Taken together, the first two #US manufacturing surveys for March give three messages:

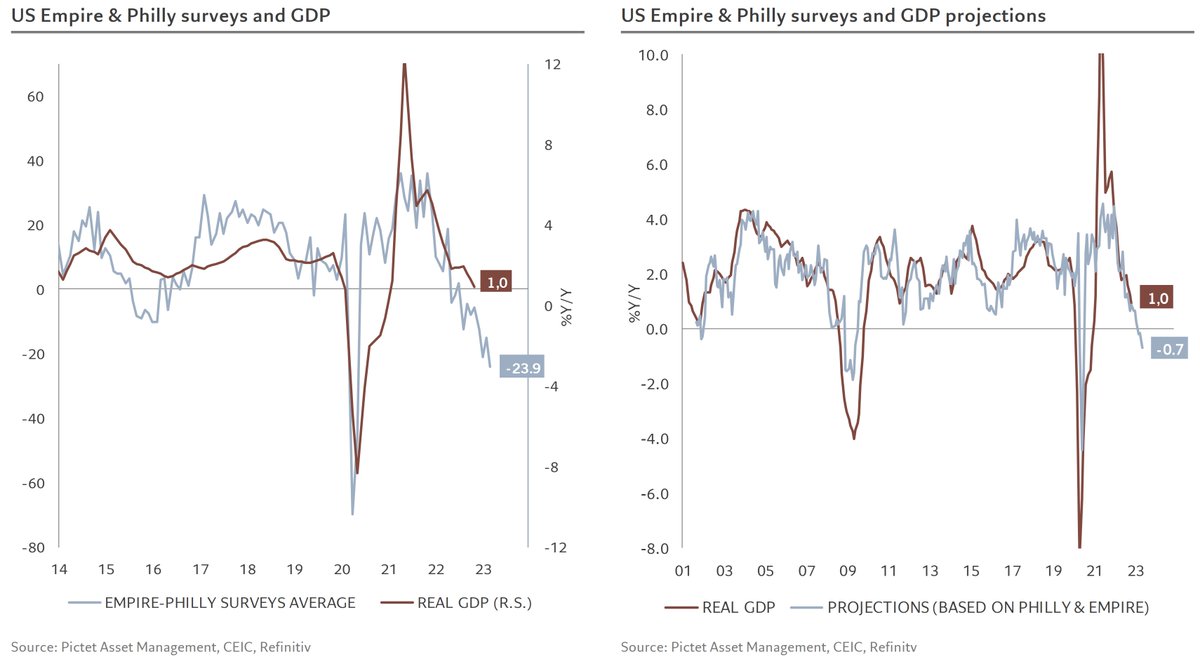

1. activity is expected to deteriorate as these survey levels are associated with a GDP contraction of 0.7% y/y

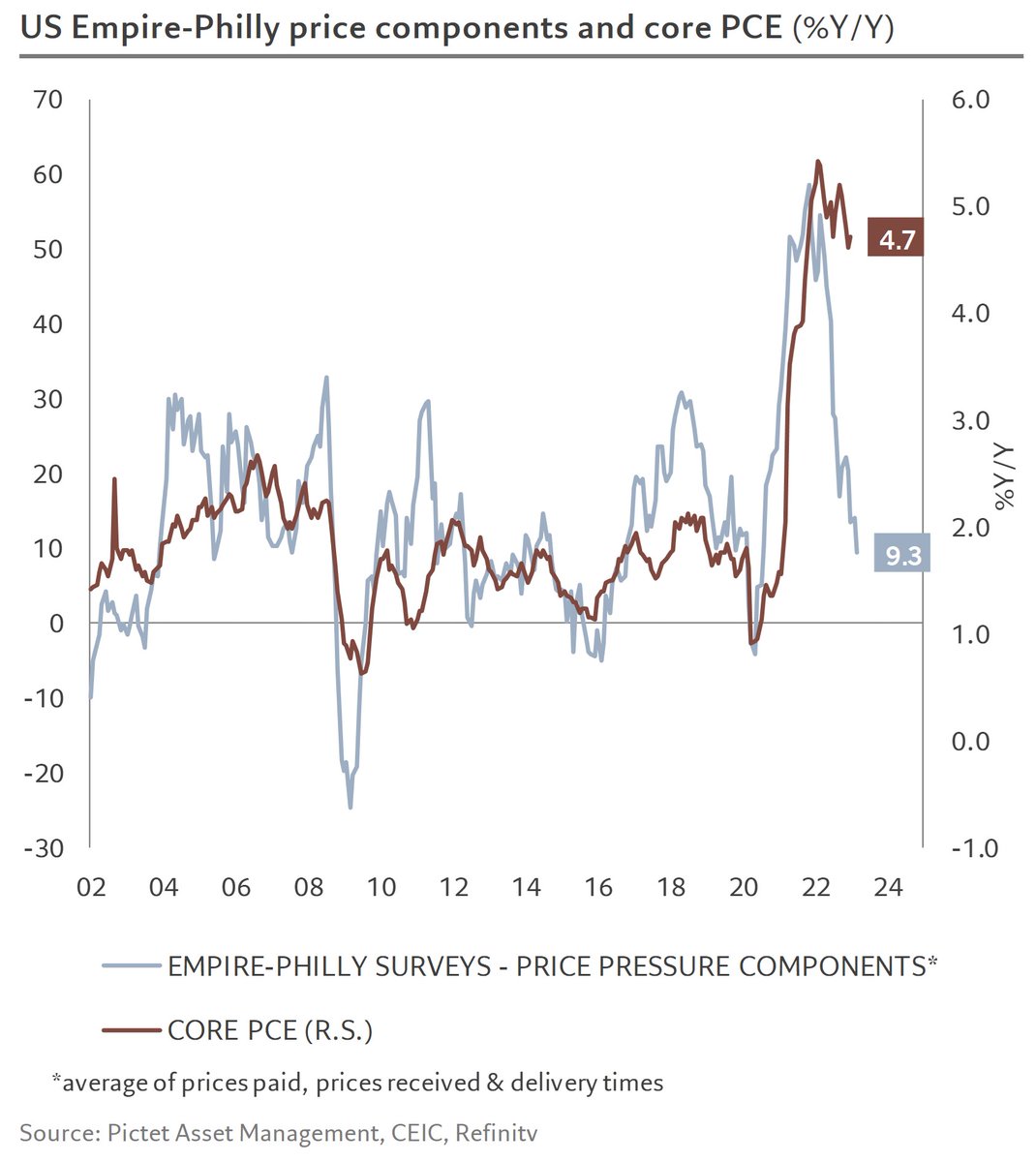

1. activity is expected to deteriorate as these survey levels are associated with a GDP contraction of 0.7% y/y

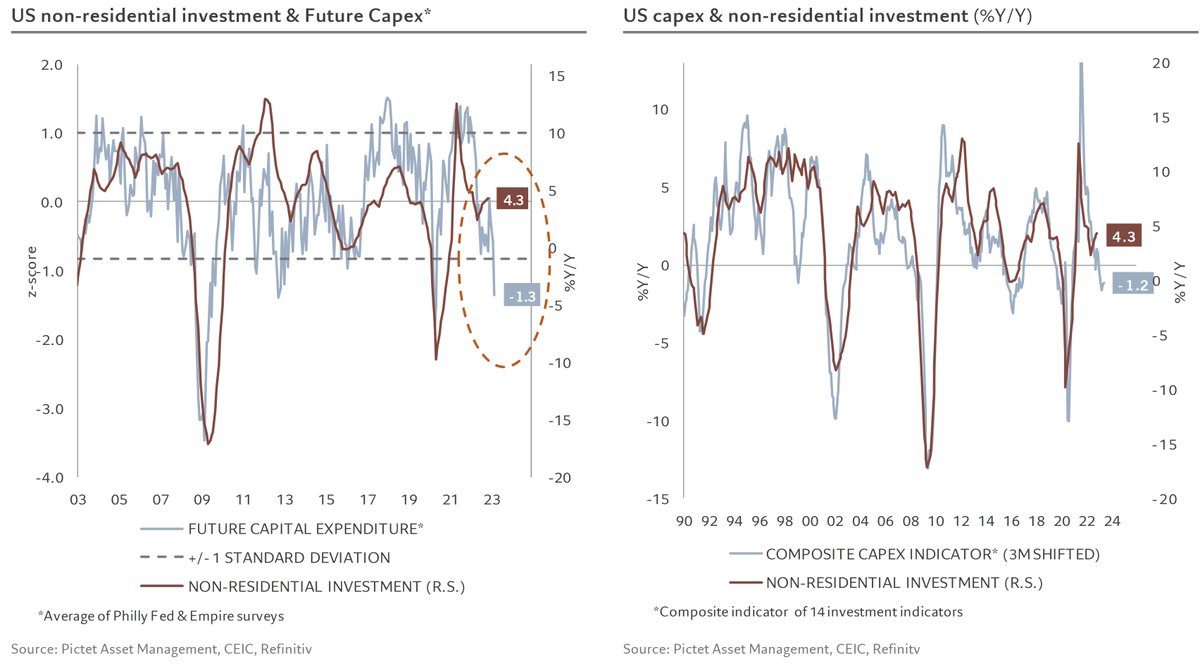

3. the transmission of monetary policy, after the banks, reaches non-financial companies: investment spending intentions are more than one standard deviation below the average

• • •

Missing some Tweet in this thread? You can try to

force a refresh