Nakamoto Portfolio Theory

-----------------------------

Schrödinger's Coin Model 🐈

Valuing Bitcoin as a Store of Value

How #Bitcoin will demonetize other assets and why it's significantly undervalued by 13x today

This is quite the thread. Hang tight🚀▶️

@SwanBitcoin @samcallah

-----------------------------

Schrödinger's Coin Model 🐈

Valuing Bitcoin as a Store of Value

How #Bitcoin will demonetize other assets and why it's significantly undervalued by 13x today

This is quite the thread. Hang tight🚀▶️

@SwanBitcoin @samcallah

This model considers Bitcoin's potential to capture the monetary premium of traditional assets like real estate, stocks, and bonds, leading to a shift in capital allocation and reevaluation of their worth ▶️

Central banks, flooded with excess currency, have fundamentally broken the value of money, leading investors to seek protection against the negative effects of money printing. This phenomenon has resulted in the financialization of the economy and huge monetary premiums ▶️

The explosion of ETFs and the popularity of second investment properties or REITs have resulted in the monetization of assets. Resulting in many of these, including housing, being valued well beyond their utility values ▶️

Inspired by the original idea from @saylor, presented here with @timevalueofbtc, it's expanded to include major asset classes and a method to apply probabilities to each and also take time value into consideration ▶️

The Schrödinger's Coin Model is based on the concept of quantum superposition, where Bitcoin is considered to have two possible outcomes: it either fails and is worthless (Dan Peña scenario) or captures the monetary premium of traditional stores of value (@saylor scenario) 🙀 ▶️

How does it work?

Let's use Gold as an example.

Gold's current market cap is around $10T:

Assume that 60% of Gold's market cap is due to monetization, not utility. This is an assumption and, of course, can be modified. Close enough for a base case IMO ▶️gold.org/goldhub/data/h…

Let's use Gold as an example.

Gold's current market cap is around $10T:

Assume that 60% of Gold's market cap is due to monetization, not utility. This is an assumption and, of course, can be modified. Close enough for a base case IMO ▶️gold.org/goldhub/data/h…

This would imply that the present value of a gold demonetization event to Bitcoin's price is equal to $87k. TODAY.

The gold demonetization by itself should justify a much higher BTC price in this scenario. ▶️

The gold demonetization by itself should justify a much higher BTC price in this scenario. ▶️

Now, let's add other asset classes to the mix and include an intertemporal discount rate of 12.5%.

Here's the potential price contribution from each asset class.

This represents a Bitcoin Fair Present Value of $379,823. ▶️

Here's the potential price contribution from each asset class.

This represents a Bitcoin Fair Present Value of $379,823. ▶️

Here are the assigned assumptions to each of these assets. In other words, in this scenario, with these probabilities, Bitcoin is undervalued by a 13x factor. ▶️

In terms of expected value, here's the path to HyperBitcoinization as this scenario plays out; leading to a Bitcoin price of +$3mm in 20 years. ▶️

The first conclusion is that the current market price of #Bitcoin represents extremely low probabilities of these events happening.

It highlights the massive asymmetry in potential returns.

#Bitcoin is still (and by far) the most asymmetric bet within any asset class. ▶️

It highlights the massive asymmetry in potential returns.

#Bitcoin is still (and by far) the most asymmetric bet within any asset class. ▶️

A curiosity about the model and how it has some parallels to the Black-Scholes model for option pricing ▶️

github.com/pxsocs/Schrodi…

github.com/pxsocs/Schrodi…

Full model description, sources and more info here:

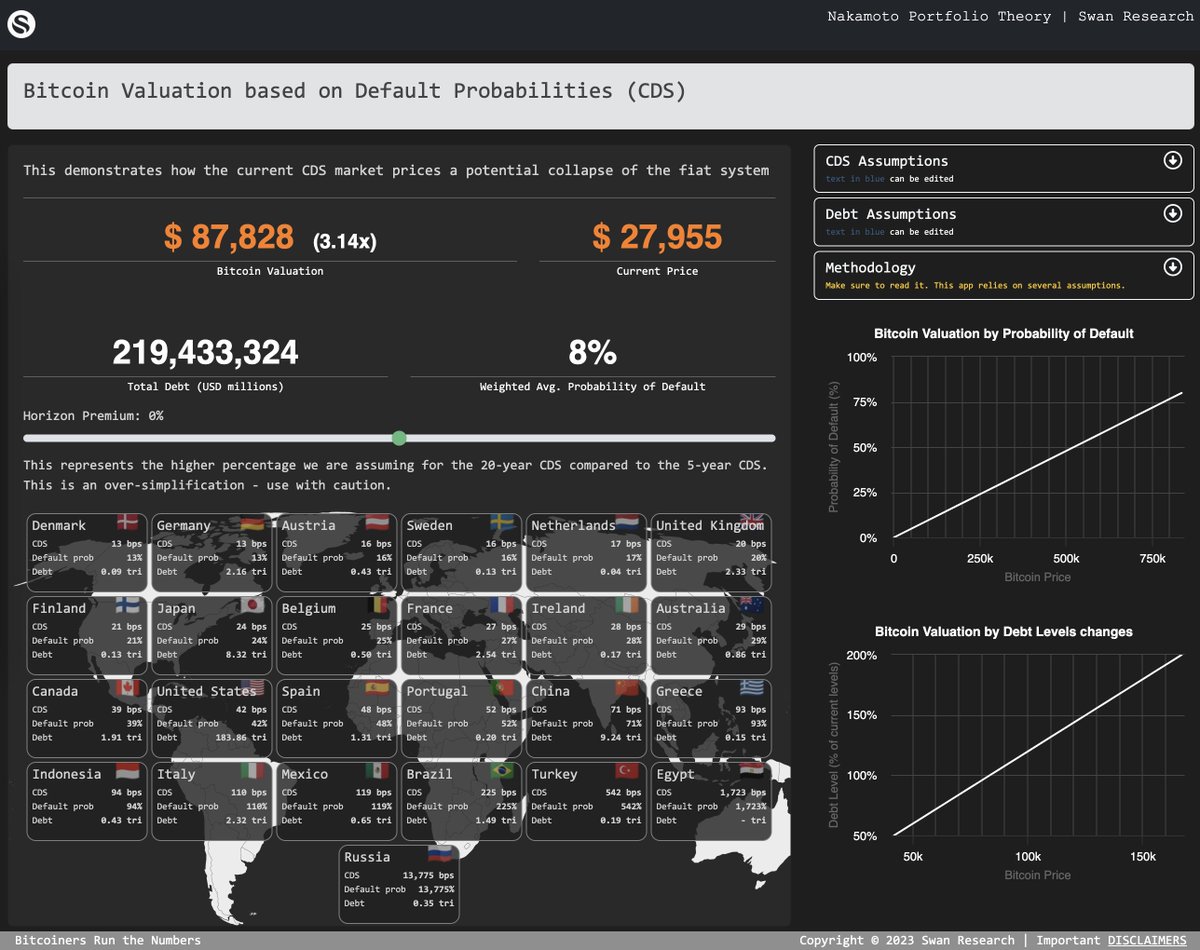

I'm figuring out a way to share the dynamic application below as open source. This way anyone can make their own scenarios and assumptions. Soon...

Bitcoiners run the numbers. ▶️ github.com/pxsocs/Schrodi…

I'm figuring out a way to share the dynamic application below as open source. This way anyone can make their own scenarios and assumptions. Soon...

Bitcoiners run the numbers. ▶️ github.com/pxsocs/Schrodi…

Bitcoin's Schrödinger Model 😼

Model description PDF available below

The cat is out of the box and is now the observer...

[EOF]github.com/pxsocs/Schrodi…

Model description PDF available below

The cat is out of the box and is now the observer...

[EOF]github.com/pxsocs/Schrodi…

For everyone that asked. Here’s the web app version of the model. 🐈 📦

nakamotoportfolio.com/apps/shrodinger

nakamotoportfolio.com/apps/shrodinger

• • •

Missing some Tweet in this thread? You can try to

force a refresh