A short 🧵🪡

1/7

Equity markets remain on a ‘hair trigger’ and today’s wobble probably due to $FRC and regional bank model concerns

👀 on #Fed FOMC 5/3-5/4

- we still expect a ‘dovish’ +25bp

- regional softness one factor

- other is lots of disinflation in pipeline

1/7

Equity markets remain on a ‘hair trigger’ and today’s wobble probably due to $FRC and regional bank model concerns

👀 on #Fed FOMC 5/3-5/4

- we still expect a ‘dovish’ +25bp

- regional softness one factor

- other is lots of disinflation in pipeline

2/7

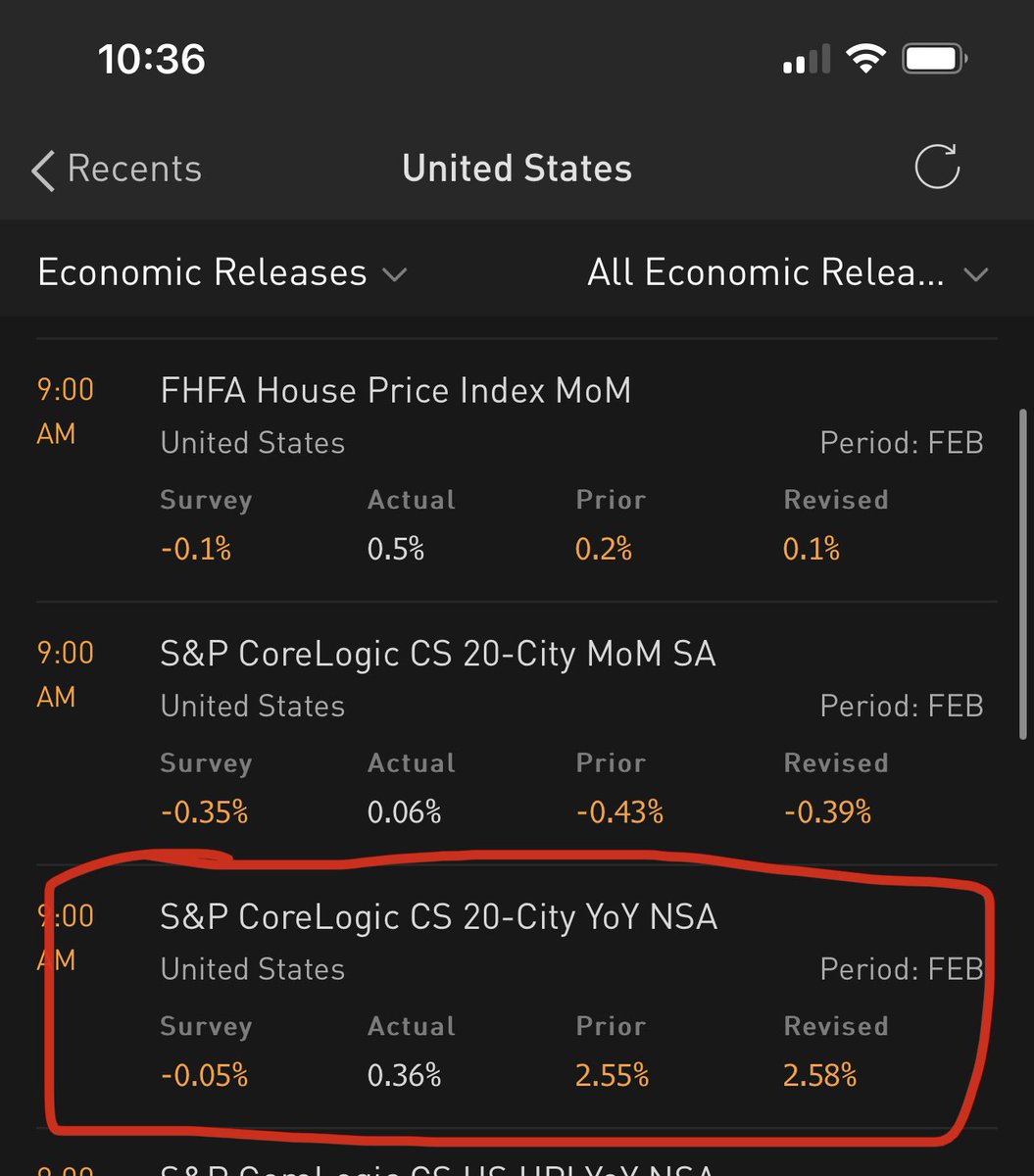

Case-Shiller showed upside surprise on price (MoM) but arguably as important is home prices went to ZERO YoY

- zero price inflation on homes

- @Redfin rent yoy negative

- Yet, #CPI showing 8.6% yoy gains for housing

CPI lagging real-time measures = disinflation in pipeline

Case-Shiller showed upside surprise on price (MoM) but arguably as important is home prices went to ZERO YoY

- zero price inflation on homes

- @Redfin rent yoy negative

- Yet, #CPI showing 8.6% yoy gains for housing

CPI lagging real-time measures = disinflation in pipeline

Link to 3 (broke somehow)

https://twitter.com/fundstrat/status/1651057926776274947

4/7

Since 1990, @FAO price index has led #CPI food yoy by 7 months

- meaning declines in food CPI yoy could happen before year end

Packaged food cos are sneaking in price increases, so it could taking longer $PEP $PG etc but it’s evident in their margin expansion

Since 1990, @FAO price index has led #CPI food yoy by 7 months

- meaning declines in food CPI yoy could happen before year end

Packaged food cos are sneaking in price increases, so it could taking longer $PEP $PG etc but it’s evident in their margin expansion

5/7

CPI weights:

Shelter 37%

Food 14%

Already 33% of CPI basket (weighted) is in outright deflation (vs 18 mo high price level)

- later in 2022, shelter + food might join, adding 51%

- would take total to 84% basket deflating

CPI weights:

Shelter 37%

Food 14%

Already 33% of CPI basket (weighted) is in outright deflation (vs 18 mo high price level)

- later in 2022, shelter + food might join, adding 51%

- would take total to 84% basket deflating

6/7

This would be the highest in 50 years, surpassing the 80% seen in depths of #GFC

- sort of suggests that inflation is less an issue in the remainder of 2023

This would be the highest in 50 years, surpassing the 80% seen in depths of #GFC

- sort of suggests that inflation is less an issue in the remainder of 2023

7/7

That’s it

There is more details in our #firstword commentary that we send out #fsinsight family members

Get the “first word” at fsinsight.com/our-services @fs_insight

That’s it

There is more details in our #firstword commentary that we send out #fsinsight family members

Get the “first word” at fsinsight.com/our-services @fs_insight

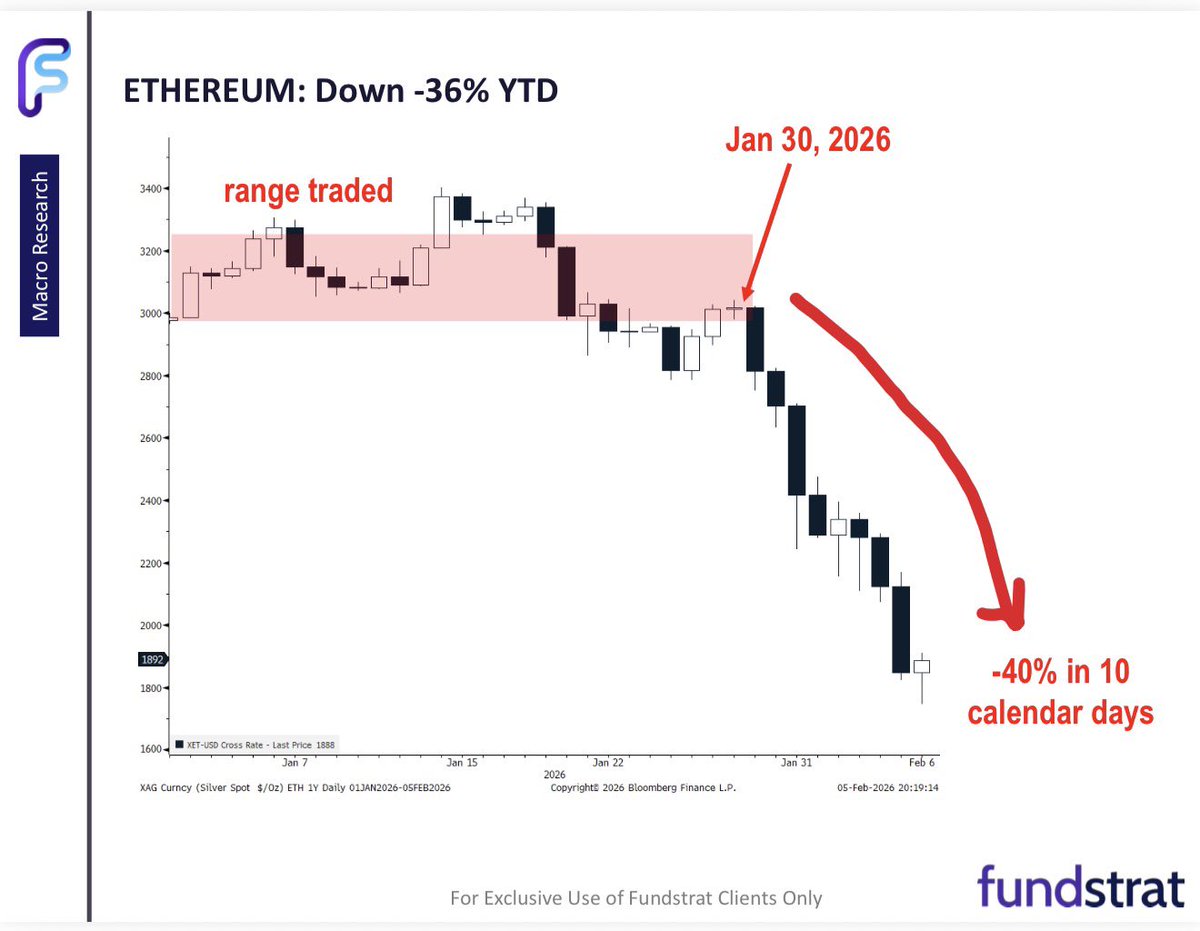

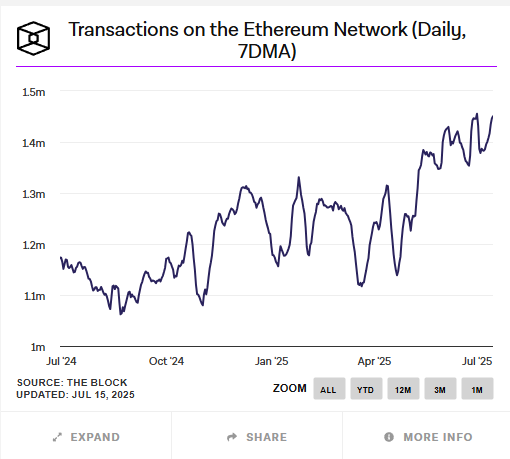

M2 (broad measure of money supply)’is declining

- look at chart, changes in M2 likely influences inflation trends as well

👇

- look at chart, changes in M2 likely influences inflation trends as well

👇

https://twitter.com/lizannsonders/status/1650954540902936586

• • •

Missing some Tweet in this thread? You can try to

force a refresh