How to get URL link on X (Twitter) App

https://twitter.com/pedma7/status/16748497058244853922/ First of all in HFT there are "strict" problems that you must get right and "loose" problems that you just want to 80/20 at the beginning.

2/ I'm going to focus on problems, ideas, and approaches in this thread.

2/ I'm going to focus on problems, ideas, and approaches in this thread.

https://twitter.com/thunderheadxyz/status/16712265589109800962/ After taker fees and maker rebates went live, non-HLP volume is pretty evenly split between maker and taker.

2/ First some background:

2/ First some background:

https://twitter.com/chameleon_jeff/status/1637986806749872128

2/ The first important number to look at is the "exchange timestamp" field of websocket messages and REST responses.

2/ The first important number to look at is the "exchange timestamp" field of websocket messages and REST responses.

2/ As a trader, the first thing you develop is a sense of skepticism, most of all towards your pnl. When you make money live, the first thing you ask is "why does this opportunity still exist"?

2/ As a trader, the first thing you develop is a sense of skepticism, most of all towards your pnl. When you make money live, the first thing you ask is "why does this opportunity still exist"?

https://twitter.com/chameleon_jeff/status/16415829908066304012/ A bit of background: our strategy began as a single file python script.

https://twitter.com/chameleon_jeff/status/1633080461051465728

https://twitter.com/hosseeb/status/16434531440332718102/ About half a year ago we tried HFT on Bitget and quickly noticed their matching engine is dishonest. I'll give specific examples later in the thread.

https://twitter.com/chameleon_jeff/status/16421985183194521602/ Let's start with Binance. The coveted "nl" flag is, alas, a joke.

https://twitter.com/0xmillie_eth/status/1642547386919559169

2/ Disclaimer: we have never accepted tokens or call options to "be the MM." We just run our usual strategies.

2/ Disclaimer: we have never accepted tokens or call options to "be the MM." We just run our usual strategies.

https://twitter.com/chameleon_jeff/status/16400082804572487682/ Again, I'm not a lawyer, just an opinionated HFT trader and builder. I do not endorse or encourage market manipulation, especially when it is illegal!

2/ Disclaimer: I'm not passing judgment on these actions. I'm not a securities lawyer.

2/ Disclaimer: I'm not passing judgment on these actions. I'm not a securities lawyer.

1/ For quants just starting out, what specific strategies should you run?

1/ For quants just starting out, what specific strategies should you run?

https://twitter.com/thiccythot_/status/1636289861060640768

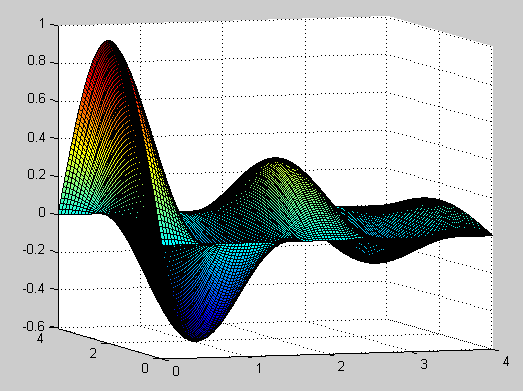

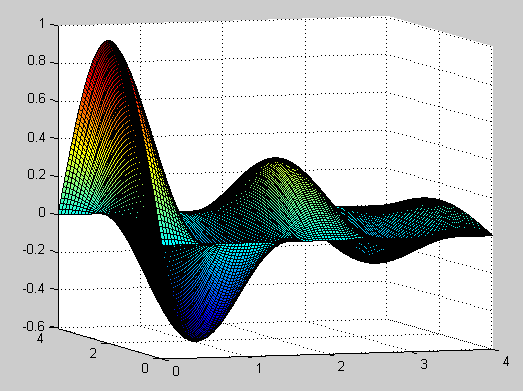

2/ In this analogy, the autocorrelation of volatility is the amplitude decaying over time at rate proportional to viscosity. It's intuitive if you think about dropping heavy objects into liquid.

2/ In this analogy, the autocorrelation of volatility is the amplitude decaying over time at rate proportional to viscosity. It's intuitive if you think about dropping heavy objects into liquid.

https://twitter.com/tier10k/status/16343978076531466242/ We've done this for OKX before, so you know the drill. Run experiments and look at data.

https://twitter.com/chameleon_jeff/status/1632477079962009600