Here's @CrossRiverBank's details over at #FDIC. Various addresses, FDIC ID numbers, charter info, etc. in case anyone's looking to dig around.

Note that for their first 5 years they were rated "Needs to improve" as a bank.

#lolbank

banks.data.fdic.gov/bankfind-suite…

Note that for their first 5 years they were rated "Needs to improve" as a bank.

#lolbank

banks.data.fdic.gov/bankfind-suite…

@crossriverbank 🧵 Who else didn't know that @CrossRiverBank changed its name from #FirstFinancialBank in 2008?

state.nj.us/dobi/bnk_depos…

state.nj.us/dobi/bnk_depos…

🧵 @CrossRiverBank is technically owned by #CRBGroup (seems like it's not the same as @CRBgrp?), a holding company in Fort Lee, NJ. Apparently #JoannaAlbertine is the CFO.

Here's their annual filings in NJ: ffiec.gov/npw/Institutio…

Here's their annual filings in NJ: ffiec.gov/npw/Institutio…

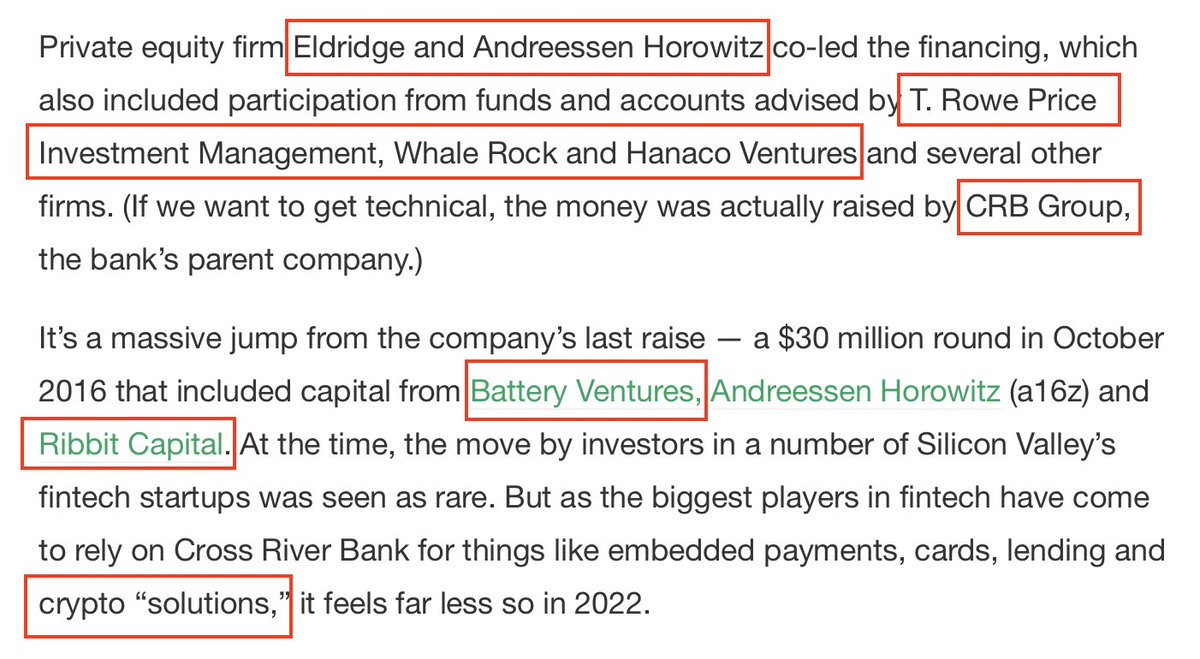

🧵 Let's take a look at @CrossRiverBank's holding company's income filings for 2022, their interest(ing) income in particular:

➤ $5.3 million in real estate

➤ $508 million in "other"

What are the loans? Anyone remember $SIVB and $SBNY's "fund banking"?

ffiec.gov/npw/FinancialR…

➤ $5.3 million in real estate

➤ $508 million in "other"

What are the loans? Anyone remember $SIVB and $SBNY's "fund banking"?

ffiec.gov/npw/FinancialR…

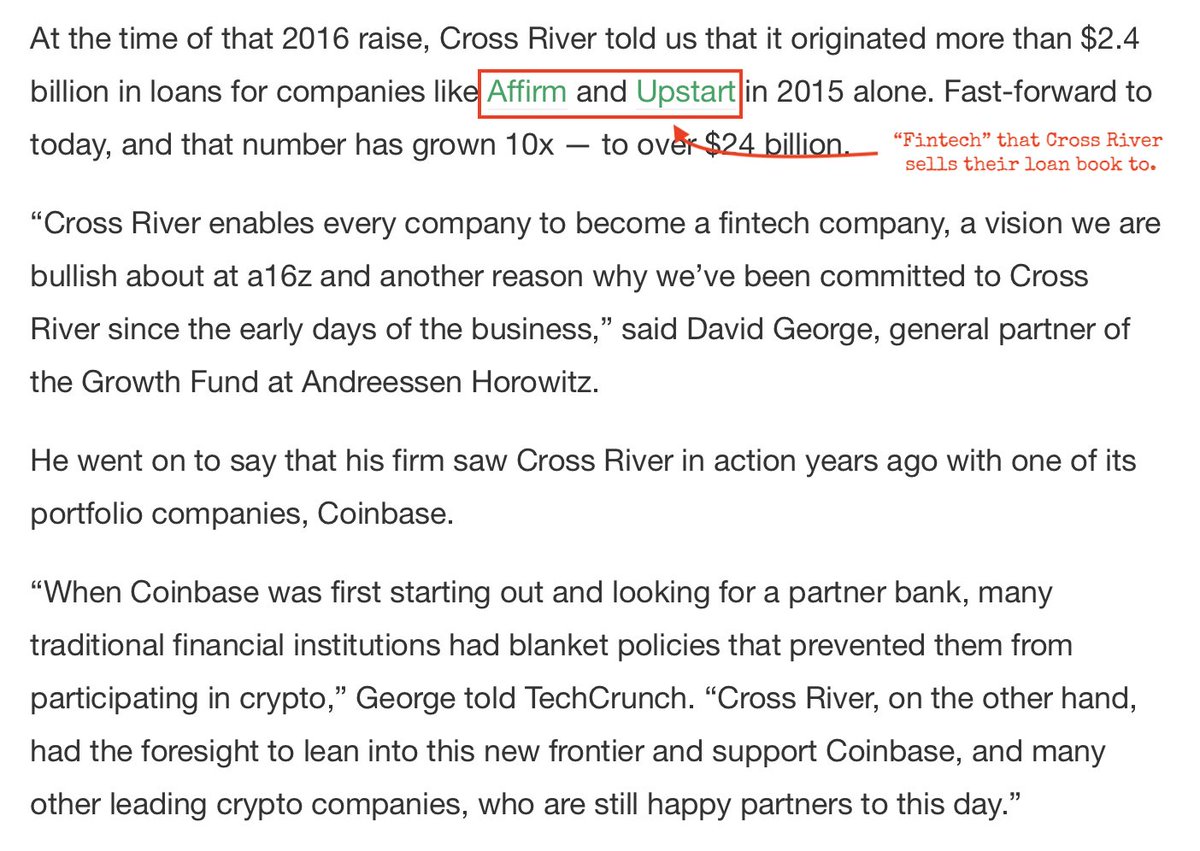

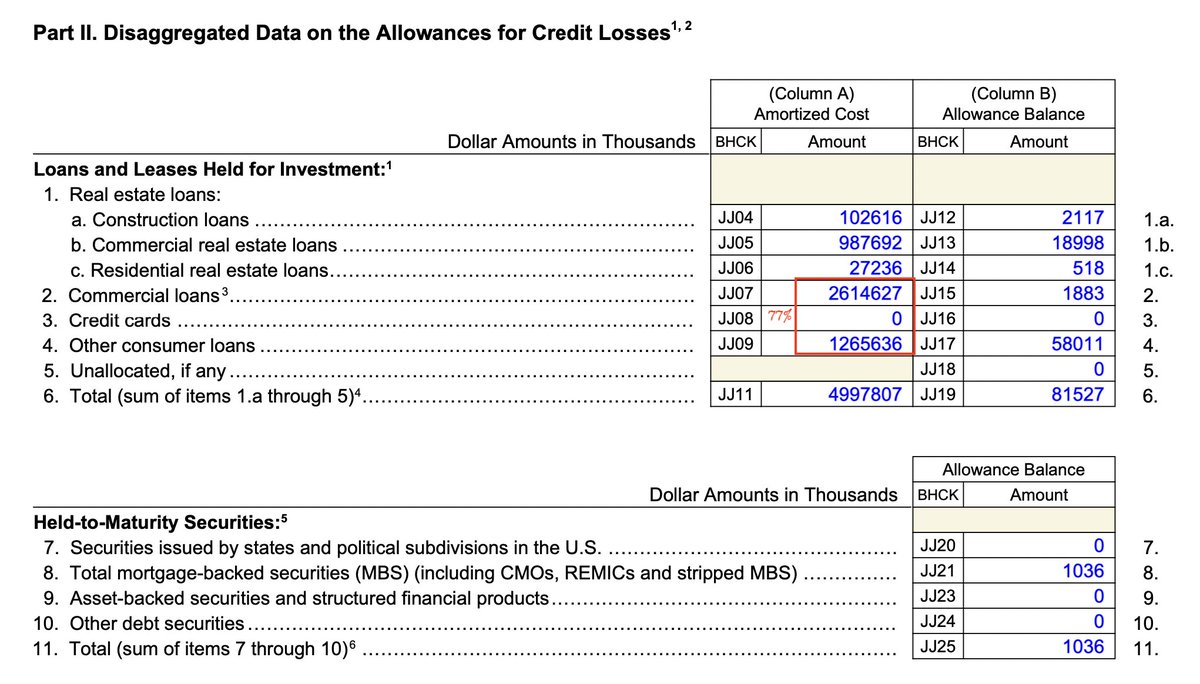

@crossriverbank 🧵 $584 million is the yearly interest INCOME for @CrossRiverBank. At 5% that's a $10 billion loan book.

And yet CRB only pays $82 million out as interest for its capital.

They also have almost no treasuries or mortgage backed securities AKA "safer" assets. All loans.

And yet CRB only pays $82 million out as interest for its capital.

They also have almost no treasuries or mortgage backed securities AKA "safer" assets. All loans.

🧵 And very interestingly only 1/10th of @CrossRiverBank's income is from loans secured by real estate.

We know they have made some big construction loans to weird luxury projects by #Moinian and #Bushburg deep in low income neighborhoods. Is that their main biz?

We know they have made some big construction loans to weird luxury projects by #Moinian and #Bushburg deep in low income neighborhoods. Is that their main biz?

🧵 @CrossRiverBank had $165 million in employee comp expense. LinkedIn lists 910 employees, so that's roughly $181,000 salary per person. CEO claims $125k avg so maybe some not on LI. Though a lot of employees are undereducated / probably make much less.

C-suite is raking it in.

C-suite is raking it in.

🧵 Important note about @CrossRiverBank's loan book: bv they have few treasuries or loans secured by RE they have low borrowing power at #FHLB, which is the lifeline many banks have turned to for cash.

Bonkers C&I loans can't be used as FHLB collateral.

Bonkers C&I loans can't be used as FHLB collateral.

https://twitter.com/Cryptadamist/status/1636860963923058688

🧵 Also an important note about @CrossRiverBank's loan book: they offered (offer?) loans collateralized by cryptocurrency to their customers.

And as a service to their partners' customers.

(if yr just catching up 👇 is a whole large thread about CRB)

And as a service to their partners' customers.

(if yr just catching up 👇 is a whole large thread about CRB)

https://twitter.com/Cryptadamist/status/1636870417901035525

🧵 Someone correct me if I misread this but it appears that @CrossRiverBank saw $143 million loss on its loan portfolio in 2022.

🧵 Also seems interesting that @CrossRiverBank issued $300 million worth of #PPP loans that the #SBA and Congress appear to think are fraudulent and will not pay them for.

That would be a pretty big loss were #CrossRiverBank to have to absorb it...

That would be a pretty big loss were #CrossRiverBank to have to absorb it...

https://twitter.com/Cryptadamist/status/1637018436575416328

@crossriverbank * oops correction this should be $53 million not $5.3 million. so 10% income is from real estate secured loans and 90% is from "other".

🧵@CrossRiverBank was registered with the federal contractor program for a year.

➤ SAM ID: XPNVAGJZKBS1.

➤ CAGE code: 8VY60

➤ #ThomasMurphy was the revenue & expense manager.

➤ Registered with SAM for "Z1 - Federal Assistance Awards"

Ω👇Ω

opengovus.com/sam-entity/XPN…

➤ SAM ID: XPNVAGJZKBS1.

➤ CAGE code: 8VY60

➤ #ThomasMurphy was the revenue & expense manager.

➤ Registered with SAM for "Z1 - Federal Assistance Awards"

Ω👇Ω

opengovus.com/sam-entity/XPN…

🧵 Also interesting what comes up as "nearby businesses".

Turns out in the same building there's a company called @PeerIQAnalytics, which it turns out was purchased by @CrossRiverBank. Its real name caught my eye immediately:

"Peeriq · Synthetic P2p Holdings Corporation"

Turns out in the same building there's a company called @PeerIQAnalytics, which it turns out was purchased by @CrossRiverBank. Its real name caught my eye immediately:

"Peeriq · Synthetic P2p Holdings Corporation"

🧵 Both @CrossRiverBank and @PeerIQAnalytics are users of the H1B visa program (basically "skilled workers" visas in the USA).

There's nothing particularly weird here that I see...

myvisajobs.com/Visa-Sponsor/C…

There's nothing particularly weird here that I see...

myvisajobs.com/Visa-Sponsor/C…

🧵 One thing that is maybe or maybe not kinda weird is that @PeerIQAnalytics registered with the SBA as a "Self Certified Small Disadvantaged Business"...

🧵 I stumbled on a company called #CrossRiverFiber... No idea if it's related but I noted that

➤ It was acquired by #Zenfi

➤ $ZENFI is a cryptocurrency

➤ #ZenFI was acquired by #BAICommunications

➤ #BAICommunications just rebranded as an AI company #BoldynNetworks.

wow.

➤ It was acquired by #Zenfi

➤ $ZENFI is a cryptocurrency

➤ #ZenFI was acquired by #BAICommunications

➤ #BAICommunications just rebranded as an AI company #BoldynNetworks.

wow.

🧵 There's another company in the same building as @CrossRiverBank: #PrestigeCapitalFinance who are some kind of investment fund that never tells you who they invested in, just the industry. ??

➤ "a CBD wellness brand"

➤ "a NY construction firm"

Ω👇Ω

prestigecapital.com/newsroom/in-th…

➤ "a CBD wellness brand"

➤ "a NY construction firm"

Ω👇Ω

prestigecapital.com/newsroom/in-th…

🧵 Back to @CrossRiverBank: Their loan book is... interesting. Not real estate centric and not much treasuries (the kind that brought down $SIVB).

It's mostly probably "buy now pay later" loans like $AFRM / $UPST which they think are high quality - 98.4% will get paid back.

It's mostly probably "buy now pay later" loans like $AFRM / $UPST which they think are high quality - 98.4% will get paid back.

🧵 As for @CrossRiverBank's deposits, some depositors are more sticky than others. CRB holds a large % of:

➤ non-interest deposits (22%)

➤ brokered deposits (24%) which can go in a flash.

It's not $SIVB's insane 91% uninsured but it's not the strongest deposit fleet.

➤ non-interest deposits (22%)

➤ brokered deposits (24%) which can go in a flash.

It's not $SIVB's insane 91% uninsured but it's not the strongest deposit fleet.

🧵 #CrossRiverBank's Chief Accounting Officer is named Elliott Rothschild.

(*cough* #LehmanBrothers *cough*)

linkedin.com/in/elliot-roth…

(*cough* #LehmanBrothers *cough*)

linkedin.com/in/elliot-roth…

I'll just point out here that #MichaelSevret, the Chief Strategy Officer of #CrossRiverFiber, appears to have been a New Jersey wedding DJ before being placed in the C-suite.

I mean maybe I'm wrong and these are different people but... kinda look the same?

I mean maybe I'm wrong and these are different people but... kinda look the same?

• • •

Missing some Tweet in this thread? You can try to

force a refresh