Weekly Recap

Do not worry in case you missed out on any action from @prometheusmacro last week. Below we pen down all the key takeaways & opinion threads that were shared with the wider community. Make sure to #SubscribeToday so that you don't miss any of the updates.

Do not worry in case you missed out on any action from @prometheusmacro last week. Below we pen down all the key takeaways & opinion threads that were shared with the wider community. Make sure to #SubscribeToday so that you don't miss any of the updates.

1. We introduced the 'Prometheus Daily Trend Signals' to share the latest trend updates for all 37 ETFs across four asset classes daily.

https://twitter.com/prometheusmacro/status/1661070239369424896?s=20

2. Next, we presented a first glimpse of the Cyclical Rotation Strategy for Equities.

https://twitter.com/prometheusmacro/status/1661173984929382401?s=20

3. We then shared the latest readings from our PMI composite. Overall, we observed that 9 out of the 11 PMIs we track have been a negative trend, reinforcing cyclical weakness.

https://twitter.com/prometheusmacro/status/1661382441192284163?s=20

4. In our note on the PMIs, we also provided a granular update from the latest readings of the Richmond Fed Manufacturing Survey.

https://twitter.com/prometheusmacro/status/1661753092621361152?s=20

5. Next, we collated all the different data points from the Housing and Resedential Sector to provide a consolidated view.

https://twitter.com/prometheusmacro/status/1661764813041664000?s=20

6. We followed this up with an insight on the ongoing tightness in the labor market.

https://twitter.com/prometheusmacro/status/1662107510780616704?s=20

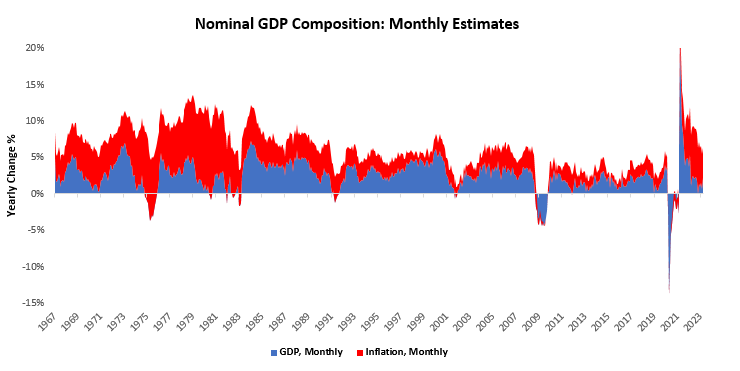

7. Finally, we provided a Market Regime Update. Markets continued to be indecisive about their pricing of nominal growth conditions, which remained roughly unchanged (though somewhat recomposed, with a bias towards higher real growth vs. inflation).

https://twitter.com/prometheusmacro/status/1662955015395319808?s=20

8. The recap reinforces our mission of providing the best & most actionable macro research to our community.

We can assure you that this is just the beginning!

#macro #markets #recap #investing

We can assure you that this is just the beginning!

#macro #markets #recap #investing

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter