Job market defying gravity in April:

*253,000 jobs added, above expectations though big negative revisions to last 2 months

*Unemp drops to 3.4%. Black unemp at record low 4.7%

*Wage growth jumps to 4.4% YoY

There's still heat in the job market #JobsReport 1/

*253,000 jobs added, above expectations though big negative revisions to last 2 months

*Unemp drops to 3.4%. Black unemp at record low 4.7%

*Wage growth jumps to 4.4% YoY

There's still heat in the job market #JobsReport 1/

Employers added 253,000 jobs, a slower pace than much of 2022, but Feb & Mar were downwardly revised by 149,000. Post-revisions, the start of the year was much slower than originally reported, but job gains remain healthy.

#JobsReport 2/

#JobsReport 2/

The unemployment rate ticked back down to 3.4%, tying the recovery low. Ties the pre-pandemic low from 2019 and before that, we hadn't seen that low level since 1969.

#JobsReport 3/

#JobsReport 3/

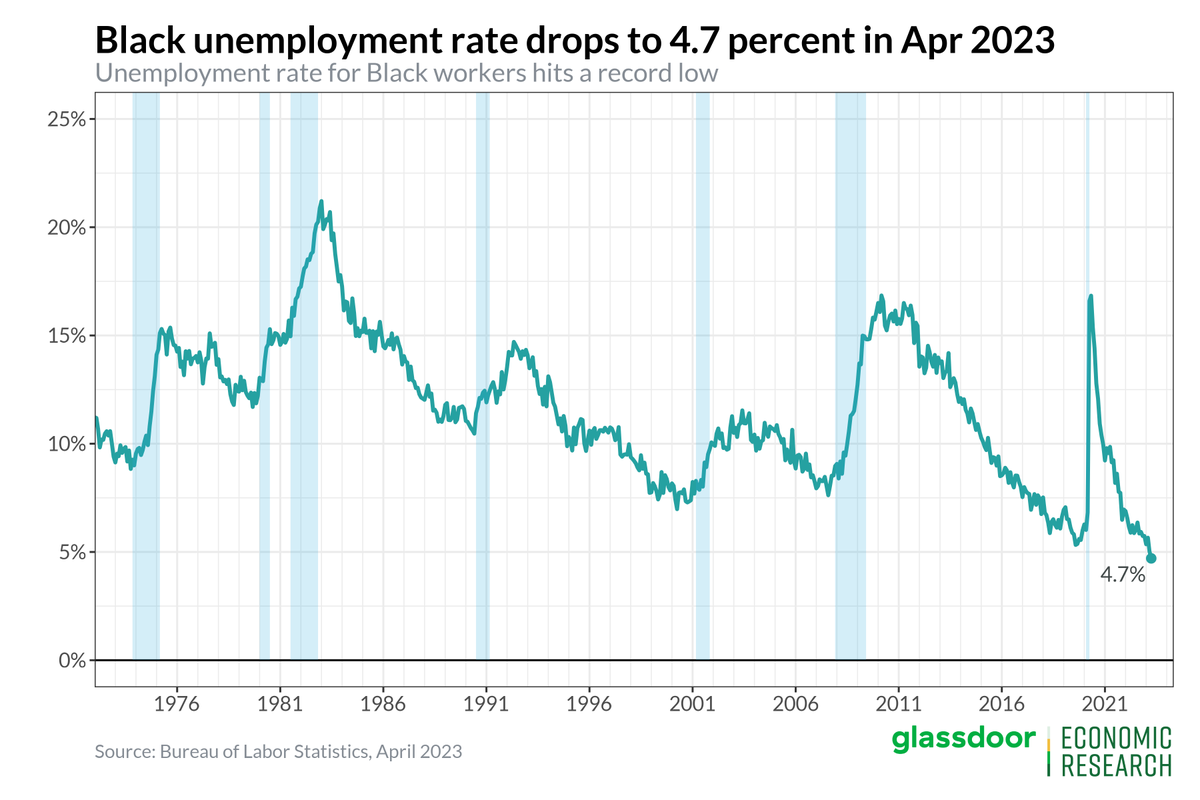

The Black unemployment rate dropped to 4.7 percent in April, hitting another record low.

The Black-white unemployment rate gap fell to 1.6 percentage points, also the lowest on record.

#JobsReport 4/

The Black-white unemployment rate gap fell to 1.6 percentage points, also the lowest on record.

#JobsReport 4/

Three years ago, the unemployment rate hit a record high 14.7% as the pandemic began.

This April, the unemployment rate hit 3.4%, tying a multi-decade low. A truly remarkable pace of recovery.

#JobsReport 5/

This April, the unemployment rate hit 3.4%, tying a multi-decade low. A truly remarkable pace of recovery.

#JobsReport 5/

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter