Phantom Digital Effects Limited (PhantomFX) -

A thread about this quality microcap.

#RETWEEET #investing #phantom #sme #microcaps

A thread about this quality microcap.

#RETWEEET #investing #phantom #sme #microcaps

Promoter :

Mr. Bejoy Arputharaj won the prestigious title of ‘Business Icon Award - 2022’ in the category Company of the Year at the Outlook Business Spotlight’s Business Icons Awards 2022.

Mr. Bejoy Arputharaj won the prestigious title of ‘Business Icon Award - 2022’ in the category Company of the Year at the Outlook Business Spotlight’s Business Icons Awards 2022.

Bejoy Arputharaj, as the company’s founder, CEO, and VFX Supervisor, dons several hats. He is a veteran of the CGI industry and has worked on more than 200 domestic and international films throughout his 20-year career in the VFX industry.

Business outlook :

Phantom Digital Effects Limited (PhantomFX) is one of India’s leading Visual Effects (VFX) Studios, that creates stunning visual effects for a host of feature films, Web Series, and Commercials for domestic and international clients.

Phantom Digital Effects Limited (PhantomFX) is one of India’s leading Visual Effects (VFX) Studios, that creates stunning visual effects for a host of feature films, Web Series, and Commercials for domestic and international clients.

The firm has produced visual effects (VFX) for numerous Indian film productions, including Vijay’s Beast, Kamal Hassan’s Vikram, Rajamouli’s epic-action drama RRR, Suriya’s Jai Bhim, Brahmastra, and numerous significant future Bollywood films.

The studio has additionally contributed breathtaking visual effects to a wide range of Hollywood films and Web series, through its administrative office in Los Angeles, Canada, and Dubai.

PhantomFX is TPN certified with a ‘data secure ecosystem’ that meets the rigorous standards of MPAA. The PhantomFX team is planning to establish world-class Digital studios in Vancouver & Montreal in Canada, Los Angeles in the USA, the United Kingdom, and Dubai.

Awards and recognition :

IAC Summit 2019 – Fastest Growing Indian Company Award in the 13th International Achievers Summit held in Bangkok

VAM Awards 2021 – Best Commercial Visual Effects for Nippon Paint

VAM Awards 2022 – Best VFX Shot Award for the Movie, Dangerous

IAC Summit 2019 – Fastest Growing Indian Company Award in the 13th International Achievers Summit held in Bangkok

VAM Awards 2021 – Best Commercial Visual Effects for Nippon Paint

VAM Awards 2022 – Best VFX Shot Award for the Movie, Dangerous

Times Business Award 2022 - Excellence in the VFX and Animation industry.

Market cap : 275 cr

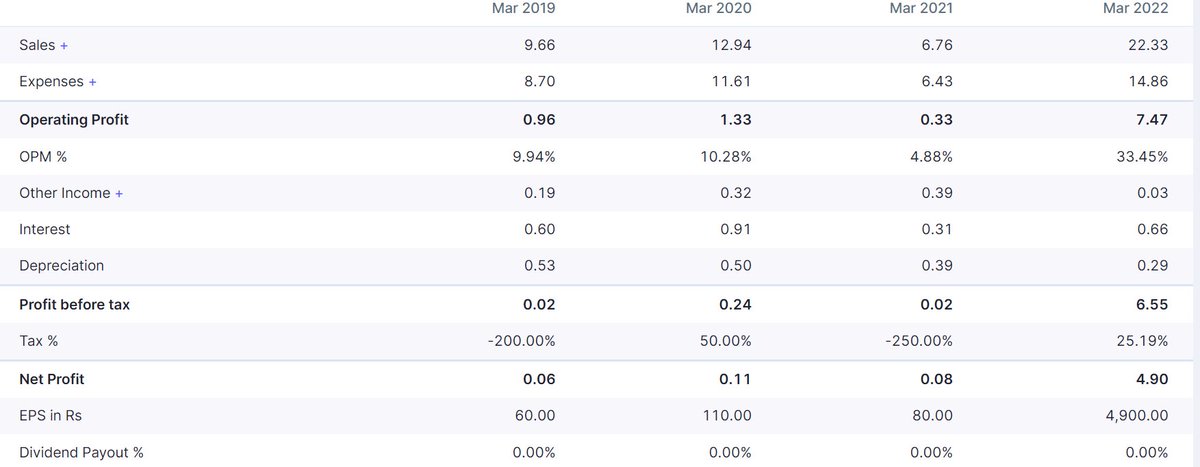

OPM: increasing and will grow.

Last year H1 was bigger than the entire previous year's profit.

OPM: increasing and will grow.

Last year H1 was bigger than the entire previous year's profit.

Growth in digital media and animation is also set to grow at 25 % cagr.

They have a good promoter and the industry is niche.

Currently, I don't see any competitor as well for them in this space.

Let's hope for the best!

They have a good promoter and the industry is niche.

Currently, I don't see any competitor as well for them in this space.

Let's hope for the best!

• • •

Missing some Tweet in this thread? You can try to

force a refresh