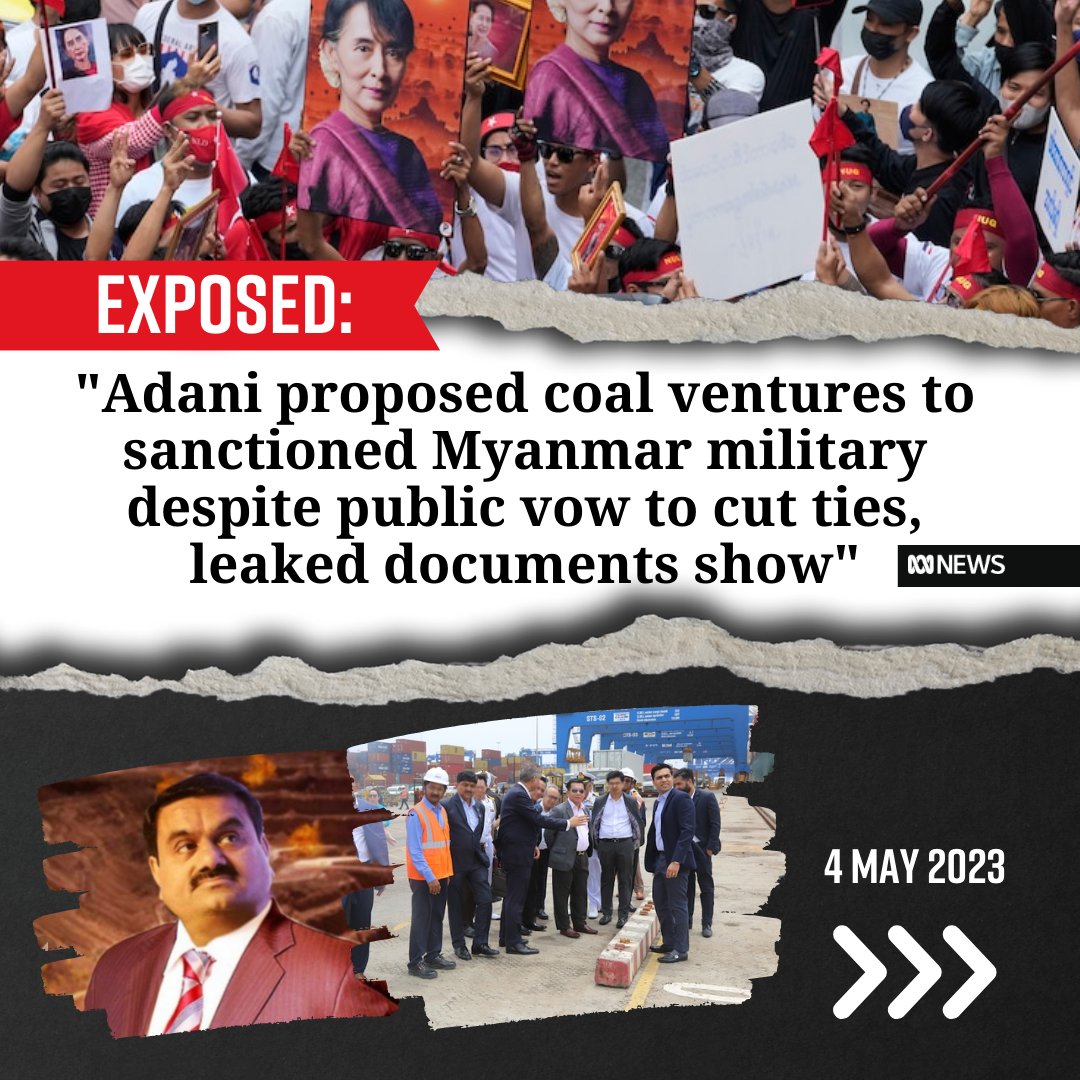

Huge breaking story on @abcnews from @jrojourno. #Adani sought new coal business ventures with sanctioned #Myanmar military entities on the very same day that it was telling the world it was exiting the country. Key points below🧵 abc.net.au/news/2023-05-0…

"leaked documents obtained by a Myanmar human rights group & shared with ABC Investigations reveal #Adani, on the same day it flagged its exit from the port, lodged an "expression of interest" to export coal from #Myanmar... that would help fund the brutal regime.

"In a letter to a US-sanctioned junta minister, an #Adani exec said the group was also negotiating a related electricity supply deal with the regime."

"A #Myanmar businessman who submitted #Adani's coal proposal, Sun Tun Aung, said after the coup Adani talked with private owners of coal deposits in Sagaing about developing mines." abc.net.au/news/2023-05-0…

"...in further revelations which cast doubt on #Adani's public disavowals of the junta, documents show it has continued to engage with sanctioned regime leaders while pouring millions into its Yangon international terminal." abc.net.au/news/2023-05-0…

"Another arm of the company, @Adaniports, last year cited its commitment to the terminal when appealing directly to junta ministers for tax breaks. "Excellency, [#Adani] has continued in investment in this prestigious project despite various external challenges.""

"The port was singled out in a UN report in 2019 as a "stark example" of foreign investment funding the #Myanmar military and posing "a high risk" of being linked to human rights violations and war crimes." abc.net.au/news/2023-05-0…

"Documents confirm a large chunk of #Adani's $US295 million ($440 million) investment in the port has gone to the military-controlled Myanmar Economic Corporation [MEC], which was slapped with Australian sanctions in February." abc.net.au/news/2023-05-0…

"Adani has paid MEC $US90 million, including a $US22 million "land clearance fee".

In the 18 months since flagging its exit, Adani Ports has loaned a further $US24 million to its Myanmar subsidiary to fund construction, dredging, and equipment." abc.net.au/news/2023-05-0…

In the 18 months since flagging its exit, Adani Ports has loaned a further $US24 million to its Myanmar subsidiary to fund construction, dredging, and equipment." abc.net.au/news/2023-05-0…

2 things should be clear to investors from this story.

1. #Adani doesn't care about human rights. They sought new business deals in #Myanmar knowing it would enable atrocities.

2. Adani are liars. They said they were exiting Myanmar while seeking new business deals with the junta

1. #Adani doesn't care about human rights. They sought new business deals in #Myanmar knowing it would enable atrocities.

2. Adani are liars. They said they were exiting Myanmar while seeking new business deals with the junta

#Adani's investors are complicit in war crimes and genocide. Tell Adani’s investors to stop enabling human rights abuses and cut ties with Adani Group companies. #StopAdani stopadani.com/adani-investors

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter