For the past few months, #Bolivia economy has been under heavy observation, bond prices shooting up, the currency peg in the country under threat and both Fitch and Moody's have downgraded the country into deeper junk status.

Below some ideas on why. 1/n

Below some ideas on why. 1/n

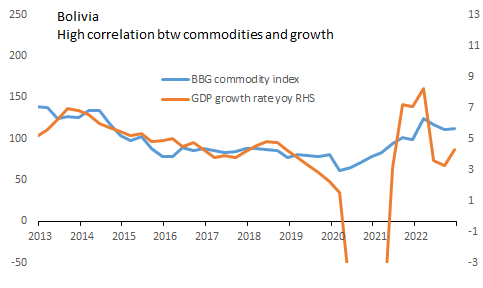

The country has traditionally been a raw materials exporter, and thus its fortunes are heavily correlated with commodity indexes. Given the current context one would expect the country to enjoy a bonanza given the increase in prices and higher demand for energy. HOWEVER.... (2/n)

The country's mainly exports are concentrated in mineral and hydrocarbon exploitation, both demand high levels of investment, coming either from the private sector (in form of FDI) or through the participation of the government. (3/n)

For the past ~18 yrs the left-leaning government of Bolivia has taken a central role on managing the exploitation and export of these commodities, making the contribution of FDI in the country almost non-existent. (4/n)

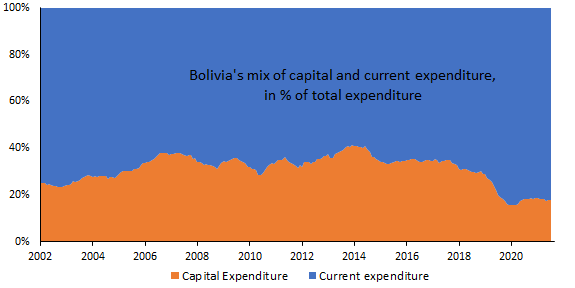

This means that the burden of financing the R&D, exploration and maintenance of the hydrocarbon/mining sector in Bolivia (a very capital intensive sector) ends up adding a fiscal pressure to the government.

At the same time, the populist stance of the government has consistently expanded the fiscal deficit to sustain consumption and (public) labor demand. Meaning that both investment and consumption have been eroding the fiscal stance.

From the financing side, both mining and hydrocarbons revenue have been sustaining around 50% of all government expenditure. So then what happened recently for the market probing?

Bolivia's populist government has "pegged" the cost of fuels for quite some time, this was achieved by subsidies to stabilize the local price of gasoline and diesel. This subsidy has increased 6x in the last 5 years.

On the same line, the government has also increased its imports of fuels and lubricants, by around 19x. Both the peg to local gas prices and the import of fuels have made a dent on gov finances, which have started to come up with "creative" ways to finance this deficit

The fiscal pressure, combined with the overall strengthening of the dollar (due to global risk) have been testing the BOBUSD peg. To sustain this peg the government has depleted its International Reserves

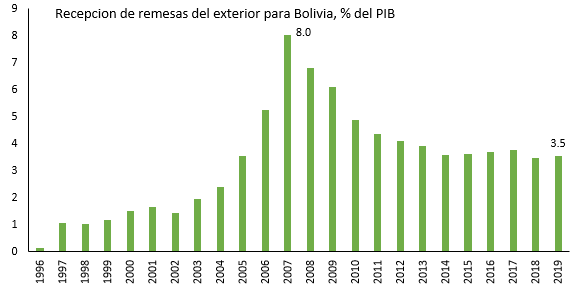

Adding to the stress of government finances, remittances from foreign workers have consistently decreased in recent months, meaning that fresh FX to finance the BoP are contracting.

The knee jerk response of the local market has been a "flight to safety" to USD. This is particularly important given Bolivia's economic history with a bi-monetary model and low confidence in the local currency.

What has been the government response? Capital controls. Local media reports that the Bolivian central bank is restricting the sale of USD and local financial institutions limiting the amounts of operations in foreign currency

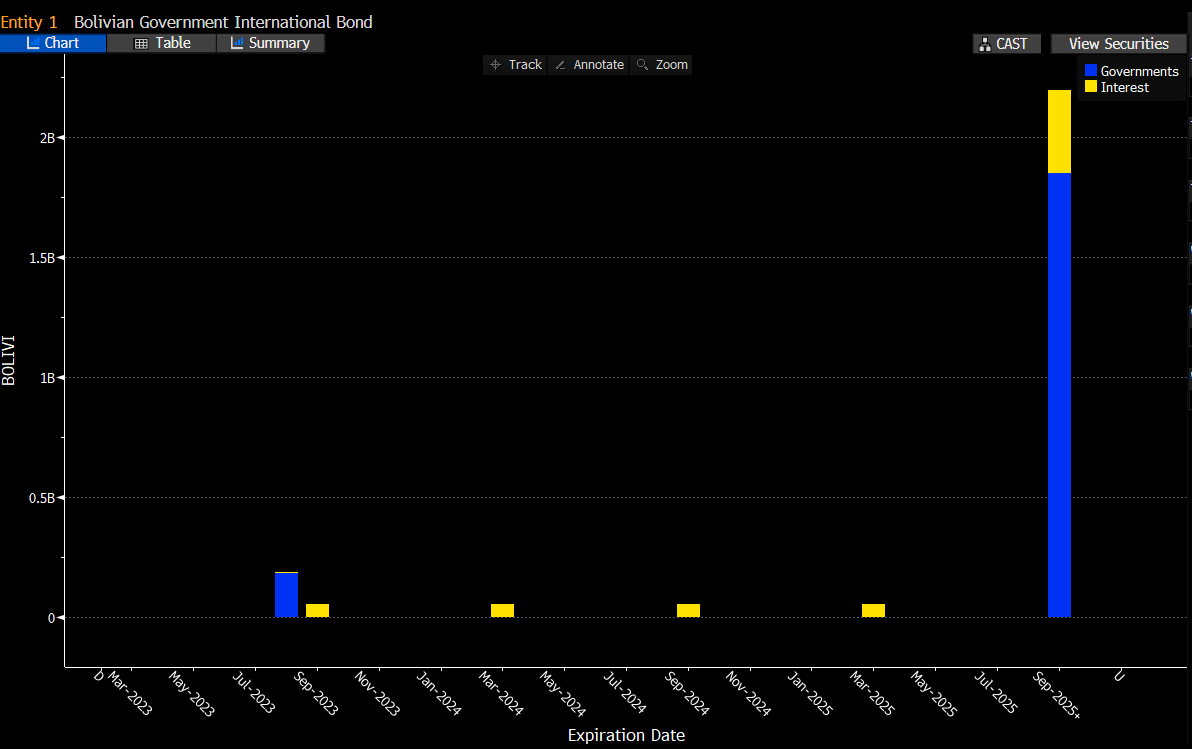

Coming back a full circle, the market seems to be aware of the challenges and thus Bolivian sov debt is currently trading at a yield of ~18%, twice as much as where bonds were at the end of 2022.

The somewhat "good" news for the current administration is that the bonds are not due until after 2025, with only a small portion maturing in Aug-23 (~185 mm)

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter