Here's a question to all my #twitter peeps.... but some background first.

One of the first things you learn in M&A 101 is that the primary benefit of a share sale vs an asset sale is that an asset sale you get to leave behind liabilities and any potential unknown skeletons...

One of the first things you learn in M&A 101 is that the primary benefit of a share sale vs an asset sale is that an asset sale you get to leave behind liabilities and any potential unknown skeletons...

Now this is not true in all cases for example in Europe (my specific experience is Germany) if you acquire a going concern via asset sale employee obligations are carried over (that the simple version its way more onnerous).

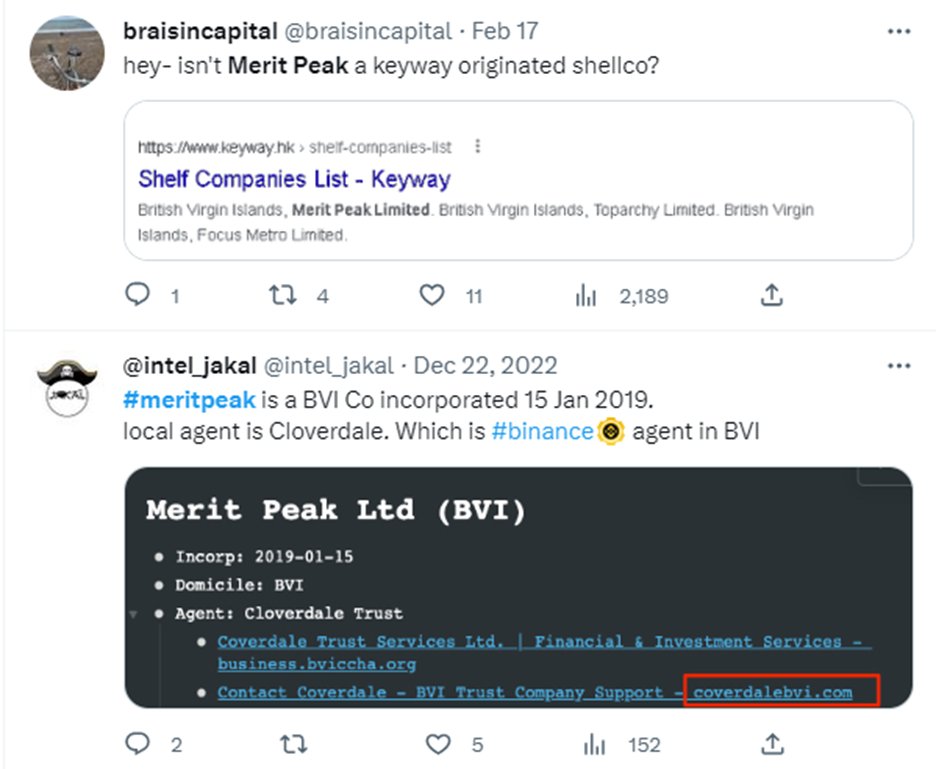

But my question relates to what about when a company acquires an asset that's subsequent to acquisition its discovered that asset was previously used for the carriage of illegal activity. Say for instance a domain. What responsibility other than the obvious reputational risk.

could the new owner be exposed to?

oh and btw the illegal activity may be promotion of #childporn.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter