#Tether watch!

Alright, i promised a post on this so here goes. #Bitfinex is amassing a much bigger Bitcoin hoard than previously disclosed. Either that (by far most likely), or some whale trusts only trusts Bitfinex to trade with, and only accumulates at quarter end, in bulk.

Alright, i promised a post on this so here goes. #Bitfinex is amassing a much bigger Bitcoin hoard than previously disclosed. Either that (by far most likely), or some whale trusts only trusts Bitfinex to trade with, and only accumulates at quarter end, in bulk.

Gonna be another screenshot heavy thread i'm afraid, since i've gotta prove ownership when that's hard to do. So.

This time we follow the money backwards. How did 53.5K Bitcoin accumulate in a ~6 month old wallet? Aside from a few tiny txn, all BTC came in via Bitfinex.

This time we follow the money backwards. How did 53.5K Bitcoin accumulate in a ~6 month old wallet? Aside from a few tiny txn, all BTC came in via Bitfinex.

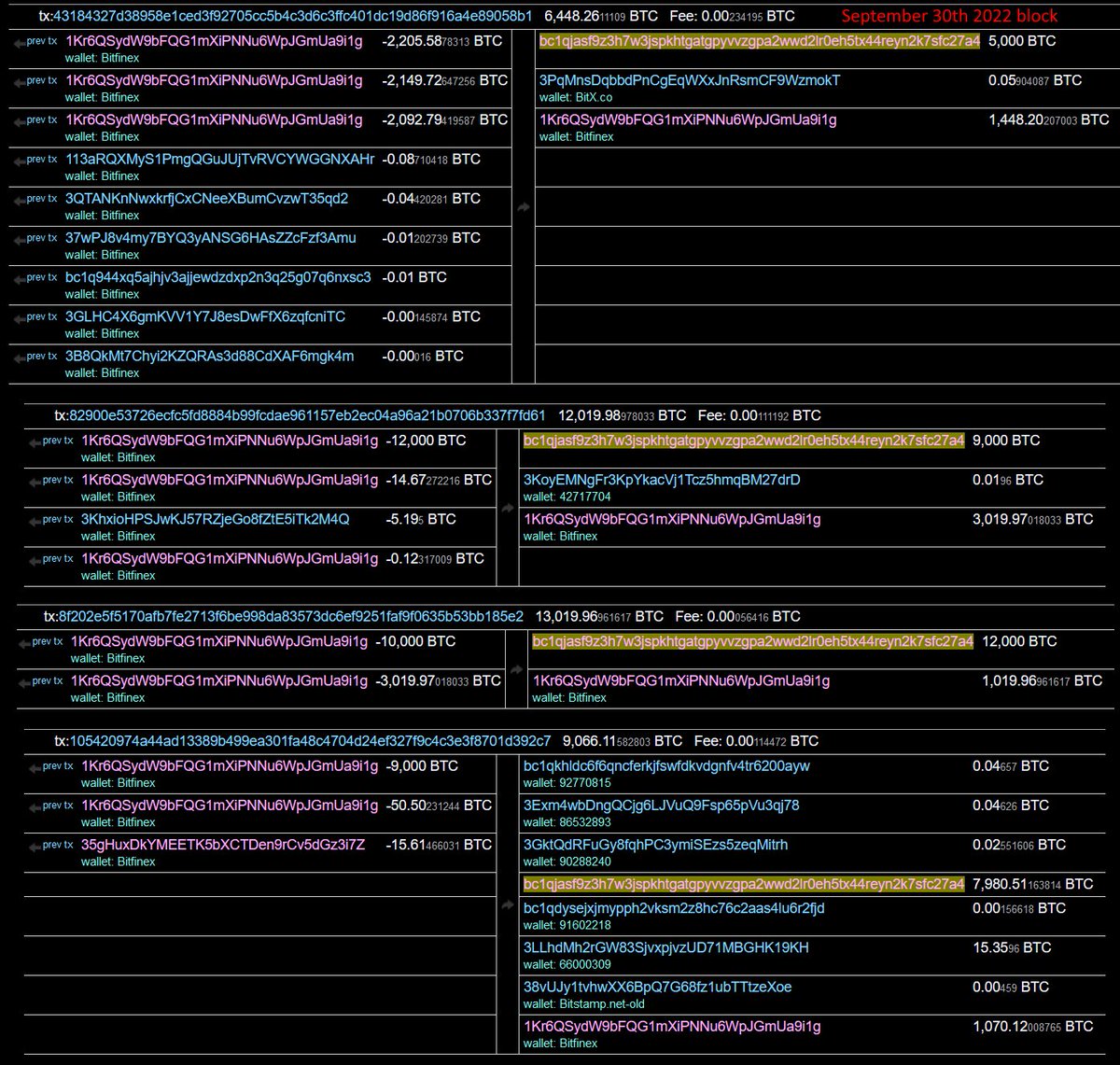

Most of the money came in via 3 distinct blocks: March 30th, December 28th 2022 and September 30th 2022.

All of it came directly from Bitfinex's hot wallet, -Ua9i1g.

All of it came directly from Bitfinex's hot wallet, -Ua9i1g.

So far so good, but naturally the next question is - where did THAT BTC come from?

For that i had to switch to another website, mempool.space where otherwise i'm using bitinfocharts.com cause it's more information dense, but it doesn't like big hot wallets.

For that i had to switch to another website, mempool.space where otherwise i'm using bitinfocharts.com cause it's more information dense, but it doesn't like big hot wallets.

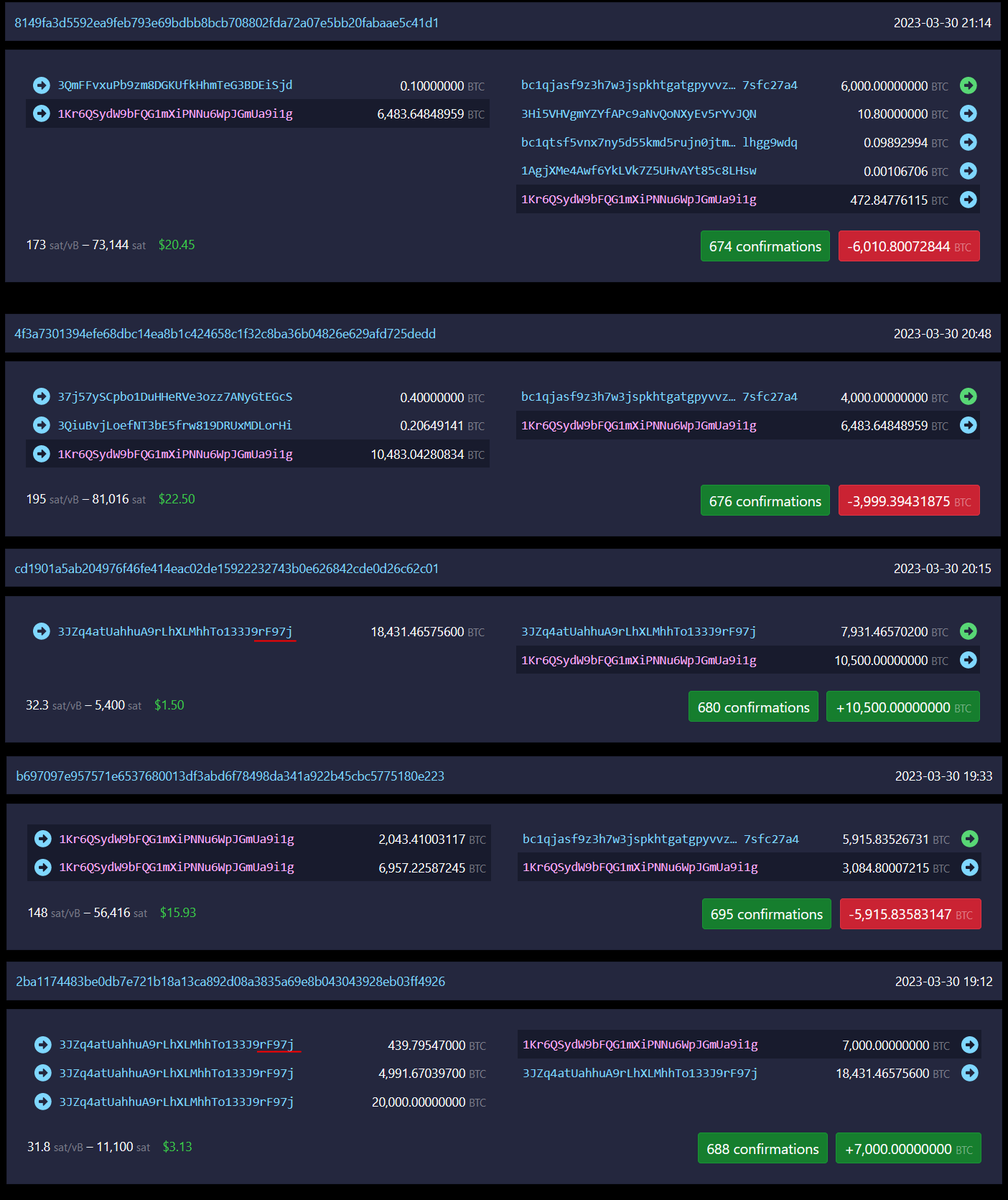

As you can see, there were 2 bulk transfers inbetween the multiple transfers to -a4, that being first +7K and then +10K from -F97j.

-F97j is Bitfinex's cold wallet 1 and has been for a long time. And that's a red flag: How did Bitfinex know, at the exact right time, to transfer?

-F97j is Bitfinex's cold wallet 1 and has been for a long time. And that's a red flag: How did Bitfinex know, at the exact right time, to transfer?

What are the odds Bitfinex transfers 7K BTC into their hotwallet exactly 21 minutes before it's needed after months of no activity?

TWICE!

I'm not gonna look up the Dec 28th and Sep 30th transactions in the hot wallet. My finger hurts from scrolling already.

TWICE!

I'm not gonna look up the Dec 28th and Sep 30th transactions in the hot wallet. My finger hurts from scrolling already.

That said, i don't need to. All i need to find is transfers out of -F97j that line up chronologically with -a4 (that is, are shortly before -a4 gets txn in) to reasonably assume those transfers follow the same pattern through Bitfinex hot.

So here's cold wallet 1:

So here's cold wallet 1:

Gives us nice timeblocks to track to increase the likeliness those BTC are the source of what arrives in -a4. After all, the longer the wallet doesn't send BTC out, the more it stands out when it finally does.

So it is with the (only) Dec 28th txn, first out in a long time.

So it is with the (only) Dec 28th txn, first out in a long time.

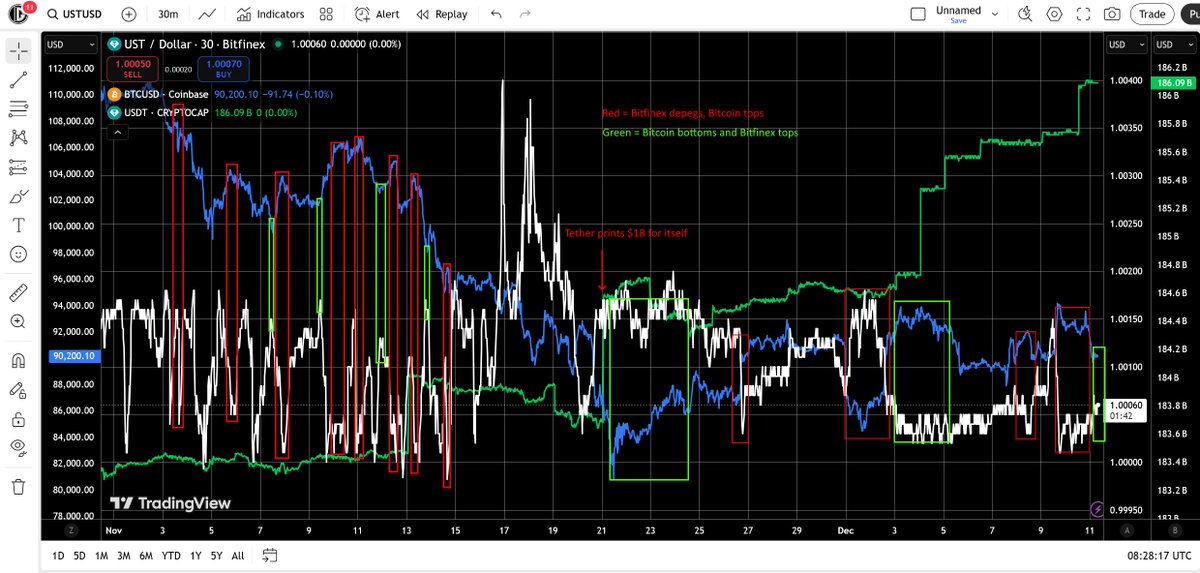

Notice btw how it's every time at quarter end. Two things of note happen there; general market rebalancing at quarter end (in favor of random trader), as well as Tether attestations (in favor of shenanigans). Hard to say which, but you guys know which one has my preference.

September 30th is the same too. Straight to Bitfinex hot. Again we can assume these transactions ended up in -a4 via Bitfinex Hot.

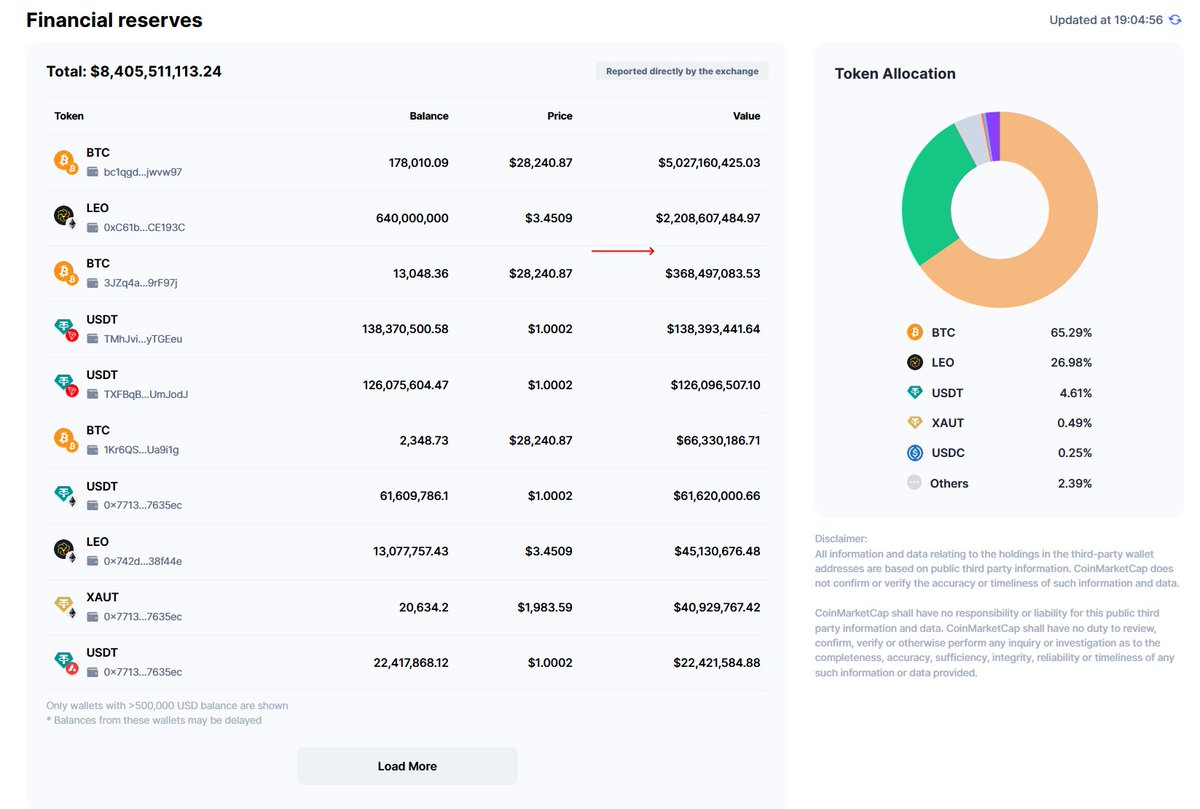

Then there remains Bitfinex's Cold 2 wallet, their main hoard of nearly 180K BTC at this point. This one transacts basically only with Bitfinex cold 1.

Here too, we can see the transfers into -a4 had an effect even on their biggest wallet.

Here too, we can see the transfers into -a4 had an effect even on their biggest wallet.

So we can surmise the March 30th transfer out of Bitfinex Hot was so large they had to tap their cold-cold storage for more coin. 10 days after they felt safe enough to put 30k in there.

Yet they knew beforehand so the required amount was in the hot wallet before the trades.

Yet they knew beforehand so the required amount was in the hot wallet before the trades.

That leaves only OTC deals - and ownership. Knowledge has to be involved. Meaning they knew where what would be when to not produce an error.

Considering the quarter end timing, and the lack of interaction of the whale with any other wallet - i say ownership.

Considering the quarter end timing, and the lack of interaction of the whale with any other wallet - i say ownership.

Something Bitfinex doesn't seem to want people to know. It's not listed as their wallet *anywhere*.

Compare a google search on the address between their hot wallet and this mystery wallet:

Compare a google search on the address between their hot wallet and this mystery wallet:

You'll notice a wallets.txt in the bottom left there, apparantly on Bitfinex's own Github. The wallet isn't listed there either.

Nor is it listed among their reserves on Nansen or Coinmarketcap.

Nor is it listed among their reserves on Nansen or Coinmarketcap.

Assuming that they're not lying (HAHAH) then the only way i have to prove other ownership is spikes in trading. If alot of BTC traded hands, it should've spiked the price.

On March 30th it fell, Sep 30th and Dec 28th do have spikes, but relatively minor considering the BTC norm.

On March 30th it fell, Sep 30th and Dec 28th do have spikes, but relatively minor considering the BTC norm.

And no that spike in March was on the 29th. Can't spike ahead of time, and if it can, that's a much bigger can of worms.

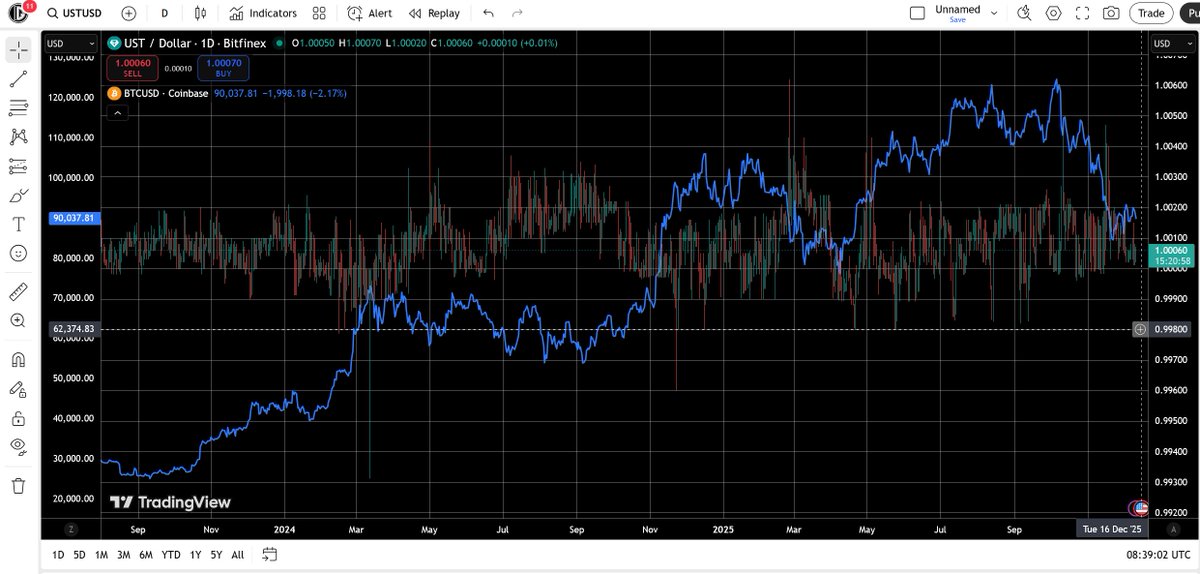

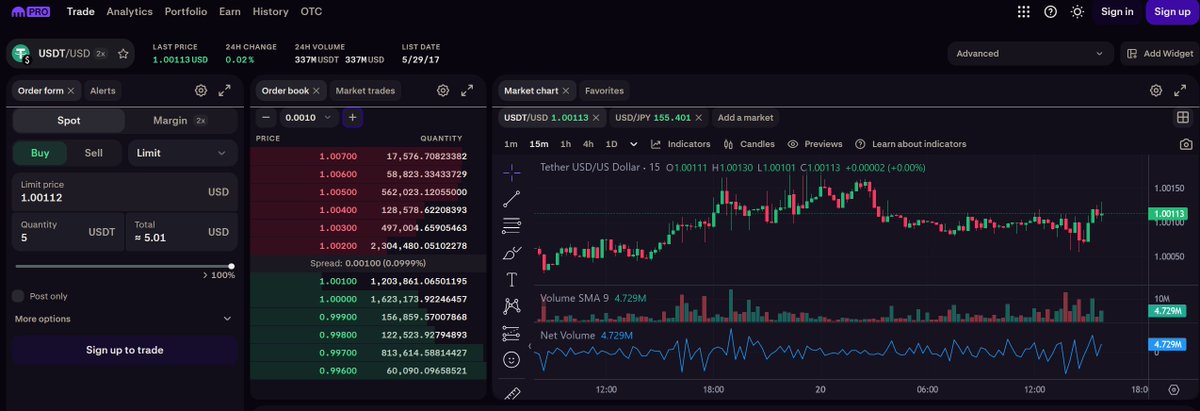

There's one more way to check, and that way says no way: The 24H BTC volume on Bitfinex, of all pairs combined.

There's one more way to check, and that way says no way: The 24H BTC volume on Bitfinex, of all pairs combined.

And the March 30th transfer of ~16,000 BTC is close enough (and last week uneventful enough) to say volume today is or must be close to volume 5 days ago.

The top 3 BTC pairs have a total volume of $77,481,785 and then it drops quickly. ~16K BTC at ~$28.15K = ~$450 million.

The top 3 BTC pairs have a total volume of $77,481,785 and then it drops quickly. ~16K BTC at ~$28.15K = ~$450 million.

Or in short - the exchange doesn't have the open market volume to process $450 million of BTC in one day, and most certainly not in 3 *bulk transactions*, indicating bulk purchases. Or that is some of the fastest and most skilled averaging in ever.

Me no think so.

Me no think so.

The alternative explanation is much simpler: They just printed and used Tether at some point to accumulate Bitcoin as part of the ponzi. Now they're trying to hide supply under the mattress.

Possibly has something to do with their Bitfinex 2 wallets:

Possibly has something to do with their Bitfinex 2 wallets:

https://twitter.com/DesoGames/status/1642817795489513473

I'm not sure if it has something to do with Tether's quarterly attestations, but considering the transfers keep happening right at quarter end, i'm heavily incentivized to think so.

Shouldn't we ask why Bitfinex has so much "value" in just 4 coins? LEO, BTC, ETH and USDT.

Shouldn't we ask why Bitfinex has so much "value" in just 4 coins? LEO, BTC, ETH and USDT.

I mean, think about this for a second: With the new wallet, all BTC wallets combined are ~250K bitcoin - nearly as much as Binance's main cold wallet!

XRP's the 5th coin with <$50M claimed in reserves. They have ~$7 BILLION in Bitcoin! 10x Ethereum even!

XRP's the 5th coin with <$50M claimed in reserves. They have ~$7 BILLION in Bitcoin! 10x Ethereum even!

That's outsized by any measure. Here's some other comparisons (except with Coinbase and Kraken, they never did Nansen reserve lists).

They have nearly half of Binance's BTC, double OKX's, and Huobi/Kucoin are nothing compared to Bitfinex's BTC shlong.

They have nearly half of Binance's BTC, double OKX's, and Huobi/Kucoin are nothing compared to Bitfinex's BTC shlong.

I mean. C'mon.

Alright that's all i got. If anyone has some evidence this wallet *isn't* Bitfinex i'd love to hear it. After all, a new whale for a billy and a half in six months would be newsworthy/bullish, no?

Alright that's all i got. If anyone has some evidence this wallet *isn't* Bitfinex i'd love to hear it. After all, a new whale for a billy and a half in six months would be newsworthy/bullish, no?

• • •

Missing some Tweet in this thread? You can try to

force a refresh