Read this short 🧵 please. When you look at all the other SEC-LIT-EMAILS cited in Ripple’s opposition, they are redacted. The one about there being reasonable grounds to not believe XRP satisfies all the Howey factors is not redacted.

https://twitter.com/johnedeaton1/status/1660088199576682498

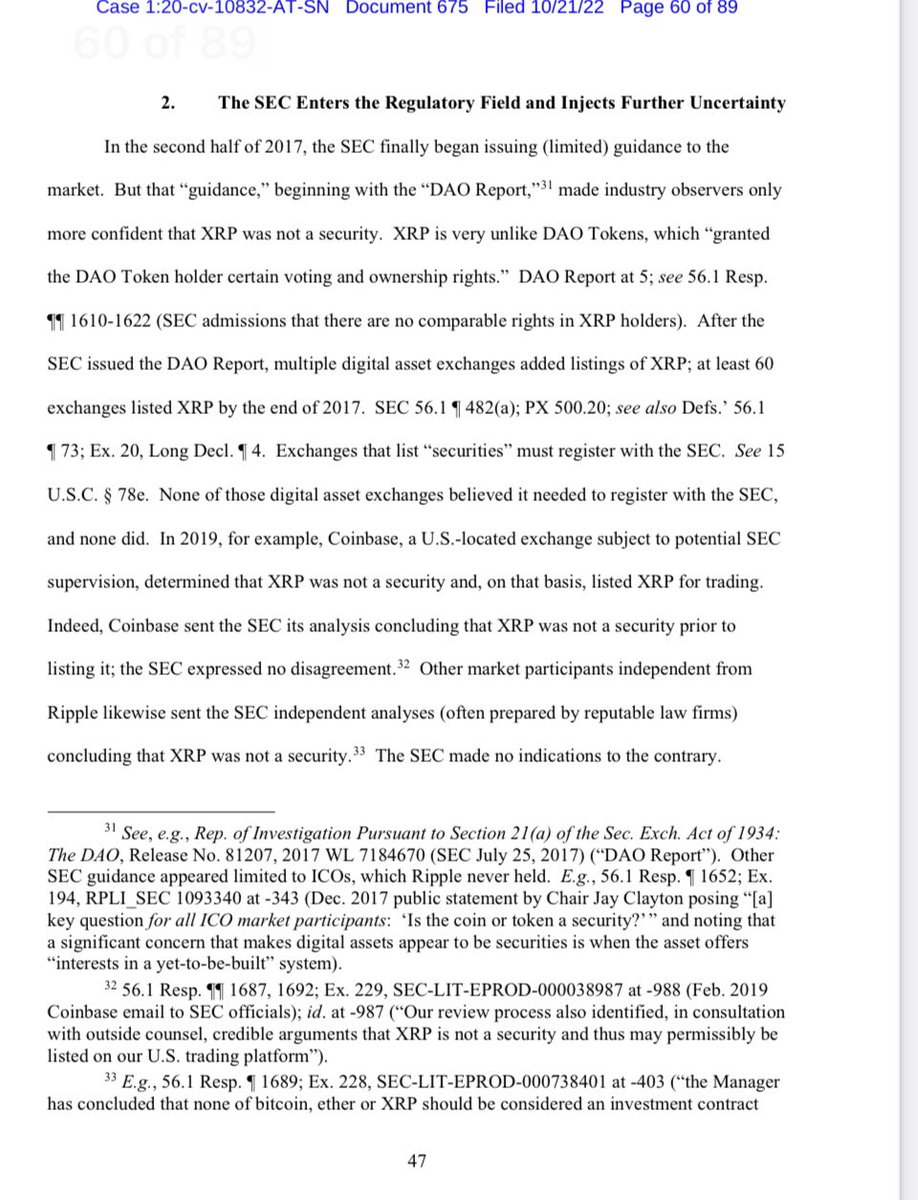

The SEC wanted all statements by SEC staff redacted and it appears they all were. What this tells me is that the statement about XRP not satisfying Howey is NOT a direct quote from a senior SEC official - otherwise it would be reacted.

I’ve concluded that that statement was made by a market participant independent of Ripple not the SEC but it was referenced by someone in the Hinman emails, or the 3rd party email was forwarded to Hinman or the email group discussing the Speech.

I always want my comments to be based on facts, so I’m making this clarification. Although it isn’t a direct quote by an SEC official it is still damaging as hell b/c it demonstrates XRP was discussed. Someone at the SEC passed this #XRP opinion to the email group for a reason.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter