How to get URL link on X (Twitter) App

1. WEEKLY LANDSCAPE:

1. WEEKLY LANDSCAPE:

1. The stats are INSANE

1. The stats are INSANE

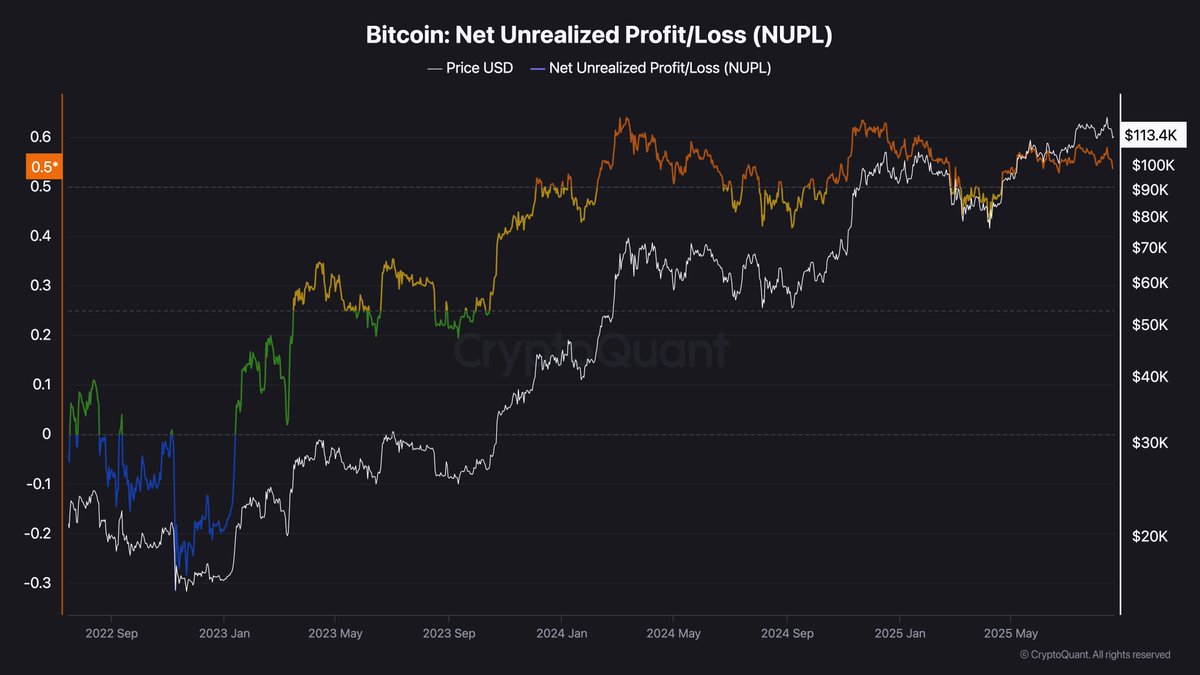

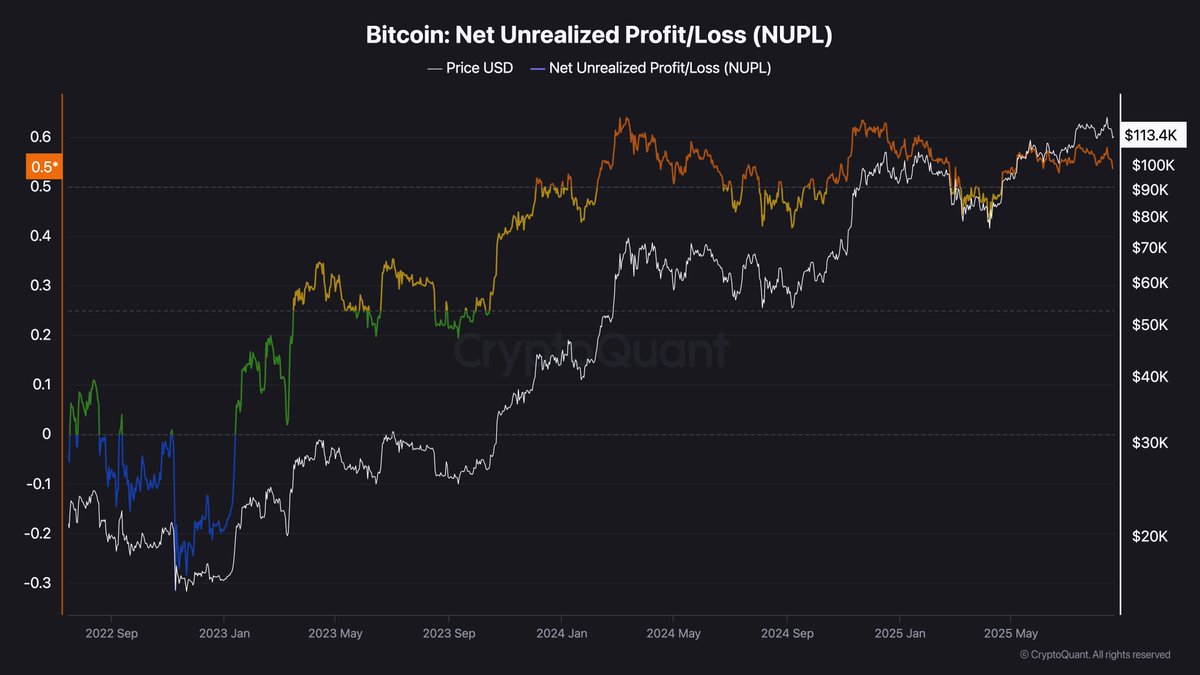

1/ $BTC is holding at $113,450.

1/ $BTC is holding at $113,450.

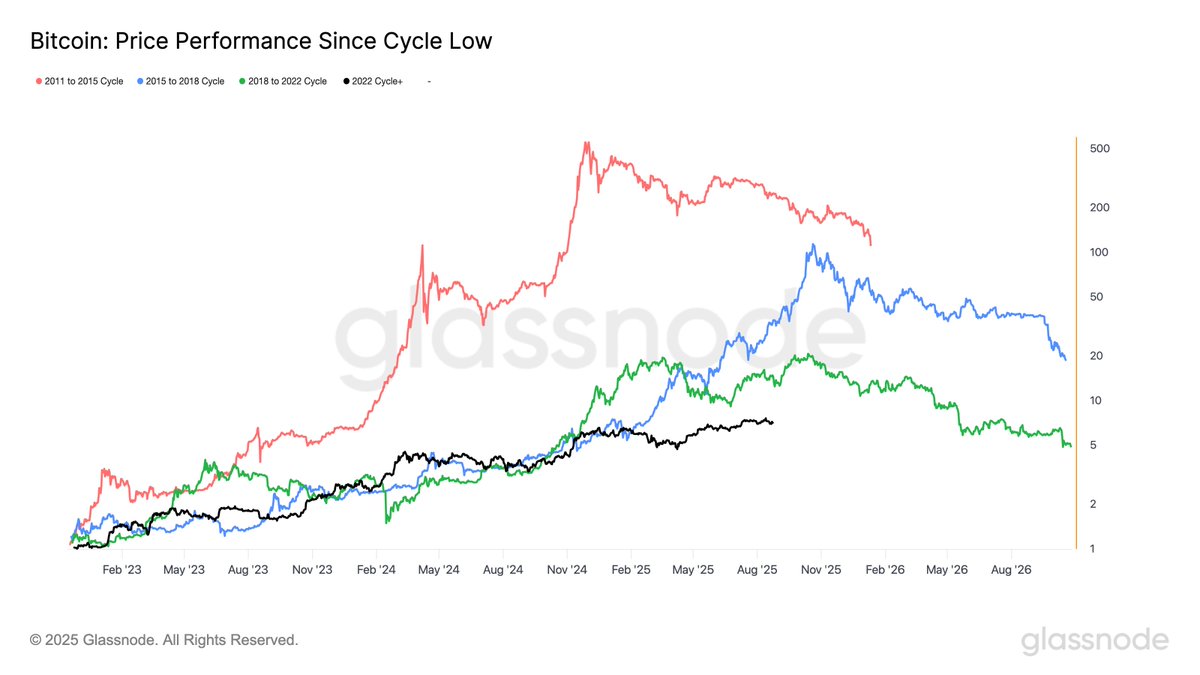

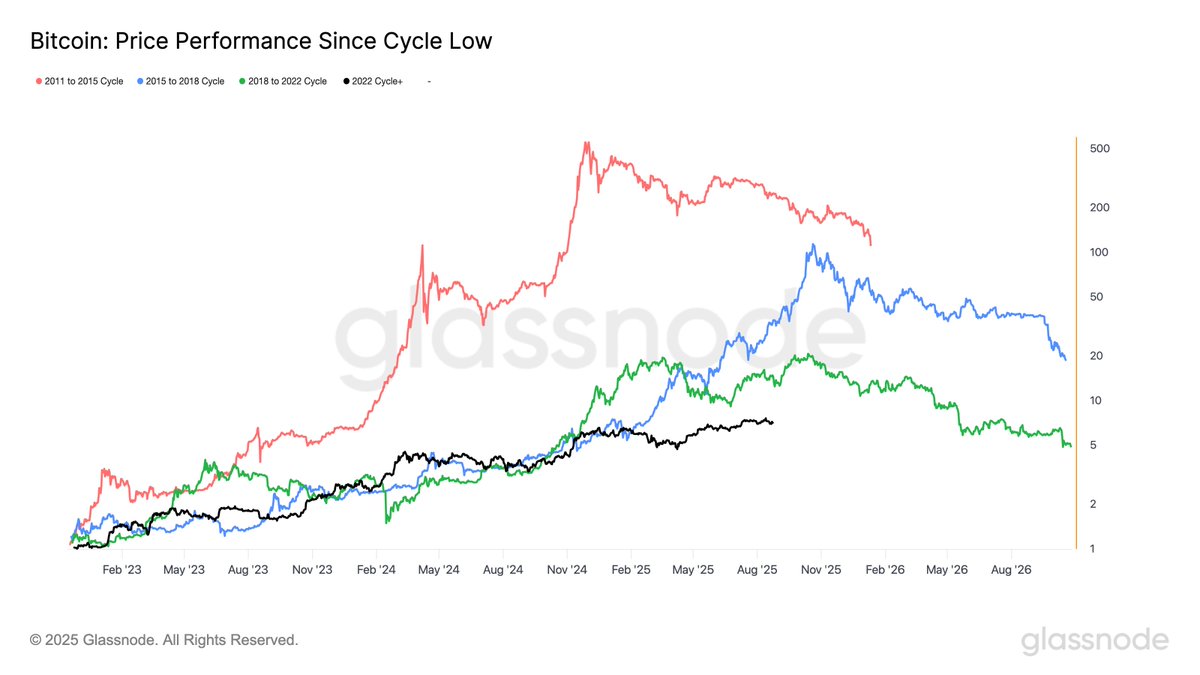

1/ We’re really late.

1/ We’re really late.

MVRV Z-Score (Market Value/Realized Value) is BTC valuation model. Z-score shows how many standard deviations a value is from the mean.

MVRV Z-Score (Market Value/Realized Value) is BTC valuation model. Z-score shows how many standard deviations a value is from the mean.

https://x.com/AltcoinPsycho/status/1767288688470290699

1) ETH Price Target: $22K by 2030?

1) ETH Price Target: $22K by 2030?