Attention @CelsiusUcc there is an unregulated offshore platform, soliciting unlicensed services to #Celsius creditors.

Are you not concerned?

Are you not concerned?

Cause & effect;

28th of Oct 2022 makes unfounded and obscure references to regulatory licensing.

46 days later, he boasts that 700+ #Celsius creditors believed his promises for those licenses and compliance and put their claims on BTTF.

They believed him and signed up.

28th of Oct 2022 makes unfounded and obscure references to regulatory licensing.

46 days later, he boasts that 700+ #Celsius creditors believed his promises for those licenses and compliance and put their claims on BTTF.

They believed him and signed up.

BTTF publicly acknowledges the need for licenses to serve non-HNW investors. However, as they haven't obtained these licenses yet, it implies that there are currently no investor protections in place.

For it needs regulatory requirements before it can operate in that capacity.

For it needs regulatory requirements before it can operate in that capacity.

Understand the deniable misdirection in the above tweets by Mr. Dixon;

BTTF requires at least 5 to 6 different licenses, over 1+ million dollars in costs & a minimum timeframe of 24+ months to become fully, if ever, regulated.

But that's not all, it's not just about licenses.

BTTF requires at least 5 to 6 different licenses, over 1+ million dollars in costs & a minimum timeframe of 24+ months to become fully, if ever, regulated.

But that's not all, it's not just about licenses.

Discrepancies in structure, limited resources & personnel challenges raise suspicions about their intentions & ability.

Dixon's licensing statement may mislead creditors to KYC with BTTF, despite the regulatory complexities.

Does he know he can't deliver what he's promising?

Dixon's licensing statement may mislead creditors to KYC with BTTF, despite the regulatory complexities.

Does he know he can't deliver what he's promising?

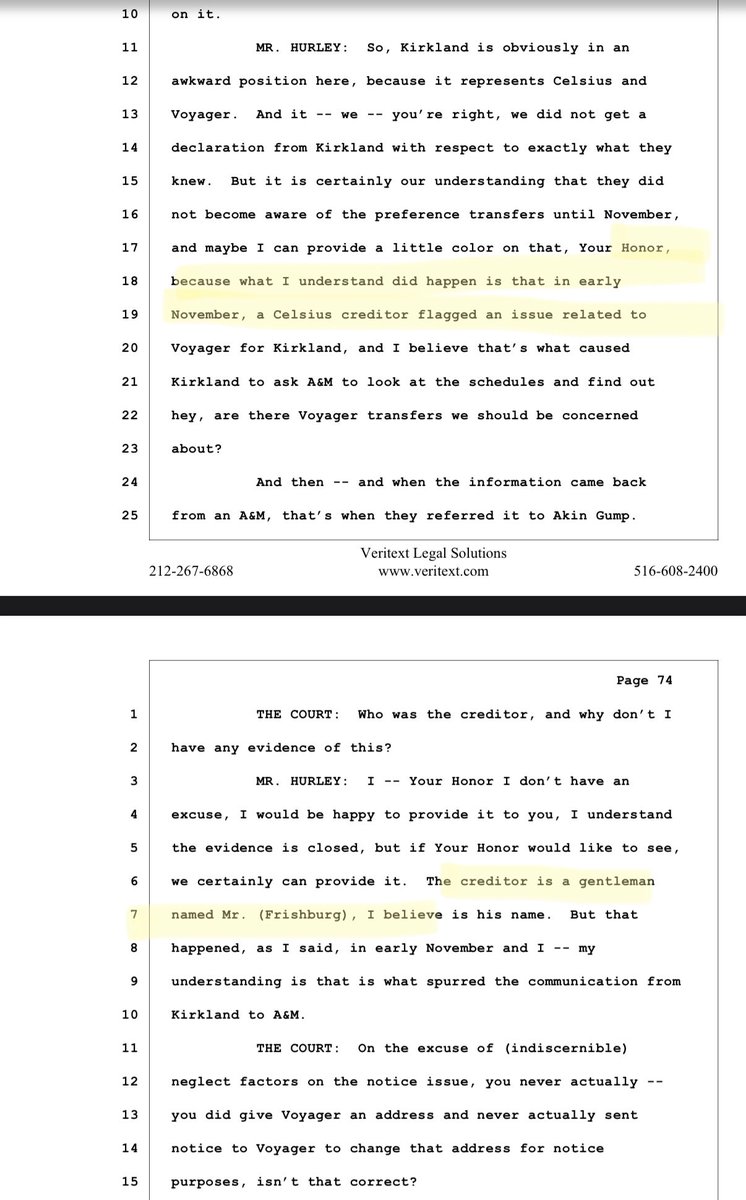

The conflict of interest at the heart of the relationship between Simon Dixon and the @CelsiusUcc is of ongoing concern and requires some clarification.

How is the UCC addressing these concerns and maintaining open communication?

How is the UCC addressing these concerns and maintaining open communication?

He's a creditor, shareholder, bidder of his own assets, and offshore platformer of claims, that he's not licensed to hold, contravening Ch 11 protocols.

How has the @CelsiusUcc maintained transparency in its dealing with him?

As creditors, we have a right to know.

How has the @CelsiusUcc maintained transparency in its dealing with him?

As creditors, we have a right to know.

Moving forward, this low bar moral ambiguity and lacking ethics has no place at the #NewCo table.

#CEL81 @CelsiusNetwork @arrington @FahrenheitHldg

#CEL81 @CelsiusNetwork @arrington @FahrenheitHldg

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter