#launchpad strategy

(to complete a prev. thread that Twitter mispublished)

this am, @binance had an IDO for @opencampus_xyz $EDU. the process involves allocating tokens based on your avg #BNB balance & can be very lucrative!

here's my strategy for how to game below 👇

1/8

(to complete a prev. thread that Twitter mispublished)

this am, @binance had an IDO for @opencampus_xyz $EDU. the process involves allocating tokens based on your avg #BNB balance & can be very lucrative!

here's my strategy for how to game below 👇

1/8

my analysis of the past 6 @binance launchpad IDOs indicate that an IDO allocation is basically free monies, with the median performance at launch of >15x (@opencampus_xyz $ID currently >25x)

2/8

2/8

the problem w/ their launchpad process is that a v large #BNB balance only yields a small IDO allocation

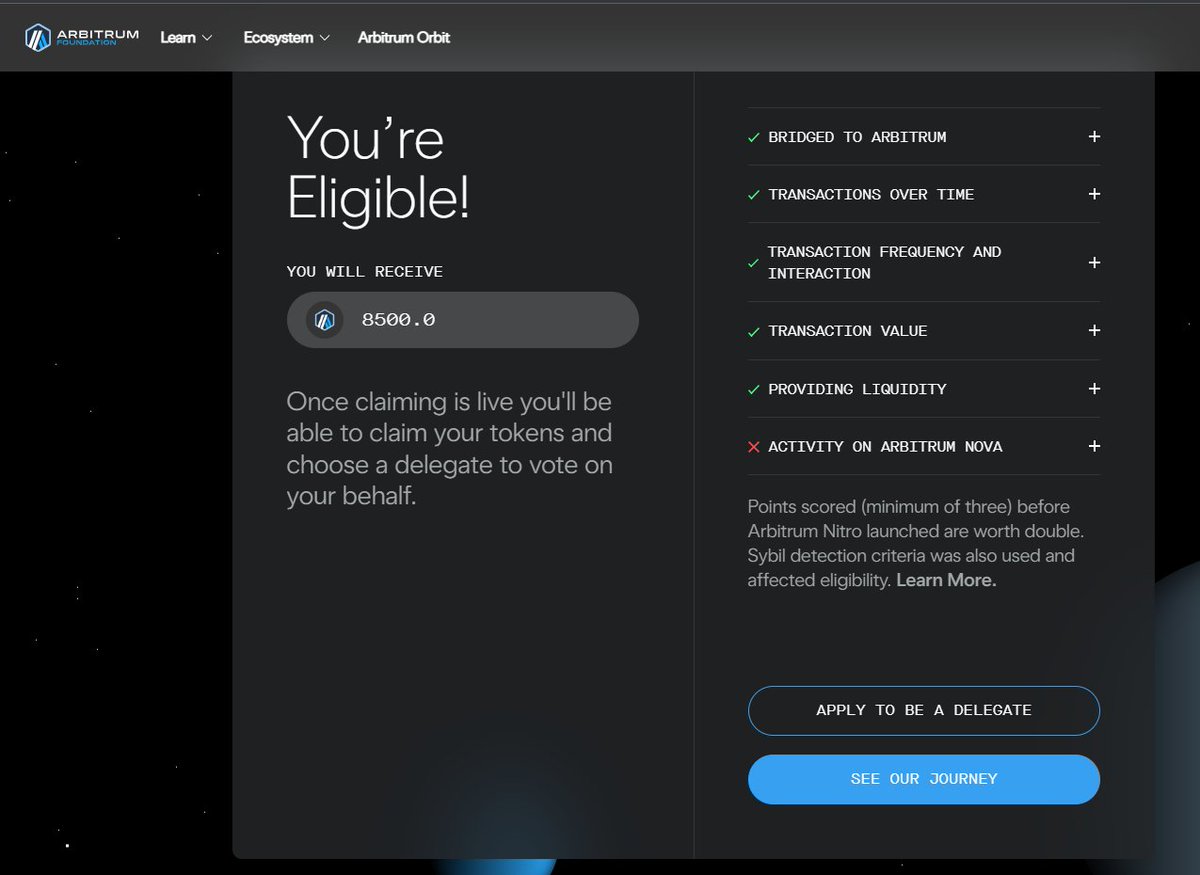

for example, for today's @opencampus_xyz $EDU IDO, I had an avg balance of 134 BNB (~$44k) which yielded an allo of 0.11 BB ($35)!!!

3/8

for example, for today's @opencampus_xyz $EDU IDO, I had an avg balance of 134 BNB (~$44k) which yielded an allo of 0.11 BB ($35)!!!

3/8

so great, that $35 allocation x current return 30x = $1k of "free money", but I needed to hold an avg balance of $44k BNB over 5 days to get it

& the process is heavily gamed by professional traders

thankfully, here's my strategy for gaming it optimally:

4/8

& the process is heavily gamed by professional traders

thankfully, here's my strategy for gaming it optimally:

4/8

overall, I think the best risk-reward approach is not participating in the launchpad all all

while there is a nice bump up on IDO date, that requires risking significant capital to earn a meager allocation

5/8

while there is a nice bump up on IDO date, that requires risking significant capital to earn a meager allocation

5/8

the median all-time high on avg is >2x the IDO performance, usually happening 50-100 days after IDO date

For @opencampus_xyz $EDU, I plan to lever long post-initial IDO dump. Binance has shown strong support & backing for these projects

6/8

For @opencampus_xyz $EDU, I plan to lever long post-initial IDO dump. Binance has shown strong support & backing for these projects

https://twitter.com/rogeravax/status/1648238305161408512

6/8

If you happen to have a large #BNB balance or want to participate in the launchpads, I utilise a few strategies to protect myself, most importantly

- shorting BNB as a hedge during the calculation period when your BNB is locked (& also 1 day before in anticipation of drop)

7/8

- shorting BNB as a hedge during the calculation period when your BNB is locked (& also 1 day before in anticipation of drop)

7/8

Overall, @binance launchpad projects are great high-quality gems to invest & trade

- invested by & supported by the #1 CEX

- clear & identifiable trading patterns in token (& #BNB) that you can use to your advantage

Good Luck & have a great weekend

8/8

- invested by & supported by the #1 CEX

- clear & identifiable trading patterns in token (& #BNB) that you can use to your advantage

Good Luck & have a great weekend

8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter