#Tether watch!

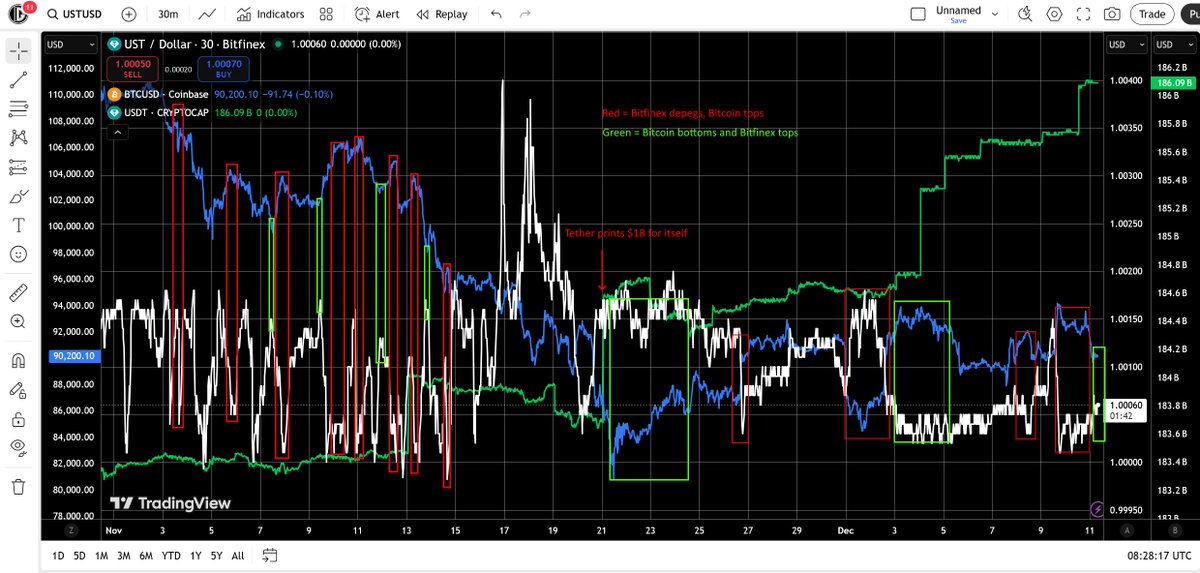

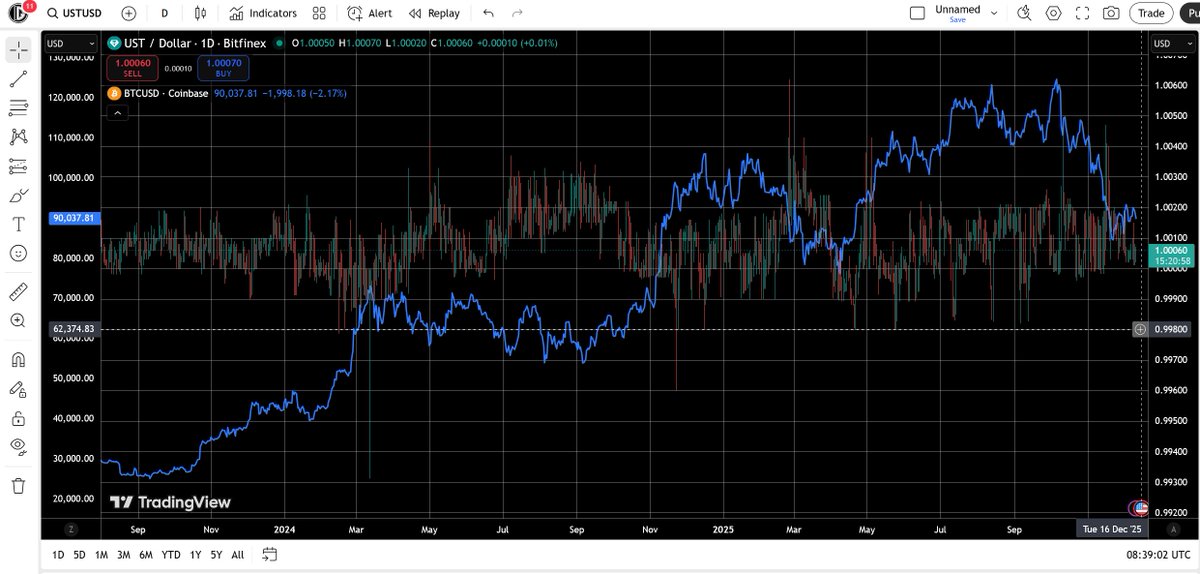

#Bitfinex is printing themselves money again. Quite literally. They're using a new account to try and obscure it but i can pretty much prove it at this point.

Lemme walk you through.

#Bitfinex is printing themselves money again. Quite literally. They're using a new account to try and obscure it but i can pretty much prove it at this point.

Lemme walk you through.

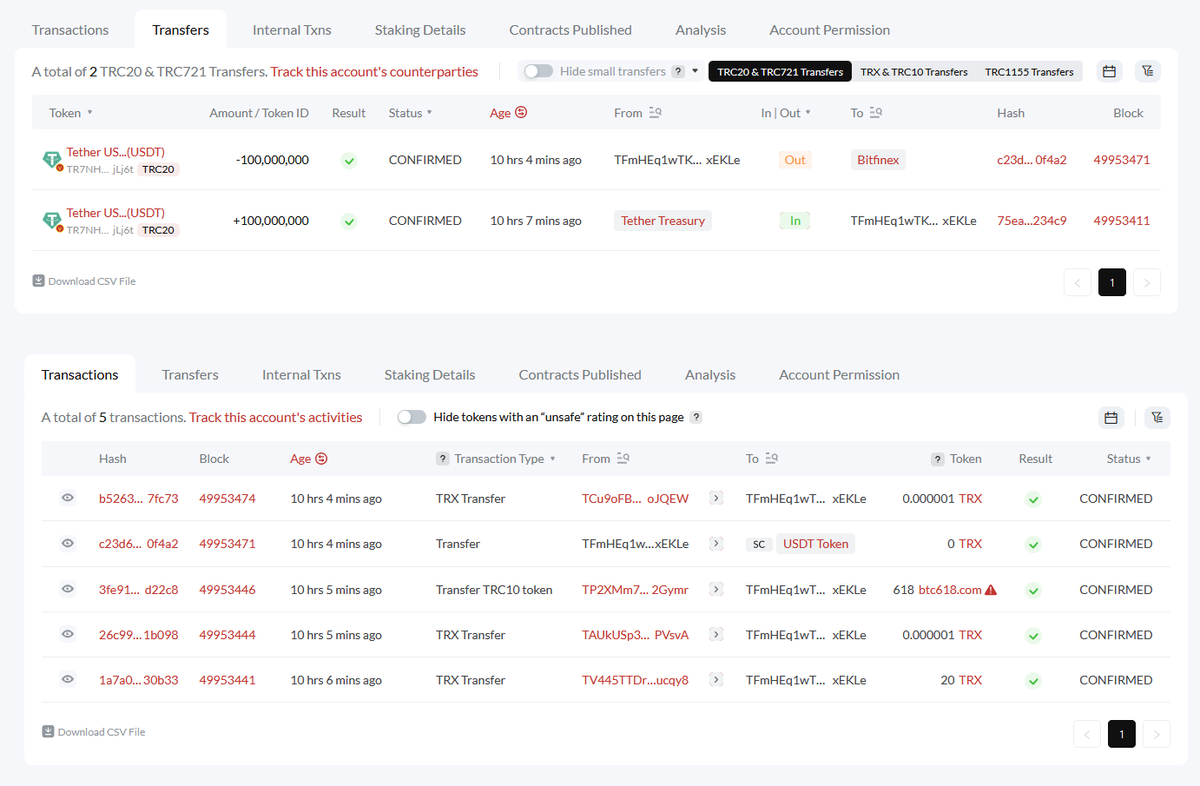

So Tether printed $100 million to an account 10 hours ago on TRON.

This is a fresh account with 5 TRX txn and 2 other txn.

This is a fresh account with 5 TRX txn and 2 other txn.

I can prove the account was made on or via Bitfinex. That first txn in comes from the Bitfinex TRX funder wallet. Still need to do more research on those, but it seems all or nearly all Bitfinex INs have that wallet for TRX funding (including the bots).

In any case, here's the $100 mil arriving in Bitfinex Hot, and you'll notice the bulk goes out right away.

To a wallet i know well, -TGEeu.

To a wallet i know well, -TGEeu.

This wallet is "Bitfinex 2" on TRON (just not labeled as such), which i've named after Bitfinex 2 on Ethereum, which is properly named.

I don't know what their exact function is - but they've heavily been used for chainswaps back and forth between TRON and ETH.

I don't know what their exact function is - but they've heavily been used for chainswaps back and forth between TRON and ETH.

Knowing both wallets on both chains serve the same function allows us to also track money coming in.

That 6D10H chainswap was funded with this block in -TGEeu. The biggest contributor/closest to $70M is $63M 6D15H ago.

We look that up in Bitfinex Hot (page 361 fml) and we find:

That 6D10H chainswap was funded with this block in -TGEeu. The biggest contributor/closest to $70M is $63M 6D15H ago.

We look that up in Bitfinex Hot (page 361 fml) and we find:

Corporate needs you to find the difference between etherscan.io/token/0xdac17f…

and

tronscan.org/#/address/TXfr…

and

tronscan.org/#/address/TXfr…

All of this HAS to be direct transfer btw, not trade.

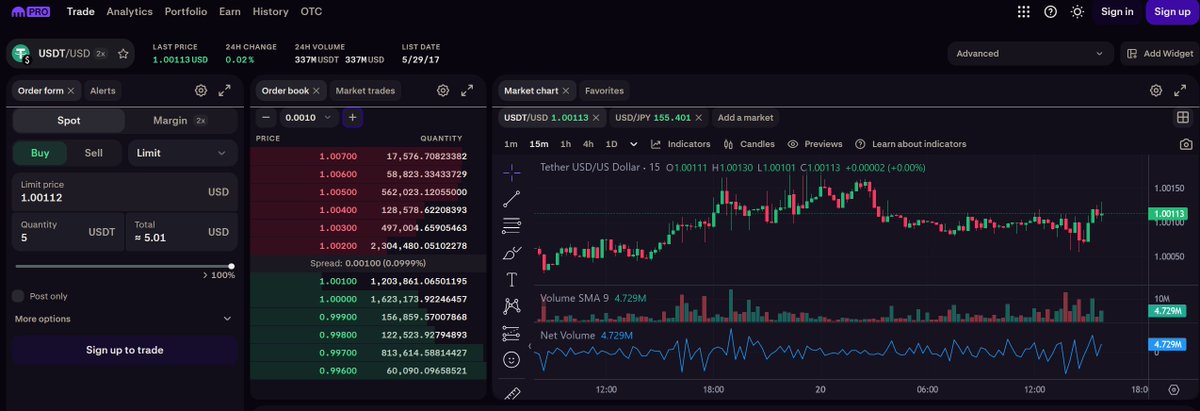

Bitfinex LITERALLY does not have $100M of 24 hour trading volume. People forget that you can send crypto from wallet to wallet directly too, and exchange wallets function absolutely no differently.

Also lol at vol vs assets.

Bitfinex LITERALLY does not have $100M of 24 hour trading volume. People forget that you can send crypto from wallet to wallet directly too, and exchange wallets function absolutely no differently.

Also lol at vol vs assets.

What, you thought their API was gonna report transfers as trading volume? Please.

In the end it all ends up in Binance though. Imagine that; $5.6B into Kraken from Tether directly, all this activity, yet their top wallet's got $200M in it - with a combined $270M for Bitfinex.

In the end it all ends up in Binance though. Imagine that; $5.6B into Kraken from Tether directly, all this activity, yet their top wallet's got $200M in it - with a combined $270M for Bitfinex.

And finally i might as well highlight something i've been meaning to for a while: TRON's rampant bot creation/destruction.

TRON recently passed 150 Million accounts! And active accounts didn't budge from 2 million.

Just compare these graphs and realize how bad the problem is.

TRON recently passed 150 Million accounts! And active accounts didn't budge from 2 million.

Just compare these graphs and realize how bad the problem is.

• • •

Missing some Tweet in this thread? You can try to

force a refresh