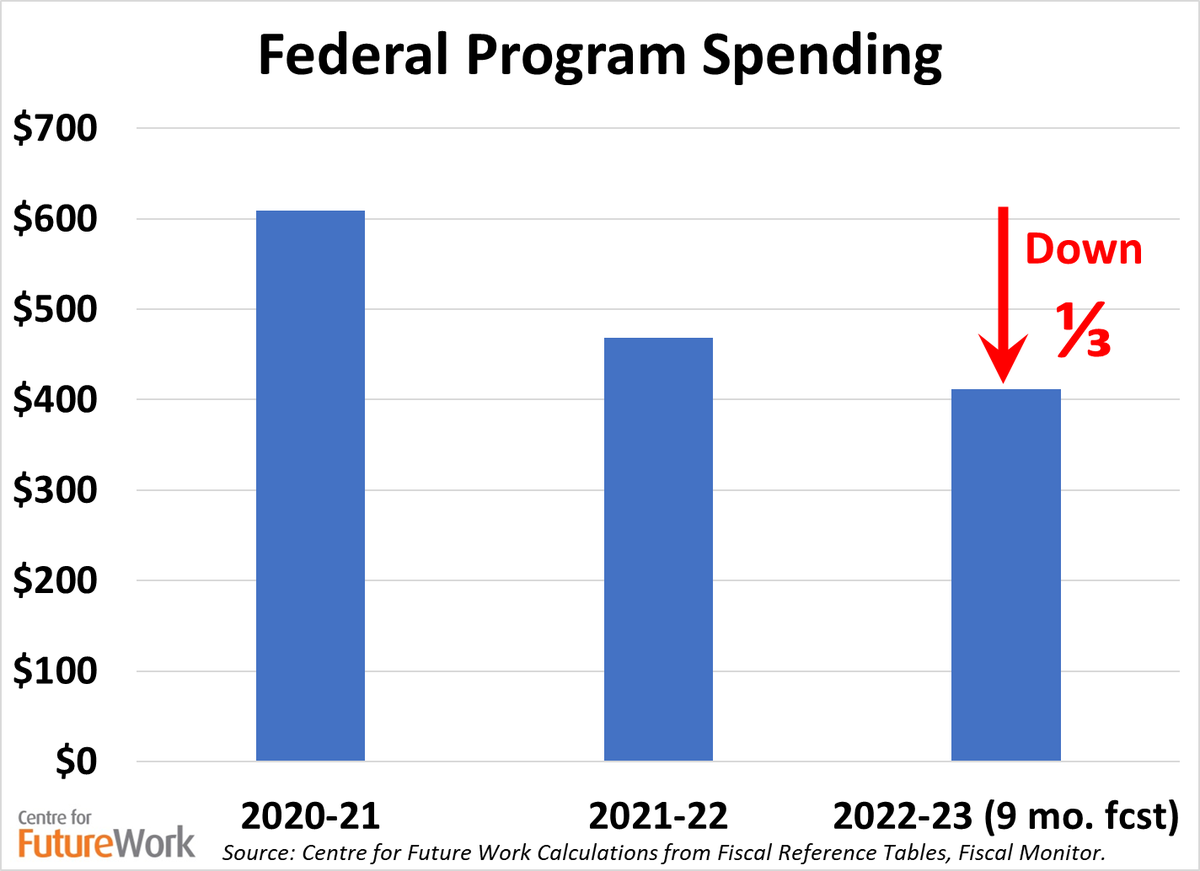

🧵For those fretting that incremental measures in today's 🇨🇦 #Budget2023 will somehow fan the flames of inflation, please remember: The fiscal foot has been firmly on the brake for 2 yrs. Program spending is down 1/3 since COVID peak. Down 12% in first 9 mos of this fy #cnecon /2

And for those who believe inflation is caused by deficits, please remember: 98% of the COVID deficit has been eliminated. Deficit over 1st 9mos of this fy was just $5.5b (Fiscal Monitor). Year-end deficit may be padded in the budget. But the deficit is effectively gone. /3

And for those who claim giving a tidbit of aid to low-income households (through extension of enriched GST credit) will fuel inflation, please remember: the $2.5b cost of that credit = 0.4% of total consumer spending (over 6 mos). No possible impact on overall price level. /4

Moreover, since the first 6-mos GST credit expansion was announced last year, CPI inflation has come DOWN: from 7.6% (July, latest data before that announcement), to 5.2% now. If a bit of help to poor people caused inflation, it would have gone the other way. /5

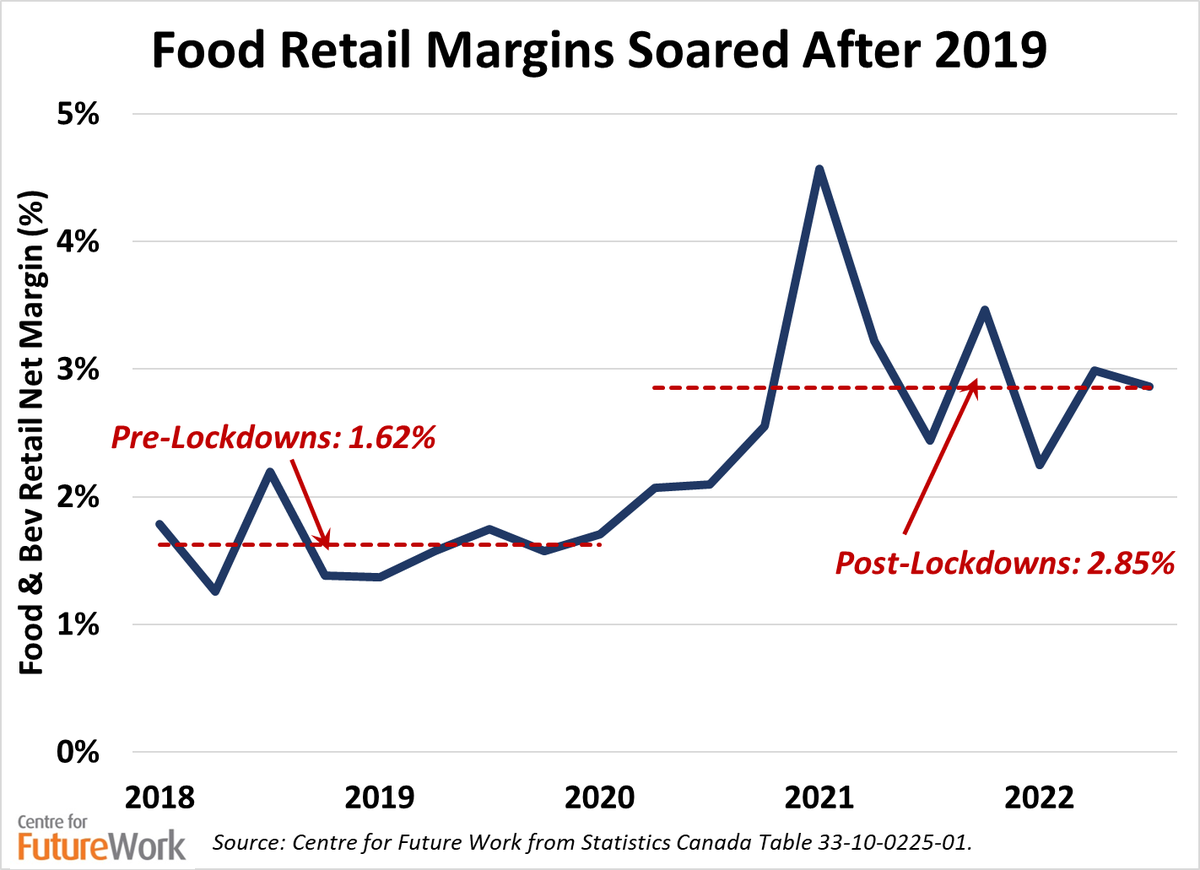

Hand-wringing about the budget & inflation is all based on assumption inflation is caused by excess demand. That's being proved more wrong every day. Employment & wages are growing--but inflation is falling. Why? It wasn't caused by workers; & its TRUE causes are dissipating. /6

Working and low-income households need MORE help to survive inflation until the post-COVID price surge fully abates: more help with groceries and rent, wage gains that keep up, indexing provincial income supports. That's not causing inflation: that's protecting its victims. /7

Is a $2.5b GST credit expansion for low-income households the culprit for inflation? Let's look at dividends & buybacks by Cdn corporations (whose profits surged with inflation):

Growth in dividend pmts = $23b in 2022

Share buybacks ≈ $25b in 2022.

Together: 20 times as much. /8

Growth in dividend pmts = $23b in 2022

Share buybacks ≈ $25b in 2022.

Together: 20 times as much. /8

In short, IF you believe inflation is caused by 'too much money' in the economy, not 'too few goods' (and that's a big IF), then take money away from those who are getting more--not from those whose living standards are being sacrificed by inflation that has made others rich.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter