1/ Sharing a smart trader on #GMX.

He went long on $BTC in the past month and made ~$522K.

Moreover, he didn't lose any money even in the down market.

How did he do it?👇

He went long on $BTC in the past month and made ~$522K.

Moreover, he didn't lose any money even in the down market.

How did he do it?👇

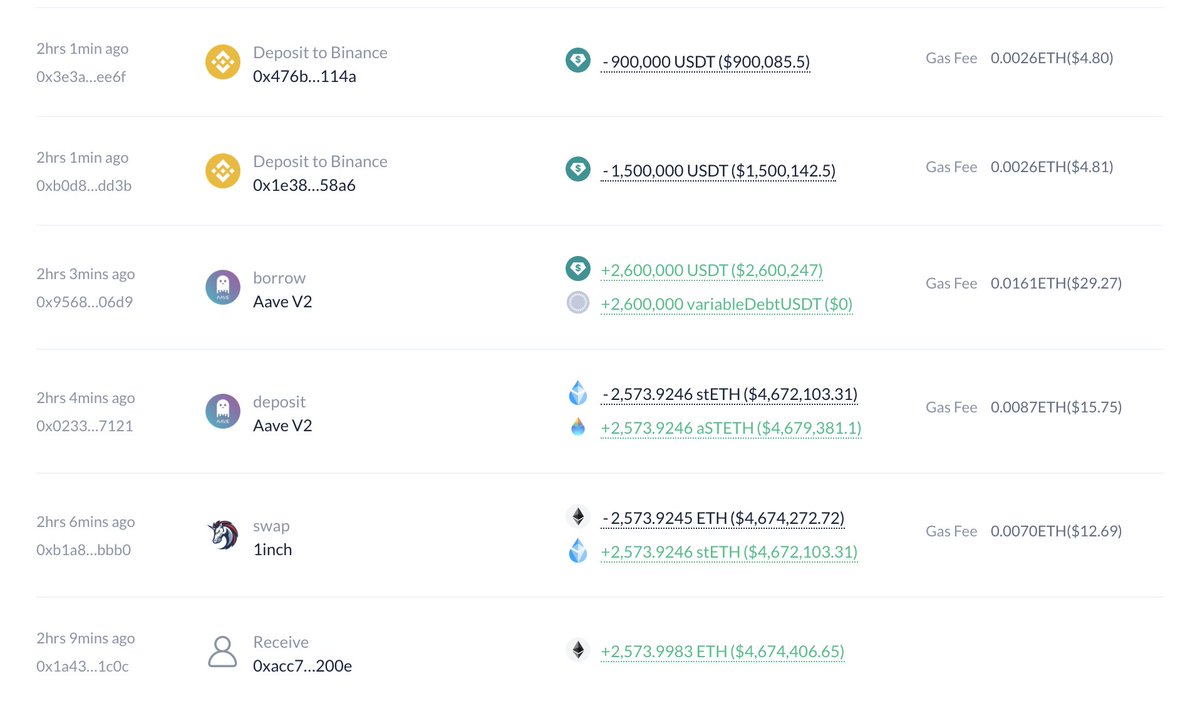

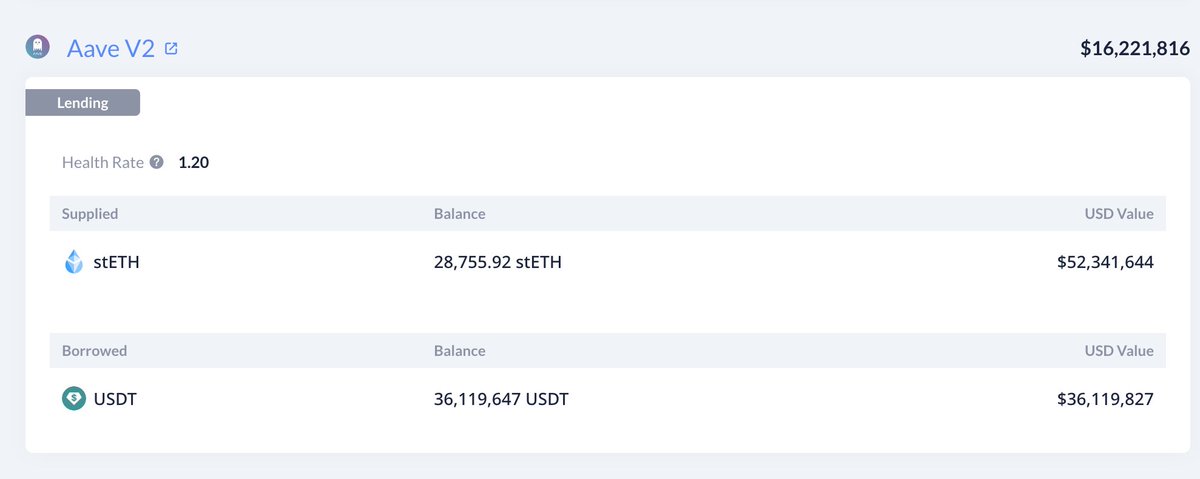

2/ The smart trader opened long positions in $BTC and $WBTC on April 23 and then closed the long position on April 28, which made him ~13 $BTC ($435K).

3/ Then the smart trader opened a long position in $BTC again on May 5 and closed on May 6, which made him ~0.77 $BTC ($25K).

4/ From May 11 to 12, the price of $BTC dropped by ~6%, and this smart trader's long position remained profitable because he placed limit orders.

He went long on $BTC after the price plummeted, and then set the closing price to make a profit, earning ~2.26 $BTC ($62K) in total.

He went long on $BTC after the price plummeted, and then set the closing price to make a profit, earning ~2.26 $BTC ($62K) in total.

5/ On May 16, this trader opened three long positions in $BTC.

As the $BTC price dropped, he increased his long positions.

And his current unrealized P&L is -$216K.

As the $BTC price dropped, he increased his long positions.

And his current unrealized P&L is -$216K.

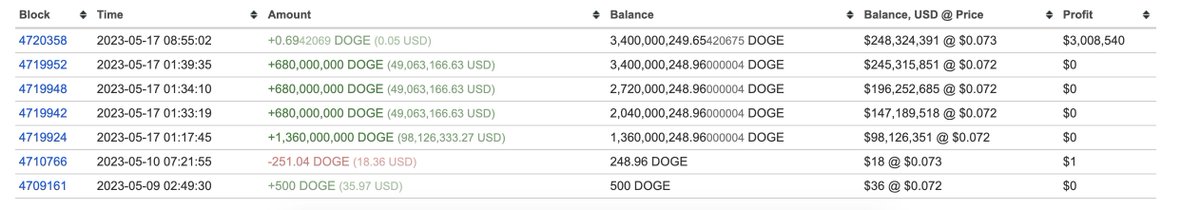

6/ Address: debank.com/profile/0xfd93…

Follow @lookonchain and turn on notifications, or join our telegram group to receive alpha information.

t.me/lookonchain

Follow @lookonchain and turn on notifications, or join our telegram group to receive alpha information.

t.me/lookonchain

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter