1/ Liquidity is definitely a factor but the fundamental reason for volatility autocorrelation is information propagation.

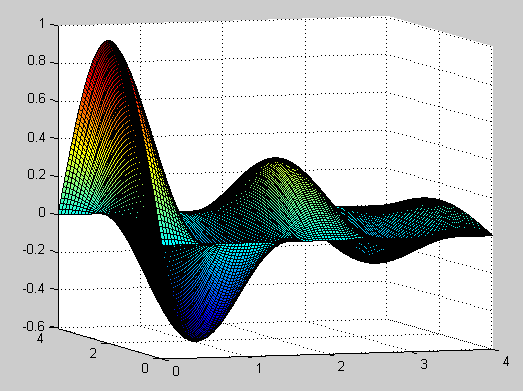

One mental model for markets is a viscous fluid. Shocks to the system play out as damped oscillations in the price discovery process.

One mental model for markets is a viscous fluid. Shocks to the system play out as damped oscillations in the price discovery process.

https://twitter.com/thiccythot_/status/1636289861060640768

2/ In this analogy, the autocorrelation of volatility is the amplitude decaying over time at rate proportional to viscosity. It's intuitive if you think about dropping heavy objects into liquid.

The viscosity parameter is the efficiency of the market. What are its components?

The viscosity parameter is the efficiency of the market. What are its components?

3/ Markets are where self-interested actors come together in a dance of price discovery. A simple example, let's say CPI prints lower than expected.

First NLP strategies parse headlines and slam BTC books. Hard coded triggers, for example 6% inflation -> BTC +2%.

First NLP strategies parse headlines and slam BTC books. Hard coded triggers, for example 6% inflation -> BTC +2%.

4/ At the optimal frontier of sophisticated trading, the fastest are the dumbest. When prices are wrong you just need to get fills.

There is always alpha pushing the price towards fair. Human traders think and adjust. Inverse correlation between time spent thinking and smartness

There is always alpha pushing the price towards fair. Human traders think and adjust. Inverse correlation between time spent thinking and smartness

5/ This human disagreement dance is the primary factor for volatility autocorrelation.

E.g. twitter traders might buy because #moneyprinter baby, past the macro-BTC correlation the tradfi folks are using. The price will settle at a dollar weighted average of their opinions

E.g. twitter traders might buy because #moneyprinter baby, past the macro-BTC correlation the tradfi folks are using. The price will settle at a dollar weighted average of their opinions

6/ There are structural causes for short term volatility autocorrelation too. A well known exacerbating factor is triggering cascades of stop loss orders. Where u at tabasco?

But in general, MMs and quant traders actually serve to *increase* the viscosity of the "fluid."

But in general, MMs and quant traders actually serve to *increase* the viscosity of the "fluid."

7/ This is counterintuitive, and yes liquidity does dry up during high volatility like @thiccythot_ mentioned.

However in aggregate (dollar-weighted) non-quant actors trade on price, not size. Illiquidity amplifies the jitter but isn't the root cause.

However in aggregate (dollar-weighted) non-quant actors trade on price, not size. Illiquidity amplifies the jitter but isn't the root cause.

8/ The easiest way to think about the quant effect is that both makers and takers only have positive pnl if on average buys are lower than sells.

This means the MMs in business predictively smooth out the ripples, smoothing out dislocations and decreasing volatility on average.

This means the MMs in business predictively smooth out the ripples, smoothing out dislocations and decreasing volatility on average.

9/ You can look empirically at electronic market history to see the positive effects of quant trading.

Tighter spreads for retail is often mentioned, but more efficient tracking of fair price is important too.

Btw I summarized the market actors here in more detail:

Tighter spreads for retail is often mentioned, but more efficient tracking of fair price is important too.

Btw I summarized the market actors here in more detail:

https://twitter.com/chameleon_jeff/status/1626665933568905216

• • •

Missing some Tweet in this thread? You can try to

force a refresh