FRAMING: In Aug, #Ripple published "Payments by the Numbers Guide." that sets their course very clearly, presenting 3 use cases; remittances, SME payments, & Treasury Flows. Surprised this hasn't generated more discussion as it's illuminating.

1/10, but there are pictures.

1/10, but there are pictures.

2. The doc is straight to the point, using 3 partners to demonstrate 3 use cases for #RippleNet.

REMITTANCES = Tranglo

SME PAYMENTS = Novatti

TREASURY = Pyypl

REMITTANCES = Tranglo

SME PAYMENTS = Novatti

TREASURY = Pyypl

3. This is important framing & clarifying as these are the major partner/investment annc's from the last couple of years that are using #RippleNet with #XRP. There are other partners of course, but these are the XRP users.

4. And the brochure touts 5 benefits of using XRP for payments. Each use case emphasizes different benefits. And so in order;

5. REMITTANCES

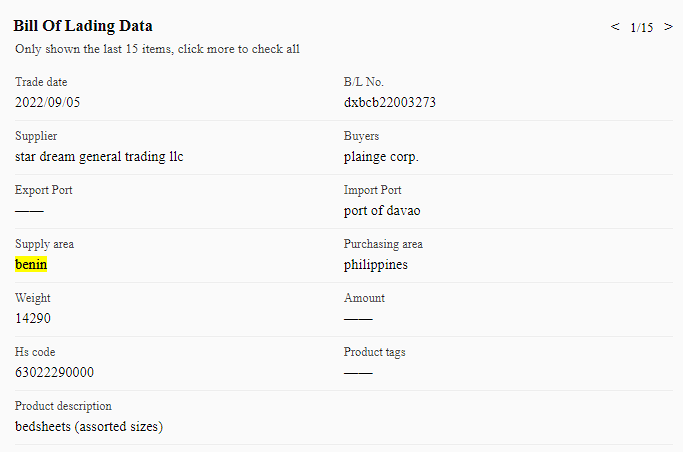

Tranglo is the key partner here noting use of ODL rails in the Philippines primarily, with more corridors being introduced.

XRP BENEFITS -> Lower Costs, faster payments

Tranglo is the key partner here noting use of ODL rails in the Philippines primarily, with more corridors being introduced.

XRP BENEFITS -> Lower Costs, faster payments

6. SME PAYMENTS

Novatti uses it for SME's, B2B, touting the agility to meet vendor/supply pymnts. Helpful to see given breadth of Novatti's efforts, including AUDD, launched on Stellar. They're bootstrapping xborder B2B processes w speed.

BENEFITS -> lower costs, new markets

Novatti uses it for SME's, B2B, touting the agility to meet vendor/supply pymnts. Helpful to see given breadth of Novatti's efforts, including AUDD, launched on Stellar. They're bootstrapping xborder B2B processes w speed.

BENEFITS -> lower costs, new markets

7. TREASURY

Pyypl's use is the most interesting! W/ a global footprint, they move "between currencies in connection w/ card scheme settlements," leveraging #XRP to "to obtain the foreign currency

liquidity they need at the start of each week."

BENEFITS-> no pre funding, 24/7

Pyypl's use is the most interesting! W/ a global footprint, they move "between currencies in connection w/ card scheme settlements," leveraging #XRP to "to obtain the foreign currency

liquidity they need at the start of each week."

BENEFITS-> no pre funding, 24/7

8. This is particularly interesting backing a card scheme w/ regular weekly use that relies on an old promise of #XRP - eliminating prefunding. No, banks aren't using XRP yet, but this is inching closer; multinationals not needing banks for treasury movements.

9. There's an organicity to these 3 uses, from personal remit's to SMEs to something institutional in treasury movements. I wonder to what degree this represents an expansion of #XRP use heading towards banks. Capturing significant market share in these alone would be huge.

10. CONTEXT: When Ripple changed their marketing and clarified their pitch to 3 offerings (xborder paymnt, crypto liquidity, CBDCs), the #XRPCommunity wondered where XRP fits in. This doc falls under the "xborder payments" wing and details how #XRP is a part of it.

Ran out of pictures,

/end

/end

Organizing how they're addressing the market is a bit of a challenge, so this is helpful to map it out. Sure, there are other ways the #XRPL might be used; CBDCs or XRP within the liquidity hub, but this is the payments approach & I think there's more to come with tokenization.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter