Job openings fell to 9,590,000 in March, down from 9,974,000 in Feb and the lowest since Apr 2021.

Falling job openings adds another data point in favor of a cooling job market.

#JOLTS 1/

Falling job openings adds another data point in favor of a cooling job market.

#JOLTS 1/

Job openings fell most sharply in some of the service sectors that have driven much of the recent jobs recovery:

Transportation, warehousing & utilities: -144,000

Professional & business services: -135,000

Retail trade: -84,000

Health care & social assistance: -71,000

#JOLTS 2/

Transportation, warehousing & utilities: -144,000

Professional & business services: -135,000

Retail trade: -84,000

Health care & social assistance: -71,000

#JOLTS 2/

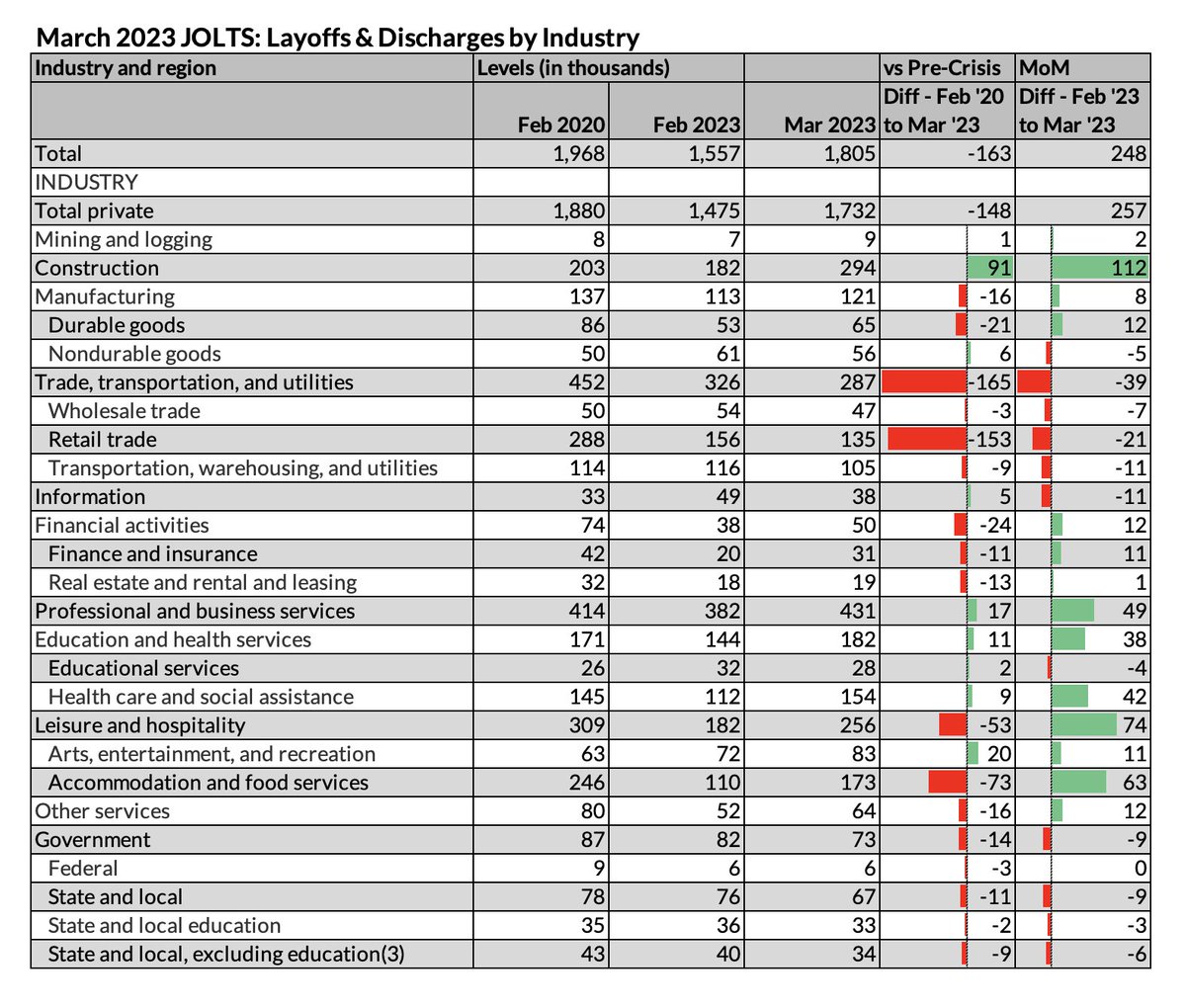

The most concerning figure from the #JOLTS report is the jump in layoffs & discharges, rising to 1,805,000 in March, near the pre-pandemic level after spending much of the last 2 years well below, amidst a historically hot job market.

3/

3/

Unusually, much of the jump in layoffs was due to construction which has been on a roller coaster in the last few months (in terms of #JOLTS data volatility). Hard to tell how construction will trend from the JOLTS data alone.

4/

4/

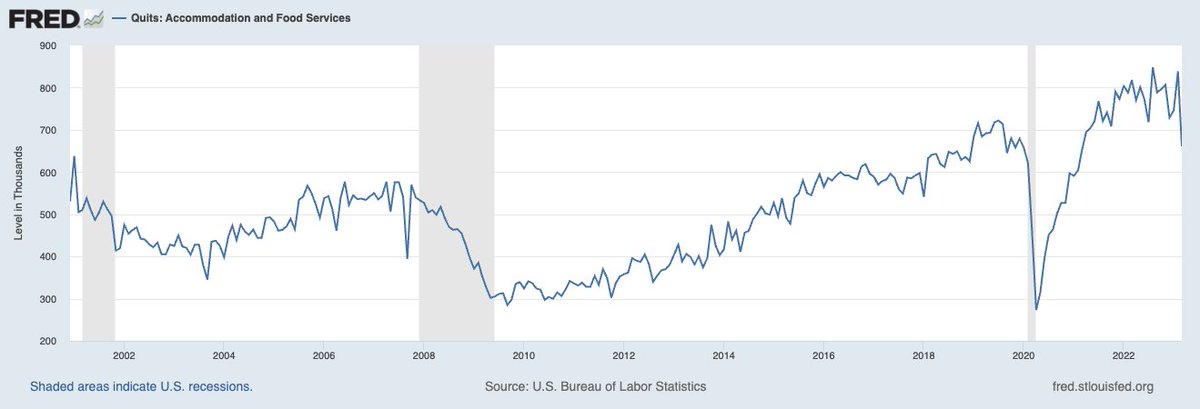

Quits fell to 3,851,000 in March, still up ~10% above pre-pandemic levels, but also falling in a sign that workers are growing less confident in their ability to quit & find new jobs amidst a cooling job market.

#JOLTS 5/

#JOLTS 5/

Notably, quits in leisure & hospitality and accommodation & food services tanked in March. Quits in accommodation & food services are now below their pre-pandemic peak from 2019.

#JOLTS 6/

#JOLTS 6/

The Federal Reserve has often pointed to openings and openings in relations to unemployment as a sign that the labor market is out of balance. While openings cooled in March, they are still elevated compared to historical levels...

#JOLTS 7/

#JOLTS 7/

Quits point to a labor market that is hot but less "out of balance", elevated but more consistent with historically low unemployment. That points to a labor market that is hot but maybe not still overheating.

#JOLTS 8/

#JOLTS 8/

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter