Thought of the day: A reminder for our followers, each new asymmetric theme should be restricted to a 5-7% portfolio weighting with around 5 stocks positions to mitigate stock specific risks in each theme. Incoming themes over the next 6 months: #regionalbanks #REITs etc

Rules of engagement for #regionalbanks & #REITs

- we are approaching entry into the eye of the storm, this will likely need to play out 75% prior to serious capital deployment (6 months +).

- shoes to drop include freezing lending markets, deposits moving to higher yields etc

- we are approaching entry into the eye of the storm, this will likely need to play out 75% prior to serious capital deployment (6 months +).

- shoes to drop include freezing lending markets, deposits moving to higher yields etc

Let some bottoming clarity take place...as in the short term, what was strong yesterday, may not be tomorrow, the rate of change can be swift until the environment settles.

We continue to look for amazing survivability entry points, more likely available in the later stages of the storm:

<1x trailing PEs

>75% trailing dividend yields

<0.15x book

Secure sustainable funding arrangements

<1x trailing PEs

>75% trailing dividend yields

<0.15x book

Secure sustainable funding arrangements

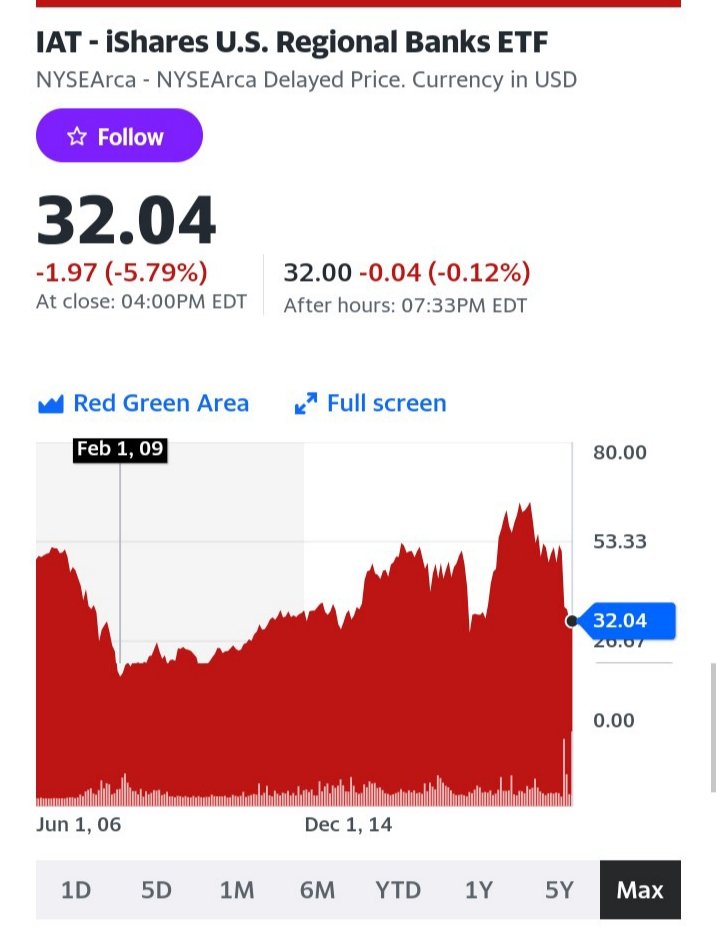

Note 2008-2009 destruction -95% and 2010-2017 recovery +10-15x

We expect similar outcomes from cycle bottoms in 2023/24 with recovery through 2027.

We expect similar outcomes from cycle bottoms in 2023/24 with recovery through 2027.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter