Most bullish $BTC season is about to start. I've prepared a short guide to help you get ready for the rallies.

A thread🧵👇

A thread🧵👇

1/ Casual disclaimer:

In this thread, I will combine many charting techniques, chart pattern studies, fundamental factors, and seasonal records of #Bitcoin.

The future is unpredictable. Profits are not guaranteed. Losses are inevitable. No holy grails.

Let's get it started👇

In this thread, I will combine many charting techniques, chart pattern studies, fundamental factors, and seasonal records of #Bitcoin.

The future is unpredictable. Profits are not guaranteed. Losses are inevitable. No holy grails.

Let's get it started👇

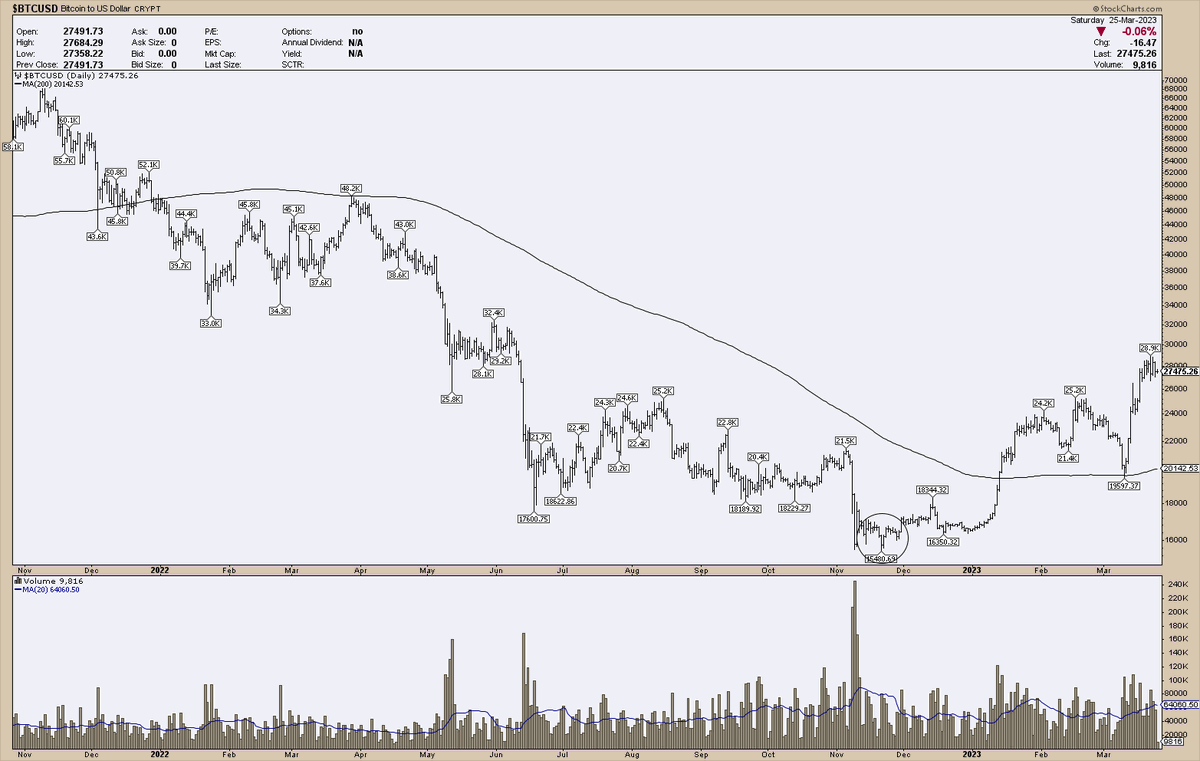

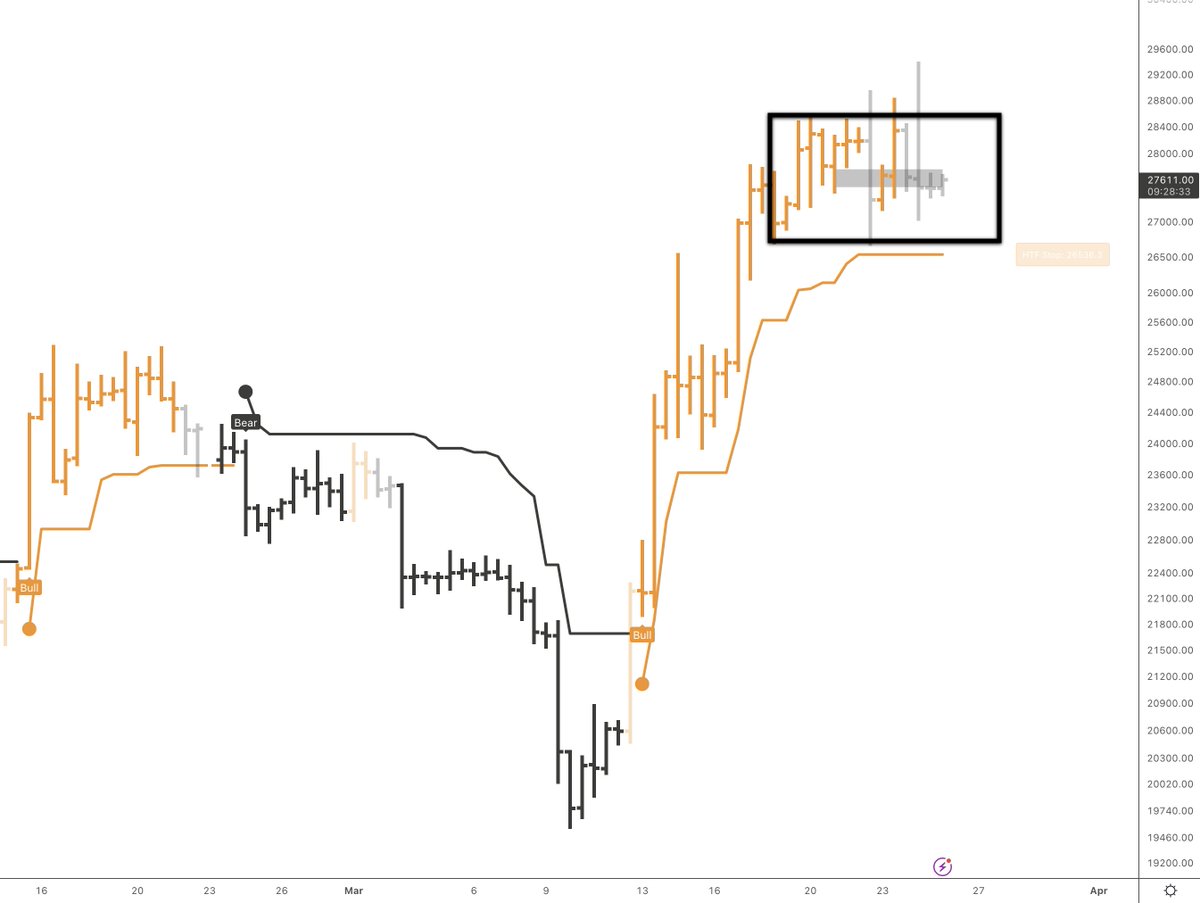

2/ The daily chart shows a local consolidation period as $BTC chops around the $28000 level.

Having bounced off the 200-day average support on an increased volume, the $30000 is the overhead resistance area of interest.

Having bounced off the 200-day average support on an increased volume, the $30000 is the overhead resistance area of interest.

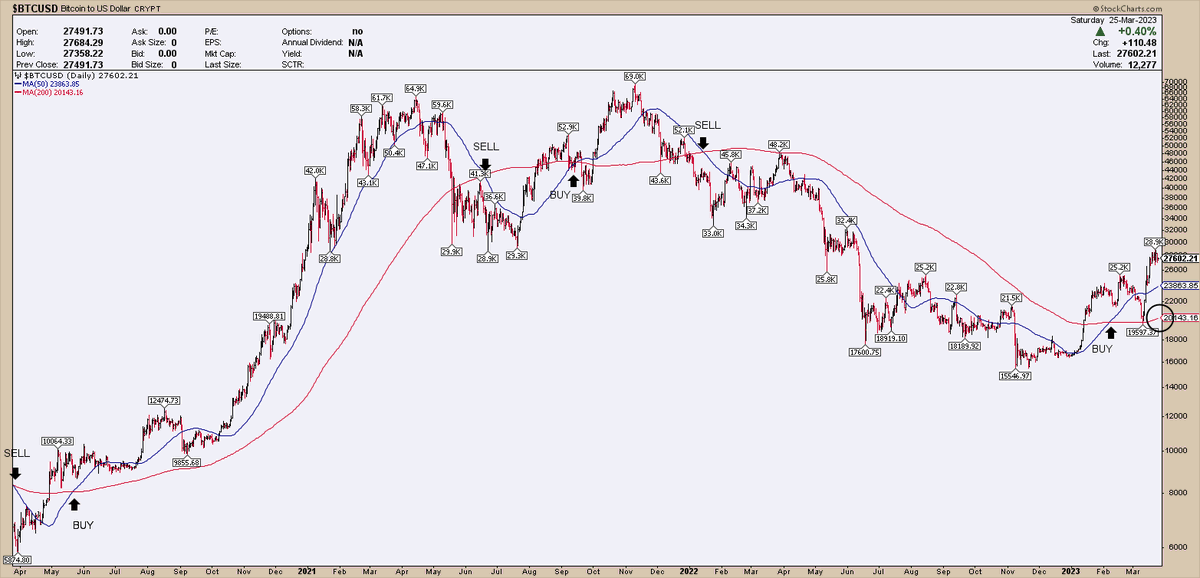

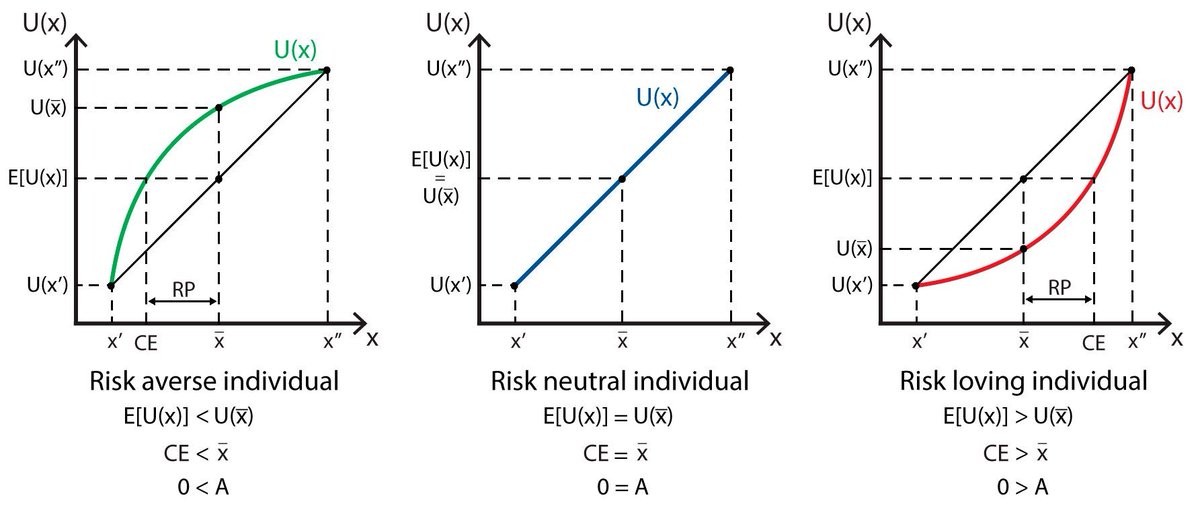

3/ Many traders anchor at the round numbers and apply heuristics. Such magical thinking is widely used for the $30000 level.

Driven by their loss aversion, traders often want to sell before $BTC hits resistance.

Hence, a cluster of ask orders can be created.

Driven by their loss aversion, traders often want to sell before $BTC hits resistance.

Hence, a cluster of ask orders can be created.

4/ The 200-day mean has shifted to more aggressive inclines. While it may seem innocent, it's significant from a technical viewpoint.

Moving averages often serve as reference points to decide the "fair" support level. As a result, the prices will often gravitate toward averages.

Moving averages often serve as reference points to decide the "fair" support level. As a result, the prices will often gravitate toward averages.

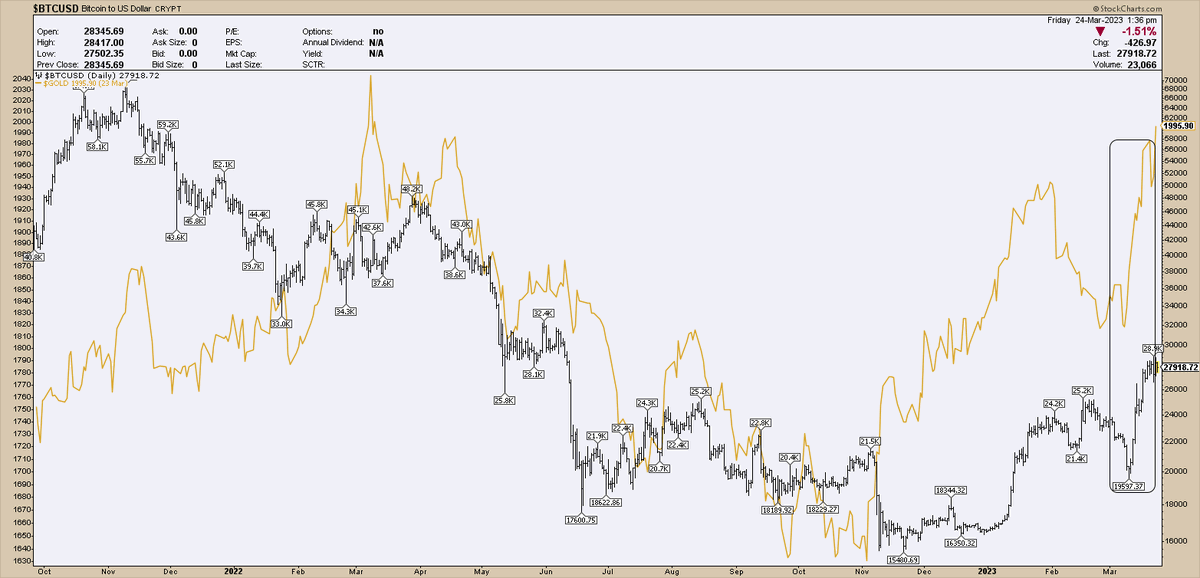

5/ Driven by a “digital gold” narrative, #BTC has moved in tandem with the gold prices as a flight to safety triggered by the banking sector turmoil.

As @RRGresearch noted, gold leads Bitcoin now.

Is the gold breakout implying an upcoming Bitcoin thrust?

As @RRGresearch noted, gold leads Bitcoin now.

Is the gold breakout implying an upcoming Bitcoin thrust?

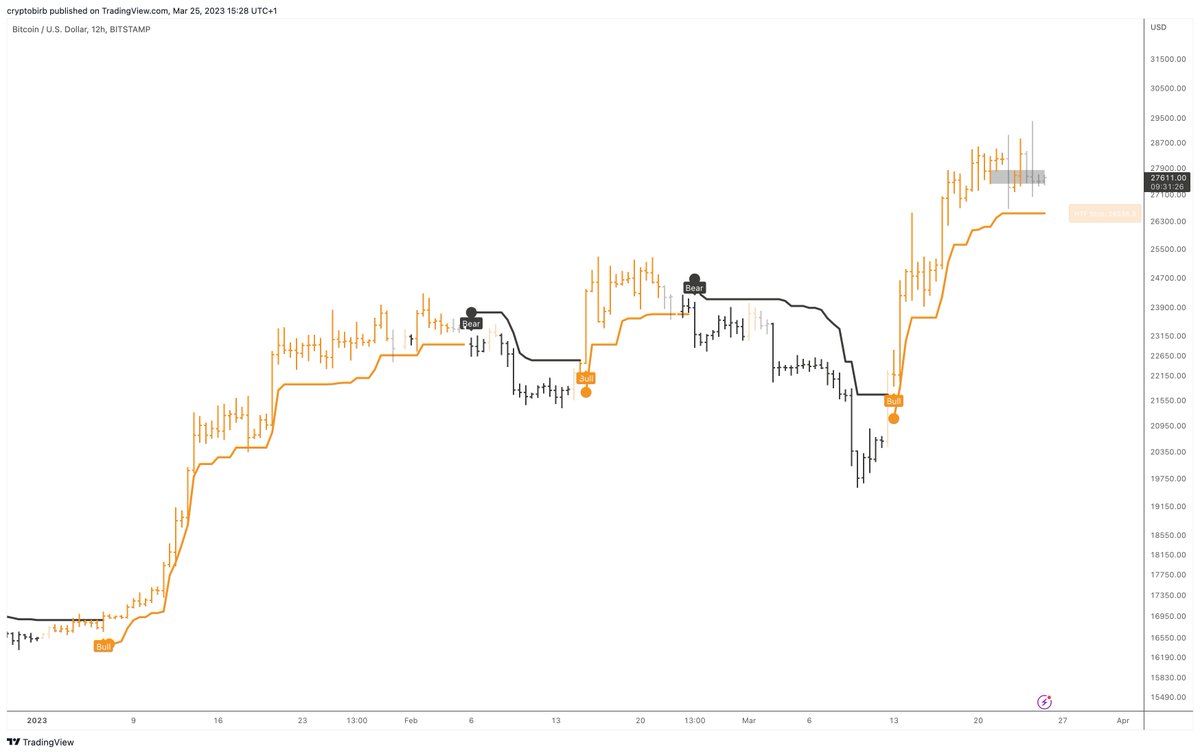

6/ The middaily chart shows that #Bitcoin is now moving sideways around the 28000 USD level in a choppy and chaotic manner.

Typically, such movements are a source of noise and false signals.

Adjusting the stops based on volatility measures may be used as a filter.

Typically, such movements are a source of noise and false signals.

Adjusting the stops based on volatility measures may be used as a filter.

7/ The HTF Trailer, a BirbicatorPRO trend indicator, implies upward trend conditions to be valid until the HTF Stop at $26536 is broken through.

Still, a $BTC daily close must be well below that support threshold to activate a trend change signal.

Still, a $BTC daily close must be well below that support threshold to activate a trend change signal.

8/ Using my custom HTF Trailer strategy, I made over +$500k profit in two months (still growing), with major rallies yet to come.

If you want to know how it works with transparent evidence and public calls, watch my latest video tutorial linked below.

🔗

If you want to know how it works with transparent evidence and public calls, watch my latest video tutorial linked below.

🔗

9/ BirbicatorPRO is my private trading system.

It can be customized to fit what, how, and when I want to trade.

Most important - It's profitable.

Learn: thebirbnest.com/bp1m

It can be customized to fit what, how, and when I want to trade.

Most important - It's profitable.

Learn: thebirbnest.com/bp1m

10/ The price action study suggests the prior swing high at $25300 should turn into support now, following the polarity change principle. If this level is retained, the bullish trend may persist higher.

Otherwise, a more destructive impact may be enhanced by a top overthrow.

Otherwise, a more destructive impact may be enhanced by a top overthrow.

11/ FEAR & GREED INDEX

At 64 points on the scale, the fear and greed index suggests a "greed" rating.

It implies robust trending conditions in the upward direction.

The trend may persist until sentiment reaches extreme values, suggesting little overbought conditions.

At 64 points on the scale, the fear and greed index suggests a "greed" rating.

It implies robust trending conditions in the upward direction.

The trend may persist until sentiment reaches extreme values, suggesting little overbought conditions.

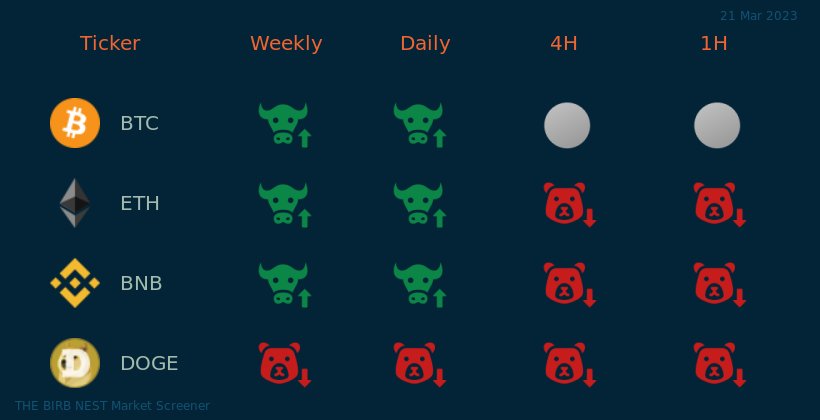

12/ The trend sentiment scanner shows bullish conditions for the weekly and daily time scopes.

Meanwhile, the shorter time frames are indecisive, highlighting the ongoing sideways process.

Meanwhile, the shorter time frames are indecisive, highlighting the ongoing sideways process.

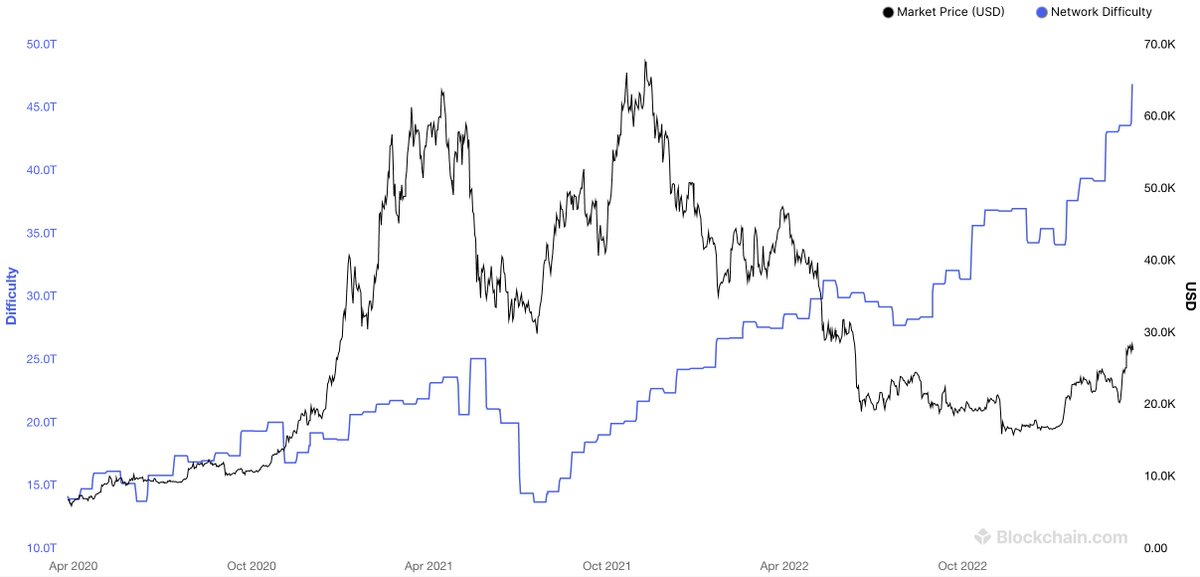

13/ Mining Difficulty & Production Costs

The miners have retained the profitability so far.

With the mining difficulty and #Bitcoin hash rate reaching all-time-high levels, these favorable conditions can support further price inclines.

The miners have retained the profitability so far.

With the mining difficulty and #Bitcoin hash rate reaching all-time-high levels, these favorable conditions can support further price inclines.

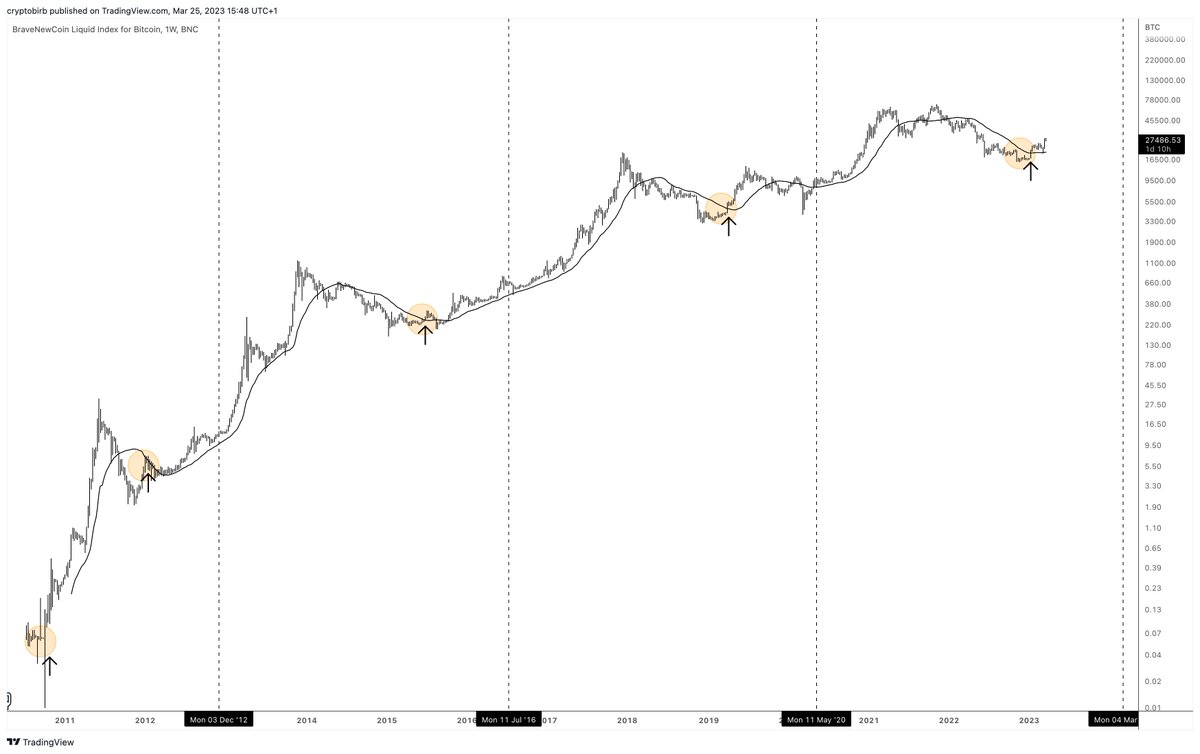

14/ Overall, the fundamental scarcity increases as $BTC nears the upcoming halving events.

This "intrinsic" scarcity has historically been a source of exponential rallies.

Will this time be different?

This "intrinsic" scarcity has historically been a source of exponential rallies.

Will this time be different?

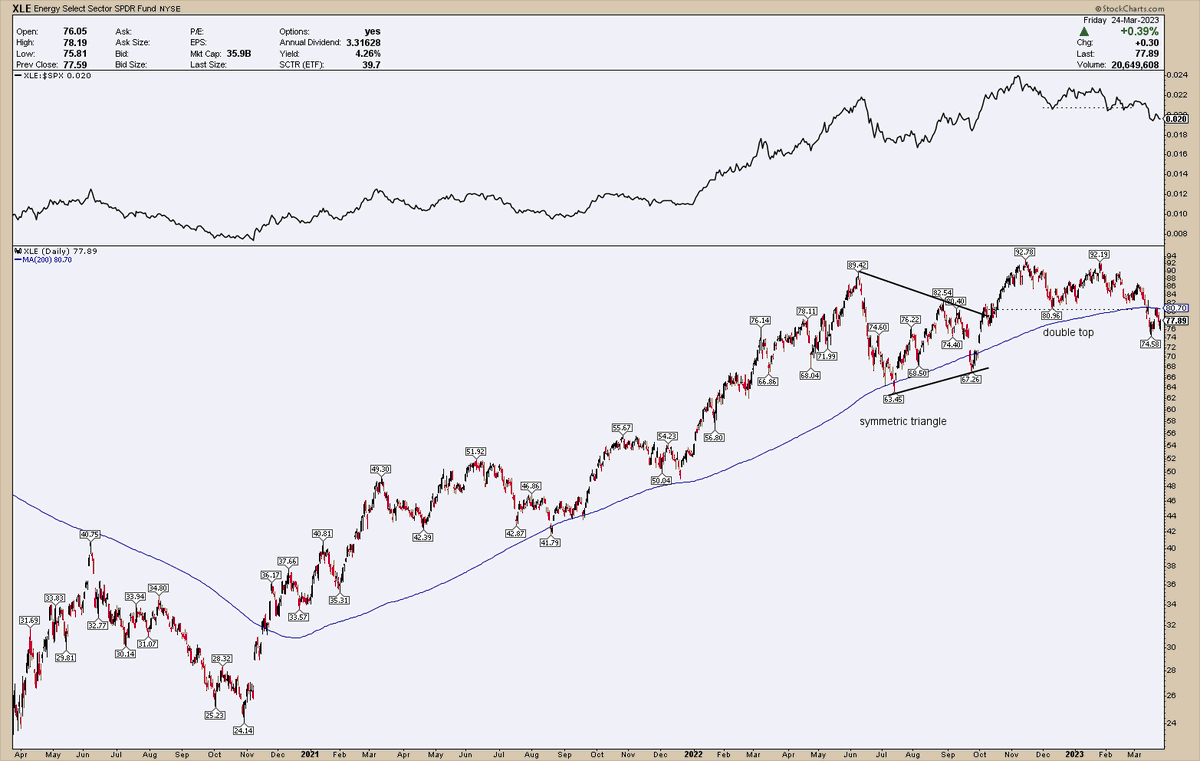

15/ The $XLE has confirmed a double top pattern, breaking below the critical support level at 200SMA.

Declining energy prices may free up more disposable income to fuel potential rallies ahead.

This is an important inter-market factor to consider.

Declining energy prices may free up more disposable income to fuel potential rallies ahead.

This is an important inter-market factor to consider.

16/ Before I go, our limited discount is about to expire. Last chance to go premium 70% off and pick your favorite hoodie with a 4-week strategy training bonus. Less than 70 spots left. Apply BIRB99 checkout code before the others book it👉thebirbnest.com/bundle

17/ Final thoughts:

Some traders are risk-seeking gamblers by nature.

Still, an average risk-averse and loss-averse trader is recommended to mind that, sometimes, no action is the best.

Making money decisions based on simple logic beats emotional trading 100% of the time.

Some traders are risk-seeking gamblers by nature.

Still, an average risk-averse and loss-averse trader is recommended to mind that, sometimes, no action is the best.

Making money decisions based on simple logic beats emotional trading 100% of the time.

18/ Important quotes:

"Don't fight the Fed."

"Don't fight the trend."

"Go with the flow"

"Follow @crypto_birb"

"Crypto isn't stressful"

"Don't fight the Fed."

"Don't fight the trend."

"Go with the flow"

"Follow @crypto_birb"

"Crypto isn't stressful"

19/ If you enjoyed this thread, consider giving me a follow (I post these often).

If you care about your crypto friends, please like and share the main tweet below.

Thanks🧡

If you care about your crypto friends, please like and share the main tweet below.

Thanks🧡

https://twitter.com/crypto_birb/status/1639632799140311042?s=20

20/ MONEY-BACK PROMISE:

If you follow my program for 14 days and don’t get any successful calls from our team, I’ll pay you 100$ or give you a free 15-minute consultation with our team (worth $371) to help you improve. Learn to trade with confidence now👉thebirbnest.com/bundle

If you follow my program for 14 days and don’t get any successful calls from our team, I’ll pay you 100$ or give you a free 15-minute consultation with our team (worth $371) to help you improve. Learn to trade with confidence now👉thebirbnest.com/bundle

• • •

Missing some Tweet in this thread? You can try to

force a refresh