🧵1/Ω

What #Tether Has Said Lately vs. Arithmetic: The Thread

let's start with the fact that #Tether announced a $1.48 billion "profit" a few days ago.

decrypt.co/139604/tether-…

What #Tether Has Said Lately vs. Arithmetic: The Thread

let's start with the fact that #Tether announced a $1.48 billion "profit" a few days ago.

decrypt.co/139604/tether-…

🧵2/Ω

Let's just conveniently ignore the fact that the auditor who provides #Tether's "attestations" that are in no way anything like an audit has never mentioned "profits".

(Also read the rest of @intel_jakal's 🧵 as they have the numbers.)

Let's just conveniently ignore the fact that the auditor who provides #Tether's "attestations" that are in no way anything like an audit has never mentioned "profits".

(Also read the rest of @intel_jakal's 🧵 as they have the numbers.)

https://twitter.com/intel_jakal/status/1632014090045628417

🧵3/Ω

Isn't it odd that somehow $1.5bn worth of bitcoin just appeared as the backing for #Tether few days ago?

➤ $1.50bn in bitcoin on March 31st

➤ $1.48bn in "profits" as of May 11th

Those numbers are ~1% different.

Are you seeing a pattern here?

Isn't it odd that somehow $1.5bn worth of bitcoin just appeared as the backing for #Tether few days ago?

➤ $1.50bn in bitcoin on March 31st

➤ $1.48bn in "profits" as of May 11th

Those numbers are ~1% different.

Are you seeing a pattern here?

https://twitter.com/Cryptadamist/status/1656312889383481346

🧵4/Ω

It gets better: #Tether just said they would use "up to 15%" of their "profits" to buy BTC.

so If they hold $1.5bn bitcoin then that would mean they actually had 6.7 * $1.5bn = $10bn in profits, right? Because 15% of $10bn = $1.5bn.

Also kinda conveniently round number...

It gets better: #Tether just said they would use "up to 15%" of their "profits" to buy BTC.

so If they hold $1.5bn bitcoin then that would mean they actually had 6.7 * $1.5bn = $10bn in profits, right? Because 15% of $10bn = $1.5bn.

Also kinda conveniently round number...

🧵5/Ω

But... they didn't make $10 billion last quarter. They made $700 million. And they wanted to make sure you knew about it:

But... they didn't make $10 billion last quarter. They made $700 million. And they wanted to make sure you knew about it:

https://twitter.com/intel_jakal/status/1632014085918449669

🧵6/Ω

There's only 3 possibilities. Tether either:

1. Already had the BTC & their attestations were total lies or hid the bitcoin in "other investments"

2. Printed unbacked $USDT to buy BTC ("secured loans")

3. Used $ other than profits to buy BTC

There's only 3 possibilities. Tether either:

1. Already had the BTC & their attestations were total lies or hid the bitcoin in "other investments"

2. Printed unbacked $USDT to buy BTC ("secured loans")

3. Used $ other than profits to buy BTC

https://twitter.com/Cryptadamist/status/1656312889383481346

🧵7/Ω

All of these are bad. Every possibility leads to one conclusion:

Tether is at least partially unbacked.

All of these are bad. Every possibility leads to one conclusion:

Tether is at least partially unbacked.

🧵8/Ω

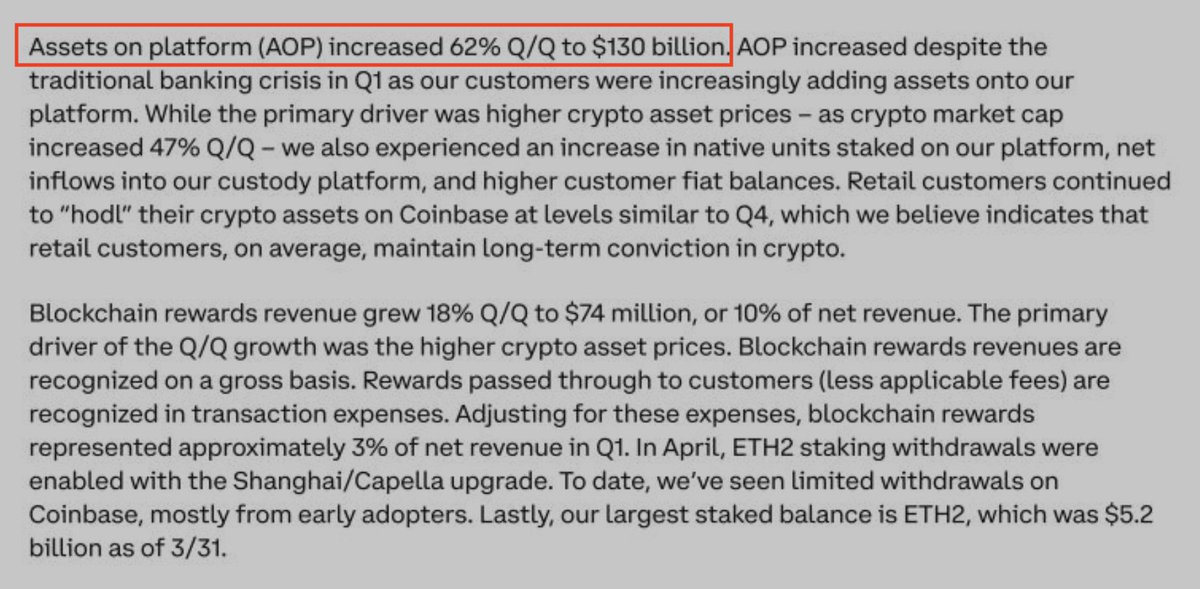

Because by their own numbers they made $700mm in 2023-Q1 and $1.5bn in 2023-Q2. That $2.2bn is the sum total of all the profits they have ever announced.

But the $1.5bn they hold at bitcoin that they just bought would be 68% (not 15%) of those profits.

Because by their own numbers they made $700mm in 2023-Q1 and $1.5bn in 2023-Q2. That $2.2bn is the sum total of all the profits they have ever announced.

But the $1.5bn they hold at bitcoin that they just bought would be 68% (not 15%) of those profits.

🧵9/Ω

It gets worse though. Look at the timing of when Tether bought these bitcoins (because they have to have bought them recently, right?) compared to the announcements of bad news for #Binance, #CryptoCom, etc.

It gets worse though. Look at the timing of when Tether bought these bitcoins (because they have to have bought them recently, right?) compared to the announcements of bad news for #Binance, #CryptoCom, etc.

🧵10/Ω

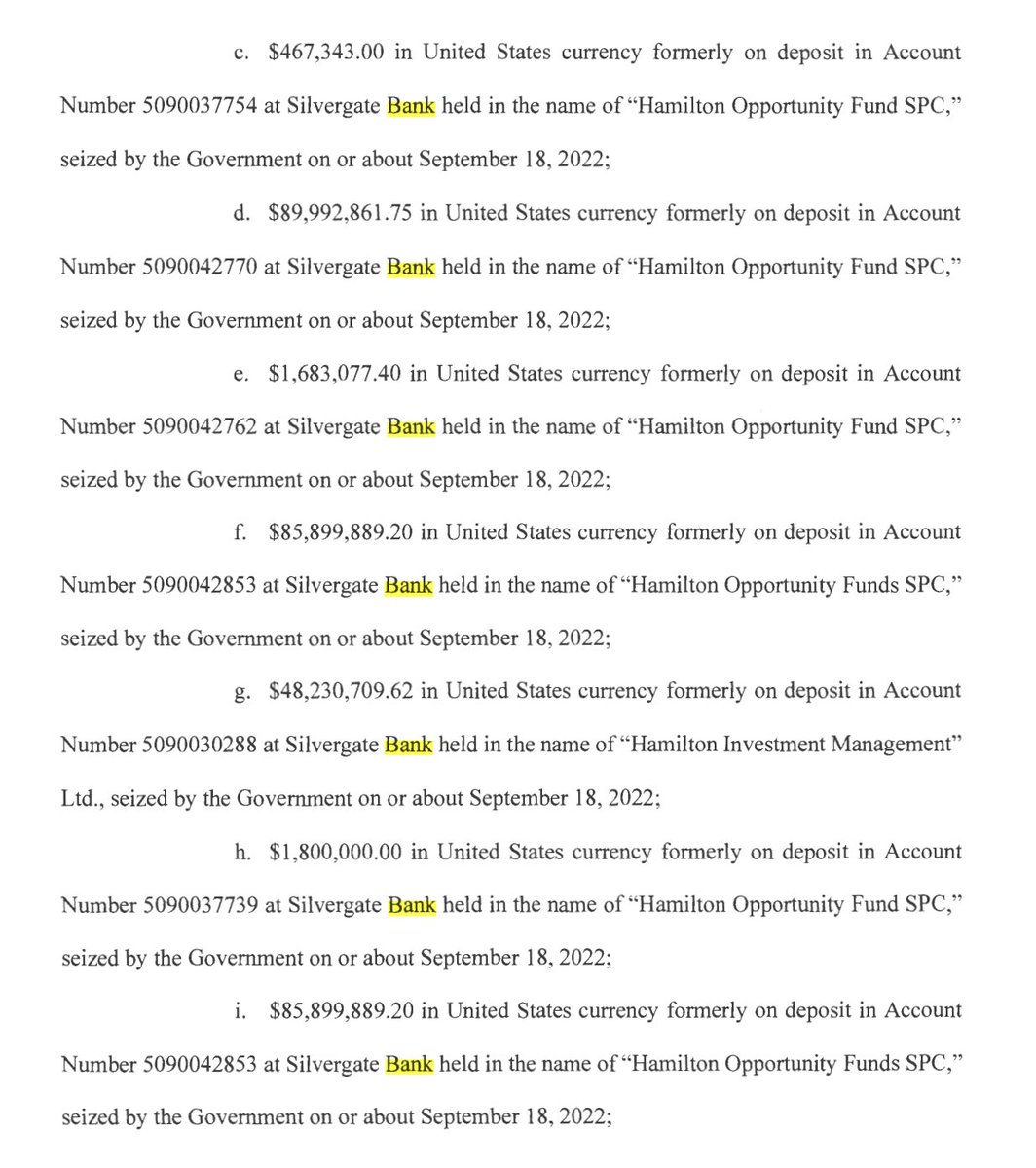

Or how about that time #Tether printed billions of $USDT straight into the US government's sale of 9 figures worth of bitcoin it seized from Silk Road?

Or how about that time #Tether printed billions of $USDT straight into the US government's sale of 9 figures worth of bitcoin it seized from Silk Road?

https://twitter.com/Cryptadamist/status/1642056909162151937

@Bitfinexed @thebankerislaw @JohnReedStark @NotChaseColeman @DylanLeClair_ @MikeBurgersburg @ParrotCapital @DataFinnovation @Patrick_TanKT @PatrickEBoyle @DoombergT @Frances_Coppola @davidgerard @ahcastor @BennettTomlin @CasPiancey @molly0xFFF @coryklippsten @SilvermanJacob

🧵11/Ω

I always come back to what Jim Chanos (@WallStCynica) said about #Tether on @CryptoCriticPod last summer because I really think it is the correct way to think about the situation and is also easy to explain to "normies":

I always come back to what Jim Chanos (@WallStCynica) said about #Tether on @CryptoCriticPod last summer because I really think it is the correct way to think about the situation and is also easy to explain to "normies":

https://twitter.com/Cryptadamist/status/1638057366951215106

🧵12/Ω

While it is impossible to say for sure bc #Tether's audits, like unicorns, do not and will never exist, to me it looks a lot like they printed a bunch of $USDT out of thin air, used it to pump the BTC price, and now they have to explain how they got all these bitcoins.

While it is impossible to say for sure bc #Tether's audits, like unicorns, do not and will never exist, to me it looks a lot like they printed a bunch of $USDT out of thin air, used it to pump the BTC price, and now they have to explain how they got all these bitcoins.

🧵13/Ω

Also more importantly #Tether's biggest risk is a bank run. The rational thing to do would be to have a pile of cash around to be able to meet redemptions, not buy bitcoins. So even if they are telling the truth¹ they are announcing gross incompetence

¹ hint: they're not

Also more importantly #Tether's biggest risk is a bank run. The rational thing to do would be to have a pile of cash around to be able to meet redemptions, not buy bitcoins. So even if they are telling the truth¹ they are announcing gross incompetence

¹ hint: they're not

🧵14/Ω *correction*

#Tether only ever announced $1.5 billion in "profits" so that means they spent at least 99% of their "profits" to buy bitcoin.

(I was confused bc it was $700 million then somehow magically became $1.5 billion a few weeks later.)

#Tether only ever announced $1.5 billion in "profits" so that means they spent at least 99% of their "profits" to buy bitcoin.

(I was confused bc it was $700 million then somehow magically became $1.5 billion a few weeks later.)

https://twitter.com/Cryptadamist/status/1658882777599574033

🧵15/Ω

But that's just more evidence to my point, which is that they needed to somehow explain where this $1.5 billion in Bitcoin came from. A few weeks ago maybe they only need to explain $700mm but things done changed.

But that's just more evidence to my point, which is that they needed to somehow explain where this $1.5 billion in Bitcoin came from. A few weeks ago maybe they only need to explain $700mm but things done changed.

🧵16/Ω

Scope this: the day Tether announces "profits" the price of BTC did a massive pump and dump "bart" formation?

It's almost as if someone needed the price of BTC to be at a given place to make "profits" hit a certain number so they pumped...

Scope this: the day Tether announces "profits" the price of BTC did a massive pump and dump "bart" formation?

It's almost as if someone needed the price of BTC to be at a given place to make "profits" hit a certain number so they pumped...

https://twitter.com/Cryptadamist/status/1658931015795048456

🧵17/Ω

To really spell it out: if the $1.48bn in "profits" was used to buy bitcoins and those bitcoins were listed in the attestation as the backing for $1.5 billion in USDT then they weren't profits at all.

To really spell it out: if the $1.48bn in "profits" was used to buy bitcoins and those bitcoins were listed in the attestation as the backing for $1.5 billion in USDT then they weren't profits at all.

🧵19/Ω

In case anyone's wondering where Tether found an extra $800 million between their announcement of $700 million and their announcement that "aw shucks it was actually $1.5 billion" i have a hypothesis...

In case anyone's wondering where Tether found an extra $800 million between their announcement of $700 million and their announcement that "aw shucks it was actually $1.5 billion" i have a hypothesis...

https://twitter.com/Cryptadamist/status/1658957302915907585

🧵20/Ω

One has to wonder whether #Tether plans to start redeeming $USDT for Bitcoin because they can't access their bank accounts any more or similar...

It's in the the terms of service that they can do that and they did do that back in 2018.

One has to wonder whether #Tether plans to start redeeming $USDT for Bitcoin because they can't access their bank accounts any more or similar...

It's in the the terms of service that they can do that and they did do that back in 2018.

https://twitter.com/Cryptadamist/status/1659042643249119232

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter