Fresh asymmetric theme incoming no rush to deploy, do the work on survivability and low end valuation entry <0.2x book #regionalbanks

https://twitter.com/GRDecter/status/1653431541622505475

2 on this list will do over 10x returns from their incoming cycle bottoms.

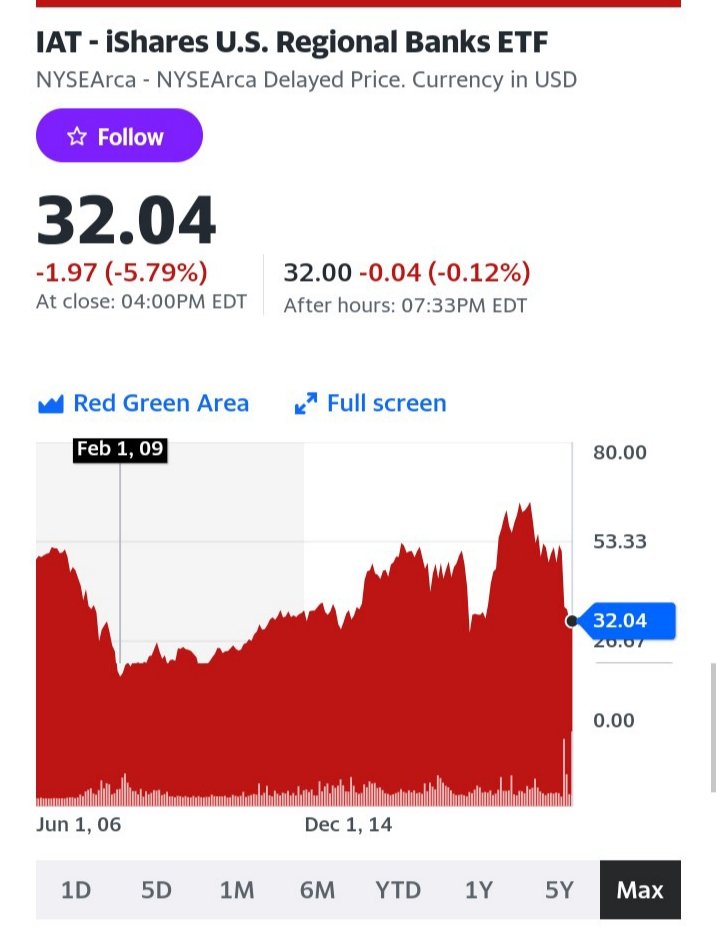

When looking for compelling cycle bottom in #regionalbanks 2009 indicates a peak to bottom of -70%, that would imply <$19 $IAT entry.

That's for 2x returns over 5yrs, individual stock selection of -95% and up 10-15x will be available

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter