***BRC-20 Token Standard***

"What #ETH tries that succeeds will eventually move to #BTC"

- Bitcoiners

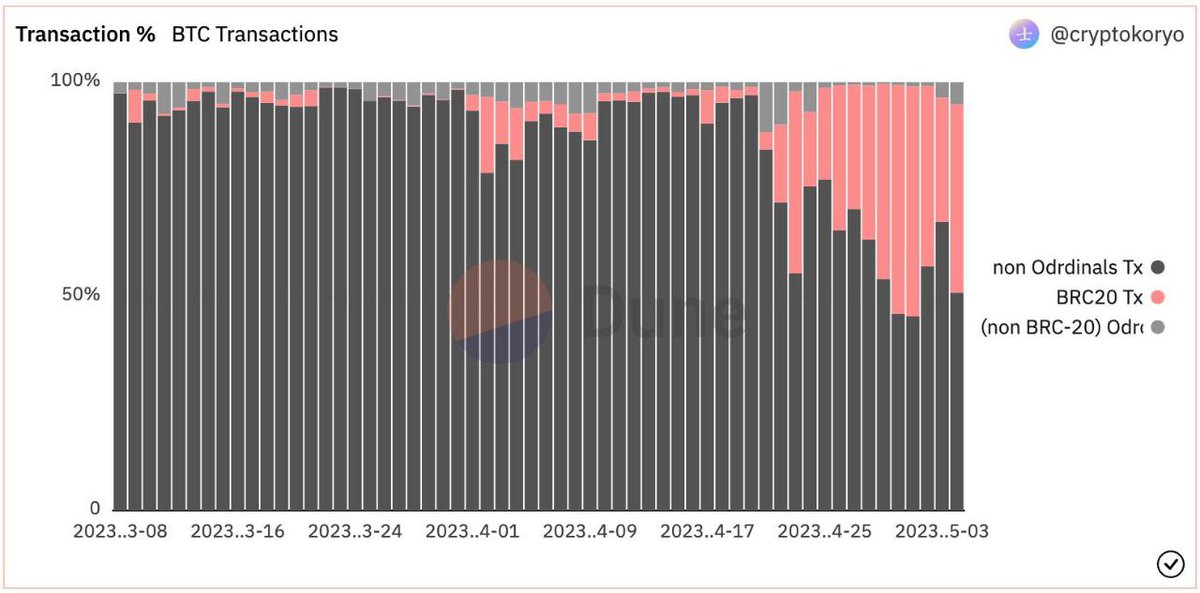

BRC-20 tokens' marketcap skyrocketed 600%+ in just a week, overtaking standard #Bitcoin transactions!

-Wtf is BRC20 & How it started

-How it works

-Importance & Criticisms

🧵

"What #ETH tries that succeeds will eventually move to #BTC"

- Bitcoiners

BRC-20 tokens' marketcap skyrocketed 600%+ in just a week, overtaking standard #Bitcoin transactions!

-Wtf is BRC20 & How it started

-How it works

-Importance & Criticisms

🧵

2/ Firstly, it would be good to understand what ordinals are, and if it's your first time hearing that, don't sweat it.

Check out this thread first to come up to speed on Ordinals.

Check out this thread first to come up to speed on Ordinals.

https://twitter.com/mattyTokenomics/status/1633059948367077378

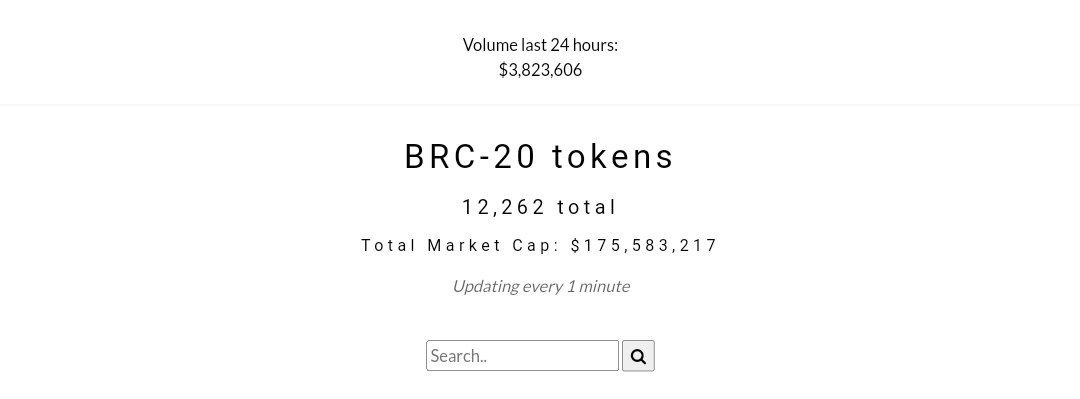

3/ BRC-20 tokens are all the rage right now.

At the time of writing, there are 12k+ tokens minted with the BRC-20 standard, most of which are memecoins like $PEPE & $MEME.

But how did this all start?

At the time of writing, there are 12k+ tokens minted with the BRC-20 standard, most of which are memecoins like $PEPE & $MEME.

But how did this all start?

4/ BRC-20 is an experimental token standard inspired by ERC-20, but it works very differently.

It was created in March by @domodata, an on-chain analyst who enables the creation & transfer of fungible tokens on the Bitcoin blockchain using the Ordinals protocol.

It was created in March by @domodata, an on-chain analyst who enables the creation & transfer of fungible tokens on the Bitcoin blockchain using the Ordinals protocol.

5/ 🎯 How does it work?

At their core BRC-20 tokens are essentially specially marked sats (satoshis, the smallest divisible unit of Bitcoin).

Each BRC-20 token is a sat that has been inscribed to belong to a specific BRC-20 "collection" (i.e. the ticker/type of BRC-20).

At their core BRC-20 tokens are essentially specially marked sats (satoshis, the smallest divisible unit of Bitcoin).

Each BRC-20 token is a sat that has been inscribed to belong to a specific BRC-20 "collection" (i.e. the ticker/type of BRC-20).

https://twitter.com/domodata/status/1633658974686855168

6/ Inscriptions are a newly invented way of storing data in the $BTC blockchain, that relies on each satoshi of the 2.1 quadrillion maximum sats of Bitcoin having a unique identifier.

Before BRC-20, they've been used to create "NFTs" on Bitcoin by inscribing images onto sats.

Before BRC-20, they've been used to create "NFTs" on Bitcoin by inscribing images onto sats.

7/ BRC-20 tokens are essentially ordinal inscriptions with text embedded, providing a set of specs for minting and managing tokens.

Developers use ordinal inscriptions of JSON data to deploy token contracts, mint tokens (by inscribing existing Bitcoin), and transfer them.

Developers use ordinal inscriptions of JSON data to deploy token contracts, mint tokens (by inscribing existing Bitcoin), and transfer them.

8/ Thus, think of BRC-20 tokens as specially marked sats.

Because they're *literally* native Bitcoins, they do not, and can not, use fully expressive smart contracts at the L1 layer of Bitcoin.

Using them in expressive smart contracts requires an L2, but more on that later.

Because they're *literally* native Bitcoins, they do not, and can not, use fully expressive smart contracts at the L1 layer of Bitcoin.

Using them in expressive smart contracts requires an L2, but more on that later.

9/ Additionally, BRC-20 tokens require a Bitcoin wallet like @unisat_wallet (or soon @xverseApp) to mint and send.

The BRC-20 frenzy has caused the number of token transactions on the Bitcoin blockchain to surpass regular BTC transactions by over 50%!

The BRC-20 frenzy has caused the number of token transactions on the Bitcoin blockchain to surpass regular BTC transactions by over 50%!

10/ 🎯 Importance and Criticisms of BRC20

The rise of BRC-20 tokens demonstrates the versatility of the Bitcoin blockchain, reshaping what we (devs/investors) believed to be possible.

It also shows how evolving & adaptive this space can be to new trends.

The rise of BRC-20 tokens demonstrates the versatility of the Bitcoin blockchain, reshaping what we (devs/investors) believed to be possible.

It also shows how evolving & adaptive this space can be to new trends.

11/ BRC-20 tokens are an exciting idea, but currently have a lot of meme coin and speculation - not unlike ERC-20 tokens, legit use cases will come with time.

Even @domodata (their creator) thinks BRC-20s will be "worthless". For now, though, the total market cap is above $170M.

Even @domodata (their creator) thinks BRC-20s will be "worthless". For now, though, the total market cap is above $170M.

12/ BRC-20s on their own don't bring smart contract-capable tokens to Bitcoin, whereas ERC-20 tokens on Ethereum do

Due to the limitations of Bitcoin, use cases beyond relatively simple transfers need a Bitcoin L2 like @Stacks or a protocol on top of Bitcoin like @TrustlessOnBTC

Due to the limitations of Bitcoin, use cases beyond relatively simple transfers need a Bitcoin L2 like @Stacks or a protocol on top of Bitcoin like @TrustlessOnBTC

https://twitter.com/punk3700/status/1652357882208464897

13/ For better or worse, BRC-20s are increasing competition for limited block space, boxing out low-fee transactions like securing cold storage funds or creating lightning channels.

This is likely to continue as builders push the limits of Taproot transactions.

This is likely to continue as builders push the limits of Taproot transactions.

https://twitter.com/ercwl/status/1653508862631084036

14/ BRC-20 tokens might be just mostly hype, meme coins, and speculation for now, but more innovation is sure to follow.

Already, @unisat_wallet has built some early features to support BRC-20 tokens including a simplistic listing marketplace for trading BRC-20s.

Already, @unisat_wallet has built some early features to support BRC-20 tokens including a simplistic listing marketplace for trading BRC-20s.

https://twitter.com/unisat_wallet/status/1651507492696776710

15/ And @ALEXLabBTC very quickly built and released a fully featured DEX and bridge for trading BRC-20s after bridging them from Bitcoin L1 to Bitcoin L2 @Stacks.

And announced the world's first BRC-20 IDO launchpad.

And announced the world's first BRC-20 IDO launchpad.

https://twitter.com/ALEXLabBTC/status/1658753930778615809

16/16 It remains to be seen if tokens on Bitcoin L1 make more sense than tokens on smart contract-capable protocols on top of Bitcoin (like L2s), but they're a great example of the renaissance of Bitcoin innovation.

Want to learn even more?

Here's a mega thread from @JamesonMah

Want to learn even more?

Here's a mega thread from @JamesonMah

https://twitter.com/JamesonMah/status/1654138848702775297

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter