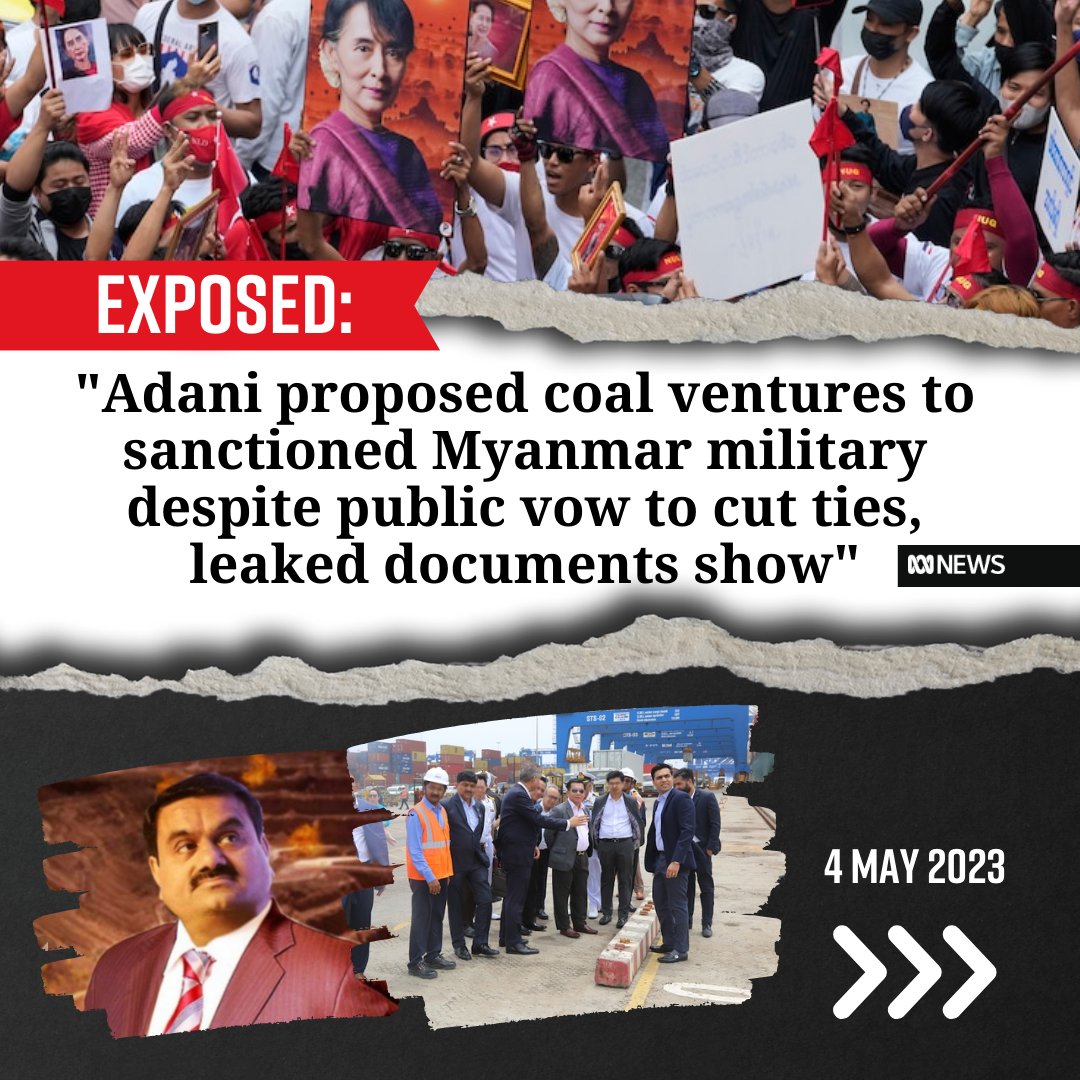

BREAKING: Leaked documents expose #Adani continuing its business partnership and even seeking new coal business deals with the murderous Myanmar military, which is ramping up its campaign of terror against the people of #Myanmar. #StopAdani

abc.net.au/news/2023-05-0…

abc.net.au/news/2023-05-0…

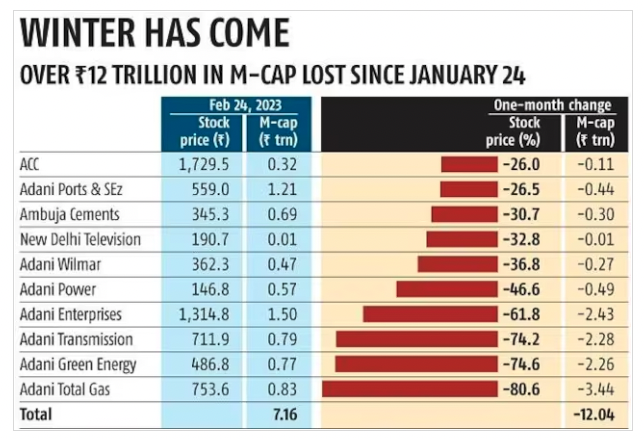

#Adani sought new coal business deals with the #Myanmar military at the same time it was telling the world it was exiting the country. Adani's investors could be funding war crimes and genocide. @JusticeMyanmar @theACIJ are calling for investors & ratings agencies to #StopAdani

The #Myanmar military recently bombed a large gathering of innocent civilians, killing at least 165 people, including many children. #Adani is enabling these atrocities by doing business with the Myanmar military. Adani’s investors are complicit & must divest immediately.

The people of #Myanmar won’t be safe until the Myanmar military is starved of funds. Tell #Adani’s investors to stop funding the Myanmar military’s atrocities, and immediately divest from Adani! #StopAdani stopadani.com/adani-investors

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter