

Great #retention provides cash flow stability and drives efficient revenue growth.

GDR and NDR focus on your existing customers. NPS is a nice supplement.

Pillar 3️⃣ - Margins💱

Understanding overall and revenue stream margins are fundamental to good financial management.

You know what is working and what is not working. You know where to focus.

A properly structured P&L is key to margin calculations.

Understanding overall and revenue stream margins are fundamental to good financial management.

You know what is working and what is not working. You know where to focus.

A properly structured P&L is key to margin calculations.

Pillar 4️⃣ - Financial Profile 📔

The Rule of 40 adds financial discipline to your decision-making process. Growth vs profit?

Below gross profit, you must understand your OpEx profile. Where are you investing?

Do we want to run positive or negative #EBITDA?

The Rule of 40 adds financial discipline to your decision-making process. Growth vs profit?

Below gross profit, you must understand your OpEx profile. Where are you investing?

Do we want to run positive or negative #EBITDA?

Pillar 5️⃣ - Efficiency 🔣

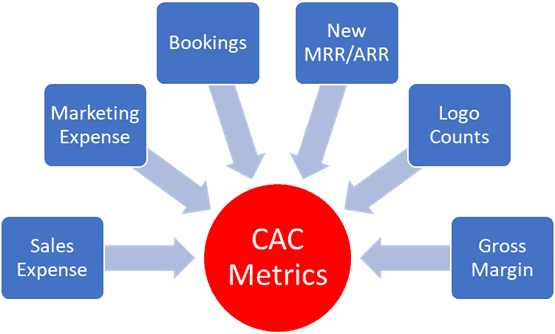

A lot of investment is poured into sales and marketing.

It's essential to track sales and marketing expenses and the resulting ROI.

Cost of ARR is one of my favorites. Intuitive and great benchmarks available.

We must understand org efficiency.

A lot of investment is poured into sales and marketing.

It's essential to track sales and marketing expenses and the resulting ROI.

Cost of ARR is one of my favorites. Intuitive and great benchmarks available.

We must understand org efficiency.

SaaS Resources: if you like these posts, join my newsletter here: mailchi.mp/df1db6bf8bca/t… If you want to apply this framework to your business, learn more here: thesaasacademy.com/saas-metrics-f…

• • •

Missing some Tweet in this thread? You can try to

force a refresh