How to get URL link on X (Twitter) App

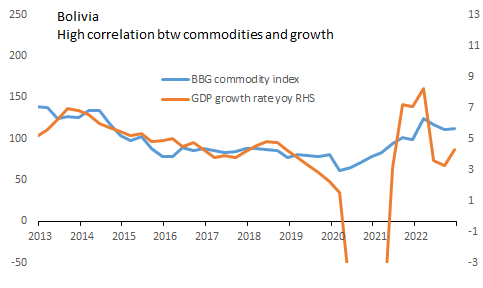

The country has traditionally been a raw materials exporter, and thus its fortunes are heavily correlated with commodity indexes. Given the current context one would expect the country to enjoy a bonanza given the increase in prices and higher demand for energy. HOWEVER.... (2/n)

The country has traditionally been a raw materials exporter, and thus its fortunes are heavily correlated with commodity indexes. Given the current context one would expect the country to enjoy a bonanza given the increase in prices and higher demand for energy. HOWEVER.... (2/n)

A big chunk of the #COVID19 intervention came in form of purchases of Treasury securities and MBS. These would be undertaken at the unprecedented rate of up to $125 bn/day during the week of March 23. Since the start of this QE the Fed has acquired around $1.6 tn of treasuries 2/

A big chunk of the #COVID19 intervention came in form of purchases of Treasury securities and MBS. These would be undertaken at the unprecedented rate of up to $125 bn/day during the week of March 23. Since the start of this QE the Fed has acquired around $1.6 tn of treasuries 2/

A diferencia de 08, #COVID19 esta afectando profundamente al lado real de la economia. La demanda global agregada por commodities ha disminuido considerablemente. Esto sumado a la rediccion significativa en el precio del petroleo significa un shock doble para #Bolivia

A diferencia de 08, #COVID19 esta afectando profundamente al lado real de la economia. La demanda global agregada por commodities ha disminuido considerablemente. Esto sumado a la rediccion significativa en el precio del petroleo significa un shock doble para #Bolivia

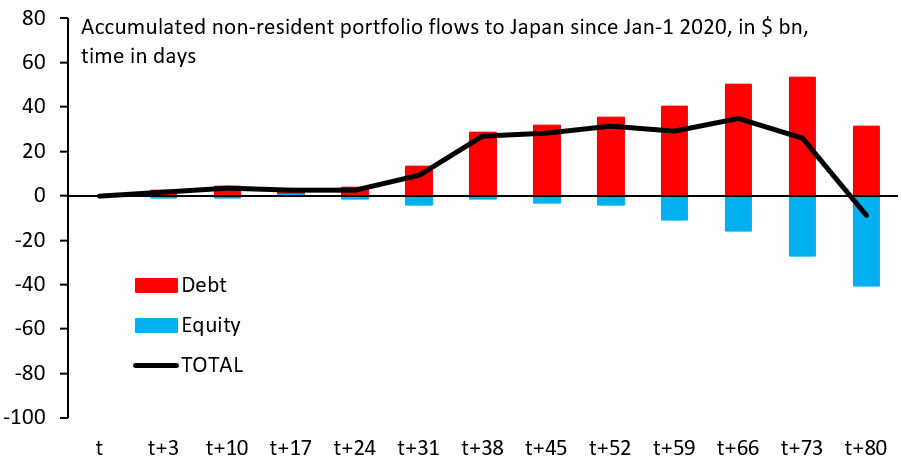

ETF high freq data and ESG data show some correlation with the recent outflow, another good reference point is the non-resident flow accounting for DM. Weekly data from Japan shows inflows ytd

ETF high freq data and ESG data show some correlation with the recent outflow, another good reference point is the non-resident flow accounting for DM. Weekly data from Japan shows inflows ytd

However, this time around the #COVID19 outflow episode was very sudden, "fast" and deep. A literal "sudden stop" The last four weeks represent the largest weekly outflows on record

However, this time around the #COVID19 outflow episode was very sudden, "fast" and deep. A literal "sudden stop" The last four weeks represent the largest weekly outflows on record https://twitter.com/econchart/status/1242228440541147138?s=20