1/ In your time bestriding the narrow world like a Colossus, you might have heard the term, “bearer asset”. That would be an asset that you take physical possession of - cash or bullion, for example - an asset that is effectively owned by whoever has possession of it

2/ You can transfer it from A to B by just handing it over. Unlike money in the bank, it does not reply on or carry a promise from a third party.

Ownership is not registered, so that makes it vulnerable to theft or loss, but it also means, it is nobody else's liability.

Ownership is not registered, so that makes it vulnerable to theft or loss, but it also means, it is nobody else's liability.

3/ The two main bearer assets in today’s financial marketplace are #gold and #Bitcoin .

Bitcoin is not a physical asset of course. But the technological genius behind it means that it is a “digital bearer asset”. No such thing previously existed.

Bitcoin is not a physical asset of course. But the technological genius behind it means that it is a “digital bearer asset”. No such thing previously existed.

4/ With bank runs, bail-outs & another banking crisis, both are suddenly fetching a bid.

#Bitcoin at $28,000, has broken out to 9-month highs.

Billionaire @balajis says hyperbitcoinisation is here and that it's going to $1 million. Not sure but the price action is strong.

#Bitcoin at $28,000, has broken out to 9-month highs.

Billionaire @balajis says hyperbitcoinisation is here and that it's going to $1 million. Not sure but the price action is strong.

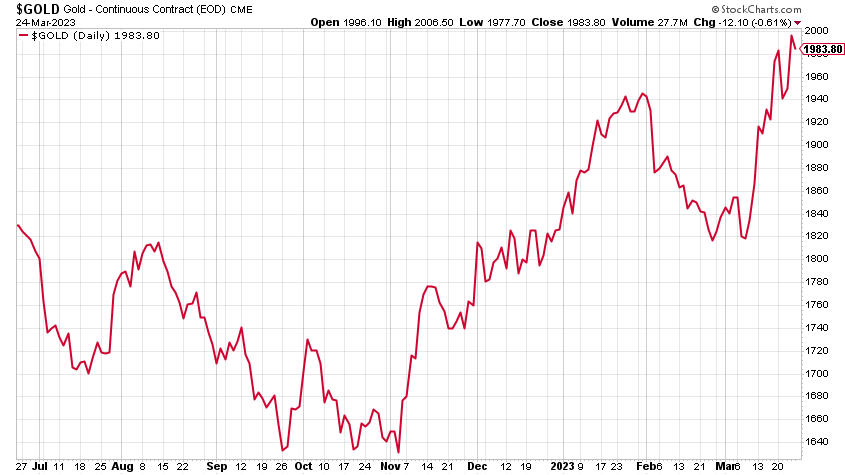

5/ Gold has meanwhile been flirting with $2,000.

Metals Daily reports a 763% increase in traffic.

Bullion dealer Pure Gold Company reports a 385% increase in new enquiries last weekend and a 274% increase in buying.

tinyurl.com/3ymmdkkr

Metals Daily reports a 763% increase in traffic.

Bullion dealer Pure Gold Company reports a 385% increase in new enquiries last weekend and a 274% increase in buying.

tinyurl.com/3ymmdkkr

6/ The same arguments we heard in 2008 are coming back. At the heart of them lie fundamental questions as to the nature of money and banking.

Don’t blame the players. It’s the game that’s at fault.

Don’t blame the players. It’s the game that’s at fault.

7/ Click below to read (or listen) in full to my article on #bearerbonds

Plus there are guides to buying #gold or #Bitcoin

tinyurl.com/yuwp9ay2

Plus there are guides to buying #gold or #Bitcoin

tinyurl.com/yuwp9ay2

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter